-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Open: Equities Slip On Kabul Chaos And Soft China Data

EXECUTIVE SUMMARY:

- CHAOTIC SCENES AT KABUL AIRPORT AS HUNDREDS ATTEMPT TO FLEE AFGHANISTAN

- CHINA ECONOMY UNDER PRESSURE AS FACTORY OUTPUT, RETAIL SALES GROWTH SLOW SHARPLY

- B.O.J. RECOVERY VIEW INTACT DESPITE Q3 GDP HEADWINDS (MNI INSIGHT)

Fig.1: Treasuries Gain Ground

Source: BBG, MNI

Source: BBG, MNI

NEWS:

AFGHANISTAN (BBG): US troops are taking control of Kabul's international airport, while desperate residents try to flee the city after the Taliban seized Afghanistan. The US military has secured the site and is taking over air traffic control to evacuate American and allied staff. Other countries are also evacuating staff, including the UK, which has sent troops for the operation. But commercial flights have mostly been suspended, stranding hundreds of Afghans and other foreign nationals. The Taliban claimed victory after the government collapsed on Sunday. President Ashraf Ghani has fled abroad.

AFGHANISTAN (RTRS): At least five people were killed in Kabul airport as hundreds of people tried to forcibly enter planes leaving the Afghan capital, witnesses told Reuters. One witness said he had seen the bodies of five people being taken to a vehicle. Another witness said it was not clear whether the victims were killed by gunshots or in a stampede. U.S. troops, who are in charge of the airport, earlier fired in the air to scatter the crowd, a U.S. official said. Officials were not immediately available to comment on the deaths.

AFGHANISTAN (BBC): A Taliban spokesman has told the BBC that the militant group is working to form a new government in Afghanistan. The group has once again ordered its fighters to leave Afghan civilians alone, as it seeks to present a moderate face to the local population. Separately, a member of the Taliban's negotiating team in Qatar told the BBC last night "there will be no revenge" on the people of Afghanistan. "We assure the people in Afghanistan, particularly in the city of Kabul, that their properties, their lives are safe - there will be no revenge on anyone," Suhail Shaheen told the BBC's Yalda Hakim live on air. Many Afghans fear a brutal return to the regime of the 1990s, which was characterised by public executions, stonings and girls being banned from school.

AFGHANISTAN / CHINA (BBG): China hopes Afghanistan enjoys a peaceful transition of power, Foreign Ministry spokesperson Hua Chunying says Monday at a regular briefing in Beijing. "We respect the Afghan people's will and choice," she said. China's embassy in the country is operating normally, Hua said; most Chinese nationals have already left Afghanistan with the embassy's help and those that remain are safe.

AFGHANISTAN / CHINA / RUSSIA (BBC): While the Taliban's taking of Kabul sparked the US and its allies to evacuate from the capital, China and Russia have indicated they have no plans to close their embassies. China warned its nationals to "stay indoors" and alert to the situation, but said it had asked "various factions in Afghanistan" to ensure the safety of its citizens. Russia's foreign ministry also told state media on Sunday that the government had no plans to evacuate.

AFGHANISTAN / UK (TELEGRAPH): The UK will waive border rules to allow Afghan asylum seekers to flee the Taliban to Britain without a passport, the Defence Secretary has announced. Ben Wallace said the Government wanted to make it easier for interpreters and contractors who supported Western forces to seek asylum in the UK, as diplomatic staff and civilians rush to evacuate Kabul. Ministers are under pressure from all sides to expand the Government's asylum scheme, and the Home Office has denied reports that Priti Patel, the Home Secretary, is reluctant to relax the rules.

AFGHANISTAN / E.U. (RTRS): The European Union is working with member states to find quick solutions for the relocation of local Afghan staff and their families to a safe place, a spokesperson said on Monday. "The matter is extremely urgent, we take it very seriously and continue to work hard, together with EU member states, on implementing rapid solutions for them and ensure their safety," the spokesperson for the bloc's executive Commission told Reuters. The Commission does not give figures for their local Afghan staff for security reasons.

CHINA ECONOMY: China's July macroeconomic indicators slowed down more than expected to the lowest levels this year amid the sporadic outbreak of local Covid-19 cases and floods, the National Bureau of Statistics said. Industrial production grew 6.4% y/y in July, down from the 8.3% gain in June and missing the 7.9% median projection. Retail sales rose 8.5% y/y in July, decelerating from June's 12.1% gain and underperforming the 10.8% forecast. Fixed-asset Investment registered a growth of 10.3% y/y in Jan-Jul period, slowing from 12.6% in H1, also below the 12.0% projection.

