-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - USD/JPY Nearing Intervention Levels

Highlights:

- USD/JPY nearing intervention levels, pair back above Y145

- GBP jumps as UK government reverse unfunded tax hike

- ISM Manufacturing next up, employment a focus ahead of Friday payrolls

Key Links: MNI RBA Preview / UK Gov U-Turns / Gilt Week Ahead / BOJ Policy Shift Would Be a 'Miracle'

US TSYS: Fading Friday's Late Month/Qtr-End Sell-Off, ISM Ahead

- Cash Tsys see a sizeable bull steepening from Friday’s close but much of that is a reversal of Friday’s late sell-off on month/quarter-end moves, with the front end still in the middle of Friday’s range and the longer end at the upper end.

- 2YY -10.1bps at 4.177%, 5YY -8.2bps at 4.008%, 10YY -6.8bps at 3.76%, and 30YY -4.7bps at 3.729%.

- TYZ2 trades 7 ticks higher at 112-09 within last week’s post-BOE gilt purchase intervention range and on low volumes after liquidity was limited by the start of a week-long holiday in China and partial holiday in Australia. The primary trend remains lower with support at 110-19 (Sep 28 low) whilst resistance is at 112-30+ (Sep 23 high).

- Near-term focus on ISM manufacturing: the broadly unrevised Eurozone final PMI suggests little intensification of the external growth slowdown, but Friday’s MNI Chicago PMI added clear downside risk to ISM with consensus marked down from 52.4 to 52.1 from August’s 52.8.

- Fedspeak: Bostic opening remarks (no text or Q&A), NY Fed’s Williams (text and Q&A incl media).

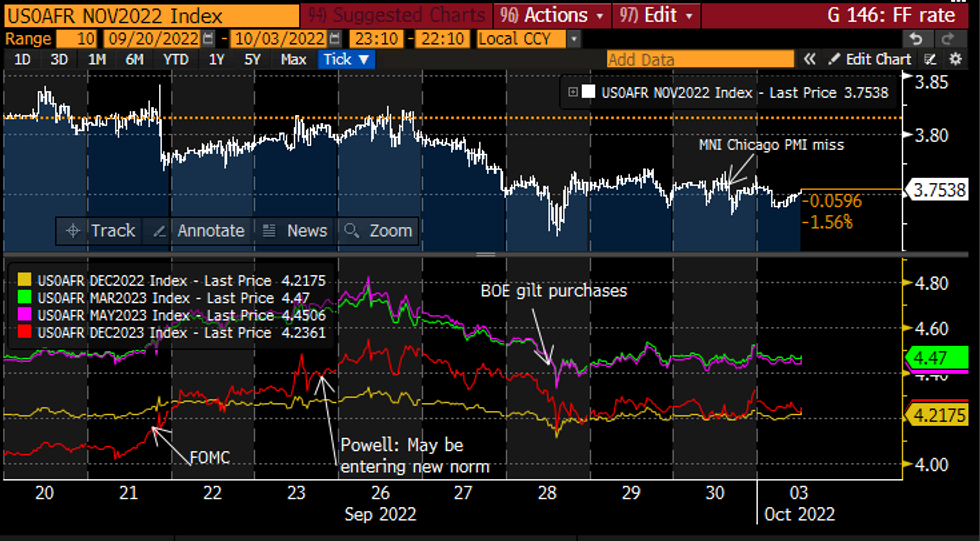

STIR FUTURES: Fed Hike Path In Friday's Range As ISM Eyed

- Fed Funds implied hikes cool from late Fri levels having seemingly been dragged higher by the front end seeing particularly large month/quarter-end moves.

- Friday’s MNI Chicago PMI miss still weighs on the 67bp for Nov (adding downside risk to ISM today) but less impact further out with 4.24% for Dec’22, 4.47% terminal Mar’23 and 4.24% Dec’23 in last week's post-BoE gilt purchase range.

- Fedspeak limited to opening remarks from Bostic (’24) before NY Fed’s Williams late at 1510ET with text and Q&A.

