-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Weak 30Y Reopen, ECB Forward Guidance Weighing

MNI ASIA MARKETS ANALYSIS: Tsys Reverse Early Data Driven Gain

MNI US Inflation Insight: Softer Housing Helps Ensure Dec Cut

MNI US OPEN - Stournaras Sees Moment For ECB/Fed Divergence

EXECUTIVE SUMMARY:

- STOURNARAS: IT'S TIME FOR THE ECB TO DIVERGE FROM THE FED

- GOLD HITS NEW HIGHS DESPITE OVERARCHING DOLLAR STRENGTH

- BIDEN DEEPENS DEFENCE TIES WITH JAPAN, PHILIPPINES

- USD/JPY CRESTS AT NEW CYCLE HIGH

NEWS

US/ASIA (BBG): Biden Vows to Back Japan and Philippines as China Jolts Allies

President Joe Biden said he was committed to “deepening maritime and security ties” with Japan and the Philippines as he sought to assure allies worried about increasingly assertive Chinese actions in disputed waters.

ECB (BBG): It’s Time for the ECB to Diverge From Fed, Stournaras Says

The European Central Bank shouldn’t be afraid to shift its “overly prudent” stance on interest rates away from that of the Federal Reserve, according to Governing Council member Yannis Stournaras. Speaking in Frankfurt after the ECB gave the clearest signal yet that it will begin unwinding its unprecedented bout of rate hikes in June, the Greek official reiterated that four cuts are possible this year — despite investors scaling back wagers on such moves globally.

ECB (BBG): ECB May Cut Rates in June on Slower Inflation, Muller Says

The European Central Bank may lower interest rates in June as euro-area inflation slows toward the 2% target, according to Governing Council member Madis Muller.“ The ever-decelerating general price increase in the euro area increases the likelihood” of a rate cut, the Estonian official said Friday in a statement. “Before we decide to cut interest rates, we’d like to see further confirmation of the downward trend continuing for increases in services prices and average wages.”

ECB (BBG): ECB Is on Track to Cut Interest Rates in June, Kazaks Says

The European Central Bank is on track to start lowering borrowing costs in June, according to Governing Council member Martins Kazaks. “If we are really in the direction of our goal 2%, then to my mind we are really close to a turning point when these rates can be lowered step by step,” he told Latvia’s TV3 channel on Friday. “If really nothing changes then June will be the month where we see the first rate cut.”

ECB (MNI): ECB Professional Forecasters' Price Outlook Steady

Financial economists and analysts see both headline and core eurozone inflation little changed in Q2 from their forecasts in the previous quarter, the ECB's survey of Professional Forecasters showed on Friday. Respondents expect headline inflation to decline from 2.4% in 2024 to 2.0% in both 2025 and 2026. They saw labour market tightness and wage growth as high, but these were generally "expected to moderate and underpin the return of both headline and core inflation to 2.0%". Longer-term HICP inflation expectations (for 2028) were unchanged at 2.0%.

CHINA (BBG): China Says Wang Yi Condemned Iran Embassy Attack in Blinken Call

China said its top diplomat discussed tensions in the Middle East on a call with Secretary of State Antony Blinken, underscoring fears that the six-month-old Gaza conflict may escalate. Wang Yi “stressed that China strongly condemns the attack on the Iranian embassy in Syria,” Foreign Ministry spokeswoman Mao Ning said at a regular press briefing in Beijing.

CHINA (BBG): China Vows to Tighten Stock Market Supervision to Control Risks

China’s cabinet vowed to tighten stock listing criteria and urged companies to improve corporate governance in new guidelines released Friday, the latest effort to support the nation’s equity market. The State Council will ensure “high quality development” of listed companies, crack down on illegal share sales and strengthen the supervision of dividend payouts, according to a statement. It will also promote the entry of medium-to-long term funds into the market, the statement said.

JAPAN (MNI): Household 5-Yr Inflation Expectations Hold At 5%

The Bank of Japan's closely watched household median inflation five-year forecast stood unchanged at 5% over Q1, but the number of households expecting prices to rise increased to 80.6% from 76.5%, the BOJ's quarterly consumer survey released Friday showed. The household median inflation view a year ahead stood at 5%, down from 8% three months ago, indicating inflation expectations may have peaked, increasing concern over the sustainable rise of CPI - a key BOJ focus.

SOUTH KOREA (MNI): BOK WATCH: Board Holds, Maintains Restrictive Stance

Bank of Korea Governor Rhee Chang-yong Friday maintained his cautious view on the outlook for inflation, following the board's unanimous decision to hold the policy rate at 3.5%, noting a restrictive monetary policy stance will be required for a sufficiently long period of time to return inflation to its 2% target.

