-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN: Dollar Gains Resume

EXECUTIVE SUMMARY:

- CHINA AGGREGATE FINANCING RISES SHARPLY, LIQUITITY RECOVERS STRONGLY

- RIKSBANK MINUTES SHOW CRACKS UNDER UNANIMOUS HIKE

- RBNZ TO OPT FOR "SHORT TERM PAIN" ON INFLATION (MNI INTERVIEW)

- TWITTER SHARES SLUMP, WITH LEGAL BATTLE AHEAD AS MUSK WALKS AWAY

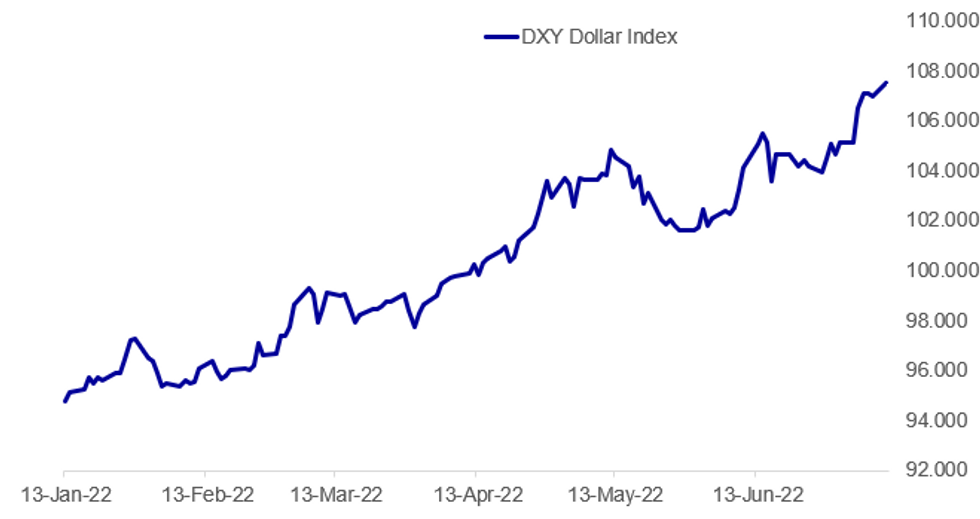

Fig. 1: King Dollar Continues To Power Higher

Source: BBG, MNI

Source: BBG, MNI

NEWS:

CHINA: The PBoC reported this morning that aggregate financing rose by 5.17tr CNY in June, significantly above expectations of 4.2tr CNY with new yuan loans rising by 2.81tr CNY (2.4tr CNY exp.).Hence, China ‘liquidity’ metric, computed as the annual change in China Total Social Financing (TSF) continues to rise, now up 2.8tr USD in the past year.

SWEDEN RIKSBANK (MNI BRIEF): The Riksbank board was unanimous in backing the 50 basis point June hike and members endorsed the central forecast, but the minutes revealed divisions under the surface. Deputy Governor Henry Ohlsson said that "If there had been a majority at today's meeting in favour of raising the policy rate by 0.75 percentage points, I would have supported it." Deputy Governor Anna Breman stressed that "monetary policy may need to change direction" rather than just raising the policy rate to around 2.0% and staying there, as the bank projected, as inflation risks are on the upside and growth ones on the downside. Meanwhile, First Deputy Governor Cecilia Skingsley will have left before the next regular meeting and Governor Stefan Ingves leaves at year end, adding to the policy uncertainty.

RBNZ (MNI INTERVIEW): A 50 basis point hike in official interest rates in New Zealand this week was the "sensible middle ground" for the central bank, a former RBNZ official has told MNI.

US EQUITIES (BBG): Twitter Inc. shares tumbled in pre-market trading after Elon Musk walked away from his $44 billion deal to buy the company, setting the scene for a disruptive legal battle. Shares fell as much as 7.8% to $33.93 in premarket trading Monday, on track to erase $2.2 billion in market value, after Musk backed out of an agreement to buy the social-media giant and take it private. Shares in Tesla Inc., the electric car maker that Musk leads, rose 1.1%.

EUROPE ENERGY (BBG): European natural gas fell after Canada said it would return a stranded turbine for a key Russian pipeline to Germany, raising optimism that tensions with Moscow over energy supplies will ease. Benchmark futures dropped as much as 12%. The Canadian move comes as much-relief for Germany, and more widely Europe, as deeply reduced flows through the Nord Stream pipeline have been threatening the region’s plan to fill storage sites in time for winter and bringing the risk of rationing.

UK: The race to become next leader of the Conservative Party and therefore next British PM has attracted a significant number of MPs seeking the position, raising concerns in the party that a lengthy leadership race could lead to a period of gov't drift and public criticism for being too internally-focused at a time of rising price pressures on consumers. Speaking to the BBC, Bob Blackman MP, who sits on the executive of the 1922 Committee of backbench Conservative MPs raised the prospect of the body raising the threshold of parliamentary support required to get onto the ballot in an effort to slim the contest down before it officially begins.

UK (BBG): Foreign Secretary Liz Truss entered the race to replace Boris Johnson as UK premier, the latest cabinet minister to make her move in an already fractious contest.Truss made tax cuts the heart of her campaign, vowing to reverse a payroll tax hike that was introduced by former chancellor Rishi Sunak and pledging to make corporation tax “competitive.”

CHINA (BBG): China Evergrande Group suffered its first rejection from local creditors to extend a bond payment, a development that may result in a landmark onshore default and encourage investors to take a tougher stance against other developers battered by the nation’s property debt crisis. Holders of a puttable yuan-denominated bond from the firm’s main onshore unit Hengda Real Estate Group Co. rejected a plan to further extend payment past a July 8 deadline by six months, according to a Shenzhen stock exchange filing Monday. The company had held a meeting last week to seek creditor approval, but more than 90% of the voting holders rejected the proposed extension.

