-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI POLITICAL RISK - Trump's First Post Election Interview

MNI POLITICAL RISK ANALYSIS - Week Ahead 9-15 Dec

MNI ASIA MARKETS ANALYSIS: Fed Out of Blackout Friday

US TSYS: Bond Weak Through Second Half, Yield Curves Off Inversion

Tsys holding mixed levels after the close, yield curves steeper with bonds trading weaker through the second half, finishing near lows. Note: 5s30s inverted (recession flag) first time since first time since 2007 yesterday (-1.823 low) finished Thu +2.668 at 2.447; 5s30s bounced 4.267 to 31.280.

- Fed policy in rear view mirror while markets still digesting forward guidance: (1.9% FF end of '22, 2.8% FF end of '23) Eurodollar short end futures firmer after EDZ2-EDH3 down as much as -0.23 Wed).

- Back to Russia/Ukraine headline risk a constant source of market volatility. Markets keyed in on peace talk progress -- or not: stocks gapped lower/Tsys gained recently after headlines that Kremlin called reports of peace talk progress "incorrect".

- Friday data roundup, at 0830ET:

- Existing Home Sales (6.5M, 6.18M)

- Existing Home Sales MoM (6.7%, -5.0%)

- Leading Index (-0.3%, 0.3%)

- Fed speakers out of Blackout:

- MN Fed Kashkari on capital, energy sectors at 1200ET

- Richmond Fed Barkin economic outlook at 1320ET

- Fed Gov Bowman, Fed listens event: Helping Youth Thrive at 1400ET

- Meanwhile, President Joe Biden and his Chinese counterpart Xi Jinping will hold a telephone call on Friday, time TBA.

- The 2-Yr yield is down 0.2bps at 1.9364%, 5-Yr is down 1.7bps at 2.1642%, 10-Yr is up 0.7bps at 2.1921%, and 30-Yr is up 3.4bps at 2.4864%.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N +0.24571 at 0.32600% (+0.24671/wk)

- 1 Month -0.01900 to 0.44857% (+0.05200/wk)

- 3 Month -0.02028 to 0.92786% (+0.10186/wk) ** Record Low 0.11413% on 9/12/21

- 6 Month +0.01772 to 1.27443% (+0.14386/wk)

- 1 Year +0.06042 to 1.77571% (+0.17971/wk)

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.08% volume: $74B

- Daily Overnight Bank Funding Rate: 0.07% volume: $260B

US TSYS: Repo Reference Rates

- Secured Overnight Financing Rate (SOFR): 0.05%, $1.016T

- Broad General Collateral Rate (BGCR): 0.05%, $375B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $364B

- (rate, volume levels reflect prior session)

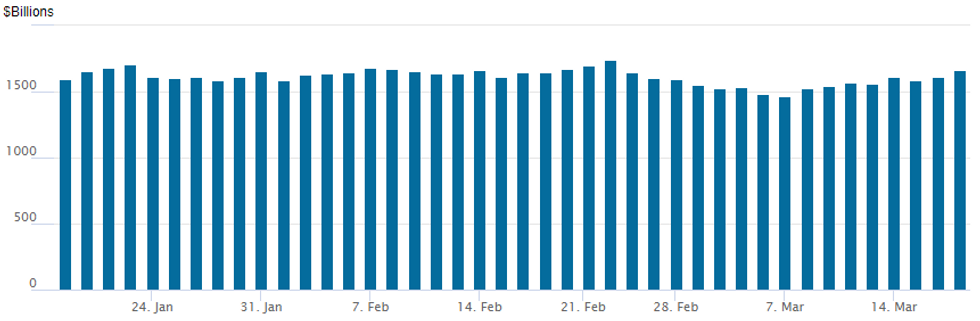

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to highest since Feb 24 at $1,659.977B w/ 86 counterparties vs. $1,613.637B prior session -- remains well off all-time high of $1,904.582B on Friday, December 31.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

FI call option volumes surged early Thursday as underlying rates (particularly the short end) rebounded from Wednesday's post-FOMC sell-off. Markets continued to digest the Fed's forward guidance -- deemed less hawkish as initially thought with short end Eurodollar futures (EDM2) climbing +0.085 by the close to 98.565.Trade highlights listed below included a buy of 12,000 Jun 98.62/98.75/98.81/99.06 broken call condors at 1.0, and a Block/cross of +19,900 Dec 98.75/99.00 call spds, 2.5 vs. 97.77/0.05. Targeting a rebound in mid-2025 sector, paper bought 8,000 Blue Jun 98.50/99.00 call spds, 1.5.

Treasury options saw varied buying in June and May 10Y calls through the day with paper buying 15,000 TYK 126.5 calls at 19 vs. 124-21/0.22% and 10,000 TYK 126 calls, 27 coming into the session.

