-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Open: Central Banks Take Centre Stage

EXECUTIVE SUMMARY:

- Markets look ahead to the FOMC meeting later today and tomorrow's BOE meeting.

FOMC: MNI Preview: Already Looking Beyond The Taper

- With a $15B/month taper all but certain to be announced at the November FOMC, most attention is on the Fed's communication surrounding inflation dynamics, and any further signals on the rate hike outlook.

- Hawkish risks to watch at the meeting include the removal/change of the "transitory" description of inflation in the Statement, and/or Powell doing little to push back against increasingly aggressive market rate hike pricing.

- The dovish-leaning risks are relatively limited, including a surprise that the taper pace will be conducted per meeting vs per month; and/or that the taper will begin in December rather than November.

- Prior to the Sept FOMC, sell-side consensus was for Fed rate liftoff in 2023, and a taper pace of $15B/meeting. That's changed to 2022 and $15B/month, alongside a significant market rate hike repricing which includes at least 2 hikes in 2022.

RBNZ: The Reserve Bank of New Zealand will increase the core funding ratio requirement for commercial banks to the previous level of 75% from the beginning of 2022 as the bank warned of ongoing vulnerability in the housing market (MNI).

PBOC: The People's Bank of China (PBOC) injected CNY50 billion via 7-day reverse repos with the rates unchanged at 2.2% on Wednesday. The operation led to a net drain of CNY150 billion after offsetting the maturity of CNY200 billion reverse repos today, according to Wind Information (MNI).

HEDGE FUNDS: Balyasny, BlueCrest, ExodusPoint Ground Traders Over Losses (Bloomberg)

HONG KONG-CHINA: Hong Kong is in advanced discussions with Chinese officials about potentially reopening their shared border, according to local media reports, as the former British colony pushes to overcome the mainland's hesitancy to revive travel crucial to the city's economy (Bloomberg).

