-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN - Dust Settles as Pelosi Departs Taiwan

EXECUTIVE SUMMARY:

- DUST SETTLES AS PELOSI SET TO DEPART TAIWAN

- TRUSS EXTENDS LEAD OVER SUNAK IN UK LEADERSHIP RACE

- OPEC SOURCES SEE LITTLE CHANCE OF OUTPUT INCREASE AT TODAY'S MEETING

- ITALIAN SERVICES SECTOR CONTRACTS AT FASTEST PACE IN A YEAR

NEWS

US/CHINA/TAIWAN (BBG): Pelosi Vows US Won’t Abandon Taiwan in Face of China Threats

House Speaker Nancy Pelosi pledged that the US wouldn’t abandon Taiwan, reaffirming American support for the democratically elected government in Taipei despite threats of fresh trade curbs and military actions by Beijing.

US-SOUTH KOREA (YTN): Pelosi Likely to Meet With Pres. Yoon During S. Korea Visit

US House Speaker Nancy Pelosi may meet with South Korean President Yoon Suk-yeol in Seoul on Thursday, YTN cable TV reports, citing Yoon’s office.

TAIWAN (BBG): Taiwan Turmoil Prompts Detours, Delays for Global Shipping

Gas suppliers are rerouting or reducing speed on some liquefied natural gas vessels currently en route to North Asia, according to people familiar with the matter. Shipments to Taiwan and Japan this weekend will be affected, said the people, who requested anonymity as the information isn’t public.

UK (MNI): NIESR Sees UK Recession, Bank Rate Holding At 3%

The UK will slip into recession later this year and the Bank of England will raise its benchmark rate will to 3.0% from the current 1.25%, stay there until the end of its three-year forecast horizon, the National Institute of Economic and Social Research forecasts Wednesday. Markets have fluctuated between showing the policy rate peaking at 2.5% or close to 3.0% but have assumed that it would soon dip lower but NIESR sees the Bank of England having to hold it at 3% to get inflation down to target and to keep it there despite the looming recession.

UK (The Times): Liz Truss has extended her lead over Rishi Sunak in the Conservative leadership race to 34 points, with 60 per cent of party members now saying they will vote for the foreign secretary to succeed Boris Johnson as prime minister. A YouGov poll for The Times and Times Radio found that almost nine in ten Tory members had made up their minds. Twenty-six per cent said they would support Sunak. The rest were undecided or said they would not vote.

GERMANY (BBG): Scholz Blames Russia for Nord Stream Gas Turbine Debacle

German Chancellor Olaf Scholz said Russia is to blame for a delay in shipping a turbine for the key Nord Stream 1 gas pipeline, and signaled extending the life of Germany’s three remaining nuclear power plants remains a potential option to help ease an energy crunch.

FRANCE (BBG): France to Cut Atomic Output as Europe’s Power Crisis Worsens

Electricite de France SA said it’s likely to extend cuts to its nuclear reactor output as scorching weather pushes up river temperatures, bringing the energy crisis in the European Union’s second-largest economy into sharp focus. Europe’s biggest producer of atomic energy, which is usually a net exporter of power for most of the year, is importing this year.

FINAL PMI DATA

- UK JUL FINAL SERVICES PMI 52.6r (FLSH 53.3); JUN 54.3

- EUROZONE JUL FINAL SERVICES PMI 51.2r (FLSH 50.6); JUN 53.0

- GERMANY JUL FINAL SERVICES PMI 49.7r (FLSH 49.2); JUN 52.4

- FRANCE JUL FINAL SERVICES PMI 53.2r (FLSH 52.1); JUN 53.9

ITALY DATA: Services PMI falls over 3 points below 50

ITALY JUL SERVICES PMI 48.4 (FCST 50.1); JUN 51.6

Highlights from the press release pretty gloomy, but also pointing to inflationary pressures peaking.

- "Both activity and new work declined for the first time since January amid reports that an uncertain economic outlook had dampened client confidence and led to a deterioration in demand. Subsequently, concerns around the outlook intensified and business confidence fell to a 20-month low."

