MNI ASIA MARKETS ANALYSIS: 50Bp Cut Positioning Cools Slightly

- Treasuries drifted higher amid ongoing speculation over more than a 25bp rate cut from the FOMC Wednesday

- Curves bull steepened most of the session, 2s10s climbing to new 3+ year high of 9.809 in the first half, before intermediate to long end rates outperformed in the second half, 2s10s flattening -.909 after the bell to 5.775.

- Projected rate hikes through year end look largely steady vs. early morning levels (*) : Sep'24 cumulative -41.0bp (-40.6bp), Nov'24 cumulative -78.2bp (-79.1bp), Dec'24 -119.8bp (-120.0bp).

- Focus turns to Retail Sales early Tuesday.

US TSYS Late Curve Consolidation

- Treasuries continued to gain Monday, amid ongoing speculation over more than a 25bp rate cut from the Fed at this Wednesday's FOMC policy announcement (including the Fed's Summary of Economic Projections).

- Tsy curves initially bull steepened to new 3+ year highs in the first half (2s10s 9.809), before reversing course (2s10s -.909 at 5.775) in the second half as intermediate to long end bonds outperformed.

- Dec'24 10Y climbed to 115-19.5 high (+6), 30s +17 at 127-08. TYZ4 still shy of initial technical resistance at 115-23.5 (high Sep 11).

- Carry-over support in underlying futures (SFRU4 +.025 at 95.17; SFRZ4 +0.035 at 96.00) remains strong as speculation over more than a 25bp rate cut Wednesday. Projected rate hikes through year end look largely steady vs. early morning levels (*) : Sep'24 cumulative -41.0bp (-40.6bp), Nov'24 cumulative -78.2bp (-79.1bp), Dec'24 -119.8bp (-120.0bp).

- Note, huge large SOFR steepener blocked at 1004:31ET - position supporting more aggressive rate cut guidance from the Fed, before moderating policy in Q1 '26: +81,500 SFRH5 96.62, post time offer vs. -81,500 SFRH6 97.175, sell through 97.19 post time.

- Focus turns to Tuesday's Retail Sales precedes Wednesday's FOMC annc at 1400ET.

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M -0.06844 to 5.01429 (-0.02711 total last wk)

- 3M -0.07781 to 4.86337 (-0.01346 total last wk)

- 6M -0.09743 to 4.48149 (-0.01307 total last wk)

- 12M -0.10352 to 3.88833 (-0.06175 total last wk)

- Secured Overnight Financing Rate (SOFR): 5.33% (+0.00), volume: $2.232T

- Broad General Collateral Rate (BGCR): 5.32% (+0.01), volume: $810B

- Tri-Party General Collateral Rate (TGCR): 5.32% (+0.01), volume: $779B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $105B

- Daily Overnight Bank Funding Rate: 5.33% (+0.00), volume: $257B

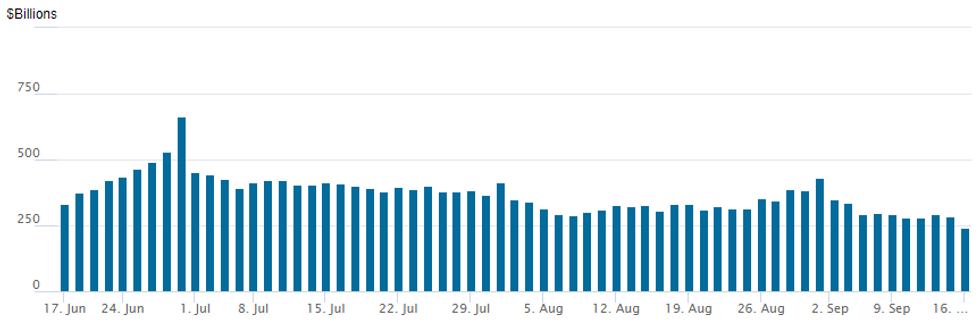

FED Reverse Repo Operation: New Lows

NY Federal Reserve/MNI

RRP usage falls to new 3+ year low at $239.386B from $284.951B last Friday. Compares to last Wednesday, September 11 multi-year low of $279.215B (early May 2021 levels). Number of counterparties falls to new low of 44 from 62 on Friday.

