-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - JPY Bounces as MoF Issue Warning

Highlights:

- EUR/USD through 1.0600 as post-ECB sell-off extends

- JPY bounces further off lows as MoF issues warning

- Focus turns to US CPI - headline seen accelerating, but core expected to moderate

US TSYS SUMMARY: Treasuries Twist Flatten Ahead Of CPI

- Cash Tsys have twist flattened through the European session as 10Y yields struggle to rise materially above 3% whilst 2Y yields continue to shift higher as year-end Fed pricing squeezes to new highs. The move is likely helped by Shanghai set to reinstate Covid restrictions on seven districts this weekend to conduct mass testing.

- The combination sees 2s10s at 18bps for the lowest since early May, although a long way off recent lows of -10bps in early April.

- 2YY +3.4bps at 2.846%, 5YY +0.9bps at 3.073%, 10YY -1.5bps at 3.027%, 30YY -1.5bps at 3.148%.

- TYU2 sits 2 ticks higher at 118-00 in the middle of yesterday’s range which sees the outlook remain bearish, eyeing support at 117-22 (Jun 9 low) with resistance at 119-16+ (Jun 1 high).

- Data: CPI inflation for May is obviously key but real earnings, the preliminary June U.Mich consumer survey and later the monthly budget statement for May are also of note.

- No issuance.

Recent flattening in 2s10sSource: Bloomberg

Recent flattening in 2s10sSource: Bloomberg

STIR FUTURES: Fed Hikes Maintain Post-ECB Move Ahead Of CPI

- Ahead of US CPI, implied Fed hikes have held onto increases seen after the ECB yesterday.

- FOMC-dated Fed Funds imply a 52bp hike next week with a cumulative 104bps for Jul. Meetings further out, likely more sensitive to CPI, have a joint post-May FOMC high of 146bps for Sep and a high of 209bps to year-end.

- Link to CPI preview: https://marketnews.com/mni-us-cpi-preview-moderating-very-slightly. Note the typo on Treasuries above 3%: it meant to say across 5-30Y tenors rather than across the curve although 3s have since exceeded that handle as well.

Cumulative hikes implied by FOMC-dated Fed Funds futuresSource: Bloomberg

Cumulative hikes implied by FOMC-dated Fed Funds futuresSource: Bloomberg

EGB SUMMARY: Rate Re-Pricing & Wider Spreads Following ECB Meeting

Euro area government bonds have broadly traded weaker and core-periphery spreads have widened following yesterday's ECB meeting.

- The ECB meeting was notably hawkish. Official inflation forecasts were revised higher, with inflation marginally above target in 2024. President Lagarde indicated the strong likelihood of a 50bp hike in September and a series of hikes thereafter.

- While this hawkish pivot has underpinned repricing at the short-end, indications that the ECB did not discuss an anti-fragmentation tool at the June meeting (although Lagarde stressed they could introduce this if they wanted), has fueled spread widening.

- Core curves have twist flattened. The very long end of the German curve is now 9bp flatter on the day.

- Most of the movement in the OATs curve has been at the shorter end where rate-repricing has driven up yields. The 2s30s spread has narrowed 6bp.

- BTPs have sold off sharply at the short end with benchmark 2-5-year yields up 11-18bp.

- Supply this morning came from Italy (BOTs, EUR6.5bn)