SOFR Options:

Block, +5,000 SFRM2 98.50/98.75 put spds, 7.0 at 0858:50ET

Eurodollar Options:

- Block, +19,900 Dec 98.75/99.00 call spds, 2.5 vs. 97.77/0.05%

- +8,000 Blue Jun 98.50/99.00 call spds, 1.5

- +20,000 Jul 97.25/97.50 put spds, 2

- +20,000 Sep 97.50/97.75/98.00 put flys, 3.5

- Overnight trade

- +12,000 Jun 98.62/98.75/98.81/99.06 broken call condors, 1.0

- +9,100 short May 97.12/97.37 strangles, 29.0 ref 97.32

- 2,500 TYJ 123.75 put spds, 11

- +5,000 FVK 115 puts, 15

- 2,000 FVK 116.25/117.25/117.75 broken call flys

- 2,500 TYM 127 calls, 29

- -5,000 TYK/TYM 124.5 straddle calendar spds, 45

- +5,000 FVK 114.75/115.75 put spds, 17.5

- 6,800 TYM2 131.5 calls, 5

- 5,000 TYM 123/125 put spds, 38

- Overnight trade

- Block, +15,000 TYK 126.5 calls, 19 vs. 124-21/0.22%

- +10,000 TYK 126 calls, 27

- +15,000 TYJ 122/123 put spds, 4 vs. 124-13 to -16/0.07%

- Blocks, -13,000 TYK 125 puts, 1-02 to 1-13/0.22%

EGB Options: Put Spread Sellers, Put Condor Buyers

Thursday's Europe rates/bond options flow included:

- RXM2 160/158ps 1x1.5, sold at 22 and 21.5 in 2k

- RXM2 160/157ps 1x1.5, sold at 54.5 in 1k

- OEM2 131.50/130.50/129.50/128.50 p condor sold at 32 in 1k

- OEM2 131.50/130.50/128.50/127.50p condor sold at 43 in 2k

- DUJ2 111.20/111.00/110.80p fly, sold at 3.5 in 2k

- ERZ2 100.37/100.50/100.625c fly, bought for 1.25 in 2k

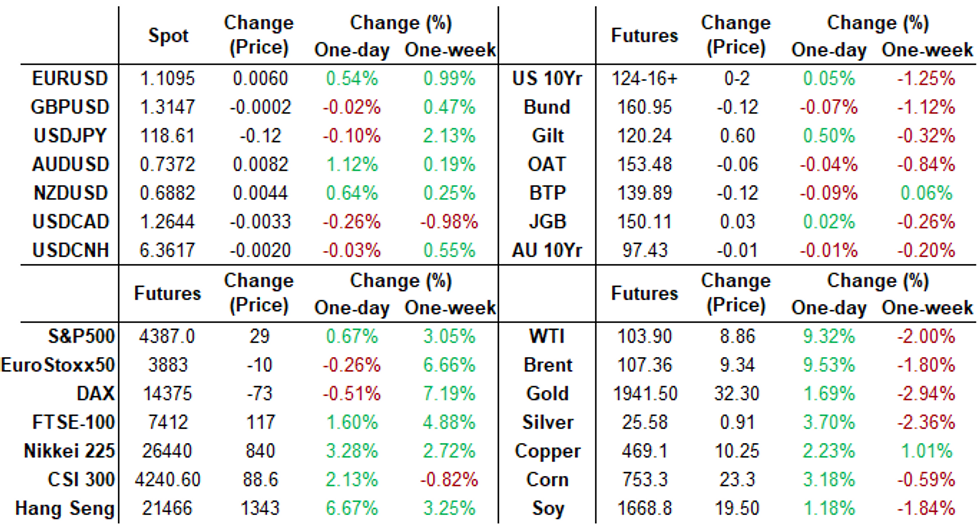

FOREX: USD Continues To Trade With Heavy Tone Amid Buoyant Equities

- The greenback continued on a downward trajectory on Thursday after faltering late Wednesday following the FOMC March decision/press conference.

- The substantial 3.5% bounce in S&P 500 futures has weighed on the dollar indices, while underpinning the likes of the Euro, Aussie and Kiwi.

- AUDUSD leads G10 performance on Thursday, rising a solid 1.2%. The pair has defined a key short-term support at 0.7165, the Mar 15 low with the strong reversal from this point signalling a possible resumption of the uptrend that started Jan 28. The extension to the upside has breached 0.7368, Mar 10 high and now targets 0.7441, the Mar 7 high and technical bull trigger.

- The underperformer amid the greenback weakness has been GBP following a more dovish reaction in markets to the Bank of England decision. The BoE said it was raising its policy rate by 25 basis points to 0.75% on Thursday but softened the move with gentler policy guidance and a warning that inflation down the track could undershoot by even more than it had previously expected.

