-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessGold Lower As 18-Month Run Of Official Chinese Buying Comes To An End

Gold pulls lower as monthly reserve data reveals a flatlining in China's gold holdings in May, bringing an end to an 18-month run of buying from the Chinese authorities

- Chinese gold purchases were seen as a major driver of the gold rally over that period, with official Chinese holdings increasing from ~62.6mn/oz in October ’22 to ~72.8mn/oz.

- Plenty of other EM nations also increased their exposure to gold over that horizon, with the global inflationary shock and a want to be less exposed to U.S sanctions touted as the key drivers of that demand.

- Elsewhere, many pointed to a de-dollarization angle, as various countries looked to become less reliant on the USD via bilateral and multi-lateral trade agreements. The USD is incrementally firmer in the wake of the Chinese data.

- Some had also pointed to the increase in Chinese metal holdings as potential signal of an imminent CNY devaluation.

- It will be interesting to see how broader EM official gold holdings evolve in the coming months, with one of the big buyers of bullion potentially having to be replaced from a flow perspective (if Chinese purchases do not resume).

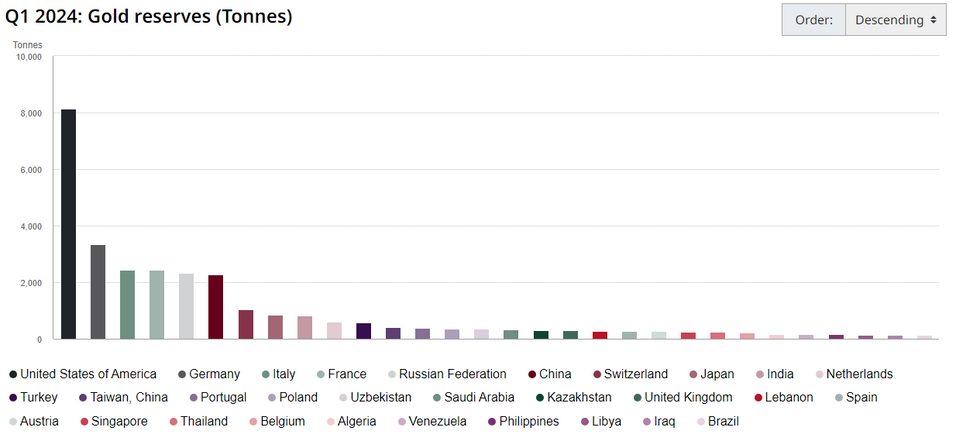

- Note that Russia has the 5th largest official reserve holdings of gold globally, while China has the 6th last holdings (per World Gold Council Data as of end Q124).

- Technicals for gold remain unchanged although spot has looked below yesterday’s lows, last a little above $2,350/oz.

- A short-term technical bear cycle has been identified, with next support at the 50-day EMA ($2,314.5/oz).

Source: World Gold Council

Source: World Gold Council

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.