-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - Treasuries Underperform EGBs Ahead of Jackson Hole

Highlights:

- Pre-Jackson Hole Fedspeak eyed, with Harker, George, Bostic due

- Greenback edges lower as equities extend recovery

- Oil futures outlook improves as WTI tops resistance

US TSYS SUMMARY: Treasuries Underperform With Fedspeak, GDP and 7Y Supply Eyed

- Cash Tsys sit richer with yields 2-3bps lower across the curve, only partly unwinding yesterday’s large cheapening that had been helped by US data resilience. The move started in Asia hours with a weaker USD seemingly providing a very modest bid for the space before more mixed European hours as the German Ifo survey beat expectations but with recession risks still prominent.

- Treasuries underperform European sovereigns after yesterday's wide ranges, heading into Jackson Hole where a dovish pivot from Powell tomorrow is unlikely (full preview).

- 2YY -2.9bps at 3.362%, 5YY -2.4bps at 3.181%, 10YY -2.2bps at 3.082% and 30YY -1.9bps 3.293%.

- TYU2 rises 4+ ticks at 117-13 to further rise off late yesterday low of 117-03+ but maintains a bearish tone, with more significant support eyed at 116-26+ (Jun 29 low).

- Fedspeak: Harker ('23 voter) speaks to MNI at 0925ET, CNBC at 1000ET for first time on mon pol matters since Jun 22, with potential for further pop-up appearances from other regional presidents.

- Data: 2nd Q2 GDP, Kansas City Fed mfg index (Empire & Richmond have seen sizeable declines, Philly a beat) plus weekly initial claims.

- Note issuance: $37B 7Y Note auction (91282CFJ5) – 1300ET

- Bill issuance: $55B 4W, $50B 8W bill auctions – 1130ET

STIR FUTURES: Harker Next With Fed Hikes A Little Off Y'day Highs

- Fed Funds implied hikes are slightly off yesterday’s recent highs despite Bostic ('24 voter) reinforcing higher for longer (link) but they remain elevated.

- 67bps priced for the Sept FOMC before 127bps to 3.60% year-end, 143bps to a terminal 3.76% in Mar’23 with little change into May and then keeping to circa 35bps of cuts to end-2023.

- Next known Fedspeak from Harker (’23) speaking to MNI at 0925ET and CNBC at 1000ET, keenly awaited having not talked on mon pol matters since Jun 22.

FOMC-dated Fed Funds futures implied rateSource: Bloomberg

FOMC-dated Fed Funds futures implied rateSource: Bloomberg

EGB/GILT SUMMARY: Sovereign FI Rallies

European government bonds have rallied this morning, unwinding some of the losses incurred earlier in the week.

- Gilts have led the charge, particularly at the short end. Cash yields are down 3-14bp on the day.

- The bund curve has bull steepened with cash yields down 1-9bp.

- The OAT curve has similarly steepened with the 2s30s spread widening 6bp.

- BTP yields are up 3-13bp with the short end/belly outperforming.

- The final estimate of German Q2 GDP came in stronger than the initial reading (0.1% Q/Q vs 0.00% and 1.7% WDA Y/Y vs 1.4%).

- The German IFO survey data for August came in better than expected across the three main components (business climate, current assessment and expectations).

- Supply this morning came from the UK (Gilts ,GBP1.50bn), Italy (BTP Short, EUR2.5bn).

- Focus shifts to US initial jobless claims and the second estimate of Q2 GDP later today.

EUROPE ISSUANCE UPDATE

UK Gilt tender result:

GBP1.5bln of the 0.625% Jun-25 Gilt. Avg yield 2.648% (bid-to-cover 3.06x, tail 0.7bp).

Italy auction result:

E2.5bln of the 1.75% May-24 BTP Short Term. Avg yield 1.86% (bid-to-cover 1.78x).

CHINA: SAFE Sees CNY Expectations Stable After Weakest Fix vs. Exp Since 2020

- China's FX regulator SAFE states the FX market has operated steadily across August, with CNY expectations broadly stable for now.

- The headlines follow clear concern around yuan depreciation among the China authorities, with today's fixing being the weakest relative to expectations since early 2020 at -120pips.

- Historically, the fixing trend has been used to slow the direction of the CNY rather than alter the trend. The market may still feel relative fundamentals are skewed towards higher USD/CNH levels, particularly with further monetary easing possible from China before year end.

- Overnight, we wrote Market Implied Probabilities Still Suggest USD/CNH Can Breach 7.00 Before Year-End: https://marketnews.com/market-implied-probabilitie...

