-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US CPI Preview: Setting The Tone For 2025

MNI ASIA MARKETS OPEN: NY Fed Inflation Expectations Gaining

MNI ASIA MARKETS ANALYSIS: Tsy Ylds Drift Higher Ahead CPI/PPI

MNI US OPEN: Stocks Continue To Bounce As Dollar Softens

EXECUTIVE SUMMARY:

- US OFFICIAL: G-7 TO EXPLORE WAYS TO SET RUSSIA OIL PRICE CAP

- KREMLIN: RUSSIA DOES NOT ACCEPT THAT IT HAS DEFAULTED ON ITS EXTERNAL DEBT

- ECB CHANGES RELEASE TIMES FOR MONETARY POLICY DECISIONS

- LE MAIRE: FRENCH PUBLIC FINANCES AT AN 'ALERT LEVEL'

- UK PM: WE BELIEVE WE CAN ACHIEVE NI PROTOCOL CHANGES THIS YEAR

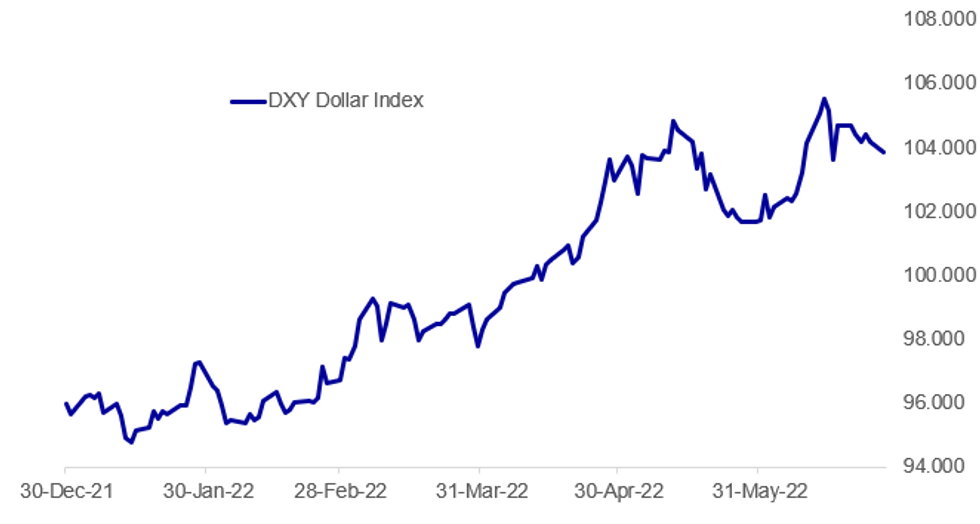

Fig. 1: Dollar Starts The Week Softly As Risk Appetite Picks Up

Source: BBG, MNI

Source: BBG, MNI

NEWS:

G7 - OIL: The G7 are working on a new package of sanctions against Russia due to be announced on Tuesday which have a strong element focused on a potential price cap on Russian oil. "The dual objectives of G7 leaders have been to take direct aim at Putin's revenues, particularly through energy, but also to minimize the spillovers and the impact on the G7 economies and the rest of the world," a US official has said on the matter.

RUSSIA DEBT (RTRS): The Kremlin on Monday rejected claims that it has defaulted on its external debt for the first time in more than a century. In a call with reporters, Kremlin spokesperson Dmitry Peskov said Russia made bond payments due in May but the fact they had been blocked by Euroclear because of Western sanctions on Russia was "not our problem."

ECB: The ECB announces the following change to its release schedule for monetary policy decisions, starting from Jul 21 (which is the date of the next Governing Council mon pol meeting):

- Monetary Policy decisions published at 1415CET (1315UK, 0815ET), vs 1345CET prior

- Press conference beginning at 1445CET (1345UK, 0845ET), vs 1430ET prior

- Related documents to be published at 1500CET

- Monetary policy meeting dates remain unchanged

FRANCE (BBG): France’s public finances have reached an “alert level” amid rising interest rates, surging inflation and dwindling growth, Finance Minister Bruno Le Maire said.The candid warning comes as President Emmanuel Macron’s government seeks to negotiate a revised 2022 budget with opposition parties after he lost his majority at the National Assembly in elections earlier this month. “Not everything is possible, quite simply because we have reached an alert level for public finances,” Le Maire said on BFM TV Monday. “We used to be able to borrow at 0% or at negative rates, but today we are borrowing at more than 2%.