US SOFR/TREASURY OPTION SUMMARY

Better SOFR option volume on the week opener, option desks reported some larger position unwinds strike adjustments in the lead-up to this Wednesday's FOMC policy annc. Carry-over support in underlying futures (SFRU4 +.025 at 95.17; SFRZ4 +0.035 at 96.00) remains strong as speculation over more than a 25bp rate cut Wednesday. Projected rate hikes through year end look largely steady vs. early morning levels (*) : Sep'24 cumulative -41.0bp (-40.6bp), Nov'24 cumulative -78.2bp (-79.1bp), Dec'24 -119.8bp (-120.0bp).

SOFR Options:

-5,000 SRZ4 95.62/95.87 2x1 put spds with 95.18/95.81 2x1 put spd strip, collecting 8.5-8.25 on double sale

over -80,000 SFRH5 96.75/97.50/97.75/98.50c condor, 12.0 to 12.25 ref 96.63

Block, 8,162 SFRH5 96.75/97.75 call spds, 19.5 vs. 96.64/0.28%

-5,000 SFRZ4 94.81 calls, 117.5 vs. 95.99/1.00%

-12,000 SFRM5 97.00/97.50 call spds, 16.75 ref 96.985

+5,000 SFRH5 97.00/98.00 call spds vs 0QH5 98.00/99.00 call spds 5.5

+15,000 SFRZ4 95.81/95.93/96.12 put trees 1.00 to 1.25 ref 9600

+5,000 SFRZ4 95.62/95.75/95.87 put flys 1.75 ref 96.00

+5,000 SFRV4 95.75/96.00/96.25 call flys 8.0 ref 96.01

-7,000 SFRZ4 95.75 puts 5.25 over 96.25/96.37 call spds ref 96.005

Block, 15,000 SFRZ4 96.25/96.37 call spds 2.5

Block, +10,000 SFRX4 96.25/96.37 call spds, 2.25 ref 96.005

4,000 SFRZ4 96.50 calls ref 95.99

4,000 2QZ4 96.50/96.87 put spds ref 97.135

2,000 SFRX4 96.25/96.50/96.62 broken call flys ref 95.985

4,000 SFRV4 95.68/95.75 put spds vs 0QV4 96.62/96.75 put spds

10,000 SFRV4 96.00/96.12/96.18/96.31 call condors ref 95.99 to -.985

7,000 SFRV4 96.00/96.12 call spds ref 95.995

2,000 SFRZ4 95.25/95.37/95.50/95.62 call condors ref 95.995

2,000 2QZ4 96.56/96.68/96.81/96.93 put condors ref 97.155

Treasury Options:

1,500 TYV4 115.5 straddles ref 115-13.5

1,500 TYV4 111/112 put spds ref 115-12.5

BONDS: EGBs-GILTS CASH CLOSE: Yields Edge Lower With Fed And BoE Eyed

Bund and Gilt yields fell Monday for the 9th day in 10, ahead of the Federal Reserve and BoE decisions later in the week.

- After starting the day on the front foot, after speculation of an outsized 50bp cut by the Fed this Wednesday rose further over the weekend, trade turned mixed in the European morning session.

- Various countervailing factors included a rebound in oil prices dampening core FI gains, with continued dovish Fed repricing and an equity pullback underpinning early. Yields resolved lower in the last couple of hours of European cash trade.

- ECB Chief Economist Lane elicited minimal market reaction with his commentary reinforcing a "meeting-by-meeting and data-dependent" approach to rate-setting.

- Bunds outperformed Gilts, with some light bull steepening through most of the UK and German curves.

- Periphery EGB spreads were mixed, with BTPs outperforming albeit gains were marginal.

- German September ZEW is the highlight Tuesday morning. Outside of the Fed, UK developments are at the fore this week, with CPI Wednesday and the BoE decision Thursday.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 2.8bps at 2.183%, 5-Yr is down 2.5bps at 1.995%, 10-Yr is down 2.6bps at 2.122%, and 30-Yr is down 3.1bps at 2.4%.

