-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - Markets More Becalmed

Highlights:

- Markets more becalmed early Friday, EUR/JPY back to Y129.00

- Treasury curve bear stepper on firmer market sentiment

- Inflation expectations of UMich the next highlight

US TSYS SUMMARY: A Corrective Bear Steepening As Sentiment Firms

- Cash Tsys have seen a modest sell-off with most of the move coming shortly after open. It follows significant rallies over the past week and a half, after 2Y yields touched highs of 2.85% (May 4) and the 10Y highs of 3.20% (May 9) before sliding on growth concerns.

- 2YY +1.9bps at 2.580%, 5YY +3.1bps at 2.852%, 10YY +4.9bps at 2.897% and 30YY +7.2bps at 3.066%.

- TYM2 sits 18 ticks lower at 119-14 on below average volumes in what’s seen as a corrective cycle this week amidst a primary downtrend.

- Fedspeak: Kashkari (’23 voter) at 1100ET and Mester (’22) at 1200ET.

- Data: Double inflation-related hit with int’l trade prices (0830ET), where non-oil imports of note to see if USD strength weighs further after weak CPI apparel, and preliminary U.Mich inflation expectations for May.

STIR FUTURES: Pausing After Powell “Prepared To Do More”

- FOMC-dated Fed Funds implied hikes have been little changed since rising on Powell yesterday repeating that 50bp hikes over the next two meetings are appropriate, but with two-sided risk including being prepared to do more if necessary.

- Pricing close to where it was once the dust had settled on CPI, with 53bps for Jun, 102bps for Jul, 140bps for Sep and a little below with 189bps for Dec.

- Ahead, repeat appearances from Kashkari (’23 voter) and Mester (’22) after Mester on Tuesday similarly noted openness to larger than 50bp hikes if inflation doesn’t slow in 2H22.

Cumulative hikes implied by FOMC-dated Fed Funds futuresSource: Bloomberg

Cumulative hikes implied by FOMC-dated Fed Funds futuresSource: Bloomberg

EGB/GILT SUMMARY: Sovereign FI Trades Weaker; Curves Steepen

European government bonds have sold off this morning alongside broad gains for equities and oil.

- Gilts have recovered some of the earlier losses while still trading below yesterday's close. Cash yields are now up 5bp on the day.

- The bund curve has bear steepened with yields up 1-6bp and the 2s30s spread widening 5bp.

- OATs have traded out a similar path with the curve 5bp steeper.

- BTPs have underperformed core EGBs with yields up 6-9bp .

- Following on the heels of some notably hawkish commentary on rates from several GC members earlier in the week, the ECB's Mario Centeno today stated that monetary policy normalisation is necessary, but that patience and gradualism are required.

- The disputed Northern Ireland protocol faced further pressure as the Democratic Unionist Party is refusing to nominate a speaker, which would paralyse Stormont and pressure the government in Westminster to resolve the protocol issue.

- Supply this morning came from the UK (UKTBs, GBP2bn).

- US import prices data and the University of Michigan survey update for May com into focus later today.

EUROPE OPTION FLOW SUMMARY

Eurozone:

IKM2 131 put sold at 120 in 3.6k (vs 130.40)

UK:

SFIM2 98.60/98.70 call spread bought for 6 in 4k (vs 98.63, 32d)