FRANCE / EUROPE ENERGY (BBG): France is working on energy contingency plans to mitigate against the escalating gas shortage across Europe. “We will determine which companies are of the most strategic importance, namely those for whom we can allow gas to be cut off and those for whom we cannot allow any cuts," French Finance Minister Bruno Le Maire said in an RMC radio interview this morning.

UK-EU: Speaking from the G7 summit in Bavaria, Germany, UK PM Boris Johnson states that he believes his gov't can pass the legislation required to unilaterally alter the Northern Ireland protocol within 2022. The second reading of the Northern Ireland Protocol bill is set to take place in the House of Commons later today around 1530BST (1030ET, 1630CET). The contentious piece of legislation is unlikely to have a smooth path through parliament. All opposition parties (barring the Democratic Unionist Party) set to oppose the bill, and there is likely to be significant intervention from pro-soft Brexit Conservatives uneasy with the potential breaches in international law the bill could entail.

DATA:

SPAIN: PPI Slows, But Stuck At Elevated Levels

Spain's factory gate inflation slowed for a second consecutive month in May, but still still at historically elevated levels, the National Institute of Statistics said Monday. Prices rose 0.9% on month, which left the producer price index 43.6% above levels seen in May 2021. This months outturn slowed from a downwardly revised 44.5% in April and a record high 47.0% in March.

Core factory inflation also slowed, decelerating on an annual reading for the first time in more than a year, rising 15.3% on year ago levels.

The data will offer some respite to ECB policymakers, with a modest dip in the core rate, but, if reflected in overall EZ inflation readings later this week, the overall level is still at levels that will have the Governing Council starting the rate hiking cycle over the summer months.

FIXED INCOME: EU, UK and US Govies trade heavy

- A mixed trading starts for EGB's and Bund, but futures are nonetheless in the red, and are trading in wide ranges (90 ticks for Bund).

- Volumes have been very low, with most investors on the sideline, ahead of a packed week for speakers, with the ECB Forum on the 27th/29th, German CPI on Wednesday, and the week ends with the EU CPI on Friday.

- Instead, investors and market participants will be on the lookout, for change in stance from Central Bankers, following a poor set of data last week.

- Peripherals are mixed, Greece is 8.4bps tighter, while Italy sits 2.5bps wider vs the German 10yr.

- Gilt trades inline with most of Europe and Germany, translating in a small 0.5bp wider Gilt/Bund spread.

- Similar story for US Treasuries. super light volumes, with just 170k lots traded overnight, and during the European morning session.

- Looking ahead, US Durable Goods, and ECB Lagarde are notable events.

- Sep Bund futures (RX) down 81 ticks at 147.13 (L: 146.92 / H: 147.82)

- Germany: The 2-Yr yield is up 3.9bps at 0.852%, 5-Yr is up 3.9bps at 1.202%, 10-Yr is up 4.4bps at 1.486%, and 30-Yr is up 3.3bps at 1.724%.

- Sep Gilt futures (G) down 47 ticks at 113.5 (L: 113.35 / H: 113.84)

- UK: The 2-Yr yield is up 4.6bps at 1.978%, 5-Yr is up 4.5bps at 1.999%, 10-Yr is up 4.9bps at 2.351%, and 30-Yr is up 5.9bps at 2.606%.

- Sep BTP futures (IK) down 82 ticks at 120.99 (L: 120.86 / H: 121.51)

- Sep OAT futures (OA) down 76 ticks at 137.58 (L: 137.46 / H: 138.38)

- Italian BTP spread down 1.3bps at 200.8bps

- Spanish bond spread up 0.9bps at 112.1bps

- Portuguese PGB spread up 1bps at 109bps

- Greek bond spread down 6.9bps at 226.9bps

FOREX: Sentiment Supported as Equities Retain Corrective Cycle Higher

- Equity markets remain in a corrective cycle, and trade higher again Monday, underpinning a calmer outlook to currency markets so far this week. As a result, the greenback is softer and the USD Index is through last week's lows. The main beneficiaries so far have been the EUR and SEK, with both currencies posturing ahead of the Riksbank decision on Thursday and the ECB's Sintra policy forum across the week.

- AUD, NZD are the weakest performers so far Monday, but both currencies hold within recent ranges and are yet to test any material downside levels. AUDUSD continues to trade above 0.6851, the Jun 14 low. This support however remains exposed and trend signals are bearish. A resumption of weakness would also signal scope for a test of key support and the bear trigger at 0.6829, the May 12 low. Clearance of this support would confirm a resumption of the downtrend and open 0.6805, the Jun 22 2020 low.

