-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - Markets Gear For Fresh Multi-Decade High CPI

Highlights:

- Markets gear for new multi-decade high CPI

- Earnings season begins, financials set the tone this week

- WTI adds over 5% off the Monday low

US TSYS SUMMARY: Treasuries Softer Pre-CPI, 2s10s At Pre March FOMC Levels

- Cash Treasuries sit softer on the day despite a recent rally, largely consolidating yesterday’s bear steepening which drove 2s10s ~10bps higher, currently at 27bps having touched -10bps early last week. It is broadly back to where it was prior to the Mar 16 FOMC decision.

- 2Y yields are 9bps off last week’s new high of 2.60% despite a continued ratcheting up in Fed hike expectations, whilst 10Y yields are only 4.5bps off highs touched overnight (highest since Dec-2018)

- 2YY +1.5bps at 2.512%, 5YY +0.9bps at 2.797%, 10YY +1.0bps at 2.790%, 30YY +0.2bps at 2.810%.

- TYM2 is down just 2 ticks at 119-22 having increased sharply in recent trade. The bear trend is seen extending, with support at the intraday low of 119-10+ after which it eyes at 119-04+ (low Dec 3 2018 cont).

- Data: Dominated by CPI for March at 0830ET, with headline surging +1.2% M/M on energy whilst core is seen at +0.5% M/M after +0.51% M/M in Feb. Monthly Budget Statement at 1400ET.

- Fedspeak: Brainard (voter, soon to be VC) at 1210ET before Barkin (2024 voter) late on at 1900ET.

- Bond issuance: US Tsy $34B 10Y note auction re-open (91282CDY4) at 1300ET

Source: Bloomberg

Source: Bloomberg

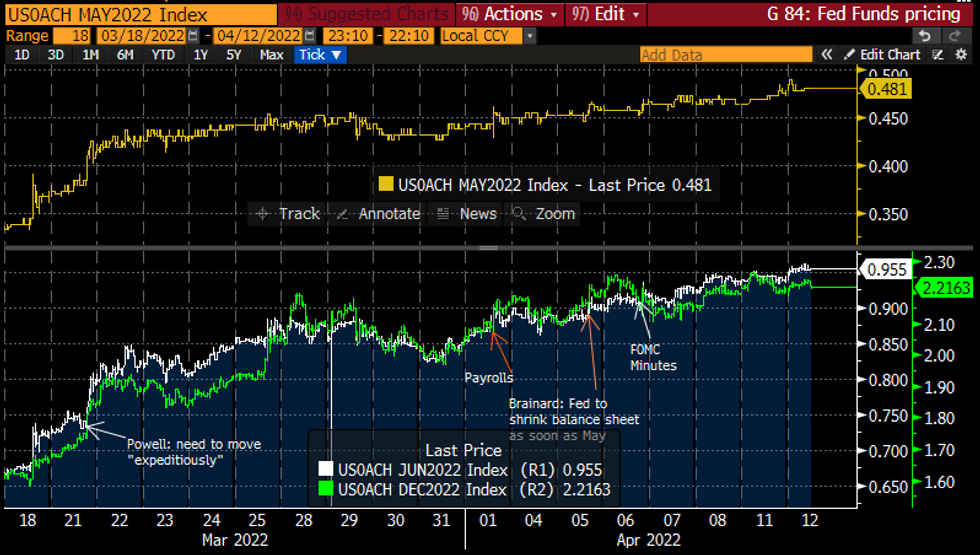

STIR FUTURES: Fed Hikes Firm Further Ahead Of CPI

- Fed Funds implied hikes up to 48bps for May 4 and 95-96bps for Jun 15. The 222bp to year-end is up overnight but remains off previous highs of 226bp.

- CPI at 0830ET: https://marketnews.com/mni-us-cpi-preview

- Fedspeak: Brainard speaks at 1210ET – no text but Q&A. Her comments prior to the minutes had buoyed expectations that the Fed will shrink the balance sheet at a rapid pace as soon as May, whilst noting it was “of paramount importance to get inflation down” and that the Fed will continue to tighten policy “methodically”.

FOMC-dated Fed Funds Futures implied cumulative hikes (bps)Source: Bloomberg

FOMC-dated Fed Funds Futures implied cumulative hikes (bps)Source: Bloomberg

EGB/GILT SUMMARY: US CPI Comes Into Focus

European government bonds sold off early in the session before starting to recoup losses.

- Expectations for more aggressive monetary policy normalisation continue to underpin weaker trading in sovereign bonds, with this afternoon's US CPI print for March providing a further potential catalyst.

- Gilts have recovered most of the earlier losses while still trading slightly below yesterday's closing levels. Cash yields are broadly 1-2bp higher on the day.

