-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: ECB Expected To Cut Rates Later

MNI EUROPEAN OPEN: A$ & Local Yields Surge Following Jobs Data

MNI US OPEN - BoJ To Mull Further Hikes if Inflation Warrants

EXECUTIVE SUMMARY:

- ISRAEL TO ALLOW MORE GAZA AID AFTER BIDEN WARNING

- BOJ TO MULL FURTHER HIKES IF INFLATION WARRANTS - UEDA

- PRIOR HOUSEHOLD SURVEYS COULD SPELL WEAKNESS FOR HEADLINE NFP

- YELLEN BLASTS CHINA AS 'COERCIVE' TOWARD US FIRMS

Figure 1: US Unemployment Rate vs. FOMC Forecast

NEWS

US/CHINA (BBG): Yellen Blasts ‘Coercive’ China Moves on US Firms, Urges Reforms

Treasury Secretary Janet Yellen chided China’s government for “unfair” treatment of American and other foreign companies, and called on Beijing to return to the pro-market reforms of the past, at the start of her four-day visit to the country.

ISRAEL (WSJ): Israel to Allow More Aid Into Gaza After Biden Warning Over U.S. Support

Israel will allow more aid to enter Gaza and reopen a major border crossing after a warning by President Biden that support for Israel's war effort against Hamas hinges on doing more to help ease the humanitarian crisis in the strip.

ISRAEL/US (BBG): Biden Tells Netanyahu US Support Hinges on Civilian Safeguards

President Joe Biden told Israeli Prime Minister Benjamin Netanyahu that US support for his war in Gaza depends on new steps to protect civilians, a shift in position for the American leader who has faced increased pressure to take a harder line against Israel amid mounting deaths. The warning, delivered in a Thursday phone call between the two leaders, signaled that Biden is toughening his stance after an Israeli strike that killed seven people delivering food to displaced Palestinians in Gaza. Biden called the incident “unacceptable,” according to a White House description of the conversation.

ISRAEL (BBG): Israel Debate Opens Fresh Rift in Sunak’s Fractious Cabinet

The Israeli drone strike in Gaza that killed seven aid workers — including three Britons — is exposing new fissures in Rishi Sunak’s cabinet as pressure mounts on the UK prime minister to suspend arms sales to Tel Aviv.

JAPAN (MNI): BOJ To Watch Forex Impact, Prices - Ueda

Bank of Japan Governor Kazuo Ueda said on Friday that the BOJ will continue to monitor carefully developments within the foreign exchange markets and their impact on economic activity and prices. However, Ueda told lawmakers the Bank does not directly target forex, but noted it is important for exchange rates to move stably and reflect economic fundamentals. The BOJ will remain in close contact with the government, he added.

JAPAN (MNI): BOJ To Mull Hikes If 2% Probability Rises - Ueda

Bank of Japan Governor Kazuo Ueda said the board will consider a further increase to its policy interest rate if the probability of achieving the bank’s 2% target increases, the Asahi Shimbun reported on Friday. Ueda in an interview with the newspaper said he expects the probability to increase from summer to autumn when hefty wage hikes in spring wage negotiations reflect prices.

JAPAN (MNI): Consumption Index Supports BOJ View

The Bank of Japan's Consumption Activity Index posted its first rise in three months, up 0.6% in February following January's 0.1% fall, supporting the BOJ’s view that private consumption has been resilient. The data is consistent with government’s real household spending index, which rose 1.4% m/m in February, the first rise in five months following -2.1% in January.

RBNZ (MNI): MPC Set To Hold, Maintain Strong Stance

The Reserve Bank of New Zealand’s monetary policy committee is likely to hold the official cash rate at 5.5% when it meets on April 10 and will probably keep its messaging largely unchanged to temper rate cut expectations. Economic activity has slowed and inflation is moderating, driving market expectations of a rate cut sooner rather than later. New Zealand dollar overnight index swaps markets have priced in 25 basis points of easing by August, and a 4.8% OCR by year’s end.

INDIA (BBG): RBI Sticks to Hawkish Line, Saying Inflation Job Not Done

India’s central bank stuck to its hawkish policy tone Friday as warnings of a coming heat wave renewed fears of an inflation spike. The Monetary Policy Committee voted five-to-one to keep the benchmark repurchase rate at 6.5% for a seventh straight meeting, a move predicted by all of the 39 economists in a Bloomberg survey. The six-member panel also decided to retain its policy stance of “withdrawal of accommodation.”

MNI US Payrolls Preview: Does Prior Household Survey Weakness Hint At A NFP Miss?