BOJ (MNI INSIGHT): Bank of Japan policy officials are focused on how the economy evolves in the third quarter as chances for an extension of lockdown conditions in Japan remains and exports take a hit from supply-chain glitches in Southeast Asia even while maintaining a recovery scenario, MNI understands. For full article contact sales@marketnews.com

JAPAN POLITICS: Japan's Kyodo News reporting that Prime Minister Yoshihide Suga's approval rating has hit an all-time low, while a significant majority of respondents state that they do not want him to remain in position as head of the Liberal Democratic Party (LDP) ahead of the autumn general election. Suga's approval rating fell 4.1% in a month to 31.8% (the lowest on record), while his disapproval ratings rose by 0.8% to 50.6% (the highest since September 2020).

U.K.: New rules come into force across England for contacts of Covid-19 cases today. For those who have received their second dose of a Covid-19 vaccine at least 14 days prior, there will be no need to self isolate if they have been a close contact of someone who has tested positive for Covid-19, they will instead be encouraged to take a PCR test as soon as possible (but will not have to isolate as they await the results). This rule change should have a positive impact on the economy as the number of people required to self-isolate (and hence to stay away from work) will be vastly reduced.

DATA:

No key data in the European morning.

FIXED INCOME: Core FI off its highs but the market still talking about risk-off events

Core fixed income is off the highs seen shortly after the European open; gilts and Bunds are now more in line with last week's close but Treasuries are still higher on the day.

- There has been little macro or headline rationale for the pullback in core FI with market conversations still focusing on the risk-off aspects of the fall of the Afghan government, softer China data and, to a lesser extent, continued Covid-19 concerns. Equities have not really recovered, however, with most indices across Europe down around 0.5%.

