-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI POLITICAL RISK - Trump's First Post Election Interview

MNI POLITICAL RISK ANALYSIS - Week Ahead 9-15 Dec

MNI ASIA MARKETS ANALYSIS: 5Y Yields Top 3.0% Briefly

US TSYS: Labor Market Unsustainably Hot

Rates finish weaker Thursday, well off midday lows to near middle of the range. Yield curves bear flattened (2s10s -2.373 at 22.675 vs. 20.661 low) after a brief steepening period in the first half as bonds extended session lows around midday (30YY taps 2.9845% high).

- Of note: 5YY climbed over 3.0% to 3.0123% high - last seen in Nov 2018.

- Little react to weekly claims at 184k, 2k less than est, continuing claims 1.417M some 58k lower than est.

- Late Fed speak: Fed Chairman Powell comments, while hawkish, weren't exceedingly so as he intimated 50bp is on the table for May 4 FOMC. Powell did say labor market is "unsustainably hot". Markets pricing in two additional 50 bps through June and July meetings.

- StL Fed Bullard also weighing in on hikes: the "world would not come to an end" if Fed anncd a 75bp hike. That said, Bullard expressed sentiment the "bond market is not looking like a safe place to be" while the Fed "should avoid disruptions from surprise market moves."

- No scheduled Fed speakers for Friday as yet - but like SF Fed Daly interview on Yahoo Finance today, there is a good chance of more popping up ahead policy blackout that starts late Friday.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements- O/N -0.00457 to 0.32643% (-0.00343/wk)

- 1M +0.03629 to 0.66786% (+0.07343/wk)

- 3M +0.04771 to 1.18400% (+0.12129/wk) ** Record Low 0.11413% on 9/12/21

- 6M +0.04700 to 1.72157% (+0.16486/wk)

- 12M +0.07157 to 2.44043% (+0.21886/wk)

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.33% volume: $71B

- Daily Overnight Bank Funding Rate: 0.32% volume: $258B

US TSYS: Repo Reference Rates

- Secured Overnight Financing Rate (SOFR): 0.27%, $912B

- Broad General Collateral Rate (BGCR): 0.30%, $345B

- Tri-Party General Collateral Rate (TGCR): 0.30%, $330B

- (rate, volume levels reflect prior session)

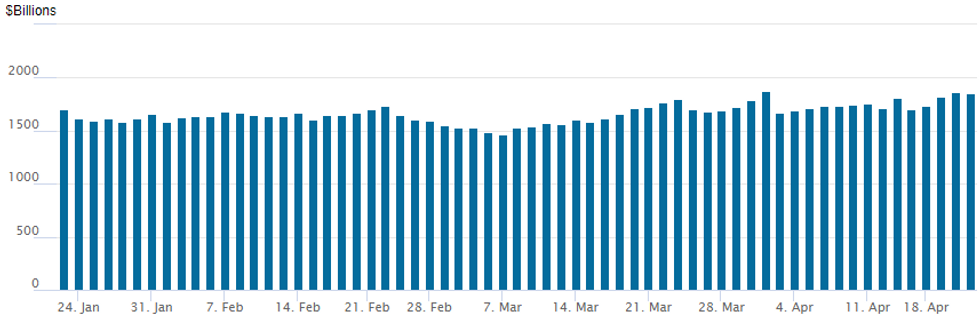

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage receded to 1,854.700B w/ 80 counterparties from prior session 1,866.560B. Compares to all-time high of $1,904.582B on Friday, December 31.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

Rate hike insurance/put buying gained momentum Thursday as rates sold off consistently through the session, yield curves bear flattening after a brief steepening period in the first half as bonds extending session lows (30YY taps 2.9845% high). Impressive moves had rates back to middle of the week's range. Curve flattening resumed as inflation expectations climbed.- Put buying strong with short end prices in more hikes. Fed Chairman Powell comments, while hawkish, weren't exceedingly so as he intimated 50bp is on the table for May 4 FOMC. Markets pricing in two additional 50 bps through June and July meetings.

- One-two punch with StL Fed Bullard weighing in on hikes: the "world would not come to an end" if Fed anncd a 75bp hike. That said, Bullard expressed sentiment the "bond market is not looking like a safe place to be" while the Fed "should avoid disruptions from surprise market moves."