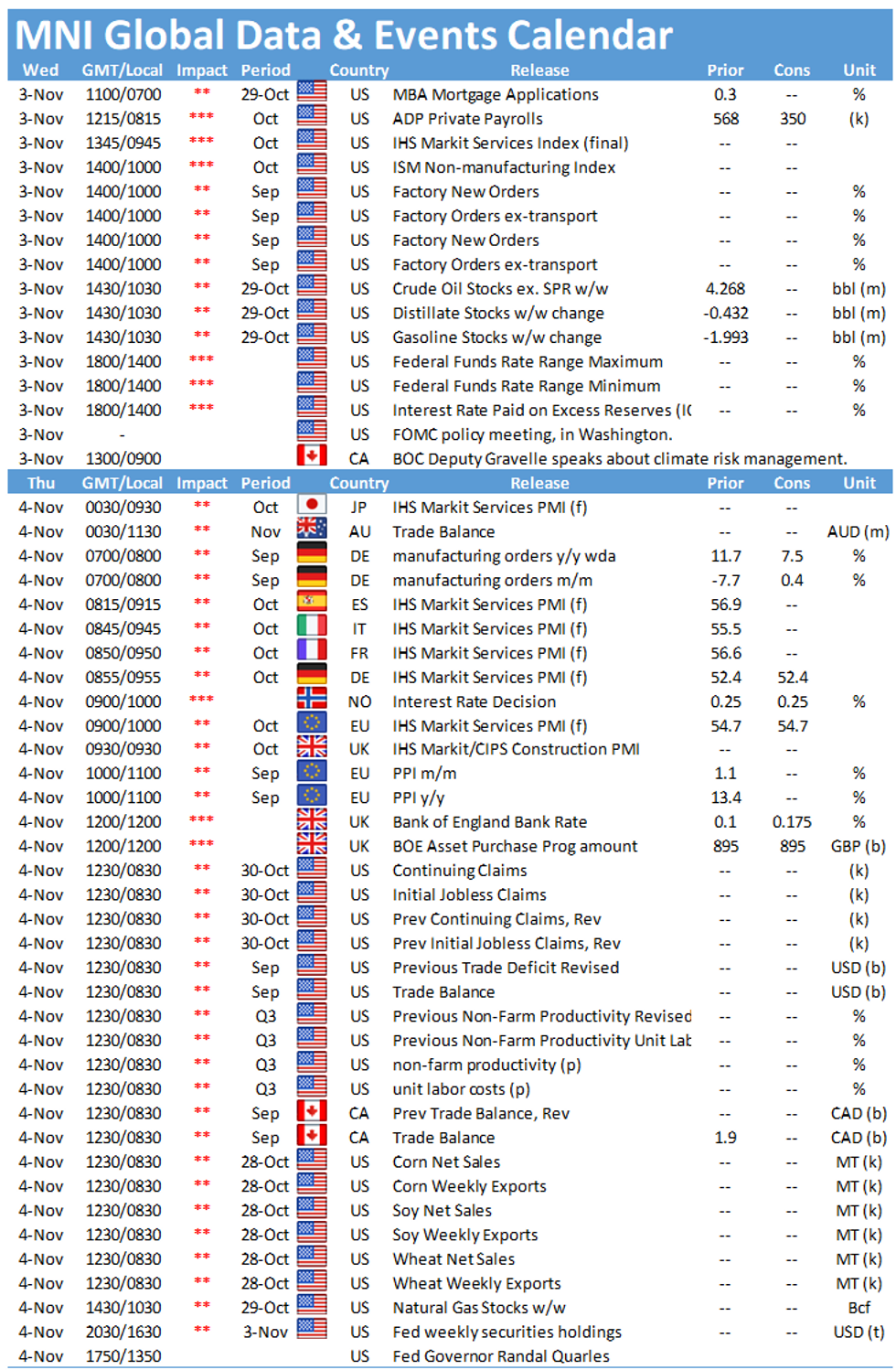

DATA:

UK Services /Composite PMIs revised higher

- The UK Markit services PMI has been revised from 58.0 to 59.1 while the composite PMI has been revised from 56.8 to 57.8.

FIXED INCOME: Central banks take centre stage

- Central banks take centre stage with the FOMC decision released later today and the BOE decision released tomorrow. Against this backdrop we also have US ADP employment today (ahead of Friday's NFP report) and US factory orders data.

- Markets this morning have continued yesterday's trends (despite a pause through the Asia session). So we have Bunds, gilts and Treasuries all moving higher while we have seen the short sterling and Eurodollar strips move a little higher, too.

- With a $15B/month taper all but certain to be announced at the November FOMC, most attention is on the Fed's communication surrounding inflation dynamics, and any further signals on the rate hike outlook. Since the September meeting, markets have shifted forward expectations for Fed hikes with two now priced in 2022 (prior to the September meeting the first was priced in 2023). For the full MNI Fed Preview click here.

- TY1 futures are up 0-6+ today at 131-05+ with 10y UST yields down -2.8bp at 1.523% and 2y yields down -0.3bp at 0.449%.

- Bund futures are up 0.28 today at 169.61 with 10y Bund yields down -2.4bp at -0.190% and Schatz yields down -0.7bp at -0.708%.

- Gilt futures are up 0.20 today at 125.34 with 10y yields down -2.3bp at 1.012% and 2y yields down -2.1bp at 0.637%.

FOREX: Weaker Dollar ahead of Fed later

- The Dollar has seen better selling in early European trade, but we trade well within past ranges, with attention turning towards the Fed later today.

- The Greenback tested session low against the EUR, CHF, AUD, CNH, NOK, SEK, NZD.

- The Kiwi remains the best performer against the USD up 0.32%, after New Zealand unemployment rate fell to the lowest level in 14 years.

- There has been limited impact in Petro currencies so far today, after Oil gave back some gains.

- We have OPEC meeting tomorrow, which could be interesting, given Biden's latest comment blaming the Cartel for inflationary pressures.

- Looking ahead, on the data front will be on ISM services. Durable good is final reading, while US ADP has no real proven correlation with NFP and the NFP isn't an "all eyes" this week, with short term focus squarely on inflationary risk.

- Most of the attention is on Fed Powell, other speakers include ECB Lagarde, Muller, Elderson, de Cos, Villeroy, abd BoE Bailey

EQUITIES: LEVELS UPDATE

- China's SHANGHAI closed down 7.091 pts or -0.2% at 3498.537 and the HANG SENG ended 74.92 pts lower or -0.3% at 25024.75

- German Dax down 15.32 pts or -0.1% at 15940.33, FTSE 100 down 11.14 pts or -0.15% at 7262.76, CAC 40 up 2.15 pts or +0.03% at 6925.75 and Euro Stoxx 50 down 2.97 pts or -0.07% at 4293.62.

- Dow Jones mini down 6 pts or -0.02% at 35930, S&P 500 mini down 1 pts or -0.02% at 4622.75, NASDAQ mini up 16.5 pts or +0.1% at 15978.

COMMODITIES: LEVELS UPDATE: Copper up, crude down

- WTI Crude down $1.45 or -1.73% at $82.56

- Natural Gas up $0.02 or +0.42% at $5.575

- Gold spot down $6 or -0.34% at $1781.63

- Copper up $6.55 or +1.5% at $443.25

- Silver up $0.02 or +0.09% at $23.5521

- Platinum up $5.95 or +0.57% at $1047.25

LOOK AHEAD

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.