-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN: Dollar Strength Post-Minutes

EXECUTIVE SUMMARY:

- EU'S FULL BAN ON RUSSIAN COAL TO BE PUSHED BACK TO MID-AUGUST (RTRS)

- CHINA VOWS "STRONG" RESPONSE IF PELOSI VISITS TAIWAN

- GERMAN INDUSTRIAL PRODUCTION SLOWS

- ECB'S LAGARDE POSITIVE FOR COVID AHEAD OF MEETING

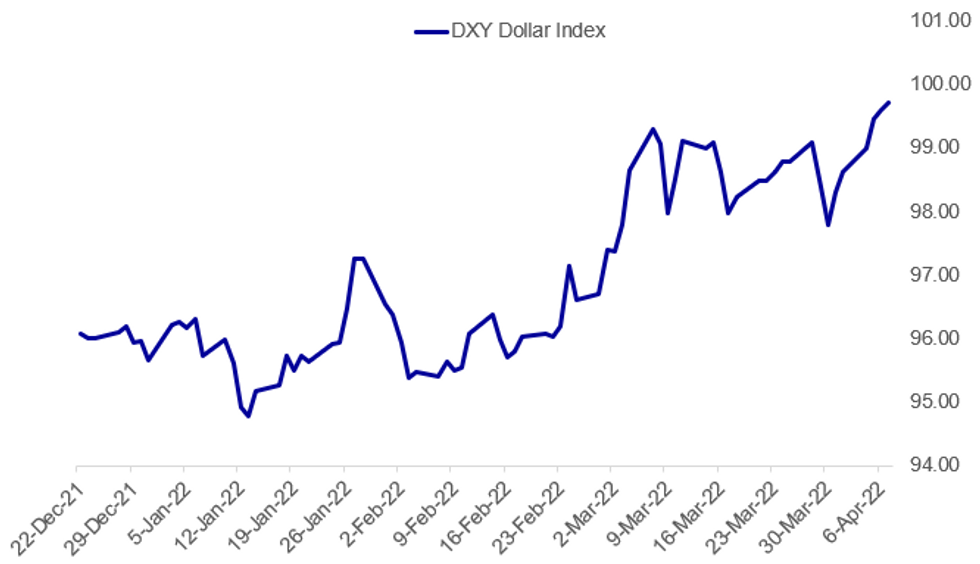

Fig. 1: Dollar Retains Strength Post-FOMC Minutes

Source: BBG, MNI

Source: BBG, MNI

NEWS:

EU/RUSSIA/ENERGY (RTRS): European Union envoys are set to approve on Thursday a ban on Russian coal that would take full effect from mid-August, a month later than initially proposed, an EU source told Reuters, following pressure from Germany to delay the measure. The phase-out of EU imports of Russian coal is the cornerstone measure in a fifth package of sanctions against Russia that the EU Commission proposed this week, as a reaction to atrocities in the Ukrainian town of Bucha.

EU/RUSSIA/ENERGY (BBG): France is prepared to embargo Russian oil imports but must act in coordination with other European countries and that may take a few more weeks, French Finance Minister Bruno Le Maire says on France Info radio.

CHINA/US/TAIWAN (BBG): China has lodged a protest with the U.S. over reports House Speaker Nancy Pelosi plans visit to Taiwan, Foreign Ministry spokesman Zhao Lijian tells regular briefing Thursday in Beijing. Pelosi visit to Taipei would violate “one-China” understanding between Beijing and Washington and send wrong signal to those who support Taiwan’s independence, Zhao says. “If she does visit, China will take strong measures and the consequences will be borne by the U.S.,” Zhao says

CHINA (BBG): China has promised once again to step up monetary support, raising expectations that an interest rate cut or other easing measures could happen as early as next week. The State Council, China’s Cabinet, on Wednesday pledged to use monetary policy tools at an “appropriate time” to boost the economy, citing worsening risks that have “intensified” and in some cases “exceeded expectations.”

BOJ: Bank of Japan board member Asahi Noguchi told reporters on Thursday that corporate retail price hikes so far are insufficient to achieve the sustained 2% price target and that wage hikes of around 3% are needed to absorb the impact of higher cost-push prices.