FOMC-dated Fed Funds implied rate at specific meetingsSource: Bloomberg

FOMC-dated Fed Funds implied rate at specific meetingsSource: Bloomberg

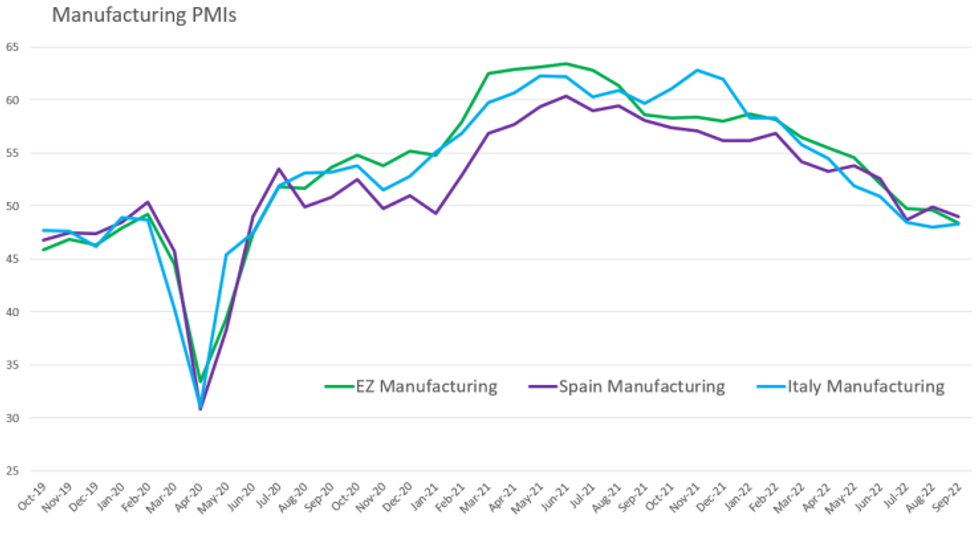

Italian and Spanish Manufacturing PMIs Reiterate Fresh Price Growth Concerns

ITALY SEP MANUF. PMI 48.3 (FCST 47.5); AUG 48.0

SPAIN SEP MANUF. PMI 49.0 (FCST 49.4); AUG 49.9

- Italian and Spanish manufacturing PMIs both remained in contractive territory in September, completing the September round of euro area PMIs.

- Italy saw a marginal improvement to 48.3, whilst Spain weakened by 0.9 - points to 49.0. Both surveys highlighted themes noted by the rest of the bloc, adding to concerning growth outlooks for the euro area.

- Output & new order declined in Italy and Spain, both noted the fastest fall in output since 2020 pandemic lows. Inflation and uncertain economic outlooks drove the decline, and client demand was weak.

- Prices saw a fresh acceleration due to higher energy and material costs.

- Employment remained strong, Italy saw a marginal uptick, whilst Spain recorded a third consecutive month of employment reduction as production outlooks were pessimistic.

- Business confidence for both Italy and Spain sank further to near-record lows of 2020.

Source: MNI / Bloomberg / S&P Global

UK: Chancellor-Rate Rises Due To Fed, Not Mini-Budget

Chancellor of the Exchequer Kwasi Kwarteng speaking to the BBC, argues that the spike in UK gilts recorded over the past 10 days is not due to his mini-budget, stating to R4 presenter Nick Robinson that, "What I’m telling you, and I don’t think you’re listening, is that interest rates have actually been driven by the Fed all year"

- Asked is the UK entering a new era of austerity, states, “You’ll see what our spending plans are in the medium-term fiscal plan and I’m not going to be drawn into that.”

- Asked whether he will repeat comment of a week ago there is 'more to come' on tax cuts, says, “There will be no tax cuts ahead of a Budget.”

- The past 10 days has seen support for PM Liz Truss' Conservatives collapse to the point where the opinion polling lead for the main opposition centre-left Labour Party is running at between 17% and 33% between 29 Sep-3 Oct, enough to give Sir Keir Starmer's party a healthy majority in the Commons.

- Conservative Party conference gets underway in Birmingham today. Could prove a difficult time for Truss & Kwarteng. Following U-turn, gov't risks being seen as 'in office but not in power'.

FOREX: USD/JPY Uptick Puts Pair Back into Intervention Territory

- JPY is among the weakest currencies in G10 early Monday, putting USD/JPY back toward recent highs and within range of the previous levels at which Japan's Ministry of Finance intervened in the currency to stem the pair's incline.

- There have been no major statements or indications from Japanese authorities of further action, but expectations will certainly grow should the pair creep higher. Overnight highs at 145.30 mark first resistance ahead of 145.90 - the cycle high - further out.

- Equities are lower across Europe, marking a sour start to the last quarter of the year, but growth proxies and high beta currencies are outperforming, putting AUD and NZD at the top of the G10 pile. Moves come ahead of tomorrow's RBA rate decision, at which the bank are seen raising rates by a further 50bps to 2.85%.

- Focus turns to the ISM Manufacturing data due later today, with particular attention likely to be paid to the employment subcomponent ahead of Friday's nonfarm payrolls release.

- Central bank speakers due today include Fed's Bostic & Williams and BoE's Mann.