- It is a similar story for bunds where the curve is 2bp steeper.

- The OAT curve has slightly twist steepened on the day with the 2s30s spread widening 1bp.

- BTPs have fully recovered the day's losses and now trade above yesterday's close. Cash yields are down 1-2bp.

- Supply this morning came from the UK (Gilt, GBP2.50bn), Germany (Schatz, EUR4.453bn), Italy (BOT, EUR6.5bn), the Netherlands (DSL, EUR2.505bn), Belgium (TCs, EUR 2.6bn) and the ESM (Bills, EUR854.8m).

- The final German CPI estimate for March matched the initial reading (7.6% Y/Y)

EUROPE ISSUANCE UPDATE:

Germany allots E4.453bln 0% Mar-24 Schatz, Avg yield 0.16% (Prev. -0.36%), Bid-to-cover 1.26x (Prev. 0.87x), Buba cover 1.55x (Prev. 1.08x)

UK DMO sells GBP2.50bln 1.00% Jan-32 Gilt, Avg yield 1.925% (Prev. 1.598%), Bid-to-cover 2.64x (Prev. 2.51x), Tail 0.2bp (Prev. 0.7bp)

Netherlands sells E2.505bln 0.50% Jul-32 DSL, Avg yield 1.131% (Prev. 0.572%)

EUROPE OPTION FLOW SUMMARY

Eurozone:

UBM2 179/177/176p fly, bought for 0.62 in 1k

RXK2 156/155/154p fly, sold at 15.5 in 3k

RXM2 167c, bought for 6 in 5.4k

DUK2 110.30/110.10ps, bought for 8 in 5.2k

DUK2 110.60/110.80cs 1x2, sold at 0.25 in 5.3k (rolling 110.60 call)

SX5E 14th April 3700^, trades 102.5 in 1.9k vs VGM2 at 3700

SX5E 17th June 3700/3300ps 1x1.5, bought for 66 in 3k

SX5E 16th Sep 3300/2550ps, bought for 87 in 5k

SX5E 16th Dec 3400/2500ps 1x2, bought for 95 in 8

SX7E 16th Dec 85/80/75p fly, bought for 0.40in 10k

US:

US 5yr roll; FVK2 113p, sold at '32 in 20k, to buy FVM2 112.25p for '38.5 in 20k

FOREX: AUD Bounces Off Overnight Lows as China Stocks Erase Early Weakness

- AUD is the strongest currency on the day across G10, with AUD/USD bouncing off overnight lows of $0.7400 in a move that coincided with a late recovery in Asia-Pacific equities. After sustaining losses of close to 1% at the midday break, the Shanghai Comp rose sharply on the resumption of trade, resulting in a near 2.5% swing for the index - a move that will likely raise questions around potential official involvement via state-run pension funds.

- GBP trades a little softer following jobs data this morning that showed payrolled employees rose by a smaller margin than forecast, with the February release also seeing a negative revision. GBP/USD edged to new lows of 1.2994 following the release, narrowing the gap with the first support of 1.2983 - the Apr 8 low.

- Lastly, the USD Index is very slightly higher - rising around 0.2% into the NY crossover having erased opening weakness. Focus turns to the looming US inflation release as well as the formal beginning of US earnings season, which sees a number of large US bank names report this week.

- Focus turns to the US CPI release, at which markets expect M/M CPI to rise to 1.2% and for the Y/Y release to hit 8.4% - the highest rate since the early 1980's.

FX OPTION EXPIRIES:

- EURUSD: 1.0930 (226mln), 1.0900 (867mln).

- AUDUSD: 0.7400 (726mln)

- USDCAD: 1.2585 (310mln), 1.2650 (1.43bn)

- USDCNY: 6.40 (509mln)

- NZDUSD: 0.6850 (304mln)

- EURGBP: 0.8300 (243mln)

Price Signal Summary - S&P E-Minis Have Breached The 50-day EMA

- In the equity space, S&P E-Minis have traded lower today, extending Monday’s bearish start to the week. The contract has breached the 50-day EMA, which intersects at 4454.59 and this reinforces a bearish threat. The move below 4400.00 signals scope for weakness towards 4362.63 next, 4362.63 50.0% retracement of the Feb 24 - Mar 29 rally. EUROSTOXX 50 futures have also traded lower today. Price has recently moved below the 20- and 50-day EMAs and breached support at 3735.00, Mar 18 low. The move lower undermines the recent bull theme and highlights a developing bearish threat. An extension lower would open 3626.50, 50.0% of the Mar 7 - 29 rally.