ECB (TWITTER): @Lagarde This morning I tested positive for COVID-19. I am vaccinated and boosted, and my symptoms are thankfully reasonably mild. I will work from home in Frankfurt until I am fully recovered. There is no impact on the ECB’s operations.

OIL/JAPAN (BBG): Japan will release 15m barrels of oil from its strategic reserves as part of coordinated efforts with the International Energy Agency to mitigate the impact of surging energy prices, Kyodo reports, without saying where it obtained the information. Oil to come from government and private-sector stockpiles

BP/RUSSIA/OIL (BBG): Shell Plc said its withdrawal from Russia will result in $4 billion to $5 billion of impairments, while also warning investors that extreme energy price volatility in the first quarter could hit cash flow. The statement from the London-based giant shows that, despite a surge in oil and gas prices, Russia’s invasion of Ukraine has upended the supermajors’ plans and left them scrambling to adapt to historic shifts in energy markets.

UK: The average value of house prices in the UK rose to a fresh record high in March, as prices rose at the fastest monthly rate in 6 months, Halifax, the UK's largest mortgage lender said Thursday. Prices rose 1.4% m/m and 11.0% y/y, pushing the average property to GBP282,753. Two years on from the first lockdown, house prices have now risen by GBP43,577, the Halifax said. However, Russel Galley, group managing director, warned that cost of living pressures will likely slow the rate of house price growth this year.

DATA:

MNI: GERMANY FEB IP +0.2% M/M, +3.2% Y/Y; JAN +1.4%r M/M

German IP Slows in February

FEB INDUSTRIAL PRODUCTION +0.2% M/M, +3.2% Y/Y; JAN +1.4%r M/M

- German IP was as forecasted at +0.2% m/m in February (+1.4% in Jan), with year-on-year growth somewhat below consensus at +3.2% y/y (vs +3.7% expected).

- Consumer goods production rose 4.4% and intermediate goods rose 0.5%, whilst capital goods saw a decline of 2.0%. Energy goods production rose a substantial 4.9% m/m.

- Compared to pre-pandemic February 2020, this year's print remained 3.8% weaker, due to input shortages which continue to hamper production.

- January's print saw substantial downwards revisions of 1.3pp on the month and 0.7pp on the year.

EUROZONE FEB RETAIL SALES +0.3% M/M, +5.0% Y/Y; JAN +8.4%r Y/Y

Retail Sales Edge Higher, Headwinds Appearing

EUROZONE FEB RETAIL SALES +0.3% M/M, +5.0% Y/Y; JAN +8.4%r Y/Y

EZ JAN RETAIL SALES REVISED UP 0.6PP to +8.4% Y/Y

- In February, eurozone retail trade rose 0.3% m/m (Jan: +0.2%), milder than the +0.5% m/m forecast.

- Retail trade grew by +5.0% y/y, 3.4pp slower than the strong upwardly-revised January print. Comparison to harsh lockdowns of Winter 2020/2021 is boosting this number.

- Automotive fuels retail trade saw a 3.2% increase, followed by +0.8% for non-food products.

- This data is largely pre-Ukraine invasion and acts as a benchmark for March data, which will incorporate the effects of substantial declines in consumer confidence.

FIXED INCOME: FI higher as markets focus on growth concerns following FOMC Minutes

- Markets have generally been drifting mildly higher this morning, but saw bigger moves through the Asian session as markets digested yesterday's FOMC Minutes. A faster pace of balance sheet wind down has led to some concerns over the growth outlook, with the Fed seemingly contemplating a 50bp hike in March (but most members were deterred by the Ukraine war).

- After being closed overnight, gilts are leading the moves today.

- Looking ahead we will receive the ECB Accounts of their monpol meeting, and given the surprisingly more hawkish tilt at the March meeting, these will be closely watched too. Any hints on how soon next steps could come and whether there is any scope to bring forward any expected policy moves are likely to be analysed.

- We will also hear from Fed's Bullard, Bostic and Evans as well as BOE's Pill (although the latter is just giving opening remarks at a conference for 15 minutes - so may not address much if anything on monpol).

- TY1 futures are up 0-12 today at 121-02 with 10y UST yields down -2.9bp at 2.571% and 2y yields down -3.8bp at 2.435%.

- Bund futures are up 0.53 today at 157.77 with 10y Bund yields down -2.8bp at 0.617% and Schatz yields down -3.7bp at -0.84%.

