-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - CAD Slips as Trump Looks to Tariffs

MNI China Daily Summary: Tuesday, November 26

MNI BRiEF: Riksbank Puts Neutral Rate In 1.5 To 3.0% Range

MNI US OPEN: Equities Hold Gains Ahead Of PPI

EXECUTIVE SUMMARY:

- GERMANY PLANS FURTHER ENERGY COST RELIEF FOR CONSUMERS: SCHOLZ

- OIL USE GROWS FASTER AS GAS CRISIS SPURS FUEL SWITCH, IEA SAYS

- RUSH OF CHINESE REPO ACTIVITY PROMPTS CONCERN - ANALYSTS (MNI)

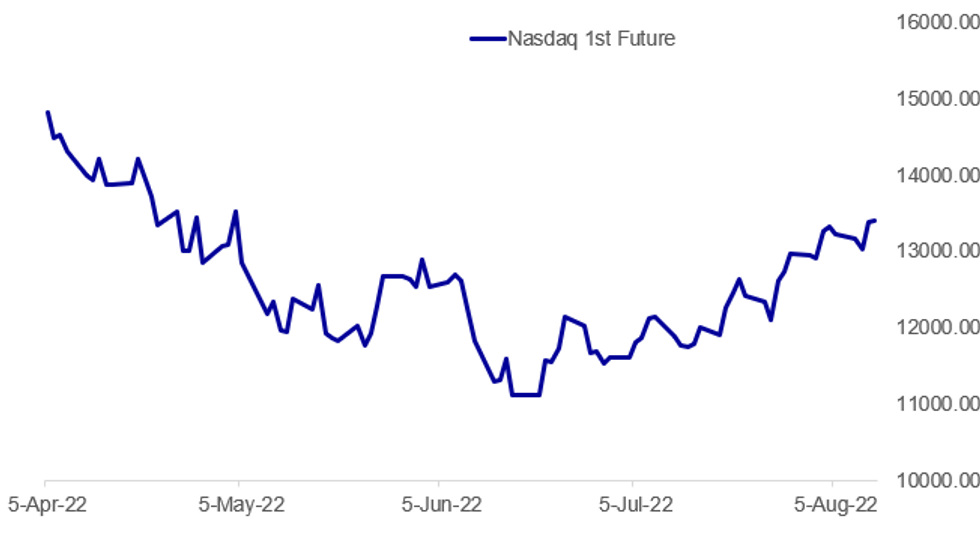

Fig. 1: Nasdaq Poised To Extend Gains

Source: BBG, MNI

Source: BBG, MNI

NEWS:

GERMANY / ENERGY (RTRS): The German government is working on a new package of measures to help consumers cope with rising energy costs, Chancellor Olaf Scholz said on Thursday. "Citizens can count on us to not leave them alone," Scholz told journalists in Berlin. An energy transition towards renewables is a top priority, and Germany will not slow its efforts to become independent of fossil fuels, he said at a summer news conference, an annual tradition introduced by his predecessor Angela Merkel.

IEA / ENERGY (BBG): The International Energy Agency boosted its forecast for global oil demand growth this year as soaring natural gas prices and heatwaves spur industry and power generators to switch their fuel to oil. World oil consumption will now increase by 2.1 million barrels a day this year, or about 2%, up 380,000 a day from the previous forecast, the Paris-based agency said in its latest monthly report. The extra demand that prompted the revision is “overwhelmingly concentrated” in the Middle East and Europe.

CHINA (MNI): Unexpectedly loose liquidity in China's interbank market at a time of weak overall credit demand has pushed short-term repo market activity to historic levels, fueling concerns over financial fragility and likely prompting the central bank to reduce the size of its medium-term lending facilities next Monday, economists and analysts said.

CHINA - TAIWAN (RTRS): Taiwan President Tsai Ing-wen said on Thursday that at present the Chinese military threat has not decreased and while Taiwan will not escalate conflicts or provoke disputes, it will firmly defend its sovereignty and national security.

CHINA - TAIWAN (RTRS): Chinese military frigates recently conducted a three-day drill in the South China Sea, Chinese state broadcaster CCTV reported on Thursday. CCTV did not specify if these drills were related to the set of drills around Taiwan which ended on Wednesday and had been conducted in response to U.S. House Speaker Nancy Pelosi visit to the self-ruled island.

BOE (RTRS): Weaking the independence of regulators would undermine Britain's proposed reforms to make capital markets more efficient, Bank of England Governor Andrew Bailey said on Thursday. "Anything that would weaken the independence of regulators would undermine the aims of the reforms," Bailey said in a letter to parliament's Treasury Select Committee.

SWEDEN (MNI POLITICS): Prime Minister Magdalena Andersson's centre-left Social Democrats retain a sizable lead in the latest polling from Novus exactly one month out from the general election taking place 11 September.

DATA:

No key data in the European morning

FIXED INCOME: Looking ahead to PPI

- Gilts are underperforming this morning, and are approaching yesterday's lows while Bunds are a little above levels seen 24 hours ago and Treasuries a little above (with Treasuries holding on to more of their gains following yesterday's weaker-than-expected CPI print.

