-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - USD Inches Higher as Equities Circle Tues Lows

Highlights:

- Eurozone CPI tops forecast, bolsters case for sizeable Sept hike

- NOK slides as Norges Bank scale up FX buys for SWF

- Markets watch newly tooled ADP methodology

US TSYS: Newly Retooled ADP on Tap

Tsy futures trading weaker, tracking German Bunds lower earlier after Italian HICP embargo appears to have been broken (HICP at 9.0%Y/Y, median consensus was 8.2%Y/Y according to Bbg).- Dec'22 takes the lead quarterly position on decent volumes (TYZ2>325k). Modest bounce in Tsy 30Y bonds after extending overnight lows recently, 30YY currently 3.2509 (+.0354) after tapping 3.2670% high.

- Upcoming data: After pausing the report back on June 30 - eagerly awaited release of ADP's retooled private-sector employment report at 0815ET. Appropriate timing ahead Aug NFP report this Friday (+300k est vs. +528k prior).

- ADP and the "Stanford Digital Economy Lab (the Lab) have developed a new methodology for the ADP National Employment Report (NER) that will provide a more robust, high-frequency view of the labor market with a focus on both jobs and pay. Using fine-grained data, this new measure will deliver a richer labor market analysis that will help answer key economic and business questions and offer insights relevant to a broader audience."

- ADP and the "Stanford Digital Economy Lab (the Lab) have developed a new methodology for the ADP National Employment Report (NER) that will provide a more robust, high-frequency view of the labor market with a focus on both jobs and pay. Using fine-grained data, this new measure will deliver a richer labor market analysis that will help answer key economic and business questions and offer insights relevant to a broader audience."

- Additionally, MNI Chicago PMI (52.1, 52.2) release at 0945ET

- Fed speak:

- Cleveland Fed Mester eco-outlook, Dayton CoC, text and Q&A at 0800ET

- Later this evening: Dallas Fed new President Lorie Logan event at 1800ET

- Atl Fed Bostic, moderated Q&A Georgia Fintech Academy, 1830ET

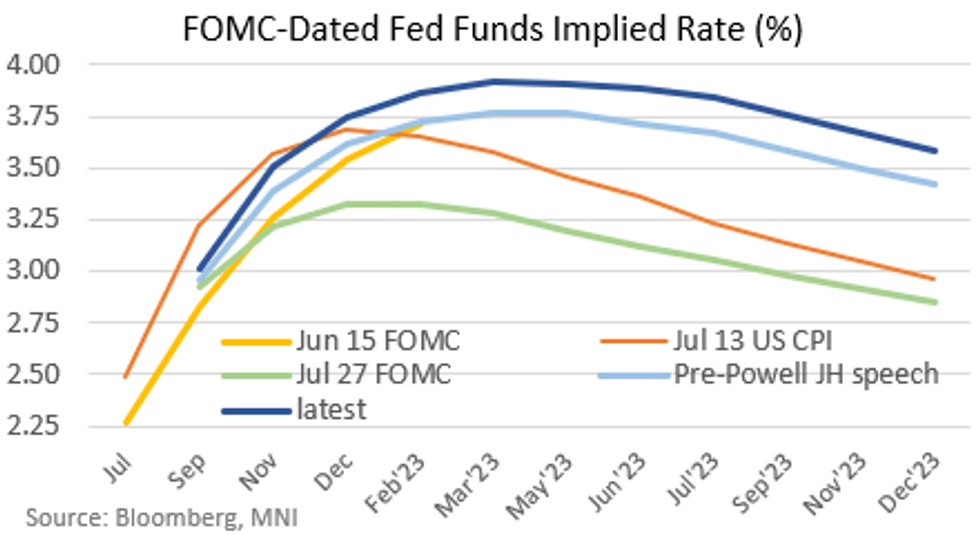

STIR FUTURES: "Higher For Longer" Remains The Theme

Futures-implied U.S. rate pricing is steady/a little firmer early Wednesday, sustaining the "higher for longer" Fed rate path seen following Jackson Hole.

- September FOMC hike pricing is flat vs Tuesday and has been fairly steady this week, roughly between 64 and 69bp implied, and currently sits at 68bp. In other words, a better than even chance of a 75bp (vs 50bp) hike, but not a done deal as August draws to a close.

- A strong JOLTS figure yesterday helped bolster 75bp Sept pricing; today's ADP data will be fresher in both data coverage (Aug vs JOLTS's Jul) and approach (see our earlier notes regarding the new methodology), and will set the stage for Friday's key nonfarm payrolls reading. And of course, MNI Chicago PMI (BBG survey expects it to remain at 52.1, same as July) merits watching.