- Gilt futures are up 0.63 today at 120.82 with 10y yields down -3.6bp at 1.666% and 2y yields down -4.6bp at 1.406%.

FOREX: Greenback Holds Close to Cycle Highs as Fed Minutes Underpin

- The greenback remains solid following Wednesdays' Fed minutes release, which underlined the hawkish bias present among the FOMC. The USD Index touched a fresh cycle high at 99.769 following the release, putting the USD at the best levels since May 2020.

- The hawkish interpretation of the Fed minutes has been based on the Fed's speedy plans for the balance sheet roll-off, with the FOMC weighing a pace of reduction at $95bln per month, while accelerating the tightening cycle at a clip of 50bps at several rate decisions.

- GBP is among the strongest performers in G10 so far, with EUR/GBP extending the recent downtick to touch 0.8314. This narrows the gap with 0.8296, the next key support which marks the mid-March lows. Weakness through here opens 0.8276, the 76.4% retracement of the Mar 7 - 31 rally as well as 0.8203, the Low from March 7 and the current bear trigger.

- GBP, JPY are among the best performers in G10, while AUD, NZD are the weakest so far.

- Focus turns to the weekly US jobless clams release, as well as scheduled speeches from BoE's Pill, Fed's Bullard, Bostic and Evans.

EQUITIES: Asia Closes Lower; Energy Names Lag In Europe

- Asian stocks closed lower: Japan's NIKKEI closed down 461.73 pts or -1.69% at 26888.57 and the TOPIX ended 30.01 pts lower or -1.56% at 1892.9. China's SHANGHAI closed down 46.731 pts or -1.42% at 3236.695 and the HANG SENG ended 271.54 pts lower or -1.23% at 21808.98.

- European futures are mixed, with the German Dax up 66.29 pts or +0.47% at 14207.28, FTSE 100 down 27.3 pts or -0.36% at 7584.37, CAC 40 up 19.07 pts or +0.29% at 6498.83 and Euro Stoxx 50 up 23.02 pts or +0.6% at 3848.57.

- U.S. futures are up slightly, led by tech: Dow Jones mini up 4 pts or +0.01% at 34403, S&P 500 mini up 9 pts or +0.2% at 4484.75, NASDAQ mini up 68.5 pts or +0.47% at 14573.75.

COMMODITIES: WTI Touches 3-Week Low

- WTI Crude up $0.25 or +0.26% at $97.69

- Natural Gas up $0.08 or +1.33% at $6.155

- Gold spot up $1.26 or +0.07% at $1925.42

- Copper down $5.35 or -1.13% at $472.55

- Silver down $0.09 or -0.36% at $24.3348

- Platinum down $7.12 or -0.74% at $951.25

LOOK AHEAD:

| Date | GMT/Local | Impact | Flag | Country | Event |

| 07/04/2022 | 1130/1330 |  | EU | ECB March meet Accts published | |

| 07/04/2022 | 1215/1315 |  | UK | BOE Pill Opening at BOE Sovereign Bond Market Conference | |

| 07/04/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 07/04/2022 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 07/04/2022 | 1300/0900 |  | US | St. Louis Fed's James Bullard | |

| 07/04/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 07/04/2022 | 1530/1130 | ** |  | US | NY Fed Weekly Economic Index |

| 07/04/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 07/04/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 07/04/2022 | 1800/1400 |  | US | Atlanta Fed's Raphael Bostic, Chicago Fed's Charles Evans | |

| 07/04/2022 | 1900/1500 | * |  | US | Consumer Credit |

| 07/04/2022 | 2005/1605 |  | US | New York Fed's John Williams | |

| 08/04/2022 | 0700/0900 | ** |  | ES | Industrial Production |

| 08/04/2022 | 0800/1000 | * |  | IT | Retail Sales |

| 08/04/2022 | 0900/1100 | ** |  | NO | Norway GDP |

| 08/04/2022 | 1115/1315 |  | EU | ECB Panetta at IESE Business School Conference | |

| 08/04/2022 | 1230/0830 | *** |  | CA | Labour Force Survey |

| 08/04/2022 | 1400/1000 | ** |  | US | Wholesale Trade |

| 08/04/2022 | 1600/1200 | *** |  | US | USDA Crop Estimates - WASDE |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.