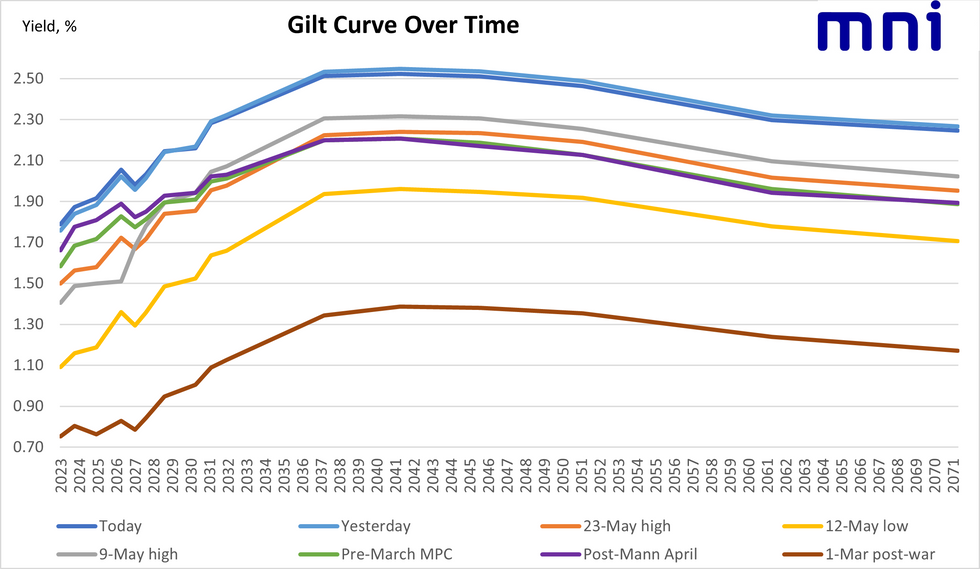

GILT SUMMARY: Front-end of the curve hitting new cycle highs

- The front-end of the gilt curve has seen yields rise above yesterday's ECB-driven moves.

- 2-year gilt yields hit a high of 1.888% earlier this morning, before falling around 1bp from here.

- Markets continue to increase expectations of future BOE hikes following the ECB's decision to keep the door open to hikes of greater than 25bp from September. At the time of writing markets were pricing around 186bp of further BOE hikes by February 2023 (over 6 meetings) with 70bp priced by August (2 meetings).

- UK inflation expectation data moved higher this morning, but probably no more than would really be expected given the moves higher in spot inflation following the implementation of the consumer energy price cap increase in April.

- Longer-term yields have moved off their highs of yesterday, however, but still remain close to cycle highs.

- US CPI later today has the potential to see another externally-driven move in gilt markets.

- Next week will be a big one for the UK with the release of April activity data Monday, labour market data Tuesday, retail sales data Friday, and the highlight being the MPC meeting - with the decision due Thursday.

EUROPE OPTION FLOW SUMMARY

Bobl package:

OEN2 123p sold in 31.25k

OEQ 121/125 RR, bought the put in 25k

Net received 44.5 ticks

ERU2 99.37p, bought for 6.75 in 3k (ref 99.45)

ERU2 99.50/99.37/99.25p ladder, bought for 2.5 in 4k

ERU2 99.62/99.87cs vs 99.25p, bought the cs for -0.75 (receive) in 2k

ERU2 99.25p, sold at 2.75 in 5k

ERZ2 99.25/99.50cs 1x2, sold at 1.5 in 4k

SX7E 16th Dec 110c, sold at 0.95 in 10k

FOREX: JPY Firmer for Second Session as Authorities Step Up Jawboning

- USD/JPY slipped to a session low following the release of a joint statement made by the MoF, FSA and BoJ. The statement clarified that the authorities had a meeting after the sudden move in the JPY, stressing that the authorities will watch the FX moves even more carefully, and with a sense of urgency.

- The statement is just jawboning for now, but looked like a modest step-up in language/urgency. The phrasing on intervention, however, looked broadly inline with the communication on currency back in late April, when the MoF stressed that recent FX moves warrant extreme concern, and will respond appropriately on FX if needed.

- Elsewhere, EUR/USD is extending the post-ECB pullback, with the pair showing below 1.06 for the first time since mid-May. The step lower in the currency remains dislocated from the run higher in rate expectations, with year-end rate expectations hitting a contract high yesterday at 0.89%.

- Focus turns to the US CPI release, with markets expecting CPI to pick up to 0.7% on the month, although core prices are seen moderating on a M/M and Y/Y basis. Full MNI preview here: https://marketnews.com/mni-us-cpi-preview-moderati...

- Preliminary Uni of Michigan confidence also crosses, as well as Canada's May jobs report.

FX OPTIONS: Expiries for Jun10 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0700(E905mln), $1.0790-00(E1.8bln), $1.0900(E1.3bln)

- USD/CAD: C$1.2600($525mln), C$1.2735-50($1.1bln)

Price Signal Summary - S&P E-Minis Fail To Clear The 50-Day EMA

- In the equity space, S&P E-Minis have failed to overcome resistance at the 50-day EMA - the average intersects at 4169.30. The pullback signals the potential end of a correction between May 20 - 31. A deeper pullback would pave the way for weakness towards the key support and bear trigger at 3807.50, May 20 low. Key short-term resistance, just above the 50-day EMA, is at 4202.25, May 31 high. EUROSTOXX 50 futures traded lower Thursday and price is once again below the 50-day EMA, which intersects at 3744.50. An extension lower would open support at 3576.00, the May 19 low. The major support and bear trigger is still far-off at 3466.00, May 10 low. Key short-term resistance has been defined at 3857.00, Jun 6 high and represents a bull trigger.

