-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - More cycle highs for yields

Highlights:

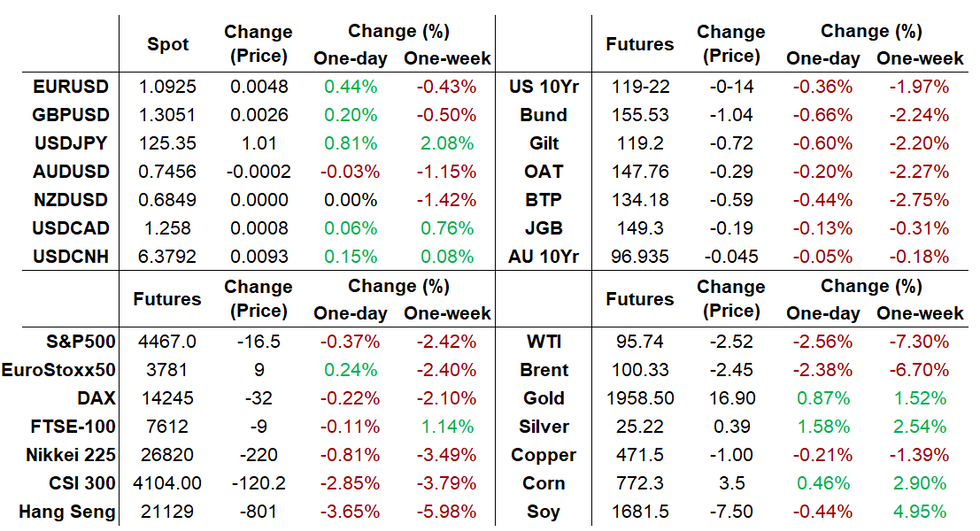

- Macron performs a bit better than expected in first round of French election; EGBs sell-off and lead FI lower.

- EURJPY the big mover in FX space as yields rise (hitting JPY) and the euro benefits from French election result.

US TSYS: Treasury Sell Off Gathers Pace

- Cash Treasuries have sold off a further ~7bps across most of the curve with only the very long end outperforming despite relatively little change in Fed hiking expectations. Tsys slightly lag the sell-offs in Bunds, Gilts on the day.

- The largely level shift in the curve sees 2s10s remains in the 15-20bps range of the past few days, having been -10bps at the start of last week as QT plans helps boost longer-term yields. The 10YY earlier touched the highest since Jan-2019.

- 2YY +7.2bps at 2.584%, 5YY +7.4bps at 2.827%, 10YY +7.4bps at 2.774%, 30YY +5.8bps at 2.775%.

- TYM2 sits 15+ ticks lower at 119-20+ having again touched a new cycle low of 119-17 earlier on average volumes. The break lower confirms a resumption of the primary downtrend and maintains the bearish price sequence of lower lows and lower highs. Beyond the intraday low, next support is eyed at 119-04+ (low Dec 3 2018 cont) whilst resistance is 121-06+ (Apr 7 high).

- Fedspeak: Bostic, Bowman opening remarks, Waller closing remarks at event starting 0930ET, Evans on mon pol at 1240ET plus an addition in NY Fed’s Williams at 1200ET.

- Bill issuance: US Tsy $57B 13W, $48B 26W bill auctions (1130ET)

- Bond issuance: YS Tsy $46B 3Y note auction (1300ET)

EGBs-GILTS: New multi year high in Yields

- Bund 10yr Yield trade at another multi year high, above 0.78%, but short of the net psychological resistance at 0.80%.

- The latter would equate to 155.29 today.

- Italian 10yr yield has cleared 2.40% in 10yr Yield, albeit off the high at the time of typing.

- Peripherals are all tighter, with Greece leading by a decent 12.2bps, Italy is 6.2bps tighter.

- Gilt remains under pressure and through new intraday lows, pushing the 10yr Yield to the highest level since 15/01/16, through 1.80%.

- Next support comes at 118.93 Low Apr 26 2016 (cont).

- Looking ahead, there are no tier 1 data left for the session.

- But attention turns to UK and US inflation data, as well as the ECB this week.