- UK: The 2-Yr yield is down 1.2bps at 3.788%, 5-Yr is down 0.8bps at 3.614%, 10-Yr is down 0.9bps at 3.759%, and 30-Yr is down 0.9bps at 4.35%.

- Italian BTP spread down 0.6bps at 135.6bps / Spanish up 0.4bps at 79.5bps

EGB OPTIONS: Active Monday Session For Euribor Tilted Toward Upside

Monday's Europe rates/bond options flow included:

- ERV4 97.00/97.125cs 1x2, bought the 1 for 1 in 4k.

- ERZ4 97.00/96.875 1x2 put spread, bought for 3 and 3.25 in 6k (bought the 1 leg)

- ERZ4 97.125/97.25/97.50c ladder, bought for 0.25 in 5k total

- 0RZ4 97.375/97.625/98.375/98.625c condor, bought for 19.75 in 4.5k

- 2RZ4 97.375/97.625/98.25/98.50c condor, bought for 19.5 in 7k

FOREX: USD Index Edges Back Towards Cycle Lows as Fed Decision Awaited

- Markets continued to assign a greater probability to the Fed cutting rates by 50bp in September and as such, the USD index has fallen 0.35% on Monday. Price action edges the index towards the prior cycle lows at 100.51. The broad consolidation for major equity benchmarks has kept the likes of GBP, AUD and NZD the main beneficiaries in G10 (all up over 0.5%), whereas the likes of CAD and JPY are relatively underperforming ahead of the APAC crossover.

- Another volatile session for the JPY has culminated with the currency at broadly unchanged levels against the dollar, which fails to tell the full story on Monday. The Yen was initially most firmly affected by the fed re-pricing, prompting USDJPY to fall as low as 139.58, the lowest level since July 2023.

- However, downside momentum rapidly lost steam on Monday, with moves sub-140.00 appearing to be well supported for now. Stronger-than-expected US Empire State manufacturing assisted the early US bounce and spot has moved steadily higher in the aftermath. At typing, we are roughly 15 pips from the overnight highs at 140.93, an area that may see some further bailing from fresh short positions.

- Price action may have been assisted by the lower volumes owing to both China and Japan being out for national holidays, especially given Fed pricing has remained unchanged since the US crossover and major equity benchmarks are little changed.

- EURUSD finds itself back above 1.11 and price action is narrowing the gap to key short-term resistance at 1.1155, the Sep 6 high. Clearance of this level would cancel a recent bearish theme and highlight scope for a stronger recovery towards 1.1202, the Aug 26 high and a bull trigger.

- In emerging markets, the Brazilian real outperforms ahead of the BCB’s expected rate hike Wednesday, whereas budget debates in Colombia comparatively weighs on COP.

- German ZEW, Canada CPI and US retail sales highlight the data calendar on Tuesday, ahead of key central bank decisions later in the week.

Late Equities Roundup: Banks, Oil Companies Buoy Broader Markets

- Stocks are gradually climbing off lows, Nasdaq still weaker in late Monday trade. The DJIA trades up 198.62 points (0.48%) at 41592.6, S&P E-Minis up 1.75 points (0.03%) at 5692.75, Nasdaq down 115.7 points (-0.7%) at 17568.38.

- Financial and Energy sectors continued to lead gainers in late trade, banks and insurance providers outperforming: KKR +3.0%, Global Life +2.84%, State Street Corp +2.65%. Oil and gas shares buoyed the Energy sector as crude prices gained (WTI +1.53 at 70.18): ONEOK +2.09%, Marathon Oil +1.72%, ConocoPhillips +1.63%.

- Conversely, Information Technology and Consumer Discretionary sectors continued to underperform, hardware and semiconductor makers weighing on the former: Qorvo -7.06%, Skyworks Solutions -6.16%, Micron -4.64%. That's not to say the IT sector didn't have some decent gainers Monday as Oracle gained +5.02%, Intel +4.53%, Crowdstrike +4.08%.

- Meanwhile, broadline retailers weighed on the Discretionary sector: Etsy -4.04%, LKQ Corp -1.22%, Ross Store -0.81%.