EXECUTIVE SUMMARY

- Bloomberg consensus sees nonfarm payrolls growth of 213k in March after a strong 275k in Feb.

- Watch two-month revisions after the February report’s -167k – response rates have improved but are still on the low side historically.

- There has been particularly wide divergence between payrolls and household survey employment growth over the past three months – we expect a bounce in the household survey and potential for a modest downside surprise for March payrolls.

- With increased focus on immigration, the u/e rate should help guide on broader labor market balance. We don’t expect it this month, but it wouldn’t take much of an upside surprise to see expectations of an overshoot of the FOMC’s recently lowered 4.0% forecast for end-2024.

- AHE growth is broadly seen returning to a more trend-like 0.3% M/M after weather distortions through Jan-Feb. UBS do however see upside risk from a calendar effect.

- FOMC pricing is off highs seen after Monday’s ISM manufacturing survey but still only has a first cut coming in July before less than 70bp of cuts for the year.

PLEASE FIND THE FULL REPORT HERE:

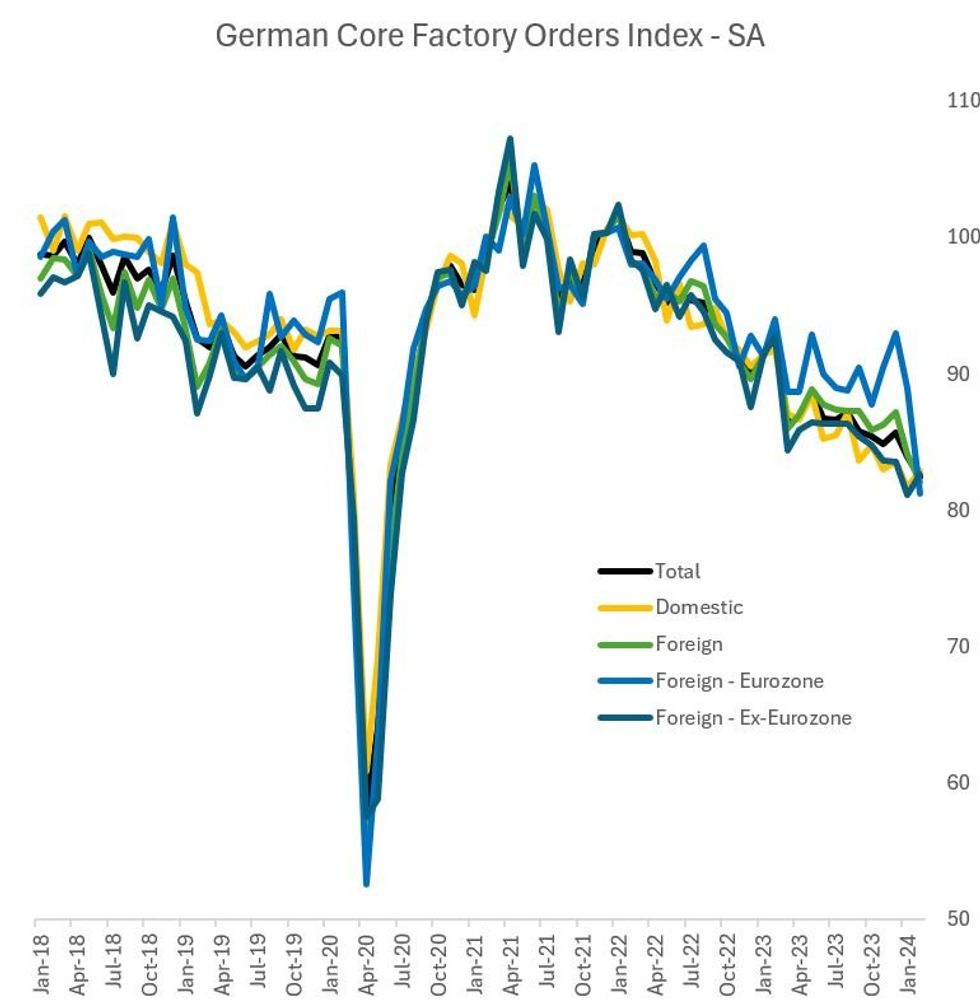

GERMANY: Plummeting Euro Core Factory Orders Cast Doubt On Recovery

German factory orders rose 0.2% M/M in February on a price/seasonally/calendar adjusted basis, softer than the 0.7% expected and an even bigger downside miss vs consensus when considering a downward revision to January (by 0.1pp to -11.4%). This leaves factory orders more than 10% lower on a Y/Y working day adjusted basis, and while the headline number shows some stabilisation in the beleaguered industrial sector, the underlying trend in early 2024 remains to the downside.- Core (ex-large ticket items) orders, a better measure of underlying activity, fell by 0.8% M/M after -3.0% in January - the 5th contraction in 6 months. The breakdown showed domestic core orders actually fairly robust at +1.5%, the biggest gain in 6 months (-2.3% prior). Instead it was foreign orders that dragged down the overall index, falling by 2.4% M/M after -3.6% in January. Eurozone orders led the drop, plummeting by 8.8% M/M, after -4.3% in January (foreign ex-Eurozone orders actually rose for the first time in 9 months).