- "The latest rise [in costs] was the slowest for six-months, hinting further at a peaking of cost pressures, but nonetheless amongst the steepest on record"

- "The rate of charge inflation also eased on the month, but was still the third-quickest on record. "

- "The Future Activity Index ticked down to the lowest level since November 2020. Panellists attributed reduced sentiment to a challenging economic climate, political uncertainty, the war in Ukraine and tighter financial conditions."

SPAIN DATA: Services PMI higher than expected but confidence lowest since Aug 20

SPAIN JUL SERVICES PMI 53.8 (FCST 52.0); JUN 54.0

Highlights from the press release:

- "The continued expansion of Spain’s service sector was signalled by July’s survey as firms recorded another solid increase in activity and a modest rise in new business. Additional staff were again taken on, which enabled companies to broadly keep on top of overall workloads."

- "Whilst firms indicated that underlying sales remained positive, a slump in new business from abroad – there was some indication that tourism numbers remain lower-than-usual – and growing client hesitancy in committing to new work weighed on growth."

- "Firms signalled that upward price pressures, and a generally unstable global economic and political environment was weighing on the outlook. Fears of recession in the second half-of-the year were increasingly common. The net result was a slump in confidence to its lowest since August 2020. "

EUROZONE DATA: PPI Sees Modest Deceleration for Second Consecutive Month

EUROZONE JUN PPI +1.1% M/M, +35.8% Y/Y (FCST +35.7% Y/Y); MAY +36.2%r Y/Y

- Euro-area factory gate inflation was only marginally hotter than expected, up +1.1% m/m and by +35.7% y/y in June.

- This is down a modest 0.4pp from May in the second month of decelerating PPI, largely due to the slowing of energy prices (+92.8% vs +94.4% in May) and intermediate goods (+23.8% vs +25.0%).

- The highest yearly increases were recorded in Romania (+61.2%), Denmark (+55.5%) and Lithuania (+52.5%).

- Excluding energy, PPI increased to 15.6% y/y in June, which is 0.4pp lower than in May and hints at a more widespread gentle deceleration of prices. This will come as welcome news to the ECB, however, slowing factory-gate inflation is yet to spill over into consumer prices which continued to soar to a record +8.9% in July.

EUROZONE DATA: June Retail Contracts by 3.7%

EUROZONE JUN RETAIL TRADE -1.2% M/M, -3.7% Y/Y (FCST -1.7% Y/Y); MAY +0.4%r Y/Y

- The June data saw Eurozone retail trade weaker than anticipated, contracting by -1.2% m/m and by -3.7% y/y. The year-on-year print is a substantial 2.0pp below forecast and a 4.1pp slide from the soft May expansion.

- The largest June year-on-year contractions were recorded by Denmark (-9.5%), Germany and Ireland (-8.8%) and the Netherlands (-6.1%).

- This mirrors slowing consumer demand across the bloc, as PMIs flagged falling new orders. Inflation surged further to +8.9% y/y in July, which will likely see retail continue to suffer into the tail end of Summer as consumer confidence slips to record lows.

- With CPI not yet showing signs of easing, the ECB appears to have sights set on prioritising front-loading policy normalisation to restore consumer confidence sooner rather than later.

GERMAN DATA: Surprise Surplus and Substantial Revisions in German Trade Balance

GERMANY JUN TRADE BALANCE EUR 6.4 BLN; MAY EUR 0.8r BLN

- German trade data for June saw significantly stronger exports (+4.5% m/m vs +1.3%r m/m in May) and softer imports (+0.2% m/m vs +3.2%r m/m in May).

- This generated a more healthy trade surplus of EUR 6.4bln, a massive beat of the 0.2bln forecast. The surplus remains less than half of that in 2021.

- The first German trade deficit since 1991 was initially reported in the May data at -1.0bln, however, this has been revised to +0.8bln in the June release.