STIR FUTURES: Fed Hike Expectations Grind Higher For 2022

- Fed Funds pricing for upcoming meetings remains largely unchanged from Friday’s highs, with 47bps for May and 94-95bps for June.

- Pricing for 2H2022 has firmed a touch more, with 224bps to year-end off new highs overnight of 226bps.

- The next test is likely CPI for March tomorrow.

- Four Fed speakers today, including Governors Bowman and Waller, but three are set to just give brief opening/closing remarks at a Fed listens event.

- Evans (2023 voter) discusses the economy/mon pol at 1240ET but his views are well known. He reiterated on Thursday that he sees 7 hikes in 2022, doesn’t have a 50bp hike in his forecast but will “see how it plays out”, and wants rates towards neutral (2.25-2.5%) by end 2022 or early 2023.

FOMC-dated Fed Funds futures implied cumulative hikes (bps)Source: Bloomberg

FOMC-dated Fed Funds futures implied cumulative hikes (bps)Source: Bloomberg

European issuance: 6/12-month bubill auction results

| Type | 6-month bubill | 12-month bubill |

| Maturity | Oct 19, 2022 | Apr 13, 2023 |

| Allotted | E2.719bln | E2.615bln |

| Previous | E1.757bln | E1.63bln |

| Avg yield | -0.5387% | -0.3374% |

| Previous | -0.7060% | -0.5573% |

| Bid-to-cover | 1.81x | 1.45x |

| Previous | 1.96x | 1.19x |

| Buba cover | 2.00x | 1.66x |

| Previous | 3.35x | 2.19x |

| Previous date | Mar 14, 2022 | Mar 21, 2022 |

| Total sold | E3bln | E3bln |

OPTION FLOW SUMMARY

RXK2 160.50/161.50cs, bought for 3 in 7k

DUK2 111/110.90ps, sold at 9 in 5kDUM2 111.10/111.30cs, sold at 2 and 2.5 in 6k

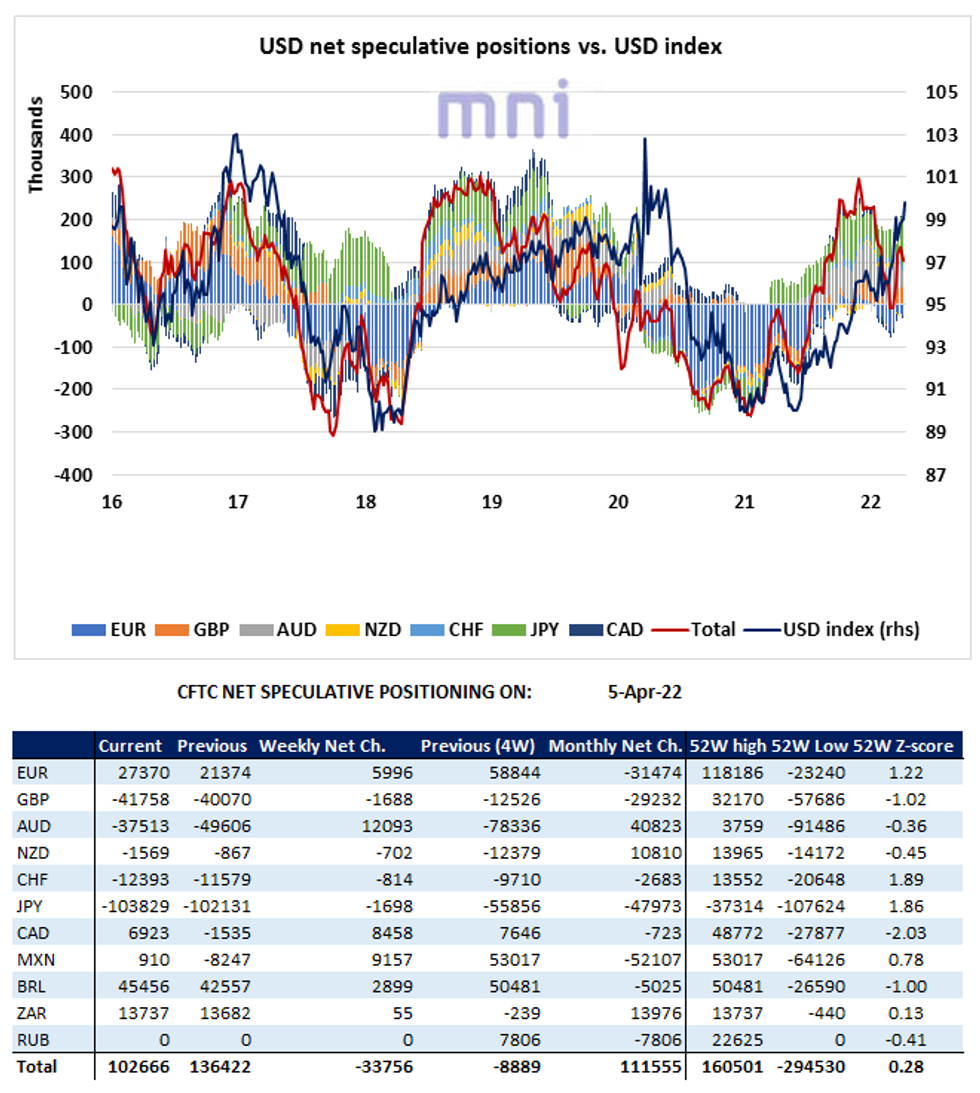

Net Dollar Specs Tick Lower Despite USD Appreciation

- Net long specs on the US Dollar ticked lower in the week ended April 5 despite the USD spike, decreasing by 33.8K to a total of 102.7K contracts.

- Speculative positions against the Yen have reached their highest level since November 2011 (+103.8K) as investors have become increasingly bearish on JPY amid monetary policy divergence.

- The global risk off environment triggered by the renewed geopolitical tensions has been supporting ‘safe-haven’ assets such as the US Dollar and Gold.

- The DXY index broke above the 99.7390 level last week (76.4% Fibo retracement of the 89.21 – 102.98 range) and found a local high at 100.1890 on Friday before consolidating lower.

