-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - USD/JPY Corrective Slippage Extends

Highlights:

- USD/JPY's corrective slippage extends, back below Y122

- Equities off highs, but retains tailwind from hopes for ceasefire

- 2y10y Yield spread pulls back from inversion

US TSYS SUMMARY: Twist Steepening As 2s10s Pull Back From Inversion

- Cash Tsys have twist steepened this morning as the curve pulls back from recent flats and the brief inversion for 2s10s yesterday for the first time since Sep-2019, now back up at 9bps.

- The move appears led by a trimming of rate hike expectations (but still north of 200bps priced over the next six meeting) which has helped see the front-end rally off recent lows and longer end more than unwind an earlier rally.

- 2YY -4bps at 2.324%, 5YY -1.7bps 2.482%, 10YY +1.3bps at 2.407%, 30YY +2.9bps at 2.530%.

- TYM2 sits only 2 ticks lower at 122-08+ after a round trip to 122-26+ overnight, which now forms new resistance, clearance of which could open 123-12 (Mar 23 high). Modestly above average volumes.

- Fedspeak: Barkin, 2024 voter (0830ET) and George, 2022 (1300ET).

- Data: The pick today is ADP employment for Mar (0815ET) plus the third release for quarterly GDP/PCE (0830ET).

- Bill issuance: US Tsy $30B 119D bill auction (1130ET).

- No bond issuance today after 2Y (tailed), 5Y (traded through) and 7Y (tailed) sales so far this week.

FED STIR FUTURES: Fed Hike Expectations Trimmed Overnight

- Fed hike expectations have been trimmed overnight to 203bps for Dec'22, down from 210bp late yesterday and Monday’s high of 220bp for FOMC-dated Fed Funds futures.

- The overnight move comes despite a lack of progress in peace talks (Kremlin most recently says there has been no breakthrough, with lots of work remaining) and with little impact from the latest lockdown in China, this time in the travel hub of Xuzhou with a population of 9M.

- Immediate meetings have seen a more gradual dip with 43bps for May and 85bps for June.

- Fedspeak from Barkin (2024 voter) and George (2022) ahead. George speaks for the first time post-FOMC and should provide a hawkish take, likely one of three dots to have looked for 9 hikes to 2.25-2.5% in 2022 or the sole dot for 10 hikes.

FOMC-dated Fed Funds futuresSource: Bloomberg

FOMC-dated Fed Funds futuresSource: Bloomberg

EUROPE ISSUANCE UPDATE

Italy sells 5/10-year BTPs:

- E3bln 1.10% Apr-27 BTP, Avg yield 1.46% (Prev. 1.07%), Bid-to-cover 1.38x (Prev. 1.37x)

E3.5bln 0.95% Jun-32 BTP, - E3.5bln 0.95% Jun-32 BTP, Avg yield 2.14% (Prev. 1.81%), Bid-to-cover 1.31x (Prev. 1.37x)

EUROPE OPTION FLOW SUMMARY

Eurozone:

DUK2 110.80/110.70ps, bought for 6.75 in 2.5k

ERU2 100.25/100.37/100.50c fly was bought for 1.25 in 2k

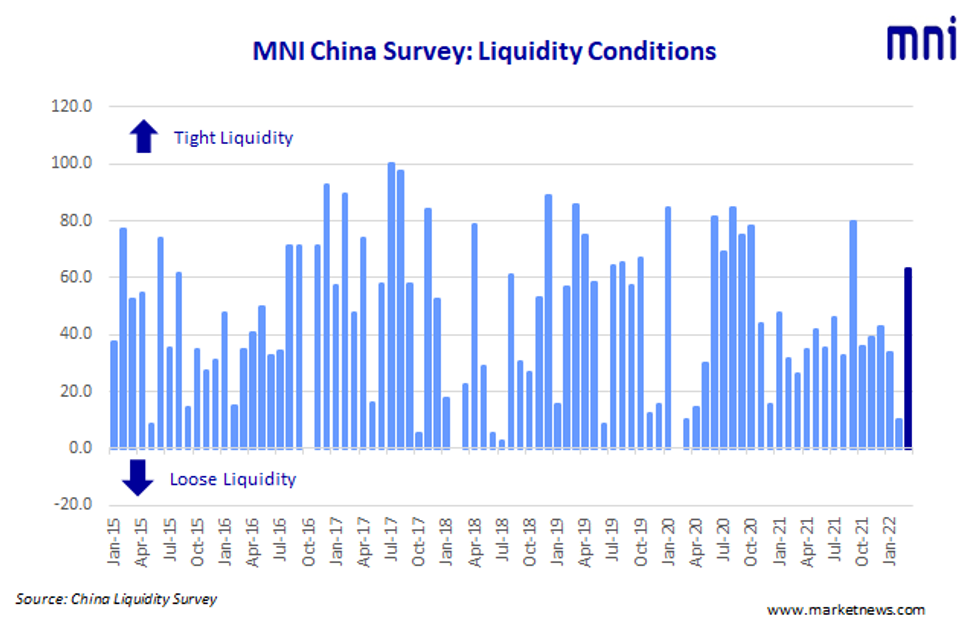

MNI China Liquidity Index™– Jumps To 63.3 in March

Liquidity across China’s interbank markets tightened in March, with banks’ more cautious as they look to keep their books healthy ahead of the quarter-end Macro Prudential Assessment (MPA), the latest MNI Liquidity Conditions Index shows.

