-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN: European Yields Rise Ahead Of ECB

EXECUTIVE SUMMARY:

- MNI ECB PREVIEW: BE PREPARED FOR A HAWKISH SURPRISE

- RUSSIA MAY PUT NUCLEAR ARMS IN BALTIC IF FINLAND, SWEDEN JOIN NATO

- BOJ SEES JGB TWEAKS ONLY SHORT-TERM IMPACT ON YEN (MNI INSIGHT)

- VETERAN BOJ WATCHER PREDICTS HAWKISH TWEAK TO BANK'S GUIDANCE (RTRS)

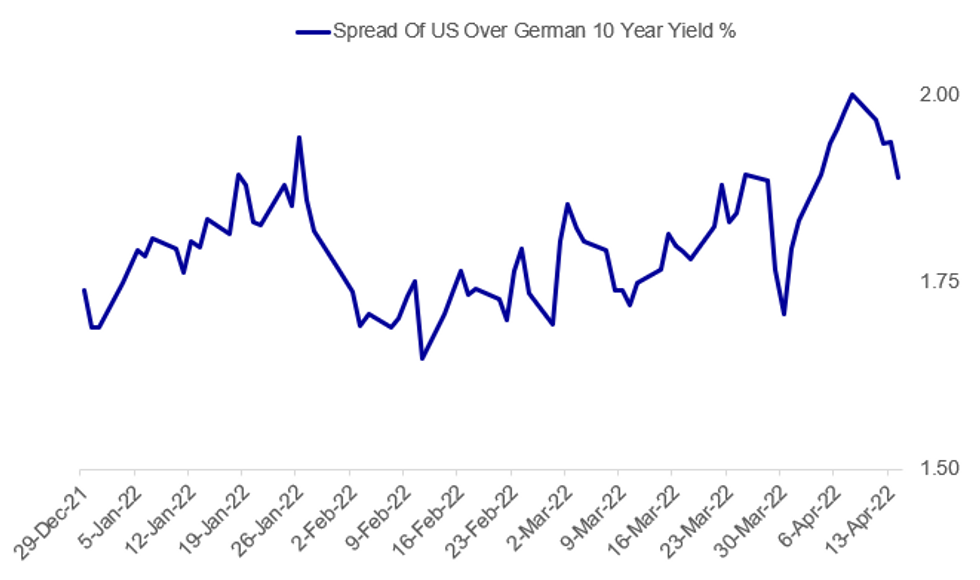

Fig. 1: US/German Yield Spread Narrows Pre-ECB

Source: BBG, MNI

Source: BBG, MNI

NEWS:

ECB PREVIEW (MNI - SEE WEBSITE FOR FULL PREVIEW): While consensus expects no material change in policy at the April ECB meeting, we believe that it is a close call and that markets should be prepared for a hawkish surprise. Inflation has accelerated rapidly since the last meeting and waiting until September or later before starting to unwind negative rates feels like an exceptionally long time given the magnitude of recent inflation surprises and upside risks to energy prices.

RUSSIA-NATO (BBG): Russia may move nuclear weapons, anti-aircraft systems, warships and infantry to the Baltic region if Sweden, Finland join NATO, Dmitry Medvedev, deputy chief of Security Council, says in Telegram post Thursday.“If Sweden and Finland enter NATO, the length of the land border of Russia with the alliance will more than double. We will need to seriously strengthen our land forces and anti-aircraft and deploy substantial naval forces in the Gulf of Finland basin.”

RUSSIA-EU (BBG): Vladimir Putin is continuing to make contracted gas deliveries to Europe and will accept payments in euros, Austrian Chancellor Karl Nehammer told the APA news service days after meeting the Russian president. Nehammer spoke to Austrian news agency following his 90-minute conversation with Putin on Monday, the first visit by a European leader to Moscow since Russia started its war against Ukraine seven weeks ago.

RUSSIA-EU (BBG): The European Union has warned member states that President Vladimir Putin’s demand that “unfriendly countries” effectively pay for Russian gas in rubles would violate sanctions imposed on Moscow following its invasion of Ukraine. The European Commission, the EU’s executive arm, has presented its analysis of Putin’s decree, according to a person familiar with the matter. The assessment raises the stakes for Europe’s energy security since Putin threatened to halt gas supplies to buyers that don’t comply with the edict.