DATA

UK (MNI): Economy Up In Feb, Signals Recession All But Over- UK GDP grew 0.1% in February 2024, following upwardly revised growth of 0.3% in January, the Office for National Statistics said Friday, noting the economy grew by 0.2% in the three months to February compared to the 3 months to November, largely in line with officiaal estimates by the Bank of England and the Office for Budget Responsibility.

- Services output grew by 0.1% in February 2024, following growth of 0.3% in January 2024 (revised up from 0.2% growth in our previous publication), and has grown by 0.2% in the three months to February 2024. Production output grew by 1.1% in February 2024 and was the largest contributor to the growth in GDP in the month, following a fall of 0.3% in January 2024 (revised down from a 0.2% fall in our previous publication); production output grew by 0.7% in the three months to February 2024.

CHINA (MNI): China Mar Exports Jump On Demand; Imports Improve

China's exports fell 7.5% y/y in March, underperforming market consensus of a 1.8% y/y fall and far behind last month's 5.6% y/y growth, data released by Customs on Friday showed. The drop was mainly driven by weak external demand, woth a low base effect also impacting. Imports fell 1.9% y/y during the month, slower than the market consensus of 1.0% y/y growth but much improved from last month's 8.2% y/y drop.

MNI: SPAIN MAR HICP +1.4% M/M, +3.3% Y/Y

MNI: FRANCE MAR HICP +0.2% M/M, +2.4% Y/Y

FRANCE MAR CPI +0.2% M/M, +2.3% Y/Y

MNI: SWEDEN MAR CPIF +2.2% Y/Y

FOREX: USD Storms to New Highs, As Post-CPI Strength Persists

- The USD is higher against all others in G10 as the currency continues its post-CPI uptick. The USD Index crested at a new multi-month high of 105.737 in early European trade, with options market activity providing support as demand for USD upside dominates.

- JPY also trades firmer, recovery off lows as a supportive Japanese yield curve lends some strength - nonetheless the dominant dollar theme has underpinned a new cycle and recovery high at 153.39 in USD/JPY.

- EUR/USD has caught focus, with the pair breaking 1.07 on the way lower to print the lowest levels since November as rate differentials weigh. ECB speak has proved negative for the pair so far today, after ECB's Stournaras stated that it's time for the ECB to diverge from the Fed. Implied pricing still heavily favours a June cut from the ECB (a notion backed by ECB's Kazaks this morning), while Fed rate cut pricing continues to be pushed back - with July now seen as a coin toss.

- Asset markets could see extra sensitivity across the University of Michigan sentiment release, as markets look to gauge any feedthrough from March's higher-than-expected CPI into inflation expectations. Import/export price indices are also due on top of speeches scheduled from Fed's Collins, Schmid, Bostic and Daly.

EGBS: Firmer But Still Short Of Wednesday’s Highs

Core/semi-core EGBs have rallied sharply morning, with this week’s main risk events now out of the way.

- Soft Chinese trade data and ongoing geopolitical tensions have supported the space, though futures remain below Wednesday’s pre-US CPI high.

- This morning, the hawkish leaning Kazaks noted that rates would be cut in June absent any surprises, while the dovish Stournaras re-iterated his preference for 4 rate cuts in 2024.

- The ECB’s Q2 Survey of Professional Forecasters expectations for inflation were unchanged through 2024 – 2026, while German, French and Spanish final March inflation figures broadly confirmed respective flash estimates.

- Bunds are +107 ticks at 132.41, while OAT and BTP futures are +110 and +117 ticks respectively.

- German cash yields are 6.5bps to 8.5bps lower today, with the 5/10s outperforming.

- Periphery spreads to Bunds are off narrowest levels but remain tighter today, with European equity futures almost 1% higher.

- Final March Eurozone HICP headlines next week’s calendar, alongside several scheduled ECB speakers (many of whom are attending the IMF Spring Meetings in Washington DC).

GILTS: Holding Most Of Early Rally, Bernanke Review Eyed

Gilt futures are off best levels but hold onto most of their gains, last +60 at 97.70 (97.22-77 range).

- Yesterday’s opening gap lower in the contact was closed, with bulls now eying a break of the Mar 15 low (98.05). We remind that the bearish technical backdrop remains in place for the contract.

- Cash gilt yields are 4-6bp lower, with the front end leading the rally.

- Soft Chinese trade data and geopolitical angst help underpin core global FI markets early Friday.

- SONIA futures are flat to +7.0, off session highs alongside gilts.