DATA:

CHINA END-JUNE M2 +11.4% Y/Y VS MEDIAN +11.0% Y/Y

- CHINA JUNE NEW LOANS CNY2.81 TLN VS MEDIAN CNY2.4 TLN

- CHINA END-JUNE M1 +5.8% Y/Y VS +4.6% Y/Y END-MAY

- CHINA END-JUNE M0 +13.8% Y/Y VS +13.5% Y/Y END-MAY

FIXED INCOME: Core FI curves diverging

- After a strong start to the European trading session, core fixed income has moved off its highs. Curve moves have diverged, however, with the UST curve bull steepening, the gilt curve seeing a parallel move and the German curve bull flattening.

- The risk-off nature of the move was largely triggered by further concerns about Covid-19 cases in China.

- Looking ahead the main event of the day will be Bailey and three other FPC members testifying ahead of the Treasury Select Committee following the recent FSR.

- TY1 futures are up 0-9 today at 117-29 with 10y UST yields down -2.0bp at 3.062% and 2y yields down -3.5bp at 3.074%.

- Bund futures are up 0.56 today at 150.63 with 10y Bund yields down -5.0bp at 1.291% and Schatz yields down -4.6bp at 0.466%.

- Gilt futures are up 0.19 today at 114.63 with 10y yields down -3.8bp at 2.193% and 2y yields down -3.8bp at 1.874%.

FOREX: China COVID Concerns Trigger Renewed Risk-Off Wave

- The greenback has resumed its incline Monday, rising against all others in G10, although Friday's highs remain out of reach for now. A break above 107.786 for the USD Index puts the dollar at its strongest levels since 2002.

- Stock futures globally are lower, with US markets indicating a negative open on Wall Street later today. The renewed wave of risk-off has been triggered by a surge in COVID-19 cases found in Shanghai, with a new subvariant detected and raising concerns of fresh lockdown pressures across China.

- The dollar strength keeps EUR/USD within range of the key psychological parity level which, if broken, puts the pair below 1.0000 for the first time in two decades.

- Soft commodities prices are adding to the risk-off pressure, with industrial metals from steel rebar to iron ore offered after weakness in local Chinese markets. Lower oil markets are working against commodity-tied currencies, putting NOK at the bottom of the G10 table ahead of the NY crossover.

- There are no notable data releases due Monday, with focus remaining on the central bank speaker slate. ECB's de Cos and Nagel speak as well as BoE's Bailey and Fed's Williams.

EQUITIES: Defensive Stocks Outperforming To Start The Week

- Asian markets closed mixed: Japan's NIKKEI closed up 295.11 pts or +1.11% at 26812.3 and the TOPIX ended 27.23 pts higher or +1.44% at 1914.66. China's SHANGHAI closed down 42.494 pts or -1.27% at 3313.584 and the HANG SENG ended 601.58 pts lower or -2.77% at 21124.2.

- European stocks are weaker, with materials / energy names leading the way lower (defensives including utilities are outperforming): the German Dax down 128.22 pts or -0.99% at 12790.44, FTSE 100 down 57.91 pts or -0.8% at 7177.74, CAC 40 down 65.35 pts or -1.08% at 5974.07 and Euro Stoxx 50 down 36.31 pts or -1.04% at 3458.99.

- U.S. futures are a little weaker, with the Dow Jones mini down 177 pts or -0.57% at 31133, S&P 500 mini down 25.25 pts or -0.65% at 3876, NASDAQ mini down 97.75 pts or -0.8% at 12054.25.

LOOK AHEAD:

| Date | GMT/Local | Impact | Flag | Country | Event |

| 11/07/2022 | - |  | EU | ECB Lagarde & Panetta at Eurogroup Meeting | |

| 11/07/2022 | 1415/1515 |  | UK | BOE Bailey Treasury Select Committee on FS Report | |

| 11/07/2022 | 1500/1100 | ** |  | US | NY Fed survey of consumer expectations |

| 11/07/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 11/07/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 11/07/2022 | 1700/1300 | *** |  | US | US Note 03 Year Treasury Auction Result |

| 11/07/2022 | 1800/1400 |  | US | New York Fed's John Williams | |

| 12/07/2022 | 2301/0001 | * |  | UK | BRC-KPMG Shop Sales Monitor |

| 12/07/2022 | 0800/0900 |  | UK | BOE Cunliffe on Crypto Markets | |

| 12/07/2022 | 0900/1100 | *** |  | DE | ZEW Current Conditions Index |

| 12/07/2022 | 0900/1100 | *** |  | DE | ZEW Current Expectations Index |

| 12/07/2022 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 12/07/2022 | 0900/1000 |  | UK | BOE Bailey Speaks at OMFIF | |

| 12/07/2022 | 1000/0600 | ** |  | US | NFIB Small Business Optimism Index |

| 12/07/2022 | - |  | EU | ECB de Guindos at ECOFIN Meeting | |

| 12/07/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 12/07/2022 | 1400/1000 | ** |  | US | IBD/TIPP Optimism Index |

| 12/07/2022 | 1530/1130 | ** |  | US | US Treasury Auction Result for 52 Week Bill |

| 12/07/2022 | 1600/1200 | *** |  | US | USDA Crop Estimates - WASDE |

| 12/07/2022 | 1630/1230 |  | US | Richmond Fed's Tom Barkin | |

| 12/07/2022 | 1700/1300 | ** |  | US | US Note 10 Year Treasury Auction Result |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.