- Data releases due Monday include prelim May durable goods as well as pending home sales. ECB's Lagarde is due to speak as she marks the opening of the ECB's central banking forum in Sintra. Markets watch for any update on the progress of the anti-fragmentation tool expected to be unveiled in the coming policy meetings.

EQUITIES: Europe Bounces Sharply From Last Week's Lows, Cyclical Names Lead Gains

- Asian markets closed stronger in a follow-through from the US equity rally late last week: Japan's NIKKEI up 379.3 pts or +1.43% at 26871.27 and the TOPIX up 20.7 pts or +1.11% at 1887.42. China's SHANGHAI closed up 29.438 pts or +0.88% at 3379.185 and the HANG SENG ended 510.46 pts higher or +2.35% at 22229.52.

- European equities are stronger, with consumer discretionary and tech names leading the way: German Dax up 149.5 pts or +1.14% at 13267.83, FTSE 100 up 53.63 pts or +0.74% at 7262.4, CAC 40 up 42.12 pts or +0.69% at 6115.68 and Euro Stoxx 50 up 32.91 pts or +0.93% at 3566.6.

- U.S. futures continue to rise, with the Dow Jones mini up 98 pts or +0.31% at 31585, S&P 500 mini up 17.75 pts or +0.45% at 3934, NASDAQ mini up 73.5 pts or +0.61% at 12214.5.

COMMODITIES: Precious Metals Bounce On Weaker USD

- WTI Crude down $0.48 or -0.45% at $107.07

- Natural Gas down $0.15 or -2.4% at $6.071

- Gold spot up $11.08 or +0.61% at $1837.96

- Copper up $2.65 or +0.71% at $376.95

- Silver up $0.35 or +1.64% at $21.5125

- Platinum up $3.47 or +0.38% at $914.55

LOOK AHEAD:

| Date | GMT/Local | Impact | Flag | Country | Event |

| 27/06/2022 | 1230/0830 | ** |  | US | durable goods new orders |

| 27/06/2022 | 1400/1000 | ** |  | US | NAR pending home sales |

| 27/06/2022 | 1430/1030 | ** |  | US | Dallas Fed manufacturing survey |

| 27/06/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 2 Year Note |

| 27/06/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 27/06/2022 | 1700/1300 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 27/06/2022 | 1700/1300 | * |  | US | US Treasury Auction Result for 5 Year Note |

| 27/06/2022 | 1830/2030 |  | EU | ECB Lagarde Opens ECB Forum | |

| 27/06/2022 | 1900/2100 |  | EU | ECB Schnabel on Financial Stability at ECB Forum | |

| 27/06/2022 | 2230/1830 |  | US | New York Fed President John Williams | |

| 28/06/2022 | 0600/0800 | * |  | DE | GFK Consumer Climate |

| 28/06/2022 | 0600/0800 | ** |  | SE | Retail Sales |

| 28/06/2022 | 0645/0845 | ** |  | FR | Consumer Sentiment |

| 28/06/2022 | 0800/1000 |  | EU | ECB Lagarde Intro at ECB Forum | |

| 28/06/2022 | 0830/1030 |  | EU | ECB Lane on Globalisation & Labour Markets at ECB Forum | |

| 28/06/2022 | 0900/1000 | * |  | UK | Index Linked Gilt Outright Auction Result |

| 28/06/2022 | 0930/1130 |  | EU | ECB Elderson on Energy Prices & Sources at ECB Forum | |

| 28/06/2022 | 1100/1300 |  | EU | ECB Panetta on Digital Currencies at ECB Forum | |

| 28/06/2022 | 1100/1200 |  | UK | BOE Cunliffe Panels ECB Forum | |

| 28/06/2022 | 1200/0800 |  | US | Richmond Fed President Tom Barkin | |

| 28/06/2022 | 1230/0830 | ** |  | US | Advance Trade, Advance Business Inventories |

| 28/06/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 28/06/2022 | 1300/0900 | ** |  | US | S&P Case-Shiller Home Price Index |

| 28/06/2022 | 1300/0900 | ** |  | US | FHFA Home Price Index |

| 28/06/2022 | 1400/1000 | *** |  | US | Conference Board Consumer Confidence |

| 28/06/2022 | 1400/1000 | ** |  | US | Richmond Fed Survey |

| 28/06/2022 | 1630/1230 |  | US | San Francisco Fed's Mary Daly | |

| 28/06/2022 | 1700/1300 | ** |  | US | US Treasury Auction Result for 7 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.