-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Open: Tech Stocks Falter Ahead Of Powell Testimony

EXECUTIVE SUMMARY:

- STOCKS DOWN AHEAD OF FED CHAIR POWELL'S CONGRESSIONAL TESTIMONY

- U.K. EMPLOYMENT UP, EARNINGS SOAR TO 13-YR HIGH

- BITCOIN SLUMPS BELOW $50K AS CAUTION SWEEPS OVER CRYPTO RALLY

- BIDEN-TRUDEAU TALKS ON TUESDAY SEEK TO EASE STRAINED RELATIONS (BBG)

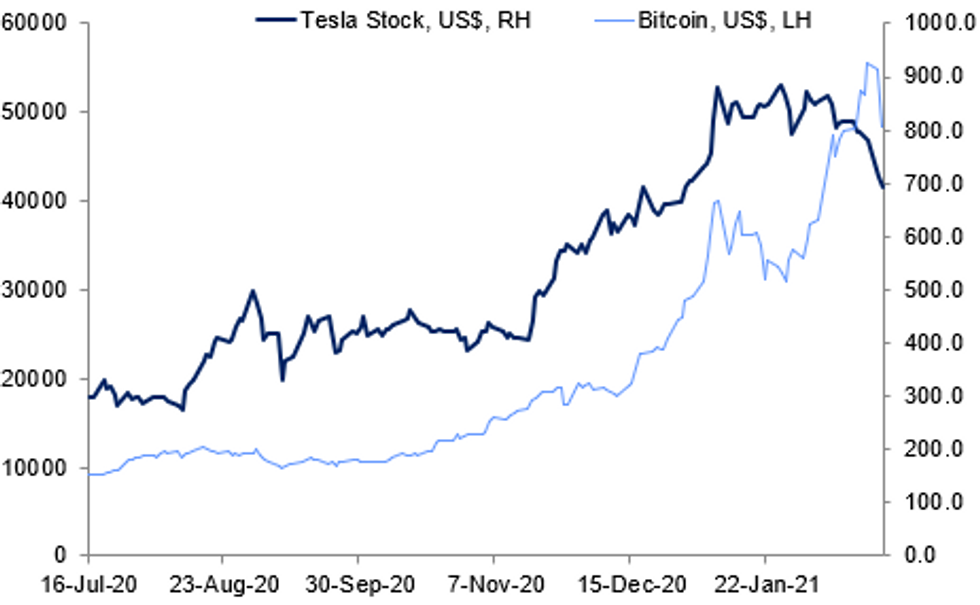

FIG.1: FOMO Rally Reversing

BBG, MNI

BBG, MNI

NEWS:

FED (WSJ): U.S. stock futures edged lower Tuesday as investors awaited Federal Reserve Chairman Jerome Powell's testimony in Congress on the health of the economy. A sharp rise in yields on U.S. government bonds in recent days has sapped investors' appetite for riskier assets, including stocks. Shares in technology companies, which have powered the broader market higher for much of the past year, are seen as particularly vulnerable. That is because many tech companies' valuations are tied to their future earnings potential. Those profits are less valuable in today's terms when investors apply a higher discount rate.

U.K. DATA: The UK's jobless rate ticked up again in Dec to 5.1% following Nov's reading of 5.0% and coming in in line with expectations (BBG: 5.1%). Total and regular pay slowed sharply at the beginning of the crisis before it recovered towards the end of the year as bonus payments had been delayed. In real terms, total pay, at 3.8%, is now growing faster than inflation, albeit skewed by composition effects.

U.K. (BBG): "I know how incredibly tough the past year has been for everyone, and every job lost is a personal tragedy," Chancellor of the Exchequer Rishi Sunak says in an e-mailed statement on Tuesday, in response to latest unemployment figures. "That's why throughout the crisis, my focus has been on doing everything we can to protect jobs and livelihoods"". At the Budget next week I will set out the next stage of our Plan for Jobs, and the support we'll provide through the remainder of the pandemic and our recovery"

BITCOIN (BBG): Bitcoin slid Tuesday after a bout of volatility highlighted lingering doubts about the durability of the token's mesmerizing rally. The cryptocurrency fell as much as 12.5% to $48,071 and was trading below $50,000 as of 8:16 a.m. in London. At one point Monday it plunged 17% before paring the slide. Bitcoin is still up some 390% in the past year Treasury Secretary Janet Yellen and Microsoft Corp. co-founder Bill Gates were the latest to weigh into a debate over the digital coin. Gates cautioned about how investors can be swept up in manias, while Yellen said Bitcoin is a very "inefficient" way of conducting transactions. In the background are jitters that the global economic recovery from the pandemic will eventually prompt central banks to dial back easy-money policies that helped propel Bitcoin higher.

U.S.-CANADA (BBG): President Joe Biden will seek to repair relations with Canada that have been strained by disputes over trade and an oil pipeline as he meets virtually with Prime Minister Justin Trudeau on Tuesday. The two leaders plan to unveil a road map on how to improve cooperation on a range of topics, from global alliances to the coronavirus, according to a senior U.S. official, who requested anonymity to preview the meeting .As part of that effort, Biden and Trudeau will announce a forthcoming ministerial meeting on climate and the resumption of the Cross-Border Crime Forum, an annual gathering of top law enforcement officials from each country to examine ways to collaborate on counterterrorism and efforts to combat smuggling, and organized crime.