- Next ST resistance to watch on the topside stands at 100.5560 (May 14 2020 high).

- On the downside, first support to watch stands at 99.40, followed by 99.

- Key support remains at 97.7270, (61.8% Fibo), which was rejected several times last month.

Source: Bloomberg/MNI

Price Signal Summary - FI Futures Resume Their Downtrend

- In the equity space, S&P E-Minis traded lower last week. The contract is testing a key area of support at the 50-day EMA. This average intersects at 4456.43 and marks a key pivot level. A clear break would strengthen a bearish case and allow for a deeper pullback that would open 4425.96 initially, 38.2% retracement of the Feb 24 - Mar 29 rally. Resistance is at 4588.75, the Apr 5 high. EUROSTOXX 50 futures also traded lower last week. Price has moved below the 20- and 50-day EMAs and probed support at 3735.00, the Mar 18 low. The move lower undermines the recent bull theme and highlights a developing bearish threat. An extension lower would open 3626.50, 50.0% of the Ma r 7 - 29 rally. Key short-term resistance has been defined at 3944.00, the Mar 29 high.

- In FX, EURUSD remains vulnerable The recent failure at 1.1185, Mar 31 high, highlights a bearish threat. Attention is on 1.0806, the Mar 7 low and a bear trigger. The GBPUSD outlook remains bearish and the pair has probed the key support at 1.3000, Mar 15 low and the near-term bear trigger. The focus is on 1.2954, 1.764 projection of the Jan 13 - 27 - Feb 10 price swing. Resistance is at 1.3136, the 20-day EMA. USDJPY has started the week on a firmer note and has breached 125.09, the Mar 28 high. The break confirms the end of the recent corrective cycle and more importantly, marks a resumption of the primary uptrend. This paves the way for strength towards 125.86 next, the Jun 5 2015 high and a major resistance.

- On the commodity front, Gold is firmer today but remains inside its range. The yellow metal recently found support at $1890.2, on Mar 29, and this level still represents the short-term bear trigger. Initial resistance is at $1966.1, Mar 24 high. In the Oil space, WTI futures traded lower last week, resulting in a breach of the 50-day EMA. The print below this average suggests scope for a continuation lower. The focus is on the next key support at $92.20, Mar 15 low. Initial firm resistance has been defined at $105.59, the Apr 5 high.

