-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - Dollar Fading Post-Fed Weakness

Highlights:

- Dollar fading post-Fed weakness

- BoE seen raising rates by 25bps

- Norges Bank flag June meeting as next likely hike

US TSYS SUMMARY: Partial Retracement Of Post-FOMC Bull Steepening

- Cash Tsys bear flatten in a partial retracement of yesterday’s surge on the FOMC announcement and in particular Powell’s press conference.

- The net impact remains one of a sizeable bull steepening though, with front-end yields down 12bps since shortly before the policy announcement compared to long-end yields down 4bps. It leaves 2s10s at 27bps, the high of the past couple weeks but within the wide range of moves from early April when it swung from -10bps to above 40bps.

- With 10Y inflation breakevens rising on the dovish reaction to the presser, real yields have carried the brunt of the decline in yields, currently at 7bps off highs of ~20bps yesterday. That said positive real yields remain rare in the post-pandemic world, only seen consistently this week.

- 2YY +4.9bps at 2.691%, 5YY +3.6bps at 2.948%, 10YY +2.2bps at 2.956% ad 30YY unchg at 3.035%.

- TYM2 is down 12 ticks at 118-25 on slightly above average volumes. Support is eyed at the bear trigger of 118-04+ (May 3/4 low) whilst resistance is seen at the 20-day EMA of 119-28.

- Data: Preliminary Q1 productivity and ULCs (0830ET) should be the pick of today’s data, with eyes ahead on tomorrow’s payrolls.

- Bill issuance: US Tsy $35B 4W, $30B 8W bill auctions (1130ET)

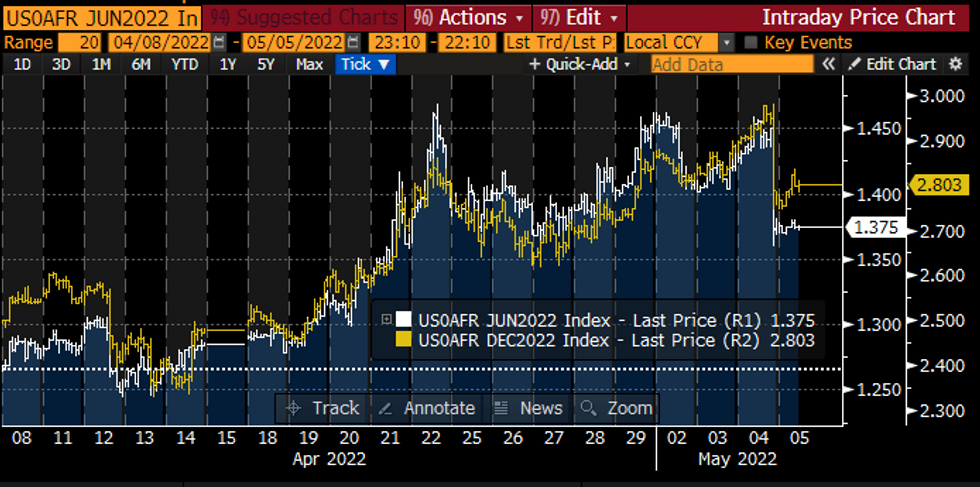

STIR FUTURES: Fed Hikes Firm Slightly After Yesterday’s Powell Slide

- The FOMC-dated Fed Funds rate for the Dec meeting has ground ~2bp higher since the initial reaction to Powell’s presser, sitting at 2.79% but still down from yesterday’s high of 2.98%.

- Little change for nearer-term meetings post-presser reaction, largely reflecting guidance that 75bp hikes aren’t actively being considered but with 50bp hikes on the table at the next couple of meetings (Jun 53bps, Jul 102bps, Sep 142bps).

- The media blackout ends tonight at midnight ET. NY Fed’s Williams (voter) is first on the slate at 0915ET tomorrow with opening remarks at an event on environmental economics, followed by Kashkari (’23), Bostic (’24) plus Bullard (’22), Waller (voter) and Daly (’24) all speaking late.

FOMC-dated Fed Funds futures implied rateSource: Bloomberg

FOMC-dated Fed Funds futures implied rateSource: Bloomberg

EUROPE ISSUANCE UPDATE:

France sells 10/20/30-year OATs:

- E6.279bln 0% May-32 OAT, Avg yield 1.510% (Prev. 1.170%), Bid-to-cover 1.78x (Prev. 1.82x)

- E2.268bln 0.50% May-40 OAT, Avg yield 1.830% (Prev. 0.690%), Bid-to-cover 1.97x (Prev. 2.29x)

- E2.452bln 0.75% May-53 OAT, Avg yield 1.960% (Prev. 1.180%), Bid-to-cover 1.97x (Prev. 2.06x)

- E2.74bln 0% Jan-27 Bono, Avg yield 1.387% (Prev. 0.581%), Bid-to-cover 1.38x (Prev. 1.51x)

- E1.05bln 0.80% Jul-29 Obli, Avg yield 1.694% (Prev. 1.227%), Bid-to-cover 1.74x (Prev. 1.83x)