GERMANY (BBG/BI): German federal and state governments are considering not making a loosening of lockdown restrictions completely dependent on achieving a particular incident rate, Business Insider reports, citing government sources.If the incidence stays below 35 for seven days, restrictions would be loosened every two weeksThe lifting of restrictions is subject to the rate not crossing the 35 threshold after a round of loosening; the rate must stay below 35 or below for 14 days

GERMANY: German exporters are more optimistic in February with expectations rising to the highest level since September 2018, with even auto manufacturers looking at a pick-up in orders from overseas, Clemens Fuest, head of the Ifo Institute said Tuesday. Ifo's export expectations index rose to 10.7 in February, up from 7.5 seen in January, boosted mainly by China's economic recovery and by improving US production output. The chemical industry, along with manufacturers of machinery and equipment, project exports to rise sharply in coming months, with the outlook for producers of electrical equipment at the highest level since February 2018.

RIKSBANK (RTRS): A third wave of the coronavirus pandemic would not necessarily force Sweden's central bank to loosen policy again, Deputy Governor Anna Breman said on Tuesday. "I would say that the main thing with a third wave would be to keep going and carry on with the measures we are taking," she told reporters. In a speech, Breman said that should more expansive monetary policy be needed, the most likely options were a rate cut and further asset purchases.

DATA:

UK Jobless Rate Rises Further - Largest Annual Rise Since Finc'l Crisis

OCT-DEC LFS JOBLESS RATE 5.1% VS 5.0%

OCT-DEC AVG TOTAL EARNINGS +4.7% VS +3.7% PRIOR

OCT-DEC AVG EARNINGS EX-BONUS +4.1% VS +3.6% PRIOR

JAN CLAIMANT COUNT DOWN 20,000 to 2,597,100

The UK's jobless rate ticked up again in Dec to 5.1% following Nov's reading of 5.0% and coming in in line with expectations (BBG: 5.1%). The ONS noted that the unemployment rate showed the largest annual rise since the financial crisis. The employment rate edged down to 75.0%, while the inactivity rate was unchanged at 20.9% in Dec. More up-to-date PAYE data showed an increase in payrolled employees by 83,000 in Jan compared to Dec following an upwardly revised figure for Dec, hence marking the second successive increase. Since Feb 2020 there were 726,000 fewer people in payrolled employment and around three-fifth of them were under-25s according to new ONS data. The redundancy rate eased slightly in Dec to 12.3% on a quarterly basis, after rising to 14.2% in Nov. Vacancies are recovering further in Dec, rising by 64,000 on the quarter to 599,000. However, vacancies remain below the pre-crisis level. Actual weekly hours worked improved to 30.2 in Dec, up from 30.1 seen in Nov. Total and regular pay slowed sharply at the beginning of the crisis before it recovered towards the end of the year as bonus payments had been delayed. In real terms, total pay, at 3.8%, is now growing faster than inflation, albeit skewed by composition effects.

FIXED INCOME: US 10s30s moving to new highs

Bunds and gilts are under pressure again this morning (but remain above yesterday's lows) while 10-year Treasuries are largely in line with yesterday's close.

- Possibly the most interesting move of the day is the continued steepening in the US 10s30s curve. Today we reached a peak of 82.2bp according to Bloomberg generic data, not far from the 83.1bp spike seen as markets became dysfunctional in March 2020. Prior to this we would need to go back to November 2016 to see the 10s30s curve this steep.

- With the exception of UK labour market data (which should some tentatively positive signs in the real-time experimental PAYE payroll employment data), there has been little top tier first print data this morning. The highlight of the US session is probably the Conference Board consumer confidence data.

- Overall, however, focus will likely be on Powell's testimony to the Senate.

- TY1 futures are down flat today at 135-11 with 10y UST yields unch at 1.366% and 2y yields down -0.1bp at 0.112%.

- Bund futures are down -0.59 today at 174.13 with 10y Bund yields up 3.2bp at -0.308% and Schatz yields up 0.3bp at -0.690%.

- Gilt futures are down -0.45 today at 129.76 with 10y yields up 4.1bp at 0.718% and 2y yields up 1.1bp at 0.045%.

FOREX: GBP Strength Persists as Markets Endorse Path Out of Lockdown

GBP's impressive performance over the past fortnight extended further in overnight Asia-Pac trade, with GBP/USD striking a new cycle high up at $1.4098. This shifts technical targets higher, with $1.4167 the longer-term target - a key retracement of the 2016 high - 2020 low.

Focus turns to the semi-annual testimony from Fed's Powell later today, with the Fed chair appearing in front of the Senate Banking Committee at 1500GMT onwards. The Bank of Canada governor is also due to speak.