Price Signal Summary - S&P E-Minis Trend Needle Remains Bearish

- In the equity space, S&P E-Minis trend conditions remain bearish. Last week’s fresh trend lows strengthens bearish conditions and note that a key support at 3657.00, the Jun 17 low and an important medium-term bear trigger, has been pierced. The break would confirm a resumption of the broader downtrend. The focus is on 3558.97, 1.382 projection of the Aug 16 - Sep 7 - 13 price swing. EUROSTOXX 50 futures remain vulnerable following last week’s continuation lower and today’s bearish start to the week. Key short-term support at 3341.00, the Jul 5 low, has been breached. The focus is on 3229.00 next, the Nov 9 2020 low (cont).

- In FX, EURUSD short-term gains are considered corrective. The move higher last week, does suggest scope for an extension of the correction. Note too that the bounce from last Wednesday’s low of 0.9536 means the bear channel base, at 0.9477 today, remains intact. The 20-day EMA, at 0.9865 represents the next resistance, a break would be a positive development. The channel top intersects at 1.0004. A resumption of weakness would open 0.9536/9477. GBPUSD is holding onto its recent gains and a corrective cycle remains in play. The latest recovery reinforces the importance of the hammer reversal candle on Sep 26 and suggests scope for stronger corrective bounce. The next resistance is 1.1261, the 20-day EMA. A clear break would strengthen the current short-term bull cycle and potentially open the 50-day EMA at 1.1587. USDJPY key support is 140.36, the Sep 22 low. Attention is on the bull trigger at 145.90, the Sep 22 high. A break would confirm a resumption of the uptrend and open 146.03, 2.764 projection of the Aug 2 - 8 - 11 price swing. Initial support is 142.95, the 20-day EMA.

- On the commodity front, Gold remains in a downtrend and recent gains are considered corrective. Fresh trend lows last week confirm a resumption of the trend and this opens $1610.5, the 1.00 projection of the Jun 13 - Jul 21 - Aug 10 swing. The next resistance is at $1676.6, the 20-day EMA. In the Oil space, a bearish threat in WTI futures remains present and the recovery from last Monday’s low is considered corrective. First resistance is at $83.31, the 20-day EMA. A clear break would open the 50-day EMA, at $87.26. On the downside, a resumption of weakness would open $76.11, 1.618 projection of the Jul 29 - Aug 16 - 30 price swing.

- In the FI space, Bund futures remain in a clear downtrend and the extension lower last week, reinforces current conditions. The focus is on 135.27, the Mar 2012 low (cont). Gains are considered corrective. The primary trend direction in Gilts remains bearish. A resumption of weakness would refocus attention on 90.99, the Sep 28 low and the bear trigger. Note that last Wednesday’s price pattern was a bullish engulfing candle. However, additional bullish price evidence is required to validate this signal and confirm a short-term reversal.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 03/10/2022 | - | *** |  | US | Domestic-Made Vehicle Sales |

| 03/10/2022 | - |  | EU | ECB Lagarde & Panetta at Eurogroup Meeting | |

| 03/10/2022 | 1305/0905 |  | US | Atlanta Fed's Raphael Bostic | |

| 03/10/2022 | 1345/0945 | *** |  | US | IHS Markit Manufacturing Index (final) |

| 03/10/2022 | 1400/1000 | *** |  | US | ISM Manufacturing Index |

| 03/10/2022 | 1400/1000 | * |  | US | Construction Spending |

| 03/10/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 03/10/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 03/10/2022 | 1800/1900 |  | UK | BOE Mann Panellist at CD Howe Institute | |

| 04/10/2022 | 0130/1230 | ** |  | AU | Lending Finance Details |

| 04/10/2022 | 0130/1230 | * |  | AU | Building Approvals |

| 04/10/2022 | 0430/1530 | *** |  | AU | RBA Rate Decision |

| 04/10/2022 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 04/10/2022 | 0900/1100 | ** |  | EU | PPI |

| 04/10/2022 | - |  | EU | ECB de Guindos at ECOFIN Meeting | |

| 04/10/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 04/10/2022 | 1300/0900 |  | US | Dallas Fed's Lorie Logan | |

| 04/10/2022 | 1315/0915 |  | US | Cleveland Fed's Loretta Mester | |

| 04/10/2022 | 1400/1000 | ** |  | US | factory new orders |

| 04/10/2022 | 1400/1000 | ** |  | US | JOLTS jobs opening level |

| 04/10/2022 | 1400/1000 | ** |  | US | JOLTS quits Rate |

| 04/10/2022 | 1500/1700 |  | EU | ECB Lagarde Q&A with Students Event | |

| 04/10/2022 | 1530/1130 | ** |  | US | US Treasury Auction Result for 52 Week Bill |

| 04/10/2022 | 1545/1145 |  | US | Fed Governor Philip Jefferson | |

| 04/10/2022 | 1700/1300 |  | US | San Francisco Fed's Mary Daly | |

| 05/10/2022 | 2200/0900 | * |  | AU | IHS Markit Final Australia Services PMI |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.