- Focus now turns to US PPI data this afternoon. Market participants are also looking ahead to tomorrow's UK activity data (including monthly GDP) and tomorrow's Michigan confidence data (including the 5-10 year inflation expectations component).

- TY1 futures are up 0-1 today at 119-25 with 10y UST yields down -0.4bp at 2.774% and 2y yields down -3.6bp at 3.180%.

- Bund futures are down -0.47 today at 156.39 with 10y Bund yields up 3.3bp at 0.919% and Schatz yields up 3.2bp at 0.556%.

- Gilt futures are down -0.55 today at 117.07 with 10y yields up 5.4bp at 2.003% and 2y yields up 6.4bp at 1.972%.

FOREX: EUR Making Furtive Progress Among Crosses

- The greenback is softer ahead of the NY crossover, although the USD Index is yet to test the Wednesday post-CPI lows. For EUR/USD, this keeps the pair below 1.0350, but strength through yesterday's 1.0368 and a close above would mark a bullish signal and could see the pair break out of the YTD downtrend channel drawn off the February high. The upper-end of this channel crosses at 1.0344 today.

- In contrast to yesterday morning's price action, the EUR is making progress in the crosses, and is stronger against all others in G10. This sees a small part of yesterday's EUR/JPY losses erased, with the cross needing to take out 138.40 before resuming the bounce posted off the late July low.

- Equity markets are generally firmer, extending the post-CPI strength as traders watch the waning expectations for a 75bps rate hike from the Fed in September. This points to another positive open on Wall Street, with the S&P 500 trading at the best levels since early May.

- With the CPI event risk now out of the way, implied vols across G10 FX are generally taking a step lower, with EUR/USD 1m implied dropping below 8.5 points and nearing the lowest levels in two months.

- Markets get another insight into the US inflation picture later today, with the PPI release for July expected to show another moderation in prices (down from 1.1% to 0.2% on a M/M final demand basis). Markets also watch the weekly US jobless claims data and the Banxico rate decision.

EQUITIES: Mixed Start, Energy Names Lead

- Japanese markets are closed for a holiday; China's SHANGHAI closed up 51.645 pts or +1.6% at 3281.665 and the HANG SENG ended 471.59 pts higher or +2.4% at 20082.43.

- European markets are mixed, with energy stocks leading higher and real estate lagging: the German Dax down 22.48 pts or -0.16% at 13578.28, FTSE 100 down 7.29 pts or -0.1% at 7486.54, CAC 40 up 4.56 pts or +0.07% at 6492.84 and Euro Stoxx 50 down 2.56 pts or -0.07% at 3722.22.

- U.S. futures are on the front foot, with the Dow Jones mini up 96 pts or +0.29% at 33356, S&P 500 mini up 8 pts or +0.19% at 4218, NASDAQ mini up 14.75 pts or +0.11% at 13405.75.

COMMODITIES: Gaining, Precious Metals Aside

- WTI Crude up $0.64 or +0.7% at $90.12

- Natural Gas up $0.09 or +1.04% at $7.99

- Gold spot down $2.63 or -0.15% at $1792.6

- Copper up $2.85 or +0.78% at $365

- Silver down $0.1 or -0.51% at $20.7223

- Platinum up $13.25 or +1.4% at $950.02

LOOK AHEAD:

| Date | GMT/Local | Impact | Flag | Country | Event |

| 11/08/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 11/08/2022 | 1230/0830 | *** |  | US | PPI |

| 11/08/2022 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 11/08/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 11/08/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 11/08/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 11/08/2022 | 1700/1300 | *** |  | US | US Treasury Auction Result for 30 Year Bond |

| 11/08/2022 | 1800/1400 | *** |  | MX | Mexico Interest Rate |

| 12/08/2022 | 0600/0700 | ** |  | UK | Index of Services |

| 12/08/2022 | 0600/0700 | *** |  | UK | Index of Production |

| 12/08/2022 | 0600/0700 | ** |  | UK | UK Monthly GDP |

| 12/08/2022 | 0600/0700 | ** |  | UK | Output in the Construction Industry |

| 12/08/2022 | 0600/0700 | ** |  | UK | Trade Balance |

| 12/08/2022 | 0600/0700 | *** |  | UK | GDP First Estimate |

| 12/08/2022 | 0600/0800 | *** |  | SE | Inflation report |

| 12/08/2022 | 0645/0845 | *** |  | FR | HICP (f) |

| 12/08/2022 | 0700/0900 | *** |  | ES | HICP (f) |

| 12/08/2022 | 0900/1100 | ** |  | EU | industrial production |

| 12/08/2022 | 1230/0830 | ** |  | US | Import/Export Price Index |

| 12/08/2022 | 1400/1000 | *** |  | US | University of Michigan Sentiment Index (p) |

| 12/08/2022 | 1600/1200 | *** |  | US | USDA Crop Estimates - WASDE |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.