-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Inflation Insight: Softer Housing Helps Ensure Dec Cut

MNI INTERVIEW2: Poland To Push For EU Defence Fund

USD/JPY Rebounds, Correlations Stronger With US Swap Rates In Recent Sessions

USD/JPY sits comfortably above session lows. The pair last in the 143.20/25 region, only down slightly on NY closing levels from Tuesday. Recent highs sit at ~143.55. Earlier lows came at 142.75, not long after headlines crossed of the Fitch US ratings downgrade. The recovery in USD/JPY is in line with US yields moving up off earlier lows. The 10yr yield is back to 4.03%, versus earlier lows near 4.00%. US equity futures are comfortably away from earlier session lows as well, although remain in the red (Eminis last -0.234% at 4586).

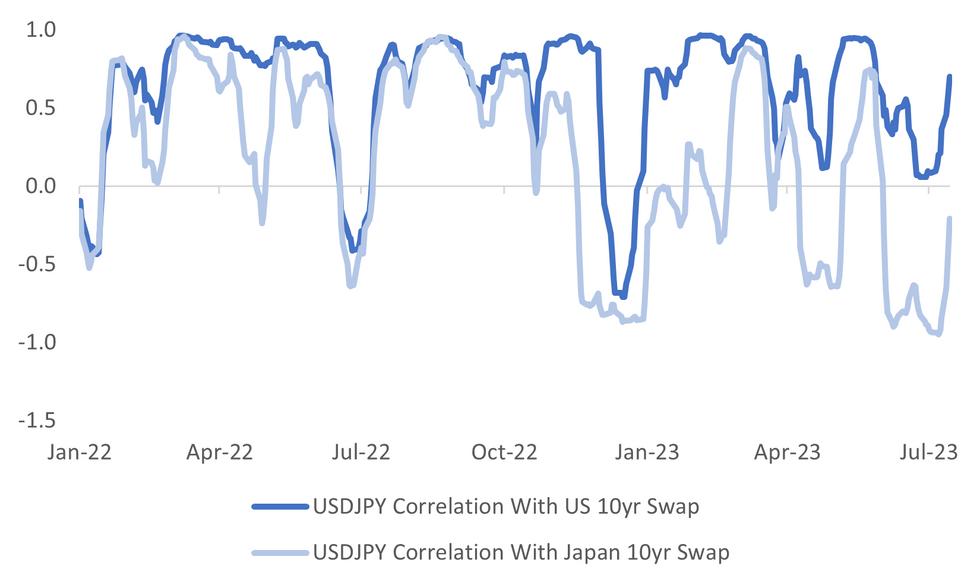

- USD/JPY correlations with US-JP 10yr swap spreads remain reasonably elevated for the past month, sitting at +68.5%. At the margin, the bigger driver of yen shifts has become the US 10yr swap rate leg, see the chart below, which plots the correlations between USD/JPY and this rate, and the equivalent correlation with Japan 10yr swap rates. Correlations with Japan 10yr swap rates have moved away from recent lows now that we are clear of the BoJ meeting.

- BoJ Deputy Governor Uchida also spoke today and emphasized that the shift last Friday on YCC was not a move away from easier policy settings. The central bank is also a long way from moving away from negative policy rates.

- We also have important US data in terms of payrolls out at the end of this week, which could skew the market focus to US rate developments.

Fig 1: USD/JPY Correlations With US & Japan 10-Year Swap Rates

Source: MNI - Market News/Bloomberg

- Interestingly, USD/JPY correlations with global equities has slipped into modestly negative territory in the past month, which goes against the historical norm of USD/JPY falling during risk-off periods of equity weakness.

- This was one avenue through yen may gain ground if we saw a period of fresh equity market weakness post the Fitch downgrade news. However, the impact appears quite muted so far, with analysts citing the fact the S&P already has a rating at that level, whilst being clear of the recent debt ceiling dramas is another offset.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.