- December FOMC pricing remains near the week's highs at 3.74%, +141bp from current levels, up 2bp overnight. The Fed rate cycle is seen peaking at/near 4% in Q2 2023 before receding.

- In that regard, Cleveland Fed Pres Mester's prepared comments will be eyed for any further insight following her Jackson Hole media appearance in which she said rates may have to go above 4% in 2023 and hold there.

EGB/GILT SUMMARY: UK Inflation Risks Drive Gilt Underperformance

European sovereign bonds have continued to sell off today with gilts leading the charge. Equities are also pushing lower alongside gains for the dollar against G10 FX.

- UK inflation risk remains firmly in the spotlight, with gilts underperforming EGBs by a wide margin. Cash yields are up 9-13bp on the day with the curve bear steepening.

- The ECB's Nagel stated that there is a risk of high inflation persisting for even longer which requires urgent action next week. He further argued in favour of a 'strong' rate hike in September.

- Eurozone inflation edged up to 9.1% Y/Y in August, marginally above the consensus estimate of 9.0% Y/Y.

- Bunds initially opened firmer before selling off through the morning with yields now up 3-5bp.

- It is a similar story for OATs with yields broadly up 1-4bp across much of the curve.

- BTPs have underperformed core EGBs with yields up 6-10bp and the long end of the curve bear flattening.

- Germany has launched a 1.30% Oct-27 Green Bobl, with the target size set at EUR5bn and books closing above EUR14bn.

US DATA: New ADP Data Comes At An Opportune Time

After a summer hiatus, ADP's monthly private-sector employment report returns today (0815ET / 1315UK) with a new methodology that incorporates a broader set of data and that will provide a new indication of pay growth.

- The current macroeconomic backdrop (and upcoming FOMC decision) means wage and job creation data is as important as it has ever been - so the new ADP report comes at an opportune time, and will be closely eyed especially for any insights into wage dynamics.

- Bloomberg reports a median consensus of +300k (160-370k range) but it's unclear what those estimates are based on given we don't have details on the new methodology and can't yet benchmark from previous years' estimates.

- ADP has historically been seen as a somewhat useful indicator of the upcoming nonfarm payrolls release, but by the same token it hasn't been seen as particularly reliable. Prior months were often revised significantly due to their methodology (which was heavily model-based).

- Today, ADP is set to release detailed info including 12 years of historical data (both monthly and weekly), and median annual pay growth. From the ADP release:

- "Jobs Report -- Based on anonymized and aggregated payroll data of over 25 million U.S. employees, this independent measure will detail the current month's non-farm private employment change and deliver weekly job data from the previous month. Data will be broken out by industry, business establishment size, and U.S. census region. Historical data from the previous 12 years at both monthly and weekly frequencies will be benchmarked and available at launch."

- "Pay Insights – ADP's new pay measure uniquely captures the salaries of the same cohort of almost 10 million individual employees over a 12-month period. The new monthly measure will report median annual pay growth by industry, business establishment size, U.S. region, gender, and age. Quarterly reports focused on pay will expand on key areas of interest, such as bonuses, benefits, and gender gaps."

- While an outsized August ADP figure today could move markets, given sensitivity to the Fed's data-dependent mantra ahead of September's (likely 50 vs 75bp hike) rate decision, the release is likely to be received with curiosity more than anything.

- While the new pay data fills a gap in the market, it will take time before the jobs estimate can be assessed as a predictor of NFPs. Sell-side expectations on this front are mixed.

- JPM analysts think "we will have to gauge the accuracy of these new estimates over time, particularly with respect to how they perform in real-time (before revisions and adjustments can align the ADP and BLS estimates)."

- Scotia writes the new ADP "may be treated skeptically by markets because of its track record and because it will take time for its revamped methodology to be assessed for accuracy in tracking nonfarm payrolls."

- Conversely, ING writes "It will be interesting to see whether the alleged higher accuracy of the new ADP index will trigger a larger-than-normal market reaction."

EUROPE ISSUANCE UPDATE

EGB SYNDICATION: 1.30% Oct-27 Green Bobl: Launched- Size set at E5bln inc E250mln retention by the issuer (MNI had expected E5-6bln)

- Spread set earlier at 1.30% Oct-27 Bobl -1.25bp

- Original guidance was 1.30% Oct-27 Bobl -1bp area

- Books close above E14bln (inc E1.9bln JLM interest)

- Timing: Books closed; allocations and pricing due later today.