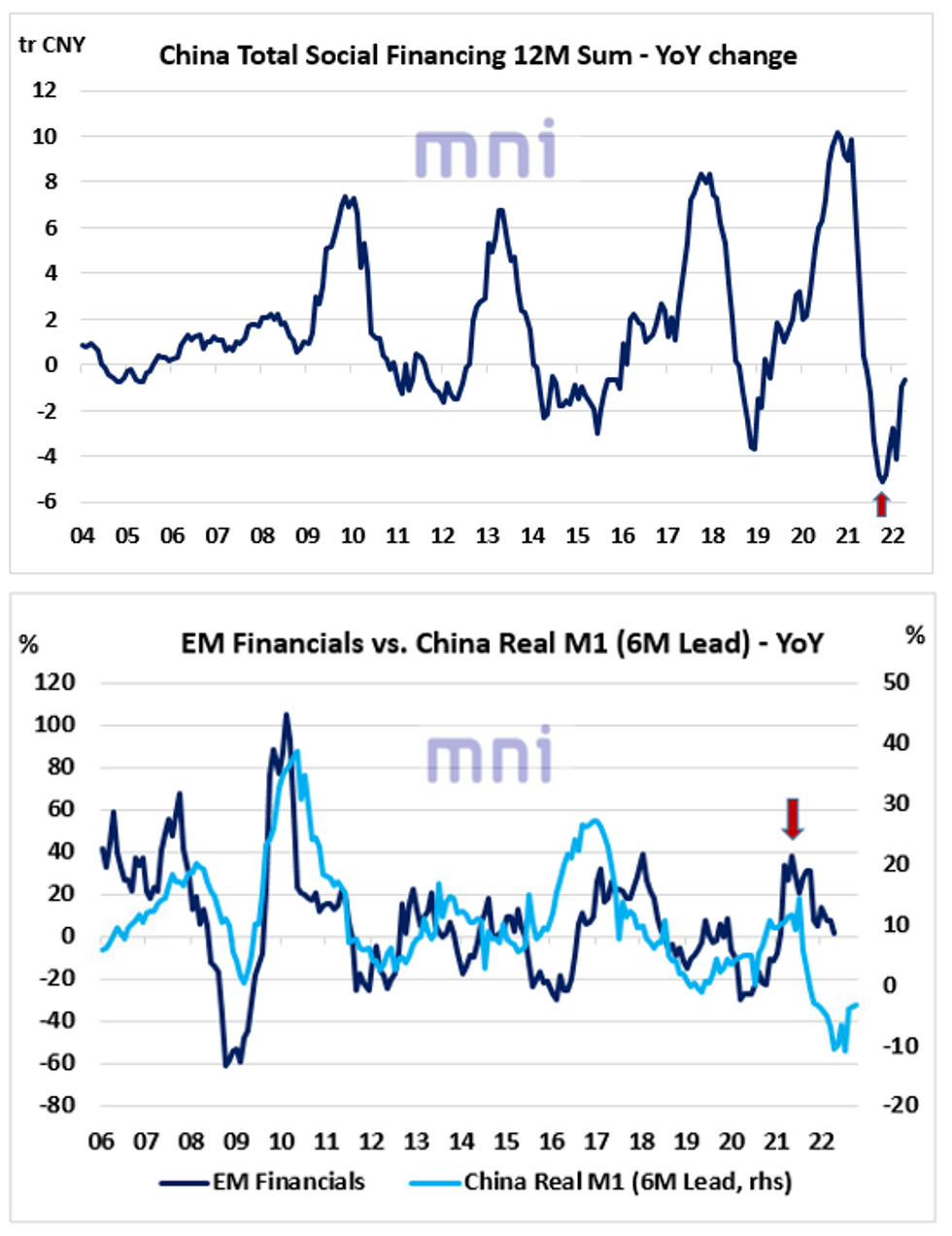

CHINA: Credit Demand Weakens Sharply in April Amid Covid Lockdowns

- PBoC reported on Friday that credit demand weakened sharply in April amid Covid lockdowns significantly disrupting the economic activity.

- Aggregate financing rose by 910.2bn CNY, significantly below expectations of 2.2tr CNY with new yuan loans rising by 645bn CNY (vs. 1.53bn CNY exp.).

- Even though the annual change in China Total Social Financing (TSF) 12M sum continues to rise (top chart), the disappointing ‘liquidity’ data could challenge domestic risky assets in the near term.

- The global risk off environment triggered by the renewed geopolitical tensions and surging stagflation risks have been weighing on Chinese equities in recent weeks.

- The Hang Seng index has been trading below the 20,000 level this week and is down over 20% since its early February high.

- China M1 money supply accelerated to 5.1% YoY in April (vs. 5% exp.), up from 4.7% the previous month.

- However, China real M1, which has historically acted as a strong leading indicator for cyclical equities (i.e. financials), is still standing at low levels historically and is currently pricing in further weakness in EM financial equities (bottom chart).

Source: Bloomberg/MNI

FOREX: EUR/JPY Steadies, Providing Some Relief

- Thursday's volatile and decisive trading has given way to relief rallies across a number of crosses early Friday - primarily EUR/JPY - which broke through considerable support yesterday to print the lowest levels since mid-March in a wide-ranging session. The cross has steadied, but holds well toward the lower-end of the week's range, with 132.66 undercutting as key support while the 50-dma at 134.59 provides first resistance.

- With the cross on more even footing, relief rallies are noted elsewhere, with EUR/USD off the Thursday low and AUD/USD oscillating either side of the 0.69 handle.

- Resultingly, the JPY is the worst performer in G10, while SEK, AUD and NOK trade more favourably. Oil prices have stabilised between $106-108/bbl, helping commodity-tied currencies find some footing while a pause in the equity sell-off is soothing recent concerns.

- Nonetheless, markets remain wary, with heightened implied volatility across G10 signalling that traders are well aware of the risk of another turn lower for risk sentiment, as a number of central bank speakers are still due: Fed's Kashkari and Mester are due to speak, while ECB's Nagel and Schnabel add to recent ECB commentary.

- Data focus turns to import/export price indices data from the US as well as the prelim read for May UMich confidence. Markets expected sentiment to moderate from April's 65.2 to 64.0. Attention again will be paid to inflation expectations, particularly in light of the hotter-than-expected CPI earlier in the week.

