-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessUSD/JPY Tanks After U.S. CPI, Relief Rally Ensues

Spot USD/JPY tumbled in reaction to a miss in U.S. CPI data, which prompted participants to withdraw hawkish Fed bets. Meeting-dated OIS are now pricing 52bp of tightening for the December FOMC. The yen was the main beneficiary of greenback sales, due to its sensitivity to relative yield dynamics.

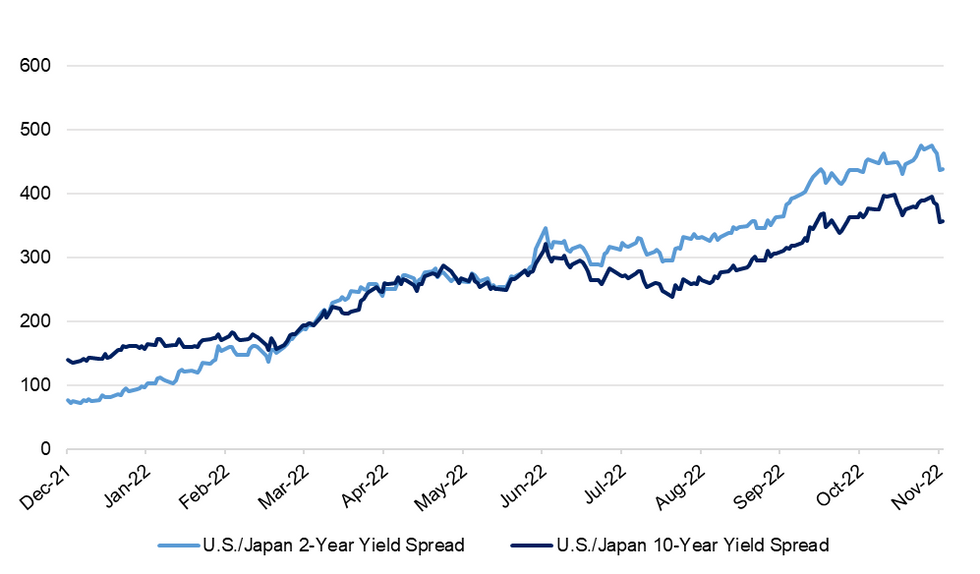

- The gap between Fed & BoJ monetary policy outlooks was a key driver of the yen's historic slump this year. Underwhelming U.S. consumer inflation data helped reign in this dynamic, which was reflected in a notable round of tightening in U.S./Japan yield spreads. 2-year yield differential shrank by 24.9bp and 10-year narrowed by 28.0bp.

- The aggressive risk rally in reaction to U.S. CPI data failed to sap strength from safe haven yen, with yield dynamics coming to the fore. The Nikkei 225 futures suggest Japanese stock market is poised for a strong re-open.

- Commenting on the latest U.S. Tsy currency report, Japan's top FX diplomat Kanda said that the Treasury largely reiterated its previous remarks on Japan and continues to see its FX policy as highly transparent. In the report, U.S. Tsy signalled its understanding for some recent FX interventions by trading partners.

- USD/JPY is catching a breather after its overnight slump and last deals at Y141.63, up 65 pips on the day. BBG cited a trader source noting that the relief rally is capped by residual NY selling. The rate hovers just above its 100-DMA after testing the water below there on Thursday.

- The next downside target is provided by Sep 22 post-intervention low of Y140.36, while bulls look for a rebound above support-turned-resistance from Oct 27 low of Y145.11.

Fig. 1: U.S./Japan 2-Year & 10-Year Yield Spreads

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.