-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN - RBA Holds, Communication Turns Slightly Dovish

MNI China Daily Summary: Tuesday, December 10

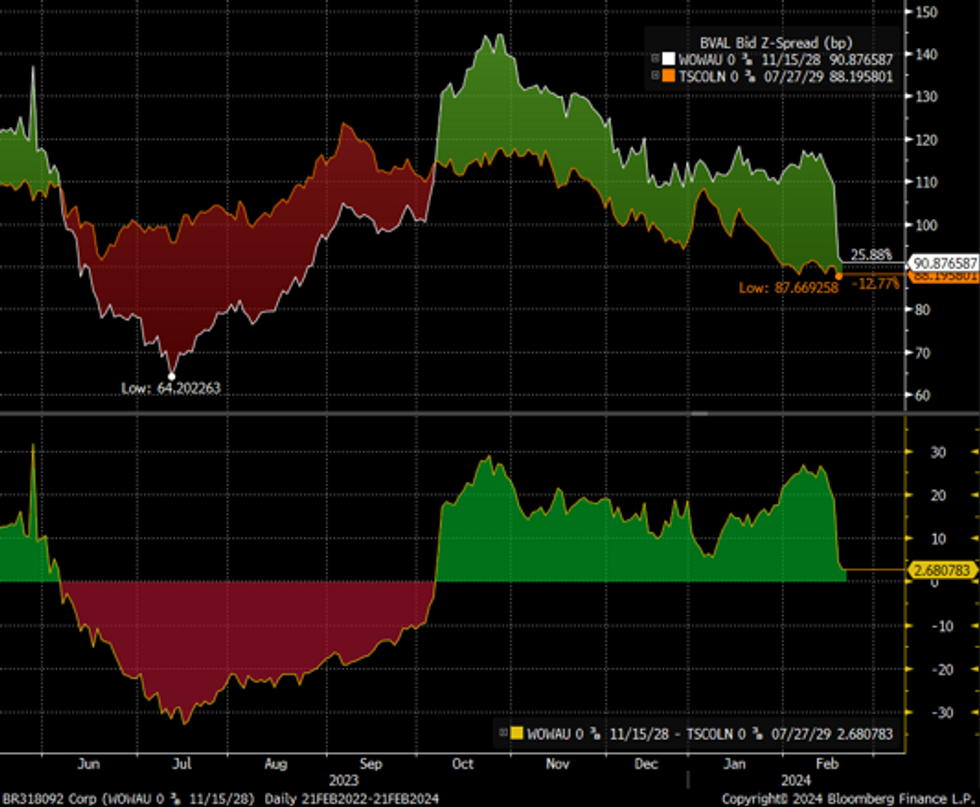

Woolworths (Baa2, BBB; S) reports in-line 1H24 results, guidance weak, CEO departs

Leverage fell from 2.6* to 2.5*, no maturities till FY25 ($400m in public debt), generated ~$1.4b in FCF - final dividend (for FY23) and repayment of lease liabilities left net $127m in cash flows over the half.

Little change in BS strategy & outlook only on easing in headline growth; "EBIT growth in H2 expected to be below H1" - some of this already in analyst forecast. CEO departure and slightly below consensus dividend likely adding to equities sell-off - stock among worst performers in €IG basket.

The single € SLB 28's have tightened significantly since we flagged it as cheap ~2 weeks ago - it was at +110 then and has moved to +91 now (b/a was 8 wide). We don't see a firm skew for it to move tighter from here & focus after CEO resignation seems to be shifting to the continuing senate inquiry into pricing from the 2 major grocers (Woolies & Coles) -no regulation change as of yet (inquiry launched in early Dec) & as noted in earnings call seems to be shared impact for now; "inquiry has led to a material drop in overall reputation and brand NPS scores for the major supermarket chains in Australia". Mmgt downplayed any link to the CEO departure; “We started the process really last year,”

Equity takes; {NSN S96KLET0G1KW <GO>}

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.