- While cable gave up early gains to remain broadly unchanged on the session, EURGBP managed to gain traction to the upside. The cross has recently broken above a key resistance of 0.8406, the Feb 25 high. This has strengthened the short-term bullish condition and signals scope for an extension towards the next resistance at the early February highs of 0.8478.

- Worth noting EURUSD gradually climbed above 1.11 throughout NY trade and in doing so, temporarily breached its key short-term resistance of 1.1121 - the Jan 28 low, a recent breakout level plus the Mar 10 high. This suggests scope for a stronger correction, initially targeting the 50-day EMA around the 1.12 mark.

- Overnight sees the Bank of Japan decision. The BoJ will leave its policy settings unchanged at its March meeting, with the uncertainty surrounding the Russia-Ukraine conflict and the resultant spiral in global energy prices set to produce increased focus on downside risks, if not a downgrade to the Bank’s overall economic view.

- Canada retail sales and US existing home sales round off the week’s economic data releases.

FX: Expiries for Mar18 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0945-50(E673mln), $1.1000-10($516mln), $1.1100-10(E1.3bln), $1.1200(E618mln)

- USD/JPY: Y116.90-00($1.6bln), Y117.50($520mln), Y119.00($505mln)

- EUR/GBP: Gbp0.8445-50(E850mln), Gbp0.8500(E679mln)

- USD/CNY: Cny6.3290($530mln), Cny6.3500($600mln)

Late Equity Roundup: Finishing Strong

Stocks looking to finish out the session near highs despite crude trading above 100.0 again (WTI +$8.7 (9.15%) at $103.76) that has been a sell trigger for stocks earlier in week, Gold higher/off highs (+$9.86 (0.51%) at $1937.46).

- SPX eminis currently trading +49.5 points (1.14%) at 4398.25. SPX leading/lagging sectors: Energy sector extends lead (+3.5%) on the back of crude bounce, amid broad swath of oil drillers, refiners and distributor share outperforming.

- Materials sector (+1.64%) and Consumer Discretionary (+1.59%) outpacing Real Estate sector (+1.04%) in second the half, w/ metals/mining and chemicals shares leading. Consumer Discretionary sees strong gains from autos and retailing.

- Laggers: Information Technology (+0.58) with hardware, software and semiconductors under pressure (AMD -3.87% at 110.91 after strong Wed gains).

- Dow Industrials: +359.27 points (1.05%) at 34423.53: Leaders/Laggers: United Health extends gain to +6.45 at 504.71; American Express (AXP) +5.21 at 185.82, Laggers: Microsoft -0.91 at 293.44 and McDonalds -1.84 at 236.44 -- off lows

- RES 4: 4730.50 High Jan 1

- RES 3: 4663.50 High Jan 18

- RES 2: 4578.50 High Feb 9 and a key resistance

- RES 1: 4397.83 50-day EMA

- PRICE: 4328.75 @ 13:37 GMT Mar 17

- SUP 1: 4129.50/4094.25 Low Mar 15 / Low Feb 24 and a bear trigger

- SUP 2: 4055.60 Low May 19 2021 (cont)

- SUP 3: 4029.25 Low May 13 2021 (cont)

- SUP 4: 3983.25 1.00 proj of the Jan 4 - 24 - Feb 9 price swing

COMMODITIES: Oil Rebounds On Peace Talks Gap

- Oil prices have moved higher through the day and sit ~9% higher as both the Kremlin and Western officials have pointed to a notably larger gap between Russia and Ukraine in peace talks than thought yesterday.

- This reversal in progress comes on the back of the IEA saying yesterday that Russian oil supply could fall by 3million bbls/day in the coming weeks, driving sizeable increases across the curve.

- WTI +8.9% at $103.46 as it moves closer towards initial resistance at $110.29 (Mar 11 high) whilst support is seen at the 50-day EMA of $93.52.

- On a subdued day for volumes, the most active strikes have been in $100/bbl puts followed by $105/bbl calls.

- Brent is +9.3% at $107.16, also moving closer to initial resistance at $113.91 (Mar 11 high) whilst support at yesterday’s low of $96.93 remains intact.

- Gold is +0.65% at $1939.7, sitting above support at $1895.3 (Mar 15 low) and resistance at $2009.2 (Mar 10 high).

Friday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 18/03/2022 | 0700/0800 | ** |  | SE | Unemployment |

| 18/03/2022 | 1000/1100 | * |  | EU | Trade Balance |

| 18/03/2022 | 1230/0830 | ** |  | CA | Retail Trade |

| 18/03/2022 | 1400/1000 | *** |  | US | NAR existing home sales |

| 18/03/2022 | 1720/1320 |  | US | Richmond Fed's Tom Barkin | |

| 18/03/2022 | 1800/1400 |  | US | Chicago Fed's Charles Evans | |

| 18/03/2022 | 1800/1400 |  | US | Fed Governor Michelle Bowman |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.