EQUITY TECHS: E-MINI S&P: (Z4) Approaching Resistance

- RES 4: 5868.50 1.00 proj of the Apr 19 - Jul 16 - Aug 5 price swing

- RES 3: 5800.00 Round number resistance

- RES 2: 5785.00 High Jul 16 and key resistance

- RES 1: 8730.50 High Sep 3

- PRICE: 5696.00 @ 1500ET Sep 16

- SUP 1: 5583.10/5451.25 50-day EMA / Low Sep 6 and a bear trigger

- SUP 2: 5424.75 Low Aug 13

- SUP 3: 5383.49 61.8% retracement of the Aug 5 - Sep 3 bull leg

- SUP 4: 5301.51 76.4% retracement of the Aug 5 - Sep 3 bull leg

S&P E-Minis remains firm. Last week’s recovery highlights a bullish reversal and the end of the corrective cycle between Sep 3 - 6. The contract is trading above the 20- and 50-day EMAs and a continuation higher would signal scope for a test of 5730.50, Sep 3 high. Clearance of this level would open 5785.00, the Jul 16 high and bull trigger. On the downside, a reversal lower and a breach of 5451.25, the Sep 6 low, would reinstate a bearish theme.

COMMODITIES: Crude Gains Ground, Spot Gold Edges Higher

- Crude markets have gained ground today, with WTI on track for its highest close since Sept 3. Curtailed Libya output and expectations of a US interest rate cut this week have helped provide some support, but gains have been limited by persistent China demand concerns after further weak data.

- WTI Oct 24 is up by 2.1% at $70.1/bbl.

- WTI futures remain in a bearish condition, suggesting that the most recent bounce is a short-term correction. However, the contract is approaching firm resistance at $70.98, the 20-day EMA.

- Meanwhile, Henry Hub is trading higher today and is on track for the highest close since early July. A recovery in LNG flows to early September levels is weighed against the gradual rebound in Gulf of Mexico production.

- US Natgas Oct 24 is up by 3.1% at $2.38/mmbtu.

- Spot gold is currently up by 0.1% to $2,581/oz, having hit a fresh all-time high of $2,589.7/oz earlier in the session, aided by further dollar weakness.

- A bullish structure in gold remains intact, with the focus on $2,600.0 next.

- Copper has also risen by 0.7% to $426.6/lb today, leaving the red metal on course for a fourth successive gain.

- For copper, resistance to watch is at $431.85, the Aug 27 high, which was almost reached earlier on Monday. A break of this hurdle would signal scope for a stronger short-term recovery.

MONDAY DATA CALENDAR

| Date | GMT/Local | Impact | Country | Event |

| 17/09/2024 | 0900/1100 | *** |  DE DE | ZEW Current Conditions Index |

| 17/09/2024 | 0900/1100 | *** |  DE DE | ZEW Current Expectations Index |

| 17/09/2024 | 0900/1000 | ** |  GB GB | Gilt Outright Auction Result |

| 17/09/2024 | 1215/0815 | ** |  CA CA | CMHC Housing Starts |

| 17/09/2024 | 1230/0830 | *** |  CA CA | CPI |

| 17/09/2024 | 1230/0830 | *** |  US US | Retail Sales |

| 17/09/2024 | 1255/0855 | ** |  US US | Redbook Retail Sales Index |

| 17/09/2024 | 1300/1500 |  EU EU | ECB's Elderson in supervisory effectiveness panel | |

| 17/09/2024 | 1315/0915 | *** |  US US | Industrial Production |

| 17/09/2024 | 1400/1000 | * |  US US | Business Inventories |

| 17/09/2024 | 1400/1000 | ** |  US US | NAHB Home Builder Index |

| 17/09/2024 | 1530/1130 | * |  US US | US Treasury Auction Result for Cash Management Bill |

| 17/09/2024 | 1700/1300 | ** |  US US | US Treasury Auction Result for 20 Year Bond |

| 17/09/2024 | 2200/1800 |  CA CA | BOC Sr Deputy Rogers fireside chat on women in finance. |