- Nonetheless, the CNH NEER FX rate is little changed across August and remains well off the YTD lows printed in May, which may soothe concerns among the Chinese authorities for now:

Source: MNI/BBG

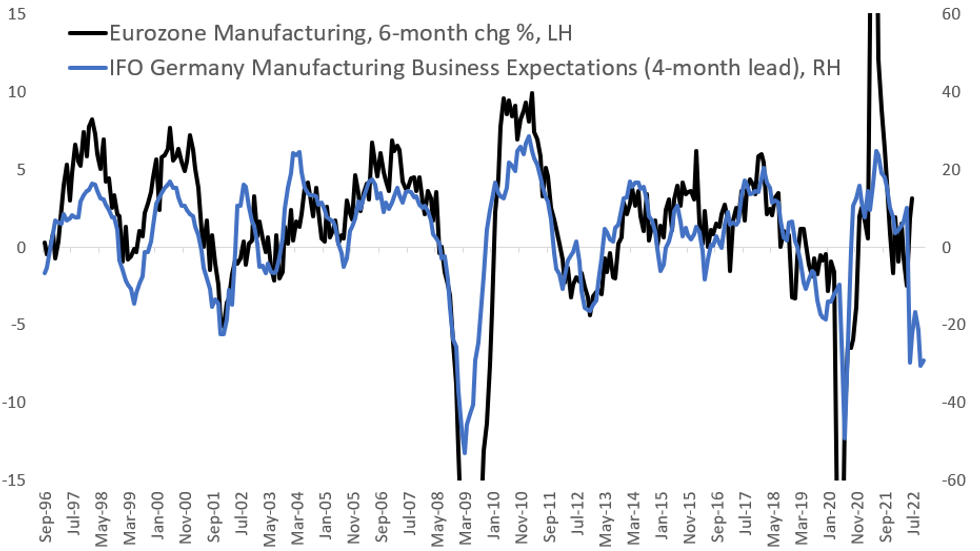

"Soft" Data Pointing To A Very Hard Manufacturing Recession

Today's German August IFO release provides another reminder that the "soft" data hasn't fully translated into weaker hard data in the Euro area just yet.

- The Eurozone industrial production index for the manufacturing industry actually picked up to a post-2017 high in June.

- However, the German IFO Manufacturing Expectations index has been firmly negative for the past six months (since February, the start of the Russia-Ukraine conflict).

- Those expectations point to a substantial drop in Eurozone manufacturing output in H2 2022 to a degree not seen on a sustained basis since just after the global financial crisis (see chart).

- Loosening supply chain bottlenecks (as noted by IFO) could help provide some welcome relief, but energy woes, poor prospects for trade / demand, and broad inflationary pressures suggest that the "soft" data may not be exaggerating the potential for manufacturing downside.

Source: IFO, Eurostat, MNI Calculations

Source: IFO, Eurostat, MNI Calculations

FOREX: AUD Nearing $0.70, With Key Test Just Above

- Growth proxy currencies are outperforming early Thursday, with AUD/USD on track to print a third higher low on the day and put the pair within range of $0.70. A break above this mark opens initial firm resistance at 0.7040, the Aug 16 high where a break is required to ease the current bearish pressure.

- High beta currencies are gaining ahead of the NY crossover while the greenback trades generally weaker. This puts the USD Index further off the recovery high printed earlier this week at 109.27, but pullbacks are expected to remain shallow ahead of the Jackson Hole Policy Symposium which formally kicks off this evening. Markets watch for confirmation of the full agenda, with a speech from Fed's Powell the focus on Friday.

- Support for the dollar could slow any weakness going forward at 107.5036, the 38.2% Fib retracement for the August upleg.

- NZD is gaining in sympathy with the AUD, while EUR continues to trade heavy. Energy costs continue to add to the stagflation narrative, with 2023 power costs across Germany rising to new record highs ahead of the NY open.

- On the docket for Thursday, markets watch the secondary Q2 GDP read (expected to be revised higher to -0.7% from -0.9%). MNI also speak with Philly Fed's Harker, who hasn't commented on monetary policy directly since late June.

FX OPTIONS: Expiries for Aug25 NY cut 1000ET (Source DTCC)

- EUR/USD: $0.9950(E888mln), $1.0000(E2.1bln), $1.0090-00(E1.0bln)

- USD/JPY: Y135.00($912mln), Y135.90-00($809mln), Y137.00($503mln), Y139.30-45($614mln)

- GBP/USD: $1.1820(Gbp574mln), $1.2150(Gbp682mln)

- NZD/USD: $0.6110-30(N$1.0bln)

- USD/CAD: C$1.2850-65($881mln)

- USD/CNY: Cny6.8500($1.4bln), Cny6.9500($2.2bln)

Price Signal Summary - Oil Futures Breach Resistance At The The 50-Day EMA

- In the equity space, the short-term trend condition in the S&P E-Minis is unchanged and remains bearish. Short-term gains are considered corrective - for now. Attention is on pivot support at 4085.13, the 50-day EMA. EUROSTOXX 50 futures remain in a short-term downtrend too following recent gains. The 20-day EMA has been cleared and the 50-day EMA at 3651.30, has been pierced. A clear break of the 50-day average would strengthen the bearish theme and open 3582.50, 50.0% of the Jul 5 - Aug 17 rally. The latest bounce is likely a correction.