The Liquidity Condition Index jumped to 63.3 in March, up sharply from 10.0 in February, with a third of traders reporting condition as “tighter than last month”. The higher the index reading, the tighter liquidity appears to survey participants.

- The Economy Condition Index stood at 21.7, sliding from the 8-month high seen in February, as regional Covid outbreaks weigh on sentiment.

- The PBOC Policy Bias Index remained below 50 for an 9th consecutive month.

- The Guidance Clarity Index was little changed, as respondents again claim to understand the signals from the PBOC.

The MNI survey collected the opinions of 30 traders with financial institutions operating in China's interbank market, the country's main platform for trading fixed income and currency instruments, and the main funding source for financial institutions.

Interviews were conducted Mar 14 – Mar 25.

Click below for the full press release:

MNI China Liquidity Index March 2022.pdf

For full database history and full report on the MNI China Liquidity Index™, please contact:sales@marketnews.com

FOREX: Dollar Pulls Back for Second Session

- The greenback is among the poorest performers in G10 Wednesday, slipping for a second session and putting the USD Index through the 98.00 handle to touch levels not seen since March 17th.

- The JPY is the strongest performer, extending the bounce off the multi-year cycle lows printed earlier in the week. This puts USD/JPY solidly back below the Y122.00 handle. The move is considered corrective and is beginning to allow a recent extreme overbought condition to unwind. An extension lower would open 120.95, the Mar 24 low ahead of the 120.00 handle. Key resistance and the bull trigger has been defined at 125.09.

- Equities across Europe and futures in the US are modestly lower, indicating a negative open on Wall Street later today. Nonetheless, any reports of further progress made between Kyiv and Moscow could continue to support underlying sentiment, with yesterday's 4631.00 print the highest level seen since mid-January.

- ADP Employment Change data crosses later today, with markets expecting the survey to show job gains of 450k, which will be followed shortly afterward by the final revision for Q4 2021 GDP data. The speaker slate should be of more interest, with ECB's Wunsch, Makhlouf and Panetta on the docket as well as Fed's Barkin and George.

FX OPTIONS: Expiries for Mar30 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1000(E2.7bln), $1.1050-60(E1.7bln), $1.1100(E1.5bln), $1.1150-55(E1.1bln), $1.1195-00($1.6bln)

- GBP/USD: $1.3195-00(Gbp774mln)

- EUR/JPY: Y121.00-05(E636mln), Y122.00-05(E660mln), Y122.90-00(E870mln)

- USD/CAD: C$1.2500($503mln), C$1.2525($640mln)

Price Signal Summary - Time For A USDJPY Correction?

- In the equity space, S&P E-Minis traded higher Tuesday, extending the bull cycle that started Mar 15. Bullish conditions have also been reinforced by the recent break of both the 20- and 50-day EMAs. Resistance at 4578.50, Feb 9 high has been cleared. The break has opened 4663.50, Jan 18 high. EUROSTOXX 50 futures have cleared resistance at the 50-day EMA - today at 3863.40. This average represented an important resistance and the break higher confirms a resumption of the bull cycle that started Mar 7. Also, the move higher has confirmed a bull flag breakout on the daily chart. The focus is on 3965.50 next, the Feb 23 high.

- In FX, EURUSD rallied Tuesday and is firmer today. The pair has traded above key near-term resistance of 1.1137, Mar 17 high. The break of this hurdle eases recent bearish threats and highlights a developing bullish theme. Note too that EURUSD has also traded above the 50-day EMA, at 1.1150. This average represents an equally important resistance. An extension higher would open 1.1232, 61.8% of the Feb 10-Mar 7 sell-off. GBPUSD traded sharply lower Monday, extending the pullback from 1.3298, Mar 23 high. Prices have this week breached 1.3120, the Mar 22 low and this opens 1.3000, Mar 15 low and the key support. Key resistance remains the 50-day EMA, at 1.3313. A break would signal a reversal. USDJPY is continuing to pull away from Monday’s high of 125.09 and has traded through initial support at 121.97, the Mar 28 low. The move is considered corrective and is beginning to allow a recent extreme overbought condition to unwind. An extension lower would open 120.95, the Mar 24 low ahead of the 120.00 handle.

- On the commodity front, Gold traded lower Tuesday but did bounce off the day low. The outlook remains bearish though. Recent weakness has allowed an overbought condition to unwind. Key support is seen at the 50-day EMA, at $1903.4, just ahead of the Mar 15 low of $1895.3. Both were probed yesterday, a clear break would signal scope for a deeper pullback. Initial resistance is at $1966.1, Mar 24 high. In the Oil space, WTI traded lower yesterday but did find support at the day low. The move lower however confirms an extension of the reversal from last week’s high of $116.64 on Mar 24. The contract has also cleared the 20-day EMA, strengthening a bearish case and has opened the 50-day EMA at $96.75, a key support.