- E1.242bln 1.45% Oct-71 Obli, Avg yield 2.851% (Prev. 1.458%), Bid-to-cover 1.59x

- E574mln 0.70% Nov-33 Obli-Ei, Avg yield -0.456% (Prev. -0.852%), Bid-to-cover 1.64x (Prev. 1.78x)

EUROPE OPTION FLOW SUMMARY

Eurozone:

RXM2 156.50/158.00cs, sold at 14 in 2.5k

RXM2 151.5/148.5ps sold at 53.5 in 2k

OEM2 126.75 put sold at 47/47.5 in 3.5k (ref 127.02)

ERU2 99.87/99.75ps, bought for 6.25 in 4k (ref 99.795)

ERZ2 99.25/99.50/99.75c fly bought vs selling 98.50p for flat in 2k

ERZ2 99.625/99.375/99.25/98.75 broken p condor, bought for 0.75 in 7.5k

ERZ2 99.00/99.25/99.50 iron fly, sold at 20 in 10k

UK:

SFIK2 98.65/98.75cs, bought for 3.25 in 4.5k

SFIK2 98.70/98.90cs bought for 1.75 and 2 in 10k

NORGES BANK: Bank Namecheck June Decision For Next Hike

Norges Bank keep rates unchanged, as expected, at 0.75%. The bank also namecheck the June decision as the next likely hike, infitting with market expectations.

Full statement here: https://www.norges-bank.no/en/topics/Monetary-poli...

Highlights:

- Based on the Committee’s current assessment of the outlook and balance of risks, the policy rate will most likely be raised in June

- Substantial uncertainty as to the potential economic impact of the war in Ukraine

- The Committee was also concerned with the risk of accelerating price and wage inflation in Norway

- If there are prospects of persistently high inflation, the policy rate may be raised more quickly than indicated by the policy rate forecast in the March Report

FOREX: Dollar Bouncing Off Post-Fed Lows

- Following the post-Fed pullback, the greenback is the strongest currency in G10 so far this morning, although the rally remains contains and yesterday's highs for the USD Index are well out of reach for now.

- Markets continue to digest Wednesday's FOMC decision, weighing the options after Powell defended the 50bps rate hike pace, but stated a 75bps move was not under consideration.

- At the other end of the table, GBP underperforms, dipping ahead of the Bank of England rate decision and on local elections day, at which the opposition Labour Party are expected to make gains in Councillor seats, but stop short of gaining a significant number of overall councils.

- Focus turns to the BoE rate decision, due at 1200BST. A 25bps hike is unanimously expected, with markets fully pricing 25bps with around a 20% probability of a 50bps hike. The focus will be on the vote split, the forward guidance and how far below 2% will the inflation forecasts be at market rates in 2/3 years time. Full MNI BOE Preview click here: https://marketnews.com/markets/central-bank-report...

- On the data front, weekly jobless claims, are the highlight, with BoC's Schembri and ECB's Holzmann also due to speak.

FX OPTIONS: Expiries for May05 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0500-10(E1.2bln), $1.0565-85(E995mln), $1.0600(E1.7bln), $1.0750-65(E1.6bln), $1.0800(E1.5bln)

- GBPUSD: $1.2550(Gbp502mln), $1.2900(Gbp1.2bln)

- EUR/GBP: Gbp0.8600(E952mln)

- USD/JPY: Y127.50($685mln)

- EUR/JPY: Y135.00(E523mln)

- AUD/USD: $0.7135-50(A$571mln)

- USD/CAD: C$1.2865-80($869mln), C$1.2890-05($689mln), C$1.3075($1.2bln), C$1.3100($1.8bln)

Price Signal Summary - S&P E-Minis Remains Below Key Short-Term Resistance

- In the equity space, S&P E-Minis rallied sharply higher Wednesday. Broader trend conditions remain bearish and the current bull phase is likely a correction. Initial resistance to watch is 4303.50, the Apr 26/28 high. A break would suggest scope for an extension higher towards the 50-day EMA at 4375.43. A resumption of weakness would refocus attention on the bear trigger at 4056.00, Monday’s low. EUROSTOXX 50 futures continue to trade above 3608.00, Apr 27 low. Short-term gains are considered corrective and a bearish trend condition remains intact. Resistance to watch is; 3790.50, the 50-day EMA and 3883.00, the Apr 21 high. The bear trigger is 3608.00, Apr 27 low.

- In FX, EURUSD remains in a clear downtrend, despite yesterday’s gains. Recent price action appears to be a bear flag. A resumption of the downtrend would open 1.0454, the Jan 1 2017 low. Resistance is at 1.0711, the 20-day EMA. The GBPUSD outlook remains bearish. A break of 1.2412, Apr 28 low, would confirm a resumption of the downtrend and open 1.2375, the 2.382 projection of the Mar 23 - Apr 13 - 14 price swing. Resistance is at 1.2782, the 20-day EMA. USDJPY trend conditions are unchanged and the direction remains up. The focus is on 131.96, the 1.00 projection of the Feb 24 - Mar 28 - 31 price swing.

