-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessOfficial Doublespeak On FX Continues As USD/JPY Prints 32-Year Highs

Further gains in USD/JPY last Friday kept participants on intervention watch, as the pair took out key resistance levels on its way to 32-year highs.

- BoJ leadership were adamant that they will stick with ultra-loose monetary policy settings. Governor Kuroda reiterated his dovish message at a G30 event and his Deputy Wakatabe concurred, despite calling yen moves "rapid" and "one-sided." Central bank officials spoke the day after the MoF's FX policy czar Kanda said recent FX dynamics raise the odds of the authorities taking "bold action" to curb excessive volatility, while FinMin Suzuki said his ministry is "deeply concerned."

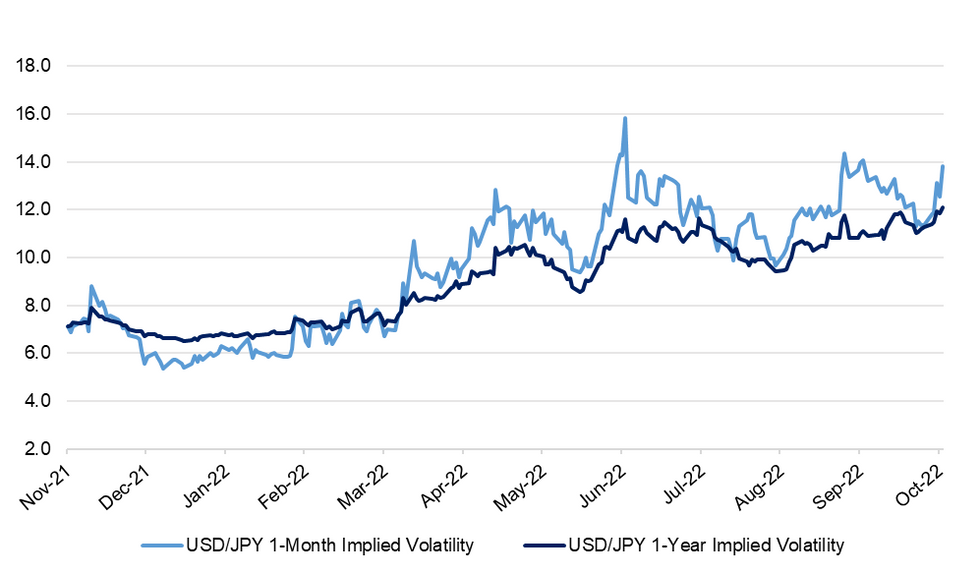

- USD/JPY implieds jumped last Friday across most maturities. One-month implied volatility sits at its best level in more than three weeks, while one-year tenor is testing its highest point since the outbreak of the COVID-19 pandemic. This occurred alongside a sharp rally in USD/JPY 1-month risk reversals towards the back end of last week.

- Leveraged funds added 6,516 net JPY shorts in the week through Oct 11, bringing net short positions to 30,843. Asset managers reduced net yen shorts by 2,509 contracts to 65.110.

- Spot USD/JPY is little changed at Y148.69, with bulls looking for an attack at the psychologically significant Y150.00 level. Bears need a fall through Oct 5 low of Y143.53 to get some initial reprieve.

- The final reading of August industrial output headlines in Japan today. BoJ Board member Adachi will speak Wednesday, trade data will cross Thursday, while national CPI will be out Friday.

Fig. 1: USD/JPY 1-Month vs. 1-Year Implied Volatility

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.