- In FX, EURUSD traded lower Thursday. This resulted in a print below support at 1.0627, the Jun 1 low. The move lower also means channel resistance at 1.0733 remains intact. The channel is drawn from the Feb 10 high and the top remains a key resistance. A clear break is required to strengthen bullish conditions. For bears, an extension lower would open 1.0533, the May 20 low. GBPUSD remains above Tuesday’s low of 1.2431 and this level represents a key short-term support. Attention is still on the 50-day EMA, at 1.2673. A break is required to strengthen bullish conditions. A reversal lower and breach of 1.2431 would expose 1.2317, the May 17 low. USDJPY remains in a clear uptrend and this week’s gains have confirmed a resumption of the primary uptrend. Sights are set on 135.00 and 135.15, the Jan 31 2002 high and a key congestion area. Trend conditions are overbought however this does not appear to be a concern for bulls at this stage.

- On the commodity front, Gold is unchanged and remains in consolidation mode. Firm resistance is still seen at the 50-day EMA, which intersects at $1871.7 today. A break of this average is required to suggest scope for stronger gains. For bears, a reversal lower would refocus attention on the key support and bear trigger at $1787.0, May 16 low. Initial support to watch is $1828.6, Jun 1 low. In the Oil space, WTI futures remain bullish and the path of least resistance remains up. The focus is on $123.35, 1.236 projection of the May 11 - 17 -19 price swing.

- In the FI space, Bund futures traded lower again Thursday as the current bear leg extends. Scope is seen for a move towards 146.68, 1.618 projection of the Apr 28 - May 9 - 12 price swing. Gilts remain in a downtrend and the focus is on weakness towards 113.56, 2.50 projection of the May 19 - 24 - 26 price swing.

EQUITIES: European Stocks Continue Weakening Post-ECB

- Asian markets closed mixed: Japan's NIKKEI closed down 422.24 pts or -1.49% at 27824.29 and the TOPIX ended 25.96 pts lower or -1.32% at 1943.09. China's SHANGHAI closed up 45.88 pts or +1.42% at 3284.834 and the HANG SENG ended 62.87 pts lower or -0.29% at 21806.18.

- European stocks continue to weaken after Thursday's ECB decision, with the German Dax down 226.99 pts or -1.6% at 13972.01, FTSE 100 down 73.6 pts or -0.98% at 7402.02, CAC 40 down 86.78 pts or -1.36% at 6271.58 and Euro Stoxx 50 down 59.6 pts or -1.6% at 3665.14.

- U.S. futures are flat, with the Dow Jones mini down 33 pts or -0.1% at 32230, S&P 500 mini down 0.25 pts or -0.01% at 4016, NASDAQ mini up 21.5 pts or +0.18% at 12296.

COMMODITIES: Precious Metals Slip As USD Rebounds From Overnight Lows

- WTI Crude up $0.2 or +0.16% at $121.71

- Natural Gas up $0.03 or +0.38% at $8.997

- Gold spot down $3.28 or -0.18% at $1844.67

- Copper down $0.9 or -0.21% at $437.2

- Silver down $0.07 or -0.33% at $21.6185

- Platinum down $0.89 or -0.09% at $974.16

| Date | GMT/Local | Impact | Flag | Country | Event |

| 10/06/2022 | 1230/0830 | *** |  | CA | Labour Force Survey |

| 10/06/2022 | 1230/0830 | *** |  | US | CPI |

| 10/06/2022 | 1345/1545 |  | EU | ECB Lagarde Message for Goethe Uni Law & Finance Institute | |

| 10/06/2022 | 1400/1000 | *** |  | US | University of Michigan Sentiment Index (p) |

| 10/06/2022 | 1400/1000 | * |  | US | Services Revenues |

| 10/06/2022 | 1600/1200 | *** |  | US | USDA Crop Estimates - WASDE |

| 10/06/2022 | 1800/1400 | ** |  | US | Treasury Budget |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.