- High commodity prices and food prices have generated inflated imports, as energy prices soar due to the effects of the ongoing Ukraine war. This coupled with lower manufacturing exports of an industry hampered by supply disruptions has accounted for a slowdown in German trade.

FOREX: Dust Settles as Pelosi Set to Depart Taiwan

- US Treasury yields are holding the bulk of the Tuesday rally, with the 10y oscillating either side of the 2.75% level. This keeps currency markets in line, with markets holding the bulk of Tuesday's greenback strength. As a result, EUR/USD remains below 1.02, with USD/JPY close to 3 points above the week's lows.

- Gains are considered corrective - for now. Recent weakness has resulted in the break of a number of important technical chart points. A bull channel breakout - drawn from the Mar 4 low - signals a short-term reversal.

- For equity markets, the dust has settled somewhat following Pelosi's visit to Taiwan yesterday, with the e-mini S&P holding above 4,100 as the House Speaker departs Taipei and concludes the visit shortly. While China announced a series of trade measures against Taiwan and tabled an extended series of war games around the island, the broader impact is seen as limited as this stage.

- NOK is the firmest currency so far, closely followed by SEK. The CHF and NZD hold at the bottom of the G10 pile.

- Focus turns to the final PMI data from the US, as well as June factory orders. ISM Services numbers also cross, and are expected to show a slowing to 53.5 from June's 55.3. Fed speakers on the docket include Bullard, Harker, Daly, Barkin and Kashkari.

BONDS: European data driving; now focus switches to Fed speakers and ISM services

- The German curve has led the way lower for core FI this morning following better German trade data, better Spanish services PMI data and upward revisions to French, German and Eurozone services PMI data (and in spite of a disappointing Italian services PMI print and poor Eurozone retail sales data).

- The German curve has bear flattened as the short-term has seen the biggest moves.

- Looking ahead, focus will switch to the US with a number of Fed speakers in the afternoon: Bullard, Harker, Daly, Barkin and Kashkari are all due to make appearances. The highlight of the day's data calendar will be the US ISM services print, too.

- TY1 futures are down -0-0+ today at 120-03+ with 10y UST yields down -0.3bp at 2.746% and 2y yields up 1.5bp at 3.067%.

- Bund futures are down -0.87 today at 157.23 with 10y Bund yields up 3.8bp at 0.854% and Schatz yields up 5.4bp at 0.360%.

- Gilt futures are down -0.44 today at 118.07 with 10y yields up 2.0bp at 1.886% and 2y yields up 2.3bp at 1.764%.