- BoE-dated OIS contracts show ~53bp of ’24 cuts vs. ~47.5bp late yesterday.

- Goldman Sachs’ tweaked their BoE view overnight, but that wasn’t a market mover.

- The Bernanke review of the BoE’s forecasting methods will be released at 12:00 London. See our earlier bullet for more colour on that matter.

| BoE Meeting | SONIA BoE-Dated OIS (%) | Difference Vs. Current Effective SONIA Rate (bp) |

| May-24 | 5.182 | -1.6 |

| Jun-24 | 5.094 | -10.4 |

| Aug-24 | 4.972 | -22.6 |

| Sep-24 | 4.890 | -30.8 |

| Nov-24 | 4.765 | -43.3 |

| Dec-24 | 4.670 | -52.8 |

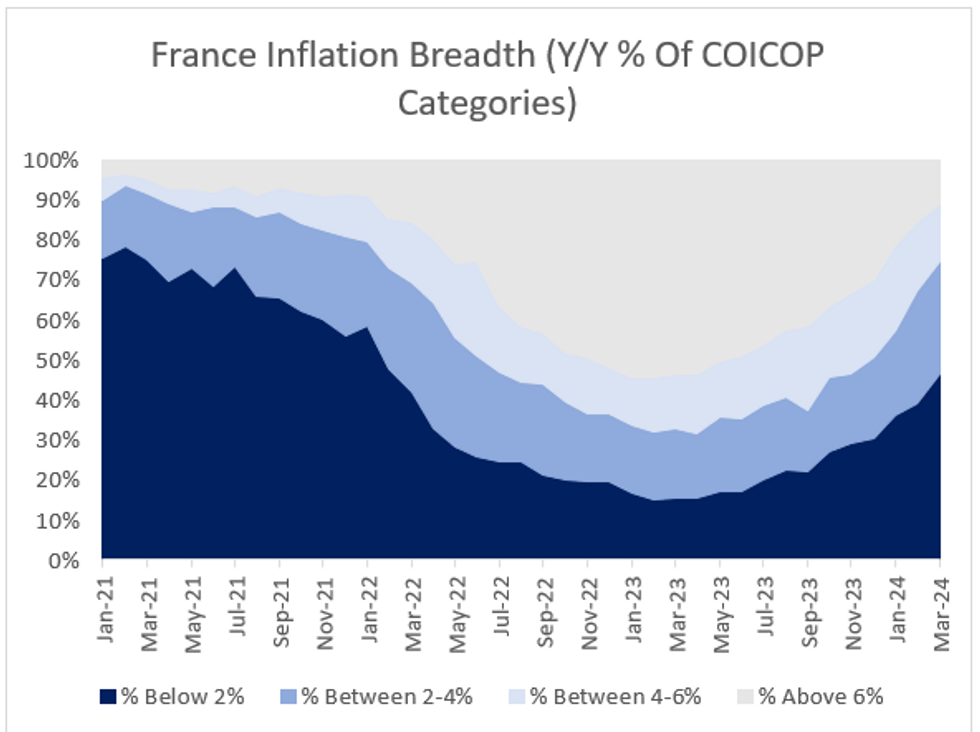

FRANCE: Final March Inflation Reading Confirms Softening Core Dynamics

France Final HICP data for March confirmed the flash reading on an annual basis at 2.4% Y/Y (3.2% Feb), though the non-seasonally adjusted M/M figure came in slightly softer than flash at 0.2% (0.3% flash, 0.9% Feb). Recall that the flash French Y/Y print was 0.4pp below-expected, and the first below 3% since September 2021, helping set the tone for a lower-than-consensus Eurozone-wide print the following week.

- This was a broadly disinflationary report: as was suspected upon the flash release, the slowdown in inflation was driven by both non-core and core components (a breakdown was not available in the flash).

- Core inflation slowed to 2.2% Y/Y (vs 2.6% prior), with a slight softening in services inflation to 3% Y/Y (vs 3.2% prior), with an unchanged non-seasonally adjusted monthly reading (0.1% M/M). Manufactured goods prices pulled back again, to 0.1% Y/Y (0.4% prior), with the smallest M/M increase since 2014 (1.5%, not seasonally adjusted).

- Similarly, food prices disinflated on an annual basis to 1.7% Y/Y (vs 3.6% prior) - the twelfth consecutive deceleration. in addition, energy prices continue to slow, with an increase in energy prices of 3.4% in March (vs 4.3% prior). Year-earlier base effects played a key role.

- Looking at the breadth of inflation, MNI's analysis shows that the proportion of components with inflation below 2% rose from 39% in February to 46% March - the highest since Feb 2022. Meanwhile, the proportion of components with inflation above 6% declined to 11% from 15% in February - the lowest level since January 2022.