- In FX, EURUSD is bearish following this week’s breach of key support at 0.9952, Jul 14 low. This confirmed a resumption of the primary downtrend. The focus is on 0.9883 next, 1.764 projection of the Jun 9 - 15 - 27 price swing. The GBPUSD trend needle continues to point south. This follows this week’s break of support at 1.1760, the Jul 14 low and bear trigger. Sights are on 1.1673, the 1.00 projection of the May 27 - Jun 14 - 16 price swing. USDJPY remains below its most recent highs. The outlook is bullish though and the focus is on a climb towards 137.96 next, the Jul 22 high. Initial support is at 135.43, the 20-day EMA.

- On the commodity front, Gold has found support and remains above Monday’s low of $1727.8. Gains are considered corrective and firm resistance is seen at $1777.2, the 50-day EMA. A resumption of weakness would open $1711.7 next, the Jul 27 low. In the Oil space, WTI futures are trading higher and this week’s gains have improved conditions for bulls. Futures have traded above the 50-day EMA and the break signals scope for $99.75, the Jul 29 high. A break below $90.42, Aug 23 low is required to signal a top.

- In the FI space, Bund futures remain in a bear trend. The focus is on the 150.00 handle next, a break would open 149.69, the Jul 21 low and key short-term support. Gilts remain vulnerable and sights are set on the key support and bear trigger at 109.89, the Jun 16 low. Treasuries maintain a softer tone. Scope is seen for an extension towards 116-26+, the Jun 29 low.

EQUITIES: Stocks Extends Mini Recovery Off Weds Low

- Japan's NIKKEI 225 closed up 165.54 pts or +0.58% at 28479.01, while the TOPIX ended 9.42 pts higher or +0.48% at 1976.6.

- Meanwhile, China's SHANGHAI COMP closed up 31.045 pts or +0.97% at 3246.248 and the HANG SENG ended 699.64 pts higher or +3.63% at 19968.38.

- Across Europe, Germany's DAX up 87.53 pts or +0.66% at 13306.47, FTSE 100 up 52.84 pts or +0.71% at 7523.82, CAC 40 up 36.2 pts or +0.57% at 6423.05 and EuroStoxx50 up 22.65 pts or +0.62% at 3689.98.

- In futures space, Dow Jones mini trades higher by 193 pts or +0.59% at 33166, S&P 500 mini up 32.75 pts or +0.79% at 4178.75, NASDAQ mini up 118.75 pts or +0.92% at 13050.5.

COMMODITIES: Industrial Metals Gain, Mimicking AUD, NZD Price Action

- WTI Crude up $0.42 or +0.44% at $95.31

- Natural Gas down $0.04 or -0.39% at $9.3

- Gold spot up $12.34 or +0.7% at $1763.4

- Copper up $5.4 or +1.48% at $370.15

- Silver up $0.27 or +1.41% at $19.3819

- Platinum up $7.61 or +0.86% at $887.71

| Date | GMT/Local | Impact | Flag | Country | Event |

| 25/08/2022 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 25/08/2022 | 1000/1100 | ** |  | UK | CBI Distributive Trades |

| 25/08/2022 | 1130/1330 |  | EU | ECB publishes accounts of July 20-21 meet | |

| 25/08/2022 | 1230/0830 | * |  | CA | Payroll employment |

| 25/08/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 25/08/2022 | 1230/0830 | *** |  | US | GDP (2nd) |

| 25/08/2022 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 25/08/2022 | 1300/1500 | ** |  | BE | BNB Business Sentiment |

| 25/08/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 25/08/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 25/08/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 25/08/2022 | 1700/1300 | ** |  | US | US Treasury Auction Result for 7 Year Note |

| 26/08/2022 | 0600/0800 | * |  | DE | GFK Consumer Climate |

| 26/08/2022 | 0600/0800 | ** |  | SE | Unemployment |

| 26/08/2022 | 0600/0800 | ** |  | SE | PPI |

| 26/08/2022 | 0645/0845 | ** |  | FR | Consumer Sentiment |

| 26/08/2022 | 0800/1000 | ** |  | IT | ISTAT Business Confidence |

| 26/08/2022 | 0800/1000 | ** |  | IT | ISTAT Consumer Confidence |

| 26/08/2022 | 0800/1000 | ** |  | EU | M3 |

| 26/08/2022 | 1230/0830 | ** |  | US | Personal Income and Consumption |

| 26/08/2022 | 1230/0830 | ** |  | US | Advance Trade, Advance Business Inventories |

| 26/08/2022 | 1400/1000 | *** |  | US | Final Michigan Sentiment Index |

| 26/08/2022 | 1400/1000 |  | US | Fed Chair Jerome Powell at Jackson Hole | |

| 26/08/2022 | 1500/1100 |  | CA | Finance Dept monthly Fiscal Monitor (expected) |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.