- Outside of the early pandemic months of 2020, this was the biggest single-month fall in core Eurozone factory orders since at least 2010. Overall (non-core) new orders from the Eurozone fell 13.1% (after -24.3% in Jan), with total ex-euro up 7.8% and domestic up 1.5%.

- It's unclear what spurred this drop, particularly as eurozone-wide surveys suggest a nascent rebound in demand and industrial production in 1Q 2024. While the drop in overall orders is clearly linked to a pullback in capital goods orders after a surge in December on a one-off contract, the core decline will be concerning if not reversed in the months ahead.

- Manufacturing turnover rose 2.2% M/M, vs -5.2% in January - the latter of which reflects major revisions from -2.0% prior (autos and machinery/equipment saw large revisions). While there is no consensus for this figure, it could underpin expectations for continued growth in industrial production in Monday's release (currently +0.5% M/M expected vs +1.0% in Jan).

- Overall though there is no convincing sign of a turnaround in German factory activity, with the manufacturing PMI falling to a 5-month low in February and the March EC manufacturing confidence survey plumbing the lowest levels since the pandemic.

Source: Destatis, MNI

Source: Destatis, MNI

DATA

UK MAR CONSTRUCTION PMI 50.2 (FCAST 49.9); FEB 49.7

EZ MAR CONSTRUCTION PMI 42.4 ; FEB 42.9

MNI: FRANCE FEB INDUSTRIAL PRODUCTION +0.2% M/M, -0.8% Y/Y

FRANCE FEB MANUFACTURING OUTPUT +0.9% M/M, -0.3% Y/Y

MNI: GERMANY FEB FACTORY ORDERS +0.2% M/M

MNI:AUSTRALIA FEB TRADE BALANCE A$+7280

FOREX: USD Index Steadies After Spell of Weakness, NFP On Tap

- Markets trade rangebound ahead of the NFP release, consolidating after sharp volatility in equity markets after the European close on Thursday, as a ratchet higher in Middle-East tensions undermined risk sentiment. The surge in oil prices continues to provide a tailwind for commodity-tied currencies, tipping NOK to the top of the G10 pile, keeping EUR/NOK within range of first support at yesterday's lows of 11.5840.

- The USD Index is more stable after three consecutive sessions of declines, leaving the currency poised for post-jobs report volatility. 103.922 marks the first downside level, the 50-dma, which provided firm support during Thursday trade, so could mark an important level ahead of the weekend.

- CHF is the weakest performer on an intraday basis, however EUR/CHF remains below yesterday's cycle high and bull trigger of 0.9849. Clearance here opens the cross to the highest levels since May last year and 0.9880.

- Focus turns to the March nonfarm payrolls report, at which markets expect 214k jobs added this month, along with a tick lower in the unemployment rate by 0.1ppts. Earnings are expected to slow further, with the Y/Y AHE seen at 4.1% vs. 4.3% previously. The Canadian jobs release is also due, at which markets expected a +25k net change in employment.

Under Light Pressure Alongside Peers

Gilts have continued to move away from early highs, following wider core global FI markets as geopolitical risk premium is unwound ahead of today’s U.S. jobs report.

- Futures last -32 at 98.74 (98.71-99.15 range), with yesterday’s range intact, leaving previously flagged technical levels untouched and the bearish threat in place.

- Cash gilt yields are 2-3bp higher across the curve.

- SONIA futures are under light pressure alongside gilts, last running unchanged to -4.0 through the blues.

- BoE-dated OIS is back to little changed on the day, with ~71.5bp of ’24 cuts priced.

- Wider macro events (U.S. NFPs) and geopolitical risks are set to dominate ahead of the weekend, with nothing of note on the domestic calendar.

EGBs: Move Off Intraday Highs Ahead Of US Payrolls

Core/semi-core EGBs have moved away from intraday highs to sit lower on the day. Markets appear to have unwound some of Thursday’s jump in the geopolitical risk premium, ahead of today’s US employment report.