- In the FI space, Bund futures remain bearish and the trend needle still points south. The focus is on a move to 156.00 next. The trend condition in Gilts remains bearish. Futures traded to a fresh cycle low Monday of 119.86. Gains are considered corrective and the focus is on 119.75, 123.6% of the Feb 15 - Mar 1 climb.

EQUITIES: Energy The Only Sector In Green

- Asian markets closed mixed: Japan's NIKKEI closed down 225.17 pts or -0.8% at 28027.25 and the TOPIX ended 24.06 pts lower or -1.21% at 1967.6. China's SHANGHAI closed up 62.657 pts or +1.96% at 3266.596 and the HANG SENG ended 304.4 pts higher or +1.39% at 22232.03

- European stocks are lower, with the German Dax down 191.42 pts or -1.29% at 14614.16, FTSE 100 down 10.69 pts or -0.14% at 7529.07, CAC 40 down 78.72 pts or -1.16% at 6707.44 and Euro Stoxx 50 down 41.47 pts or -1.04% at 3955.72.

- U.S. futures are down slightly, with the Dow Jones mini down 111 pts or -0.32% at 35079, S&P 500 mini down 17.25 pts or -0.37% at 4608.25, NASDAQ mini down 75.25 pts or -0.49% at 15162.5.

COMMODITIES: WTI, Copper Regain Ground

- WTI Crude up $2.29 or +2.2% at $106.29

- Natural Gas up $0.03 or +0.6% at $5.358

- Gold spot down $0 or 0% at $1920.94

- Copper up $5 or +1.06% at $478.05

- Silver up $0.03 or +0.13% at $24.8069

- Platinum down $2.35 or -0.24% at $984.29

LOOK AHEAD:

| Date | GMT/Local | Impact | Flag | Country | Event |

| 30/03/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 30/03/2022 | 1200/1400 | *** |  | DE | HICP (p) |

| 30/03/2022 | 1215/0815 | *** |  | US | ADP Employment Report |

| 30/03/2022 | 1230/0830 | *** |  | US | GDP (3rd) |

| 30/03/2022 | 1315/0915 |  | US | Richmond Fed's Tom Barkin | |

| 30/03/2022 | 1415/1615 |  | EU | ECB Panetta Hearing on Digital Euro at ECON | |

| 30/03/2022 | 1430/1030 | ** |  | US | DOE weekly crude oil stocks |

| 30/03/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 30/03/2022 | 1700/1300 |  | US | Kansas City Fed's Esther George | |

| 31/03/2022 | 2350/0850 | ** |  | JP | Industrial production |

| 31/03/2022 | 0030/1130 | * |  | AU | Building Approvals |

| 31/03/2022 | 0030/1130 | ** |  | AU | Lending Finance Details |

| 31/03/2022 | 0600/0700 | *** |  | UK | GDP Second Estimate |

| 31/03/2022 | 0600/0700 | * |  | UK | Quarterly current account balance |

| 31/03/2022 | 0630/0730 |  | UK | DMO Gilt Operations Calendar April-June | |

| 31/03/2022 | 0630/0830 | ** |  | CH | retail sales |

| 31/03/2022 | 0645/0845 | ** |  | FR | Consumer Spending |

| 31/03/2022 | 0645/0845 | ** |  | FR | PPI |

| 31/03/2022 | 0645/0845 | *** |  | FR | HICP (p) |

| 31/03/2022 | 0755/0955 | ** |  | DE | unemployment |

| 31/03/2022 | 0800/1000 |  | EU | ECB Lane Lecture at Paris School of Economics | |

| 31/03/2022 | 0900/1100 | ** |  | EU | unemployment |

| 31/03/2022 | 0900/1100 | *** |  | IT | HICP (p) |

| 31/03/2022 | 1000/1200 |  | EU | ECB de Guindos at Discussion at University of Amsterdam | |

| 31/03/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 31/03/2022 | 1230/0830 | ** |  | US | Personal Income and Consumption |

| 31/03/2022 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 31/03/2022 | 1230/0830 | *** |  | CA | Gross Domestic Product by Industry |

| 31/03/2022 | 1300/0900 |  | US | New York Fed's John Williams | |

| 31/03/2022 | 1345/0945 | ** |  | US | MNI Chicago PMI |

| 31/03/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 31/03/2022 | 1530/1130 | ** |  | US | NY Fed Weekly Economic Index |

| 31/03/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 31/03/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 31/03/2022 | 1600/1200 | ** |  | US | USDA GrainStock - NASS |

| 31/03/2022 | 1600/1200 | *** |  | US | USDA PROSPECTIVE PLANTINGS - NASS |

| 01/04/2022 | 2200/0900 | ** |  | AU | IHS Markit Manufacturing PMI (f) |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.