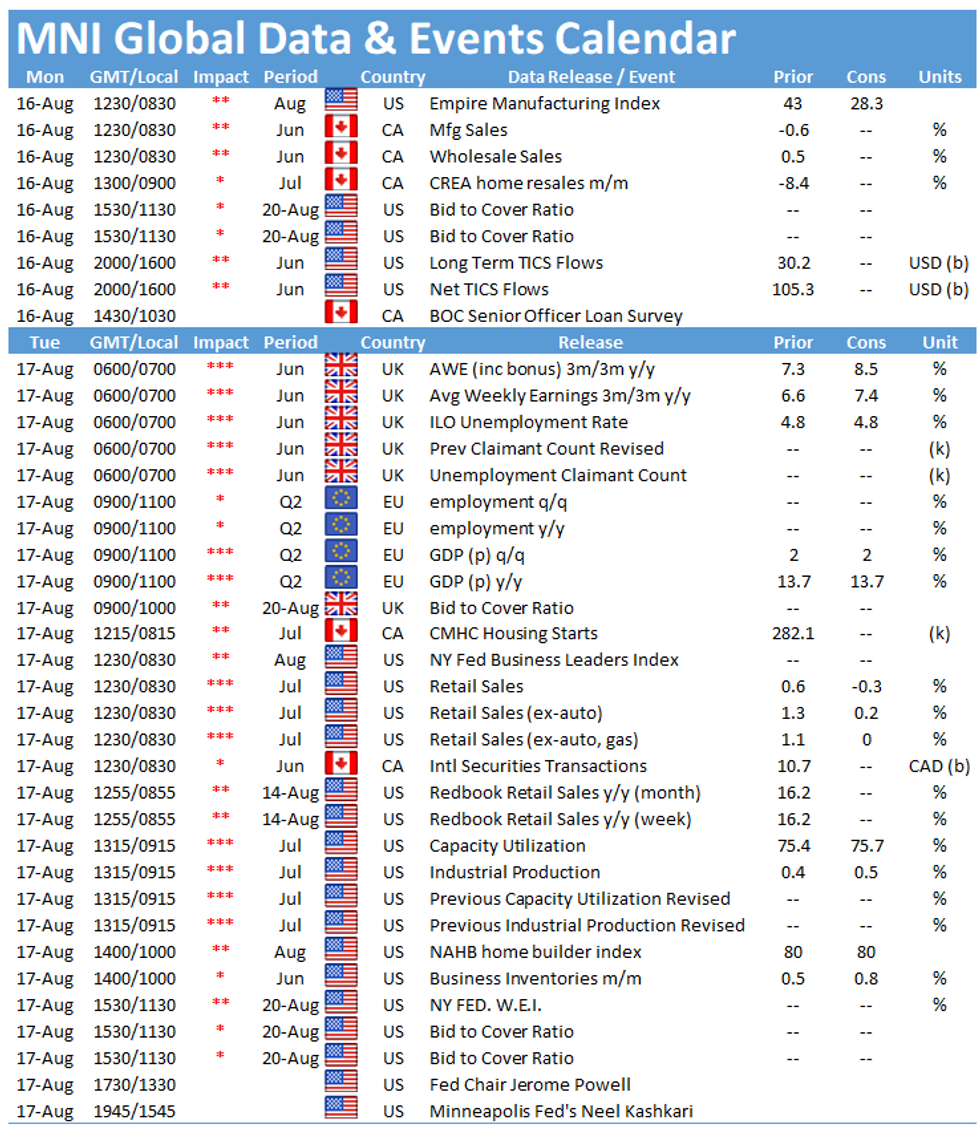

- There is no tier 1 data due today with US Empire Manufacturing and TIC flows the highlights.

- Looking ahead to the rest of the week, we have the FOMC Minutes on Wednesday while US retail sales and IP data tomorrow will also be watched. In the UK we have labour market data, inflation, retail sales and public finance data all due this week. The Eurozone data calendar is a lot more sparse.

- TY1 futures are up 0-7+ today at 134-06 with 10y UST yields down -0.7bp at 1.271% and 2y yields down -0.8bp at 0.201%.

- Bund futures are up 0.05 today at 176.69 with 10y Bund yields up 0.2bp at -0.466% and Schatz yields down -0.2bp at -0.745%.

- Gilt futures are up 0.03 today at 129.70 with 10y yields up 0.5bp at 0.577% and 2y yields up 0.5bp at 0.136%.

FOREX: Greenback Clawing Back Small Segment of Friday Losses

- Currency markets have been relatively quiet so far Monday, with most currencies trading inside their recent ranges - the 10y yield came under pressure early doors, extending losses back below the 1.25% mark in an extension of Friday's UMich-inspired move. Despite this, USD's a touch stronger as it chews through a minority of Friday's losses.

- AUD is the underperformer so far, following domestic equities lower as markets respond to the NSW state government tightening COVID restrictions and placing the whole state into a strict 1-week lockdown.

- China data overnight was a general disappointment, with retail sales and IP missing expectations. CNH is little changed, however, with recent pledges of PBoC support possibly lending a hand. Nonetheless, the poor China data has fuelled JPY gains, putting USD/JPY back below the Y109.50 mark.

- Data releases and central bank speakers are few and far between Monday, with US Empire Manufacturing and Canadian existing home sales the sole releases.

EQUITIES: Defensive Start To The Week, But S&P And Eurostoxx Uptrends Intact

A combination of weak Chinese economic data and concerns over the situation in Afghanistan have global equity markets on the back foot to start the week. However, the major equity markets remain in an uptrend technically.

- Asian markets closed mostly lower, with Japan's NIKKEI down 453.96 pts or -1.62% at 27523.19 and the TOPIX down 31.41 pts or -1.61% at 1924.98. China's SHANGHAI closed up 1.046 pts or +0.03% at 3517.345 and the HANG SENG ended 210.16 pts lower or -0.8% at 26181.46.

- European stocks have slipped, with the German Dax down 64.27 pts or -0.4% at 15925.74, FTSE 100 down 62.61 pts or -0.87% at 7176.09, CAC 40 down 52.8 pts or -0.77% at 6855.74 and Euro Stoxx 50 down 22.39 pts or -0.53% at 4207.87.

- U.S. futures are a little weaker, with the Dow Jones mini down 60 pts or -0.17% at 35360, S&P 500 mini down 7.5 pts or -0.17% at 4455, NASDAQ mini down 16.25 pts or -0.11% at 15109.5.

COMMODITIES: Weak China Data Sets Negative Tone For Copper

Copper has weakened sharply in Monday trade following weaker-than-expected readings on Chinese industrial output and fixed-asset investment.

- WTI Crude down $0.5 or -0.73% at $67.06

- Natural Gas down $0.01 or -0.31% at $3.827

- Gold spot down $3.84 or -0.22% at $1776.43

- Copper down $5.8 or -1.32% at $431.4

- Silver down $0.18 or -0.77% at $23.5498

- Platinum down $20.14 or -1.95% at $1015.68

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.