EUROPE OPTION FLOW SUMMARY

Eurozone:

- OEV2 123.50/122.00 put spread sold at 64 in 2k

- ERH3 98.375/98.125/98.00 put fly vs 99.625 call. Sells put fly at 8 in 5k

- ERV2 98.25/98.125/98.00/97.875 put condor bought for 3 in 30k

FOREX: NOK Slides as Norges Bank Step Up SWF Sales

- The greenback trades to the better ahead of the NY crossover, with the USD Index rising back above the 109 handle and trading well within range of the Tuesday highs. Monday's 109.478 marks the recovery and cycle high for the index, and would form a strong signal that the USD upside bias continues to underpin currency markets.

- USD trades stronger so far Wednesday in tandem with a softer equity outlook. US stock futures indicate another lower open on Wall Street later today, with Tuesday's lows in the e-mini S&P providing the first downside target at 3964.50. Despite softer stocks, however, CHF remains in a near-term downtrend, putting EUR/CHF at higher highs for a seventh consecutive session. The 50-dma remains the next upside level at 0.9812 for the cross.

- NOK the notable underperformer in G10 so far Wednesday, trading lower against all others following confirmation from the Norges Bank that they are to sell NOK 3.5bln per day across September (effectively buying more FX for the sovereign wealth fund). This is a notable uptick in FX activity from the August rate of NOK 1.5bln per day, as announced at end-July. EUR/NOK now through 9.90 and trading at highest levels since mid-August. Next key resistance rests at the 200-dma of 10.0076.

- Focus turns to the MNI Chicago PMI at 1445BST/0945ET. Markets expect the figure to hold at 52.1, inline with the July read. Canadian GDP data also crosses as well as speeches from Fed's Mester and Bostic.

- Additionally, after a brief hiatus, the ADP release their private sector jobs report with a new methodology, which markets could closely comb through for clues ahead of Friday's NFP release.

FX OPTIONS: Expiries for Aug31 NY cut 1000ET (Source DTCC)

- EUR/USD: $0.9925(E1.2bln), $1.0000(E1.6bln), $1.0100(E1.8bln), $1.0150-62(E1.2bln)

- USD/JPY: Y136.00($1.5bln), Y137.50($695mln), Y138.00($753mln), Y139.90-00($1.3bln)

- AUD/USD: $0.6785(A$719mln). $0.7089-00(A$1.1bln)

- NZD/USD: $0.6400(N$706mln)

- USD/CNY: Cny6.70($1.2bln), Cny6.80-81($1.1bln), Cny6.90($1.5bln), Cny6.9250($920mln)

Price Signal Summary - Bearish Engulfing Reversal In WTI

- In the equity space, S&P E-Minis resumed bearish activity Tuesday and confirmed an extension of the current downtrend. Attention is on 3902.01 next, the 61.8% retracement of the Jun 17 - Aug 16 upleg. On the upside, initial firm resistance has been defined at 4217.25, the Aug 26 high. A break would ease the current bearish pressure. First resistance is at 4110.75, the Aug 24 low. The EUROSTOXX 50 contract maintains a bearish tone and is trading lower today. This reinforces a bearish case and sights are set on 3526.00, 61.8% of the Jul 5 - Aug 17 rally. Clearance of this level would open the 3500.00 handle.

- In FX, the EURUSD is consolidating. The trend direction remains down, following the recent breach of key support at 0.9952, Jul 14 low. This confirmed a resumption of the primary downtrend and opens 0.9883 next, 1.764 projection of the Jun 9 - 15 - 27 price swing. Friday’s 1.0090 is the first resistance. The GBPUSD trend needle still points south and a continuation lower is likely near-term . The focus is on the 1.1600 handle. USDJPY is holding onto its recent gains and short-term conditions remain bullish. Monday’s climb resulted in a breach of resistance at 137.71, the Aug 22 high. The break opens 139.39, Jul 14 high and the trigger for a climb towards 140.00.

- On the commodity front, Gold is softer today as the current bear cycle extends. The yellow metal has arrived at $1711.0, 76.4% retracement of the Jul 21 - Aug 10 upleg. A clear breach of this retracement would expose $1700.00. In the Oil space, WTI reversed course Tuesday and is trading lower today. The sharp sell-off threatens the recent bullish theme. A strong reversal pattern has appeared on the daily chart - a bearish engulfing candle. If correct, this pattern suggests potential for a strong sell-off near-term that would expose key support at $91.22, the Jul 14 low. Key resistance has been defined at $97.66, yesterday’s high,

- In the FI space, Bund futures are weaker again today as the downtrend extends. The contract has cleared 147.94, 61.8% of the Jun 16 - Aug 2 bull leg. The break reinforces bearish conditions and opens 146.50, the Jun 30 low. Gilts are down sharply today as the bearish impulsive run continues. The breach of support yesterday at 108.94, Aug 24 low, confirmed a resumption of the downtrend and today’s weakness has delivered a print below the 108.00 handle. This has opened 107.36, 1.00 projection of the Aug 22 - 24 - 26 price swing.