Alongside GBP strength, the USD also trades well but is still uncomfortably close to the near-term support for the USD index at 90.05. US Treasury yields are more stable relative to yesterday's open, although weakness in equities persists. The e-mini S&P is at new weekly lows, opening a gap of over 100 points with last week's all time highs.

On the data front, US consumer confidence crosses, seen showing a modest improvement from the prior reading.

EQUITIES: Tech Stocks Tumble

- Asian stocks closed mixed (Japan is closed for holidays). China's SHANGHAI closed down 6.088 pts or -0.17% at 3636.357 and the HANG SENG ended 312.81 pts higher or +1.03% at 30632.64

- European equities are lower, with the German Dax down 211.56 pts or -1.52% at 13761.95, FTSE 100 down 14.39 pts or -0.22% at 6612.15, CAC 40 down 18.48 pts or -0.32% at 5758.27 and Euro Stoxx 50 down 41.21 pts or -1.11% at 3664.23.

- U.S. futures are weaker led by Tech, with the Dow Jones mini down 57 pts or -0.18% at 31408, S&P 500 mini down 19.75 pts or -0.51% at 3853.5, NASDAQ mini down 172.75 pts or -1.31% at 13051.5.

COMMODITIES: Oil Shrugs Off Broader Weakness

- WTI Crude up $0.39 or +0.63% at $62.14

- Natural Gas down $0.04 or -1.32% at $2.917

- Gold spot down $2.87 or -0.16% at $1804.78

- Copper down $1.45 or -0.35% at $413.6

- Silver down $0.22 or -0.77% at $27.8864

- Platinum down $24.69 or -1.94% at $1248.4

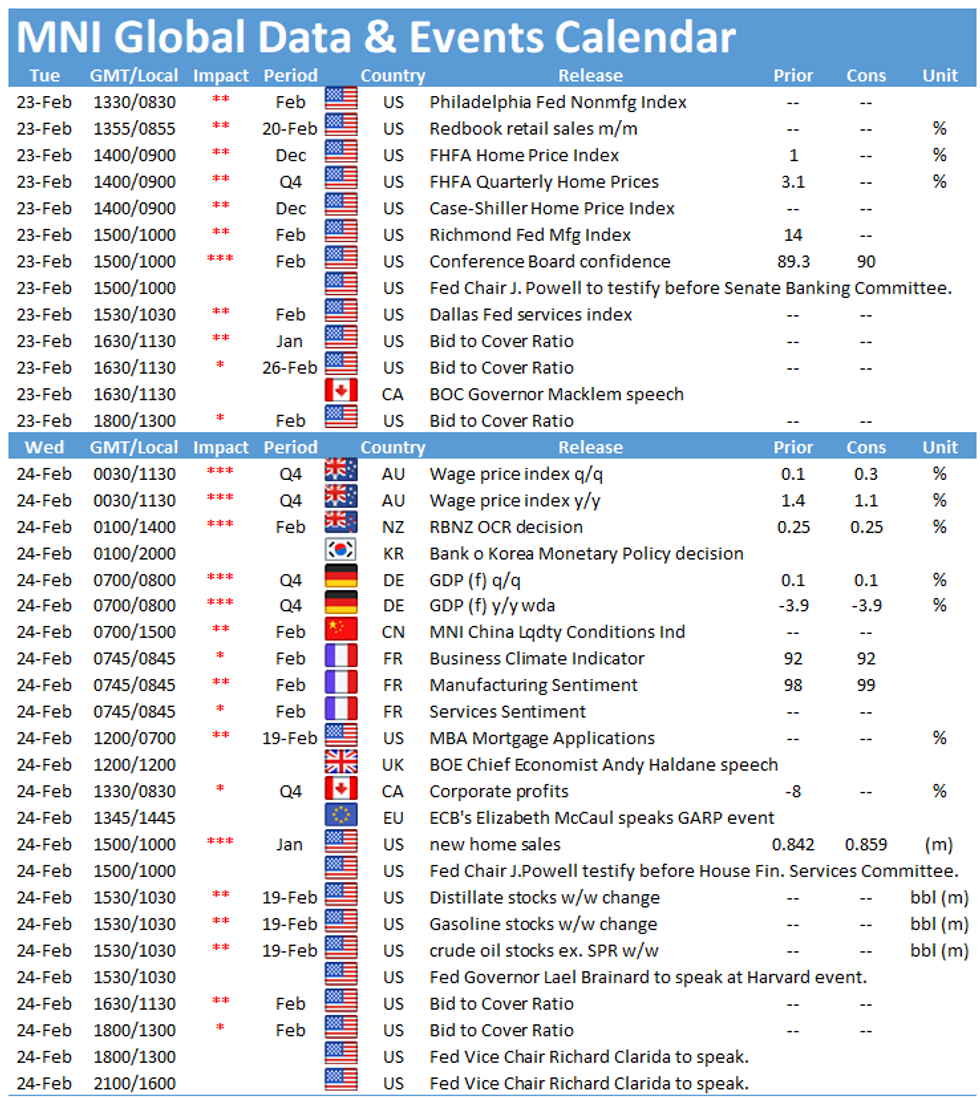

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.