- Salient trade included buy of 10,000 Sep Eurodollar 96.50/96.75/97.00 put flys w/ Dec 96.12/96.37/96.62 put flys, 6.5 total on the package. In SOFR options, paper bought 15,000 SFRU2 97.06/97.43/97.81 put flys 2.25 over 98.37 calls. Treasury option volume was more muted, but paper bought 4,200 USM 132/134/136/138 put condors and 10,000 TYM 115.5/117.5 3x2 put spds, 38 ref 118-29.5.

- +15,000 SFRU2 97.06/97.43/97.81 put flys 2.25 over 98.37 calls

- +10,000 Sep 96.50/96.75/97.00 put flys w/ Dec 96.12/96.37/96.62 put flys, 6.5 total

- Block, 10,900 Sep 98.00/98.50 call spds w/ 97.00/97.50 put spds, 26.5 total

- +15,000 Jun 98.00/98.12/98.25 put flys, 2.75

- +7,000 Jul 97.12/97.37 2x1 put spds, 1.5

- +1,500 May 98.12 puts, 2.75 vs. 98.25/0.25%

- +5,000 short May 96.50/96.75 2x1 put spds, 2.5

- +5,000 short Aug 96.50/96.75 2x1 put spds, 2.5

- Overnight trade

- +10,000 Sep 96.62 puts, 5.0 vs. 96.48/0.12%

- +2,500 Jun 97.87/98.00 put spds, 1.25 ref 98.215

- 3,000 May 98.00 puts, 1.0

- 7,500 Jun 98.31 puts

- 4,200 USM 132/134/136/138 put condors

- +10,000 TYM 115.5/117.5 3x2 put spds, 38 ref 118-29.5

- +3,000 FVN 116 calls, 6

- Overnight trade

- 5,300 TYK 119.5/120 call spds vs 118.75 puts

- 13,000 TYK 118 puts, 2

FOREX: US Yields/Equities Weigh On Antipodean FX, CNY Continues Slide

- Initially On Thursday, the USD Index extended on the prior day’s declines, exacerbated by a firm rally in the Euro. EURUSD rose from 1.0825 to a high print of 1.0936 in early European trade. This prompted the DXY to retreat a further 0.5% and briefly trade back below 100

- However, during the US session, continued upward pressure on US yields and equities extending to fresh session lows lent support to the greenback which recovered to print fresh highs for the day.

- EURUSD fell roughly 90 pips off the earlier highs, narrowing the gap with the intra-day low at 1.0824.

- In similar vein, USDJPY made fresh session highs above 128.64. Short-term pullbacks - as seen on Wednesday - may prove technically corrective. Recent activity reinforces underlying bullish conditions and signals potential for a continuation of the bull cycle, with the focus on 129.40/44, yesterday’s high as well as a Fibonacci projection.

- The weakness in major equity benchmarks weighed on the likes of AUD and NZD, both falling around 1% and were the main underperformers. Despite the notable intra-day shift, both pairs simply erased the entirety of yesterdays gains and spot prices reside close to the week’s opening levels.

- The last few days were marked by some significant moves in the CNY, with USDCNY breaking above the key 200DMA and probing resistance at the 6.45 level. The 200DMA has historically acted as a strong resistance; therefore, the bull trend could extend further in the near term following the recent breakout.

- Approaching the APAC crossover, markets will turn their focus to a swathe of flash manufacturing and services PMIs, first for Australia and Japan before key European readings. Canadian retail sales will also be published before further comments at the IMF spring meetings from BOE Governor Andrew Bailey.

FX: Expiries for Apr22 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0700(E814mln), $1.0850(E640mln), $1.0900(E1.4bln), $1.0925-30(E554mln)

- GBP/USD: $1.2900(Gbp1.1bln), $1.3000(Gbp1.2bln)

- USD/CAD: C$1.2500($514mln), C$1.2540-60($1.2bln)

- USD/CNY: Cny6.4000($529mln)

EQUITIES: Late Equity Roundup: Trading Heavy

Stocks have reversed midmorning gains, trading weaker/near session lows after the FI close -- even as Tsy yields retreated from midday highs through the second half with several small program sales noted.

- SPX emini futures, ESM2 currently -59.0 (-1.3%) at 4396.50 after hitting 4508.0 before 1000ET. Focus turned to key support of 4355.50 Low Apr 18 and the bear trigger.

- Earnings after the close: PPG, XM, SAM, SVP, SNAP. Pre-open: AAL record 2Q revs on soaring demand, ATT EPS 0.77 vs. 0.69 est, Dow Inc. net income +$1.57B.

- SPX leading/lagging sectors: Consumer Staples managed to outperform (+0.13%) lead by food, beverage and tobacco shares.

