-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN: ECB Turning More Hawkish?

EXECUTIVE SUMMARY:

- ECB'S VILLEROY: RATES SHOULD RISE ABOVE ZERO THIS YEAR; MUST WATCH FX

- BOE'S PILL: ARGUMENTS ON RATE-SETTING "FINELY BALANCED"

- GERMAN INDUSTRIAL PRODUCTION FALLS AS SUPPLY BOTTLENECKS WORSEN

- INFLATION RISKS PUSHED RIKSBANK ACTION: MINUTES

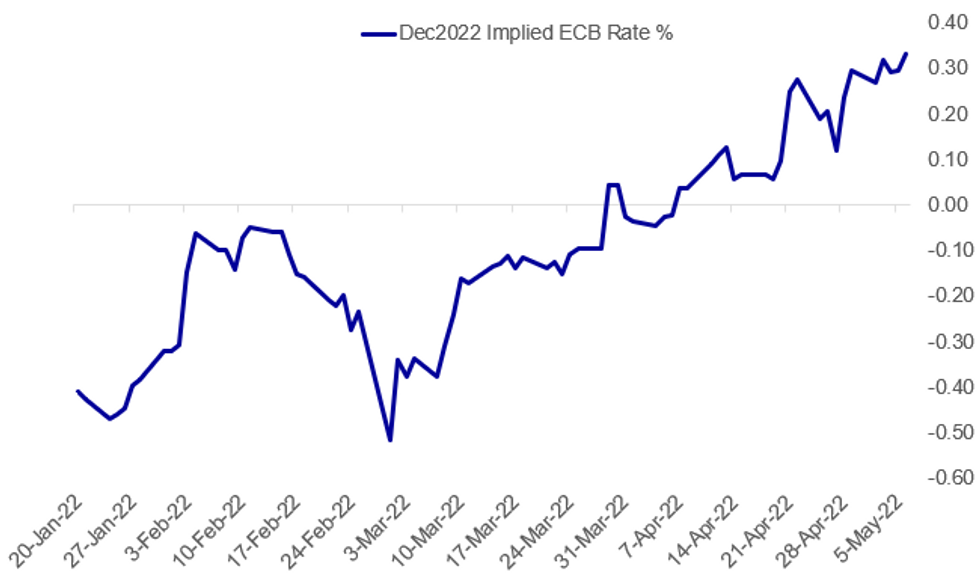

Fig. 1: OIS Implied ECB Rate % Rises On Increasingly Hawkish Rhetoric

Source: BBG, MNI

Source: BBG, MNI

NEWS:

ECB (BBG): European Central Bank Governing Council member Francois Villeroy de Galhau said interest rates may be raised back above zero this year if the euro-zone economy doesn’t suffer another setback. In a speech in Paris, the Bank of France chief also suggested that the ECB should conclude net bond purchases at the end of June -- a necessary precursor to raising the deposit rate from its current level of -0.5%. “The three conditions of our forward guidance on interest rates are, according to my personal judgment, fulfilled,” Villeroy said Friday. “Barring unforeseen new shocks, I would think it reasonable to have entered positive territory by the end of this year.”

ECB / EURO: The EUR is now one of the strongest currencies in G10, erasing overnight weakness as markets eye hawkish comments from ECB's Villeroy. One of the more notable comments from Villeroy was on FX, where he stated that the ECB "must watch FX; too weak a EUR jeopardizes their price stability objective". Looks like a possible step-up in language on currency from an ECB member - recent comparable comments are:

- Schnabel on May 3: "Through the higher cost of imports, this has effects on inflation, which we are closely monitoring. But we do not target the exchange rate."

- Lagarde on April 14: "ECB always attentive to FX move, didn't discuss today"

- Visco on March 23: "ECB taking into account FX rate when taking decisions"

ECB (BBG): The European Central Bank must press on with normalizing policy this year because the “window of opportunity” is closing, according to Governing Council member Joachim Nagel. “The window of opportunity that opened up for initial monetary policy actions is closing slowly, and we need to see that we get something done this year”

BOE (RTRS): Bank of England Chief Economist Huw Pill said on Friday that the central bank faced difficult choices about how far to raise interest rates to control inflation without slowing growth more than necessary. "It's a tricky balance to seek in current difficult circumstances. And the arguments around where rates should be set in order to achieve that balance are quite finely balanced in themselves," Pill told CNBC television. On Thursday, the BoE raised interest rates for a fourth time in a row despite saying there was a risk of recession in Britain after inflation goes above 10% later this year.

RIKSBANK: Countering the risk of higher inflation becoming entrenched in second round effects pushed the Riksbank into a much earlier than originally forecast rate hike, the minutes of the April meeting confirmed. The Riksbank policymakers said inflation has risen rapidly, both abroad and in Sweden, noting that the upturn in the rate of price increase in Sweden is now broad-based, and not merely driven by rapidly rising energy prices. Even excluding energy prices, inflation is at the highest level since the early 1990s, the minutes note.

UK-EU: The UK and the EU should continue on a 'diplomatic path' over the Northern Ireland Protocol -- a key element of the Brexit agreement -- and not risk a rift in the Western alliance at a time of war in Ukraine, EU Commissioner Maros Sefcovic said in an interview Friday. With results from the Northern Ireland assembly election due later in the day and polls pointing to a change to a more-EU friendly legislature in the province, Sefcovic told CNBC discussions were ongoing with UK Foreign Secretary Liz Truss, but added that Brussels remained committed to the Protocol, even as talks continued over the implementation of the agreement.