- In FX, EURUSD is unchanged and remains vulnerable The recent failure at 1.1185, Mar 31 high, highlights a bearish threat. Attention is on 1.0806, the Mar 7 low and a bear trigger. The GBPUSD outlook remains bearish and support at 1.3000, Mar 15 low, remains exposed. The focus is on 1.2954, 1.764 projection of the Jan 13 - 27 - Feb 10 price swing. Resistance is at 1.3136, the 20day EMA. USDJPY started the week on a firm note and is holding onto its gains. The pair has cleared 125.09, the Mar 28 high. The break confirms a resumption of the primary uptrend. This paves the way for strength towards 125.86 next, the Jun 5 2015 high and a major resistance.

- On the commodity front, Gold traded higher yesterday and probed initial resistance at $1966.1, Mar 24 high. A clear breach of this hurdle would signal a range breakout and suggest scope for an extension of short-term gains. This would open $1980.3 initially, 50.0% retracement of the Mar 8 - 29 downleg. Support lies at $1913.0, the 50-day EMA. In the Oil space, WTI futures remain bearish. The print below the 50-day EMA suggests scope for a continuation lower. The focus is on the next key support at $92.20, Mar 15 low. Initial firm resistance has been defined at $105.59, the Apr 5 high.

- In the FI space, Bund futures have traded lower once again today, confirming a resumption of the primary downtrend. The next objective is the 154.00 handle. Gilts continue to trade lower too and recent weakness has confirmed a resumption of the primary downtrend. The focus is on 118.05, 0.618 projection of the Mar 1 - 28 - Apr 4 price swing.

EQUITIES: Financials Due to Set The Tone After Volatile Quarter

- US Earnings season begins in earnest this week, with financials the early highlight. JPM and BlackRock are due to set the tone on Wednesday, before Citigroup, GS, MS and WFC follow later in the week.

- Full schedule with timings and EPS & Revenue expectations here:

- https://marketnews.com/mni-us-earnings-schedule-ba...

COMMODITIES: WTI Rallies 5% From Monday Lows

- WTI Crude up $2.87 or +3.04% at $96.94

- Natural Gas up $0.14 or +2.12% at $6.781

- Gold spot down $1.92 or -0.1% at $1951.41

- Copper up $5.1 or +1.1% at $468.5

- Silver down $0.16 or -0.62% at $24.943

- Platinum down $16.53 or -1.68% at $964.87

| Date | GMT/Local | Impact | Flag | Country | Event |

| 12/04/2022 | 0900/1100 | *** |  | DE | ZEW Current Conditions Index |

| 12/04/2022 | 0900/1100 | *** |  | DE | ZEW Current Expectations Index |

| 12/04/2022 | 1000/0600 | ** |  | US | NFIB Small Business Optimism Index |

| 12/04/2022 | 1230/0830 | *** |  | US | CPI |

| 12/04/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 12/04/2022 | 1400/1000 | ** |  | US | IBD/TIPP Optimism Index |

| 12/04/2022 | 1610/1210 |  | US | Fed Governor Lael Brainard | |

| 12/04/2022 | 1700/1300 | ** |  | US | US Note 10 Year Treasury Auction Result |

| 12/04/2022 | 1700/1300 |  | US | Philadelphia Fed's Patrick Harker | |

| 12/04/2022 | 1800/1400 | ** |  | US | Treasury Budget |

| 12/04/2022 | 2245/1845 |  | US | Richmond Fed's Tom Barkin | |

| 13/04/2022 | 0200/1400 | *** |  | NZ | RBNZ official cash rate decision |

| 13/04/2022 | 0600/0700 | *** |  | UK | Consumer inflation report |

| 13/04/2022 | 0600/0700 | *** |  | UK | Producer Prices |

| 13/04/2022 | 0700/0900 | *** |  | ES | HICP (f) |

| 13/04/2022 | 0800/1000 | * |  | IT | Industrial Production |

| 13/04/2022 | 0830/0930 | * |  | UK | ONS House Price Index |

| 13/04/2022 | 0900/1100 | ** |  | EU | industrial production |

| 13/04/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 13/04/2022 | 1400/1000 | *** |  | CA | Bank of Canada Policy Decision |

| 13/04/2022 | 1400/1000 |  | CA | BOC Monetary Policy Report | |

| 13/04/2022 | 1430/1030 | ** |  | US | DOE weekly crude oil stocks |

| 13/04/2022 | 1500/1100 |  | CA | BOC Governor Press Conference | |

| 13/04/2022 | 1630/1230 |  | US | Richmond Fed's Thomas Barkin | |

| 13/04/2022 | 1700/1300 | *** |  | US | US Treasury Auction Result for 30 Year Bond |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.