- Consumer Discretionary had been leading the session receded (-1.27%), autos still leading but well off highs, notably Tesla (2.69% from +8.93% earlier after earnings beat of $3.22/share vs. $2.26 est late Wed. Elon Musk making waves again re: seeking financing for Twitter bid.

- Laggers: Energy sector retreated late (-3.35%) edging Communication Services (-2.45%) as media/entertainment lags: Meta (FB) -6.82%, Warner Bros (WBD) -6.17%, DISH -4.80%.

- RES 4: 4663.50 High Jan 18

- RES 3: 4631.00 High Mar 29 and a key resistance

- RES 2: 4588.75 High Apr 5

- RES 1: 4519.75 High Apr 8

- PRICE: 4391.00 @ 1545ET Apr 21

- SUP 1: 4355.50 Low Apr 18 and the bear trigger

- SUP 2: 4321.07 61.8% retracement of the Mar 15 - Mar 29 rally

- SUP 3: 4247.89 76.4% retracement of the Mar 15 - Mar 29 rally

- SUP 4: 4129.50 Low Mar 15

S&P E-Minis firmer early as the contract extends this week’s gains. The move higher refocuses attention on initial resistance at 4519.75, the Apr 8 high. Clearance of this level would signal potential for a stronger recovery, and open 4588.75, the Apr 5 high Current gains are still considered corrective. The bear trigger is at 4355.50, Apr 18 low where a break would resume recent bearish activity.

COMMODITIES: Oil Shifts Higher As Supply Fears Outweigh Demand Concerns

- Oil prices are currently up just over 1.5% in a volatile session, but one where persistent supply risks are seen outweighing China demand concern resulting from lockdowns.

- Part of the supply risks stem from Russia, with April oil output down 0.9mln bpd from March to 10.1mln bpd.

- WTI is +1.7% at $103.93, sitting marginally closer to resistance at $109.2 (Apr 18 high) than support at $97.37 (50-day EMA).

- Interestingly, the most active strikes in the Jun’22 contract have been $80/bbl puts.

- Brent is +1.6% at $108.5 with resistance eyed at $114.84 (Apr 18 high) and support at $104.65 (Apr 20 low).

- Gold is currently rallying but nevertheless is down -0.3% at $1951.81, hurt by another step higher in US Treasury yields. Technicals are unchanged: support is the 50-day EMA of $1926.5 whilst resistance remains the bull trigger of $1998.4 (Apr 18 high).

Friday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 22/04/2022 | 2301/0001 | ** |  | UK | Gfk Monthly Consumer Confidence |

| 22/04/2022 | 2330/0830 | *** |  | JP | CPI |

| 22/04/2022 | 0030/0930 | ** |  | JP | IHS Markit Flash Japan PMI |

| 22/04/2022 | 0600/0700 | *** |  | UK | Retail Sales |

| 22/04/2022 | 0715/0915 | ** |  | FR | IHS Markit Services PMI (p) |

| 22/04/2022 | 0715/0915 | ** |  | FR | IHS Markit Manufacturing PMI (p) |

| 22/04/2022 | 0730/0930 | ** |  | DE | IHS Markit Services PMI (p) |

| 22/04/2022 | 0730/0930 | ** |  | DE | IHS Markit Manufacturing PMI (p) |

| 22/04/2022 | 0800/1000 | ** |  | EU | EZ Current Acc |

| 22/04/2022 | 0800/1000 | ** |  | EU | IHS Markit Services PMI (p) |

| 22/04/2022 | 0800/1000 | ** |  | EU | IHS Markit Manufacturing PMI (p) |

| 22/04/2022 | 0800/1000 | ** |  | EU | IHS Markit Composite PMI (p) |

| 22/04/2022 | 0830/0930 | *** |  | UK | IHS Markit Manufacturing PMI (flash) |

| 22/04/2022 | 0830/0930 | *** |  | UK | IHS Markit Services PMI (flash) |

| 22/04/2022 | 0830/0930 | *** |  | UK | IHS Markit Composite PMI (flash) |

| 22/04/2022 | - |  | EU | ECB Lagarde & Panetta in IMF/World Bank Meetings | |

| 22/04/2022 | 1300/1500 |  | EU | ECB Lagarde Speech at Peterson Institute | |

| 22/04/2022 | 1345/0945 | *** |  | US | IHS Markit Manufacturing Index (flash) |

| 22/04/2022 | 1345/0945 | *** |  | US | IHS Markit Services Index (flash) |

| 22/04/2022 | 1430/1530 |  | UK | BOE Bailey Panels IMF Event |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.