EU/RUSSIA (RTRS): European Commission President Ursula von der Leyen said on Friday she was confident the bloc would approve a new package of sanctions against Russia. "I am confident that we will get this package on track - if it takes a day longer, it takes a day longer - but we are moving in the right direction," she told a conference hosted by the Frankfurter Allgemeine Zeitung newspaper.

DATA:

IP Falls as Supply Bottlenecks Worsen

GERMANY MAR IP -3.9% M/M, -3.5% Y/Y; FEB +0.1%r M/M

- German industrial production contracted by 3.9% in March compared to February.

- Today's print saw the m/m print 2.6pp lower and the y/y print 3.1pp lower than consensus forecasts.

- Due to the onset of the Ukraine war, supply chain disruptions have become more acute. The ifo Institute study found that in March 80% of industrial producers had issues with bottlenecks and sourcing input and raw materials.

- Capital goods production dropped by 6.6% m/m, as firms showed less incentive to invest due to economic and political uncertainty and intermediate goods production fell by 3.8% m/m.

- The March data highlights the effects of the Ukraine war on both investment and production sentiment, as well as global supply issues. The April release will be vital in addressing how lasting these effects will be following the initial shock.

FIXED INCOME: Yields make new multi year highs

- EGBs and Bund yield spikes higher this morning following more early ECB Hawkish comments, this morning from Villeroy:

- "Inflation is not only higher, but broader" "Inflation is less and less Anchored".

- Bund 10yr yield breached above the 2015 peak, the German 2yr Schatz trades at highest level since Dec 2011.

- Similar price action in Peripherals, with Italy breaking above the 3% in 10s.

- A more subdued session for Gilts, with the contract trading near pre BoE level at 118.11.

- US Treasuries are mostly inline with Germany, albeit a touch tighter on the Tnotes/Bund spread, by just 0.9bp.

- Looking ahead, US, sees the awaited NPF, which will potentially provide some knee jerk reaction, but the focus at the forefront remains inflation and in turn Growth.

- Speakers will supersede the NFP release.

- Still scheduled to speak, ECB Elderson, Rehn, BoE Tenreyro, Fed Williams, Kashkari, Bostic.

FOREX: EUR Stronger as Villeroy Eyes Currency Weakness

- The EUR is one of the strongest currencies in G10 early Friday, erasing overnight weakness as markets eyed hawkish comments from ECB's Villeroy. One of the more notable comments from Villeroy was on FX, where he stated that the ECB "must watch FX; too weak a EUR jeopardizes their price stability objective" - marking a possible step-up in language on currency from an ECB member.

- EUR/GBP trades a new multi-month high, touching 0.8565 and nearing the next bull trigger at the December 2021 high of 0.8600. In tandem, GBP/USD has touched a new multi-year cycle low of 1.2276.

- Moving in tandem with equity markets (indices are lower again in Europe), AUD is the poorest performer in G10, with AUD/USD through yesterday's low and eyeing the May 2 low at 0.7030. Weakness through here opens the lowest levels since January - this level has been defined as key support and the bear trigger.

- Focus turns to the Canadian and US jobs reports, with markets expecting +380k jobs added across April for the US, which should pressure the unemployment rate to 3.5%. Meanwhile for Canada, analysts see 40k jobs added across the month, dropping 0.1ppt from the unemployment rate.

EQUITIES: US Futures Resume Descent

- Asian equities closed mixed: Japan's NIKKEI closed up 185.03 pts or +0.69% at 27003.56 and the TOPIX ended 17.56 pts higher or +0.93% at 1915.91. China's SHANGHAI closed down 66.198 pts or -2.16% at 3001.561 and the HANG SENG ended 791.44 pts lower or -3.81% at 20001.96.

- European stocks are sharply lower, with Energy the only sector in the green: the German Dax down 175.41 pts or -1.26% at 13732.86, FTSE 100 down 58.14 pts or -0.77% at 7443.88, CAC 40 down 76.08 pts or -1.19% at 6292.83 and Euro Stoxx 50 down 53.42 pts or -1.45% at 3644.95.

- U.S. futures are descending again, with the Dow Jones mini down 86 pts or -0.26% at 32824, S&P 500 mini down 15.25 pts or -0.37% at 4128, NASDAQ mini down 66.25 pts or -0.52% at 12791.75.

COMMODITIES: Energy Prices Higher, Defying Broader Market Risk-Off

- WTI Crude up $1.74 or +1.61% at $109.97

- Natural Gas up $0.08 or +0.89% at $8.861

- Gold spot up $4.23 or +0.23% at $1881.8

- Copper down $0.4 or -0.09% at $428.75

- Silver down $0.07 or -0.31% at $22.4342

- Platinum down $27.08 or -2.75% at $958.5

LOOK AHEAD:

| Date | GMT/Local | Impact | Flag | Country | Event |

| 06/05/2022 | 1115/1215 |  | UK | BOE Pill Monetary Policy Report National Agency briefing | |

| 06/05/2022 | 1230/0830 | *** |  | CA | Labour Force Survey |

| 06/05/2022 | 1230/0830 | *** |  | US | Employment Report |

| 06/05/2022 | 1315/0915 |  | US | New York Fed's John Williams | |

| 06/05/2022 | 1400/1000 | * |  | CA | Ivey PMI |

| 06/05/2022 | 1500/1600 |  | UK | BOE Tenreyro Lecture at Irish Economic Association | |

| 06/05/2022 | 1500/1100 |  | US | Minneapolis Fed's Neel Kashkari | |

| 06/05/2022 | 1900/1500 | * |  | US | Consumer Credit |

| 06/05/2022 | 1920/1520 |  | US | Atlanta Fed's Raphael Bostic |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.