- On the commodity front, Gold remains vulnerable, despite this week’s recovery. The recent pullback from the $1998.4 high (Apr 18), and the breach last week of $1890.2, the Mar 29 low, continues to highlight a bearish threat. Attention is on $1848.8, 76.4% retracement of the Jan 28 - Mar 8 rally. On the upside, $1913.9, the 20-day EMA is seen as a firm short-term resistance. In the Oil space, WTI futures remain above the Apr 25 low of $95.28. The contract has broken out of its triangle - to the upside - and this strengthens the short-term condition for bulls. Attention is on resistance at $109.20, Apr 18 high, where a break would signal scope for a continuation higher and open $113.51, the Mar 24 high. Initial firm support is at $100.28, May 2 low.

- The trend direction in the FI space remains down. Bund futures traded lower yesterday. This once again reinforces bearish conditions and an extension lower would open 151.99, the 0.618 projection of the Mar 7 - 29 - Apr 4 price swing. The broader trend condition in Gilts remains bearish. Resistance has been defined at 119.79, the Apr 26 high. Attention is on the bear trigger at 117.22, the Apr 22 low.

EQUITIES: Fading Some Post-Fed Gains

- Japanese markets were closed for holidays; elsewhere performance was mixed: China's SHANGHAI closed up 20.696 pts or +0.68% at 3067.759 and the HANG SENG ended 76.12 pts lower or -0.36% at 20793.4

- European equities are stronger, with the German Dax up 201.25 pts or +1.44% at 14172.65, FTSE 100 up 73.18 pts or +0.98% at 7566.5, CAC 40 up 95.56 pts or +1.49% at 6489.86 and Euro Stoxx 50 up 47.62 pts or +1.28% at 3773.63.

- U.S. futures are fading some post-Fed gains, with the Dow Jones mini down 153 pts or -0.45% at 33816, S&P 500 mini down 26.75 pts or -0.62% at 4268.5, NASDAQ mini down 98.75 pts or -0.73% at 13432.5.

COMMODITIES: Oil Steady Ahead Of OPEC+ Meeting

- WTI Crude up $0.16 or +0.15% at $107.73

- Natural Gas up $0.08 or +0.9% at $8.495

- Gold spot up $14.21 or +0.76% at $1894.31

- Copper up $3.3 or +0.76% at $436.75

- Silver up $0.02 or +0.09% at $22.9956

- Platinum down $8.72 or -0.88% at $986.05

LOOK AHEAD:

| Date | GMT/Local | Impact | Flag | Country | Event |

| 05/05/2022 | 1000/1200 |  | EU | ECB Lane Speech on Euro Area Outlook | |

| 05/05/2022 | 1100/1200 | *** |  | UK | Bank Of England Interest Rate |

| 05/05/2022 | 1130/1230 |  | UK | BOE post-MPC press conference | |

| 05/05/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 05/05/2022 | 1230/0830 | ** |  | US | Preliminary Non-Farm Productivity |

| 05/05/2022 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 05/05/2022 | 1300/1400 |  | UK | Bank of England DMP Survey | |

| 05/05/2022 | 1340/0940 |  | CA | BOC Deputy Schembri speech to Indigenous group. | |

| 05/05/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 05/05/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 05/05/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 06/05/2022 | 2350/0850 | ** |  | JP | Tokyo CPI |

| 06/05/2022 | 0130/1130 |  | AU | RBA May SoMP | |

| 06/05/2022 | 0545/0745 | ** |  | CH | unemployment |

| 06/05/2022 | 0600/0800 | ** |  | DE | Industrial Production |

| 06/05/2022 | 0600/0700 | * |  | UK | Halifax House Price Index |

| 06/05/2022 | 0700/0900 | ** |  | ES | Industrial Production |

| 06/05/2022 | 0730/0930 |  | SE | Riksbank Minutes April meet | |

| 06/05/2022 | 0800/1000 | * |  | IT | Retail Sales |

| 06/05/2022 | 0830/0930 | ** |  | UK | IHS Markit/CIPS Construction PMI |

| 06/05/2022 | 0915/1015 |  | UK | BOE Mann Speaker at European University Institute | |

| 06/05/2022 | 1115/1215 |  | UK | BOE Pill Monetary Policy Report National Agency briefing | |

| 06/05/2022 | 1230/0830 | *** |  | CA | Labour Force Survey |

| 06/05/2022 | 1230/0830 | *** |  | US | Employment Report |

| 06/05/2022 | 1315/0915 |  | US | New York Fed's John Williams | |

| 06/05/2022 | 1400/1000 | * |  | CA | Ivey PMI |

| 06/05/2022 | 1500/1600 |  | UK | BOE Tenreyro Lecture at Irish Economic Association | |

| 06/05/2022 | 1500/1100 |  | US | Minneapolis Fed's Neel Kashkari | |

| 06/05/2022 | 1900/1500 | * |  | US | Consumer Credit |

| 06/05/2022 | 1920/1520 |  | US | Atlanta Fed's Raphael Bostic |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.