FX OPTIONS: Expiries for May13 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0835-50(E865mln)

- GBP/USD: $1.2100(Gbp647mln), $1.2200(Gbp674mln)

- USD/JPY: Y129.95-00($520mln)

- AUD/USD: $0.6725(A$1.3bln), $0.7200-05(A$946mln), $0.7400(A$1.1bln)

Price Signal Summary - Bear Flag Breakout In EURUSD

- In the equity space, S&P E-Minis remain vulnerable and short-term gains are considered corrective. This week’s continuation lower, delivering fresh cycle lows, reinforces the primary bearish trend condition and signals scope for a continuation lower. The next objective is 3843.25, the Mar 25 2021 low (cont). In terms of resistance, the key short-term level is at 4303.50, the Apr 26/28 high. Initial resistance is at 4099.00, the May 9 high. EUROSTOXX 50 futures outlook remains bearish and short-term gains are also considered corrective. Recent weakness has resulted in a breach of support at 3608.00, Apr 27 low and of 3551.60, 61.8% retracement of the Mar 7 - 29 rally. This has exposed 3458.90 next, the 76.4% retracement. Initial resistance is at 3664.80, the 20-day EMA.

- In FX, EURUSD traded lower Thursday and cleared support at 1.0472, Apr 28 low. The break lower confirms a bear flag breakout and a resumption of the primary downtrend. The focus is on 1.0341, the Jan 3 2017 low and a key support. GBPUSD remains weak following this week’s extension of the downtrend. The focus is on 1.2162 next, the May 22 2020 low. The USDJPY primary uptrend remains intact and this week’s move lower is likely a correction. Initial support has been defined at 127.52, yesterday’s low. A resumption of gains would refocus attention on the bull trigger at 131.35, May 9 high. A break would open 131.96, the 1.00 projection of the Feb 24 - Mar 28 - 31 price swing.

- On the commodity front, Gold remains vulnerable following this week’s resumption of the downtrend. Further weakness is likely and attention is on the $1800.0 handle next ahead of $1780.4, the Jan 28 low. In the {7I} Oil space, a bearish threat in WTI futures remains present, despite the recovery from Wednesday’s low of $98.20. Key short-term resistance is at $111.37, the May 5 high. $98.20 and $111.37 are viewed as important short-term directional triggers.

- In the FI, Bund futures remain in a downtrend. This week’s gains are considered corrective. A fresh cycle low on Monday reinforced the bearish condition and confirmed, once again, an extension of the bearish price sequence of lower lows and lower highs. A resumption of weakness would refocus attention on 150.15, the 0.764 projection of the Mar 7 - 29 - Apr 4 price swing. Firm trend resistance to watch is 156.00, Apr 28 high. The broader trend condition in Gilts remains down. However, yesterday’s move higher resulted in a break of resistance at 119.79, the Apr 25 high. This signals potential for a stronger short-term corrective phase and opens 121.84 next, 50.0% of the Mar 1 - May 9 bear leg. On the downside, key support has been defined at 116.87, the May 9 low. This is also the bear trigger.

EQUITIES: Stocks Regain Some Stability Overnight

- Asian markets closed stronger: Japan's NIKKEI closed up 678.93 pts or +2.64% at 26427.65 and the TOPIX ended 35.02 pts higher or +1.91% at 1864.2. China's SHANGHAI closed up 29.29 pts or +0.96% at 3084.284 and the HANG SENG ended 518.43 pts higher or +2.68% at 19898.77.

- European equities are gaining, with the German Dax up 168.21 pts or +1.22% at 13804.13, FTSE 100 up 92.52 pts or +1.28% at 7288.71, CAC 40 up 71.41 pts or +1.15% at 6247.86 and Euro Stoxx 50 up 47.42 pts or +1.31% at 3632.19.

- U.S. futures are bouncing a little, led by tech, with the Dow Jones mini up 253 pts or +0.8% at 31905, S&P 500 mini up 43.75 pts or +1.11% at 3971, NASDAQ mini up 206.25 pts or +1.73% at 12152.75.

COMMODITIES: Oil Off Session Highs, But Holding Previous 2 Days' Gains

- WTI Crude up $0.79 or +0.74% at $106.87

- Natural Gas up $0.08 or +1.06% at $7.738

- Gold spot up $0.95 or +0.05% at $1824.6

- Copper down $1.3 or -0.32% at $411.15

- Silver up $0.15 or +0.72% at $20.8225

- Platinum up $9.32 or +0.98% at $958.92

LOOK AHEAD:

| Date | GMT/Local | Impact | Flag | Country | Event |

| 13/05/2022 | 0900/1100 | ** |  | EU | industrial production |

| 13/05/2022 | 1230/0830 | ** |  | US | Import/Export Price Index |

| 13/05/2022 | 1400/1000 | *** |  | US | University of Michigan Sentiment Index (p) |

| 13/05/2022 | 1500/1100 |  | US | Minneapolis Fed's Neel Kashkari | |

| 13/05/2022 | 1600/1800 |  | EU | ECB Schnabel Panelist at IRFMP | |

| 13/05/2022 | 1600/1200 |  | US | Cleveland Fed's Loretta Mester |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.