- In the FI space, Bund futures have traded to a fresh cycle low today, confirming a resumption of the primary downtrend. The next objective is 155.03, the Dec 4 2015 low (cont). Gilts continue to trade lower and recent weakness has confirmed a resumption of the primary downtrend. The focus is on 118.93, the Apr 26 2016 low (cont). Treasuries are weaker too as the downtrend extends. This has opened 119-04+ next, the Dec 3 2018 low (cont).

EQUITIES: French equities buoyed by election; others down as yields rise

- Japan's NIKKEI down 164.28 pts or -0.61% at 26821.52 and the TOPIX down 7.15 pts or -0.38% at 1889.64.

- China's SHANGHAI closed down 84.724 pts or -2.61% at 3167.126 and the HANG SENG ended 663.71 pts lower or -3.03% at 21208.3.

- German Dax down 56.03 pts or -0.39% at 14229.64, FTSE 100 down 17.48 pts or -0.23% at 7652.14, CAC 40 up 45.65 pts or +0.7% at 6593.7 and Euro Stoxx 50 up 0.74 pts or +0.02% at 3859.42.

- Dow Jones mini down 20 pts or -0.06% at 34602, S&P 500 mini down 17.5 pts or -0.39% at 4466.75, NASDAQ mini down 116.75 pts or -0.81% at 14211.5.

COMMODITIES: Crude under pressure this morning

- WTI Crude down $2.46 or -2.5% at $95.85

- Natural Gas (NYM) up $0.08 or +1.23% at $6.357

- Natural Gas (ICE Dutch TTF) down $2.28 or -2.2% at $101.7

- Gold spot up $7.1 or +0.36% at $1953.91

- Copper down $1.3 or -0.28% at $471.4

- Silver up $0.23 or +0.93% at $24.9947

- Platinum up $12.92 or +1.32% at $991.2

| Date | GMT/Local | Impact | Flag | Country | Event |

| 11/04/2022 | 1330/0930 |  | US | Atlanta Fed's Raphael Bostic | |

| 11/04/2022 | 1330/0930 |  | US | Fed Governors Michelle Bowman and Christopher Waller | |

| 11/04/2022 | 1500/1100 | ** |  | US | NY Fed survey of consumer expectations |

| 11/04/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 11/04/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 11/04/2022 | 1600/1200 |  | US | New York Fed's John Williams | |

| 11/04/2022 | 1640/1240 |  | US | Chicago Fed's Charles Evans | |

| 11/04/2022 | 1700/1300 | *** |  | US | US Note 03 Year Treasury Auction Result |

| 12/04/2022 | 2301/0001 | * |  | UK | BRC-KPMG Shop Sales Monitor |

| 12/04/2022 | 0600/0700 | *** |  | UK | Labour Market Survey |

| 12/04/2022 | 0600/0800 | *** |  | DE | HICP (f) |

| 12/04/2022 | 0645/0845 | * |  | FR | Foreign Trade |

| 12/04/2022 | 0645/0845 | * |  | FR | Current Account |

| 12/04/2022 | 0900/1100 | *** |  | DE | ZEW Current Conditions Index |

| 12/04/2022 | 0900/1100 | *** |  | DE | ZEW Current Expectations Index |

| 12/04/2022 | 1000/0600 | ** |  | US | NFIB Small Business Optimism Index |

| 12/04/2022 | 1230/0830 | *** |  | US | CPI |

| 12/04/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 12/04/2022 | 1400/1000 | ** |  | US | IBD/TIPP Optimism Index |

| 12/04/2022 | 1610/1210 |  | US | Fed Governor Lael Brainard | |

| 12/04/2022 | 1700/1300 | ** |  | US | US Note 10 Year Treasury Auction Result |

| 12/04/2022 | 1700/1300 |  | US | Philadelphia Fed's Patrick Harker | |

| 12/04/2022 | 1800/1400 | ** |  | US | Treasury Budget |

| 12/04/2022 | 2245/1845 |  | US | Richmond Fed's Tom Barkin |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.