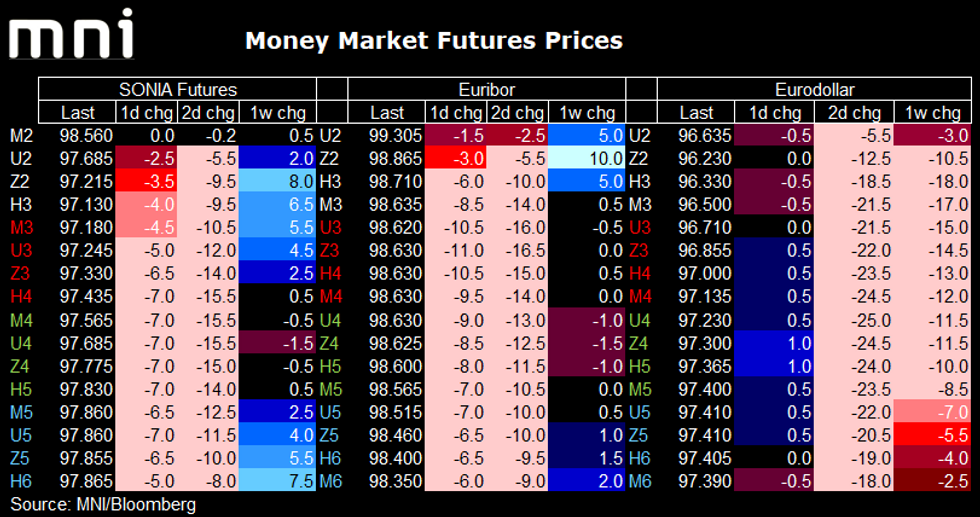

STIR FUTURES: Euribor leading SONIA futures lower; ED steady

- Euribor and SONIA futures are both lower this morning, with Euribor futures leading the way. The moves started early, possibly helped by the better-than-expected German trade data, and then accelerated following the release of a stronger-than-expected Spanish PMI services print. A weaker Italian services PMI print did not halt the downward moves with upward revisions to French, German and Eurozone prints. Euribor Reds are over 10 ticks lower on the day. Markets now price 44bp for the September ECB meeting, a cumulative 79bp by October and 102bp by the December meeting. No further rate hikes are fully priced.

- The SONIA strip is down up to 7 ticks on the day, dragged lower by Euribor futures in spite of the downward revision to the UK services PMI. Markets continue to price 45bp for tomorrow's meeting (around an 80% probability of a 50bp hike) with a cumulative 90bp priced by September, 129bp by November and 152bp by December. There are also no 2023 hikes fully priced with the curve peaking at 167bp priced in March before inverting.

- Eurodollar futures are all within 1 tick of yesterday's close. Markets price in 61bp for September, 92by by November and 105bp by December. By July 2023 a 25bp cut is fully priced from December's peak pricing.

FOREX: Dust Settles as Pelosi Set to Depart Taiwan

- US Treasury yields are holding the bulk of the Tuesday rally, with the 10y oscillating either side of the 2.75% level. This keeps currency markets in line, with markets holding the bulk of Tuesday's greenback strength. As a result, EUR/USD remains below 1.02, with USD/JPY close to 3 points above the week's lows.

- Gains are considered corrective - for now. Recent weakness has resulted in the break of a number of important technical chart points. A bull channel breakout - drawn from the Mar 4 low - signals a short-term reversal.

- For equity markets, the dust has settled somewhat following Pelosi's visit to Taiwan yesterday, with the e-mini S&P holding above 4,100 as the House Speaker departs Taipei and concludes the visit shortly. While China announced a series of trade measures against Taiwan and tabled an extended series of war games around the island, the broader impact is seen as limited as this stage.

- NOK is the firmest currency so far, closely followed by SEK. The CHF and NZD hold at the bottom of the G10 pile.

- Focus turns to the final PMI data from the US, as well as June factory orders. ISM Services numbers also cross, and are expected to show a slowing to 53.5 from June's 55.3. Fed speakers on the docket include Bullard, Harker, Daly, Barkin and Kashkari.

COMMODITIES: LEVELS UPDATE: More limited moves this morning

- WTI Crude down $1.17 or -1.24% at $93.12

- Natural Gas (NYM) up $0.05 or +0.65% at $7.737

- Natural Gas (ICE Dutch TTF) up $0.3 or +0.15% at $205.055

- Gold spot up $5.8 or +0.33% at $1766.64

- Copper down $1.8 or -0.51% at $349.45

- Silver down $0.05 or -0.27% at $19.927

- Platinum up $3.23 or +0.36% at $901.43

EQUITIES: LEVELS UPDATE: Equities continue to grind higher

- Japan's NIKKEI up 147.17 pts or +0.53% at 27741.9 and the TOPIX up 5.28 pts or +0.27% at 1930.77.

- China's SHANGHAI closed down 22.592 pts or -0.71% at 3163.674 and the HANG SENG ended 77.88 pts higher or +0.4% at 19767.09.

- German Dax up 30.07 pts or +0.22% at 13468.83, FTSE 100 down 2.7 pts or -0.04% at 7406.28, CAC 40 up 10.34 pts or +0.16% at 6420.58 and Euro Stoxx 50 up 15.65 pts or +0.42% at 3698.38.

- Dow Jones mini up 90 pts or +0.28% at 32452, S&P 500 mini up 15 pts or +0.37% at 4106.25, NASDAQ mini up 36.25 pts or +0.28% at 12951.25.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.