BOJ (MNI): A wider yield curve control range for the 10-year Japanese Government Bond (JGB) or a focus on a shorter-dated tenor would at best have a short-lived impact on the yen's level against the USD, which is now driven by an expected increasingly wide interest rate gap to U.S Treasuries, MNI understands. For full article contact sales@marketnews.com

CHINA (MNI): China’s struggling retail sector is making less of a contribution to growth, policy advisors told MNI, calling for authorities to intensify measures including subsidies aimed at supporting employment and schemes to issue coupons for consumers to buy cars and appliances. For full article contact sales@marketnews.com

BOJ (RTRS): The Bank of Japan (BOJ) will give a slightly hawkish tilt to its guidance on the future path of monetary policy by phasing out a pledge to ramp up stimulus if needed, Naomi Muguruma, a veteran analyst well-versed in the bank's policy, said on Thursday. The tweak could come at the central bank's policy meeting this month, Muguruma wrote in a research note, having initially expected the tweak to be made in July. The projection by Muguruma, a prominent BOJ watcher who has closely tracked its policy for years, comes despite reassurances by Governor Haruhiko Kuroda that the BOJ is in no rush to follow in the footsteps of other central banks in withdrawing stimulus.

DATA:

MNI: SWEDEN MAR CPIF +6.1% Y/Y

Swedish CPIF at 1991 High

MARCH CPIF +6.1% Y/Y, +1.7% M/M; FEB +4.5% Y/Y

- Swedish inflation hit +6.1% y/y in March, a 1991 high. This was up 1.6pp compared to Feb and significantly outpaced the forecast of +5.5% y/y.

- Core CPIF rose to +4.1% y/y in March from +3.4% y/y.

- Electricity and fuel prices were the key upwards drivers, contributing 0.8pp to the m/m increase, followed by food (+0.3pp).

- The Riksbank is due to meet on April 27 for their second meeting of the year, following the dovish February decision.

- Some analysts were already starting to look for an April hike and this higher inflation print is likely to increase market expectations of a more activist Riksbank.

FIXED INCOME: German-US spreads tighten ahead of the ECB decision

- Core fixed income markets are seeing some divergence this morning ahead of the ECB (policy announcement due at 12:45BST / 7:45ET with the press conference due at 13:30BST / 8:30ET).

- Bunds are lower while USTs are higher, leading to a tighter 10-year spread of about 4.3bp at the time of writing. However, volumes are very low ahead of the Easter break and with investors likely sitting on the sidelines awaiting the ECB announcement. Gilts are moving more in line with the German curve than the US curve today.

- While consensus expects no material change in policy at the April ECB meeting, the MNI Markets team believe that it is a close call and that markets should be prepared for a hawkish surprise. Markets currently price 17bp for July, 37bp by September, 47bp by October and 69bp by the December ECB meeting (so almost fully pricing three 25bp hikes by year-end).

- Elsewhere we also have US retail sales, weekly claims and Michigan confidence numbers with the Fed's Williams, Mester and Harker all due to speak.

- TY1 futures are up 0-6+ today at 121-00 with 10y UST yields down -2.3bp at 2.679% and 2y yields down -1.5bp at 2.336%.

- Bund futures are down -0.34 today at 155.52 with 10y Bund yields up 2.3bp at 0.786% and Schatz yields up 1.4bp at 0.082%.

- Gilt futures are down -0.17 today at 119.27 with 10y yields up 2.5bp at 1.823% and 2y yields up 1.1bp at 1.490%.

FOREX: Markets Tread Water Ahead of ECB

- Currency markets are more muted early Thursday, with traders sitting on the sidelines ahead of both the ECB rate decision as well as a deluge of US economic data ahead of the extended weekend.

- Scandi currencies have been a highlight, with SEK outperforming all others in G10 after CPI for March came in well ahead of expectations, prompting a series of sell-side outfits to bring forward their expectations for Riksbank tightening. Many banks now see rate hikes as soon as June, from prior consensus forecast of September.