EQUITIES: Trend Condition Unchanged, And Pointed Higher

The trend condition in S&P E-Minis is unchanged and remains bullish. The recent move down highlights a short-term corrective cycle and this is allowing a recent overbought signal to unwind. The contract has breached bull channel support drawn from the Jan 17 low. A corrective cycle in Eurostoxx 50 futures remains in play and the move down is allowing an overbought trend condition to unwind. The break of support around the 20-day EMA suggests potential for a deeper retracement.

- Japan's NIKKEI closed higher by 80.92 pts or +0.21% at 39523.55 and the TOPIX ended 12.68 pts higher or +0.46% at 2759.64.

- Elsewhere, in China the SHANGHAI closed lower by 14.773 pts or -0.49% at 3019.473 and the HANG SENG ended 373.34 pts lower or -2.18% at 16721.69.

- Across Europe, Germany's DAX trades higher by 207.17 pts or +1.15% at 18161.45, FTSE 100 higher by 96.24 pts or +1.21% at 8019.4, CAC 40 up 93.79 pts or +1.17% at 8117.27 and Euro Stoxx 50 up 57.17 pts or +1.15% at 5023.51.

- Dow Jones mini up 77 pts or +0.2% at 38808, S&P 500 mini down 0 pts or 0% at 5243.75, NASDAQ mini down 19.25 pts or -0.1% at 18467.5.

COMMODITIES: Gold Surges to New Highs, Momentum Still Firm

A bull theme in WTI futures remains intact and the contract is holding on to the bulk of its recent gains. Recent gains reinforced current bullish conditions and confirmed a resumption of the uptrend. The contract has traded through $84.87, the Sep 15 ‘23 high. The trend condition in Gold remains bullish and the yellow metal is trading higher today, extending the current impulsive bull phase. The move higher maintains the price sequence of higher highs and higher lows and note that moving average studies.

- WTI Crude up $0.73 or +0.86% at $85.77

- Natural Gas down $0.01 or -0.62% at $1.754

- Gold spot up $22.66 or +0.96% at $2396.66

- Copper up $9.6 or +2.26% at $434.6

- Silver up $0.67 or +2.35% at $29.1285

- Platinum up $14.12 or +1.44% at $998.17

| Date | GMT/Local | Impact | Flag | Country | Event |

| 12/04/2024 | 1100/1200 |  | UK | BOE's Bernanke Review of Forecasting for Monetary Policymaking | |

| 12/04/2024 | 1100/1300 |  | EU | ECB's Elderson Speaks At Delphi Economic Forum | |

| 12/04/2024 | - | *** |  | CN | Trade |

| 12/04/2024 | 1200/0800 |  | US | San Francisco Fed's Mary Daly | |

| 12/04/2024 | 1230/0830 | ** |  | US | Import/Export Price Index |

| 12/04/2024 | 1300/0900 | * |  | CA | CREA Existing Home Sales |

| 12/04/2024 | 1400/1000 | ** |  | US | U. Mich. Survey of Consumers |

| 12/04/2024 | 1700/1300 | ** |  | US | Baker Hughes Rig Count Overview - Weekly |

| 12/04/2024 | 1700/1300 |  | US | Kansas City Fed's Jeff Schmid | |

| 12/04/2024 | 1830/1430 |  | US | Atlanta Fed's Raphael Bostic | |

| 12/04/2024 | 1930/1530 |  | US | San Francisco Fed's Mary Daly | |

| 15/04/2024 | 2350/0850 | * |  | JP | Machinery orders |

| 15/04/2024 | 0630/0230 |  | US | Dallas Fed's Lorie Logan | |

| 15/04/2024 | 0900/1100 | ** |  | EU | Industrial Production |

| 15/04/2024 | 1115/1215 |  | UK | BoEs Breeden on Payments Innovation | |

| 15/04/2024 | 1230/0830 | ** |  | CA | Monthly Survey of Manufacturing |

| 15/04/2024 | 1230/0830 | ** |  | CA | Wholesale Trade |

| 15/04/2024 | 1230/0830 | *** |  | US | Retail Sales |

| 15/04/2024 | 1230/0830 | ** |  | US | Empire State Manufacturing Survey |

| 15/04/2024 | 1400/1000 | * |  | US | Business Inventories |

| 15/04/2024 | 1400/1000 | ** |  | US | NAHB Home Builder Index |

| 15/04/2024 | 1415/1615 |  | EU | ECB's Lagarde Speaks On ECB Podcast |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.