EQUITIES: Risk-Off Tone Persists, US Futures Eye Tuesday Lows

- Japan's NIKKEI 225 closed lower by -0.37% at 28091.53 and the TOPIX ended 5.22 pts lower or -0.27% at 1963.16.

- Meanwhile, China's SHANGHAI closed down 25.082 pts or -0.78% at 3202.138 and the HANG SENG ended 5.36 pts higher or +0.03% at 19954.39.

- Across Europe, Germany's DAX trades lower by 59.79 pts or -0.46% at 12900.46, FTSE 100 down 43.95 pts or -0.6% at 7317.57, CAC 40 down 39.33 pts or -0.63% at 6170.26 and Euro Stoxx 50 down 11.16 pts or -0.31% at 3550.21.

- In US futures space, Dow Jones mini up 42 pts or +0.13% at 31815, S&P 500 mini up 7.25 pts or +0.18% at 3994.75, NASDAQ mini up 47.75 pts or +0.39% at 12408.

COMMODITIES: Core Energy Prices Lower for Second Session

- WTI Crude down $1.26 or -1.37% at $90.43

- Natural Gas up $0.07 or +0.79% at $9.107

- Gold spot down $10.56 or -0.61% at $1715.5

- Copper up $1.55 or +0.44% at $356.4

- Silver down $0.25 or -1.35% at $18.237

- Platinum down $4.45 or -0.52% at $848.51

| Date | GMT/Local | Impact | Flag | Country | Event |

| 31/08/2022 | 0900/1100 | *** |  | EU | HICP (p) |

| 31/08/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 31/08/2022 | 1200/0800 |  | US | Cleveland Fed's Loretta Mester | |

| 31/08/2022 | 1215/0815 | *** |  | US | ADP Employment Report |

| 31/08/2022 | 1230/0830 | *** |  | CA | CA GDP by Industry and GDP Canadian Economic Accounts Combined |

| 31/08/2022 | 1345/0945 | ** |  | US | MNI Chicago PMI |

| 31/08/2022 | 1430/1030 | ** |  | US | DOE weekly crude oil stocks |

| 31/08/2022 | 2200/1800 |  | US | Dallas Fed's Lorie Logan | |

| 31/08/2022 | 2230/1830 |  | US | Atlanta Fed's Raphael Bostic | |

| 01/09/2022 | 2300/0900 | ** |  | AU | IHS Markit Manufacturing PMI (f) |

| 01/09/2022 | 0030/0930 | ** |  | JP | IHS Markit Final Japan Manufacturing PMI |

| 01/09/2022 | 0130/1130 | * |  | AU | Private New Capex and Expected Expenditure |

| 01/09/2022 | 0130/1130 | ** |  | AU | Lending Finance Details |

| 01/09/2022 | 0145/0945 | ** |  | CN | IHS Markit Final China Manufacturing PMI |

| 01/09/2022 | 0630/0830 | *** |  | CH | CPI |

| 01/09/2022 | 0630/0830 | ** |  | CH | retail sales |

| 01/09/2022 | 0715/0915 | ** |  | ES | IHS Markit Manufacturing PMI (f) |

| 01/09/2022 | 0745/0945 | ** |  | IT | IHS Markit Manufacturing PMI (f) |

| 01/09/2022 | 0750/0950 | ** |  | FR | IHS Markit Manufacturing PMI (f) |

| 01/09/2022 | 0755/0955 | ** |  | DE | IHS Markit Manufacturing PMI (f) |

| 01/09/2022 | 0800/1000 | ** |  | EU | IHS Markit Manufacturing PMI (f) |

| 01/09/2022 | 0830/0930 |  | UK | S&P Global Manufacturing PMI (f) | |

| 01/09/2022 | 0830/0930 | ** |  | UK | IHS Markit/CIPS Manufacturing PMI (Final) |

| 01/09/2022 | 0830/0930 |  | UK | BOE Decision Makers Panel | |

| 01/09/2022 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 01/09/2022 | - | *** |  | US | Domestic-Made Vehicle Sales |

| 01/09/2022 | 1230/0830 | * |  | CA | Building Permits |

| 01/09/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 01/09/2022 | 1230/0830 | ** |  | US | Non-Farm Productivity (f) |

| 01/09/2022 | 1345/0945 | *** |  | US | IHS Markit Manufacturing Index (final) |

| 01/09/2022 | 1400/1000 | *** |  | US | ISM Manufacturing Index |

| 01/09/2022 | 1400/1000 | * |  | US | Construction Spending |

| 01/09/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 01/09/2022 | 1930/1530 |  | US | Atlanta Fed's Raphael Bostic |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.