- While not market movers, this morning’s Eurozone industrial production data aligned with recent themes in regional surveys. German factory orders and French IP were softer than expected but Spanish IP was stronger.

- Eurozone retail sales remained negative on an annual basis for the 17th consecutive month.

- Bunds are -16 ticks at 132.58. A bearish threat remains present, and resumption of weakness (e.g. in response to a stronger than expected NFP figure) would refocus attention on key support and the bear trigger at 131.23, the Feb 29 low.

- The German and French cash curves have twist steepened today, with short end yields remaining lower.

- Periphery EGB spreads are wider to Bunds, a function of yesterday’s sell-off in equities following an increase in tensions between Israel and Iran. The 10-year BTP/Bund spread is 3.2bps wider at 141.7bps.

- The US NFP release at 1330GMT/1430CET remains the focus across global markets.

EQUITIES: Corrective Cycle at Play in E-mini S&P

The trend condition in S&P E-Minis remains bullish, however, the recent move lower highlights a corrective cycle and yesterday’s sell-off reinforces this condition. The contract has breached bull channel support drawn from the Jan 17 low, and cleared the 20-day EMA. A bullish trend condition in Eurostoxx 50 futures remains intact and the latest pullback is considered corrective. The break of support around the 20-day EMA - at 4965.50 - suggests potential for a deeper retracement near-term.

- Japan's NIKKEI closed lower by 781.06 pts or -1.96% at 38992.08 and the TOPIX ended 29.38 pts lower or -1.08% at 2702.62.

- Across Europe, Germany's DAX trades lower by 269.28 pts or -1.46% at 18133.52, FTSE 100 lower by 78.33 pts or -0.98% at 7897.89, CAC 40 down 113.13 pts or -1.39% at 8039.22 and Euro Stoxx 50 down 75.26 pts or -1.48% at 4995.23.

- Dow Jones mini up 62 pts or +0.16% at 38979, S&P 500 mini up 12.75 pts or +0.25% at 5209.5, NASDAQ mini up 50 pts or +0.28% at 18125.

COMMODITIES: Bull Theme in Oil Boosted by Middle-East Tensions

The trend condition in Gold remains bullish and the yellow metal is trading closer to this week’s all-time high. The latest rally maintains the price sequence of higher highs and higher lows and note that moving average studies are in a bull-mode condition. A bull theme in WTI futures remains intact and this week’s rally reinforces current conditions. The rally has confirmed a resumption of the uptrend. The contract has traded through $84.87, the Sep 15 ‘23 high, paving the way for a climb towards the $90.00 handle further out.

- WTI Crude down $0.02 or -0.02% at $86.56

- Natural Gas down $0.01 or -0.73% at $1.761

- Gold spot down $3.54 or -0.15% at $2287.57

- Copper down $2.95 or -0.69% at $421.9

- Silver down $0.15 or -0.55% at $26.765

- Platinum down $9.82 or -1.05% at $925.07

| Date | GMT/Local | Impact | Flag | Country | Event |

| 05/04/2024 | 1230/0830 | *** |  | US | Employment Report |

| 05/04/2024 | 1230/0830 | *** |  | CA | Labour Force Survey |

| 05/04/2024 | 1230/0830 |  | US | Boston Fed's Susan Collins Boston Fed's Susan Collins | |

| 05/04/2024 | 1315/0915 |  | US | Richmond Fed's Tom Barkin | |

| 05/04/2024 | 1400/1000 | * |  | CA | Ivey PMI |

| 05/04/2024 | 1500/1100 |  | US | Dallas Fed's Lorie Logan | |

| 05/04/2024 | 1615/1215 |  | US | Fed Governor Michelle Bowman | |

| 05/04/2024 | 1700/1300 | ** |  | US | Baker Hughes Rig Count Overview - Weekly |

| 05/04/2024 | 1900/1500 | * |  | US | Consumer Credit |

| 08/04/2024 | 2301/0001 |  | UK | KPMG-REC Jobs Report | |

| 08/04/2024 | 0130/1130 | ** |  | AU | Lending Finance Details |

| 08/04/2024 | 0500/1400 |  | JP | Economy Watchers Survey | |

| 08/04/2024 | 0545/0745 | ** |  | CH | Unemployment |

| 08/04/2024 | 0600/0800 | ** |  | DE | Trade Balance |

| 08/04/2024 | 0600/0800 | ** |  | DE | Industrial Production |

| 08/04/2024 | 1530/1630 |  | UK | BOE's Breeden Panellist at 'Towards the future of the monetary system' | |

| 08/04/2024 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 08/04/2024 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.