- The greenback trades mixed-to-lower, while EUR, JPY make furtive gains. Recent ranges have been respected, keeping EUR/USD within range of first resistance at the Monday high of 1.0954.

- The ECB rate decision takes focus going forward, with markets on watch for any hawkish signals from the bank after CPI data came in over three times the bank's price target. US retail sales and import price indices also cross alongside the regular weekly jobless claims data. Central bank speakers include Fed's Williams, and then Harker and Mester follow after the early US close.

EQUITIES: Energy Lags, Cyclicals Lead In Europe

- Asian markets closed stronger: Japan's NIKKEI closed up 328.51 pts or +1.22% at 27172 and the TOPIX ended 17.99 pts higher or +0.95% at 1908.05. China's SHANGHAI closed up 38.817 pts or +1.22% at 3225.641 and the HANG SENG ended 143.71 pts higher or +0.67% at 21518.08

- European equities are mixed, with the German Dax up 16.17 pts or +0.11% at 14099.8, FTSE 100 down 17.74 pts or -0.23% at 7561.18, CAC 40 up 15.91 pts or +0.24% at 6564.22 and Euro Stoxx 50 up 7.95 pts or +0.21% at 3838.52.

- U.S. futures are flat, with the Dow Jones mini down 6 pts or -0.02% at 34476, S&P 500 mini down 2.5 pts or -0.06% at 4439.75, NASDAQ mini up 10 pts or +0.07% at 14231.

COMMODITIES: Oil Slipping After 2 Positive Sessions

- WTI Crude down $0.7 or -0.67% at $103.49

- Natural Gas up $0.03 or +0.46% at $7.038

- Gold spot down $8.19 or -0.41% at $1972.1

- Copper up $1.15 or +0.24% at $474.2

- Silver down $0.11 or -0.44% at $25.6618

- Platinum down $7.24 or -0.73% at $984.37

LOOK AHEAD:

| Date | GMT/Local | Impact | Flag | Country | Event |

| 14/04/2022 | 1100/0700 | * |  | TR | Turkey Benchmark Rate |

| 14/04/2022 | 1145/1345 | *** |  | EU | ECB Deposit Rate |

| 14/04/2022 | 1145/1345 | *** |  | EU | ECB Main Refi Rate |

| 14/04/2022 | 1145/1345 | *** |  | EU | ECB Marginal Lending Rate |

| 14/04/2022 | 1230/0830 | ** |  | CA | Wholesale Trade |

| 14/04/2022 | 1230/0830 | ** |  | CA | Monthly Survey of Manufacturing |

| 14/04/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 14/04/2022 | 1230/0830 | *** |  | US | Retail Sales |

| 14/04/2022 | 1230/0830 | *** |  | US | PPI |

| 14/04/2022 | 1230/0830 | ** |  | US | Import/Export Price Index |

| 14/04/2022 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 14/04/2022 | 1230/1430 |  | EU | ECB President Lagarde Post-meet presser | |

| 14/04/2022 | 1400/1000 | *** |  | US | University of Michigan Sentiment Index (p) |

| 14/04/2022 | 1400/1000 | * |  | US | Business Inventories |

| 14/04/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 14/04/2022 | 1530/1130 | ** |  | US | NY Fed Weekly Economic Index |

| 14/04/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 14/04/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 14/04/2022 | 1920/1520 |  | US | Cleveland Fed's Loretta Mester | |

| 14/04/2022 | 2200/1800 |  | US | Philadelphia Fed's Patrick Harker | |

| 15/04/2022 | 0645/0845 | *** |  | FR | HICP (f) |

| 15/04/2022 | 0800/1000 | *** |  | IT | HICP (f) |

| 15/04/2022 | 0800/1000 |  | EU | ECB Professional Forecasters Survey | |

| 15/04/2022 | 1230/0830 | ** |  | US | Empire State Manufacturing Survey |

| 15/04/2022 | 1315/0915 | *** |  | US | Industrial Production |

| 15/04/2022 | 2000/1600 | ** |  | US | TICS |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.