-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Debt Deal Heads to the House

- REPUBLICAN U.S. REPRESENTATIVE MCHENRY SAYS MORE THAN HALF OF HOUSE REPUBLICANS WILL SUPPORT THE DEBT CEILING BILL; Rtrs

- MCHENRY SAYS HE HAS NO DOUBT THE DEBT CEILING BILL WILL PASS THE HOUSE; Rtrs

- MNI NATO: Blinken: We Will Work For Sweden's NATO Accession By Vilnius Summit

- MNI US: Rep Davidson Declines To Run In Crucial Ohio Senate Race

- Christie allies launch super PAC ahead of expected 2024 campaign for the GOP presidential nomination, APW

Key Links: MNI: Debt Limit Legislation Faces Final Test In Rules Committee / MNI: Conference Board Labor Differential Softens Ahead Of Payrolls / MNI Regional Fed Manufacturing Surveys Imply Downside Risk For ISM

US TSYS: Markets Roundup: Debt Deal Meets House Rules Hurdles

- US fixed income markets enjoyed strong support after returning from extended holiday weekend, risk appetite generally positive after a bipartisan agreement to suspend the debt limit for the next two years while keeping non-defense spending flat for the next year (+1% in the second year) was announced Saturday.

- Getting the deal to pass through a fractious Congress before the June 5 "X" date is the real challenge. The agreement faces its final procedural hurdle today when it is considered by the House Rules Committee at 15:00 ET 20:00 BST.

- Treasury futures briefly pared early support following stronger than expected Home Price Index (0.6% M/M; EST. 0.2%), rebounding to new session highs after Conference Board consumer confidence came out stronger than expected in May at 102.3 (cons 99.0) although still represented a decline on the month after a sizeable upward revision to 103.7 (initial 101.3). The net impact was lowest consumer confidence since November.

- Focus turns to key employment data later this week: ADP private employment data to be released Thursday, one day later than usual due to the holiday, while May NFP will be released Friday, current median estimate at +190k job gains for May vs. +253k prior. Fed enters policy blackout at midnight Friday.

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M +0.00682 to 5.16026 (+.05971 total last wk)

- 3M +0.01291 to 5.27665 (+.10027 total last wk)

- 6M +0.02073 to 5.31909 (+.15183 total last wk)

- 12M +0.06031 to 5.16202 (+.22405 total last wk)

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00014 to 5.06557%

- 1M +0.01672 to 5.17043%

- 3M +0.02029 to 5.49600 */**

- 6M +0.03757 to 5.61857%

- 12M +0.07000 to 5.73029%

- * Record Low 0.11413% on 9/12/21; ** New 16Y high: 5.49600% on 5/30/23

- Daily Effective Fed Funds Rate: 5.08% volume: $136B

- Daily Overnight Bank Funding Rate: 5.07% volume: $286B

- Secured Overnight Financing Rate (SOFR): 5.06%, $1.476T

- Broad General Collateral Rate (BGCR): 5.05%, $588B

- Tri-Party General Collateral Rate (TGCR): 5.05%, $582B

- (rate, volume levels reflect prior session)

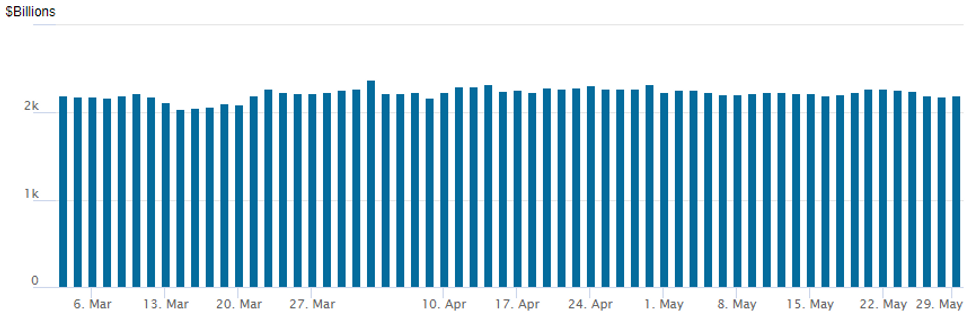

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage rebounds to $2,200.479B w/ 103 counterparties, compares to prior $2,189.638B. Compares to high usage for 2023: $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

Late SOFR/Treasury Option Roundup: Bullish Rate Hedging

Mixed trade in SOFR and Treasury options overnight, segued to better 5- and 10Y call trade after initially better puts during the NY session. Underlying futures climbing higher, 10s +25 at 113-06, yield 3.6942% -.1041.- SOFR Options:

- +5,000 SFRZ3 94.50/94.75/95.00 put trees, 2.75-3.0 2 legs over

- 4,500 SFRN3 95.00/95.25/95.50 call flys ref 94.77

- -2,000 SFRM3 94.81/94.87 put spds, 5.25

- 2,500 SFRM3 95.00/95.25/95.50 call flys ref 94.685

- 2,000 SFRN3 95.00/SFRU3 95.12 call spds

- 4,150 OQM3 96.00/96.25 put spds ref 95.935

- 2,500 SFRM3 94.56 puts, 2.0 ref 94.70

- 2,500 SFRN3 94.50/94.75 3x2 put spds ref 94.79

- 2,000 OQM3 95.93/96.06/96.18 call flys ref 95.89

- 12,000 SFRM3 94.87/94.93/95.00 call flys, ref 94.70

- 5,100 SFRN3 94.75 puts, 16.5 ref 94.795

- 1,250 SFRU3 95.12/95.37/95.50 broken call flys ref 94.79

- Block, 5,000 SFRH4 95.25/95.50 put spds 7 over SFRH3 97.50/98.50/99.00 broken call flys

- Treasury Options:

- Block, 7,500 TYN3 114.5 puts ,116 ref 114-00.5

- -6,000 FVQ3 106.75 puts 1.5-2.0 over the FVQ3 110/112 call spds

- 2,500 TYN 115 calls, 33 ref 113-23.5

- 5,500 USN3 120 puts, 9 ref 127-08

- 4,300 USN3 122/123 put spds, 10 ref 127-08

- 22,000 wk2 TY 115.75/116.75 call spds ref 113-27.5

- 4,100 FVN3 110.75 calls ref 108-17.75

- over 11,000 FVQ3 110.5 calls, ref 108-15

- 5,500 wk2 TY 114 calls, 36 ref 113-22

- 1,500 FVN3 108.5 calls, ref 108-12.75

- 7,600 TYQ3 113.5 calls, 129 ref 113-18

- 5,200 FVN3 109 calls ref 108-11.75

- 5,700 FVN3 110 calls, ref 108-10.5

- 7,100 wk2 TY 114.5 calls ref 113-18.5

- 4,000 TUN3 102.5 puts, 21 ref 102-18.25

- 4,700 TYN3 110.5 puts, 13 ref 113-15.5

- 5,000 TYN3 113 puts ref 113-15.5

EGBs-GILTS CASH CLOSE: Bunds Outperform

European core FI rallied Tuesday with Bunds outperforming Gilts, and periphery spreads tightening.

- Bunds rallied from the start, with weaker-than-expected Spanish inflation data sending a dovish signal ahead of the remaining Eurozone CPI prints this week.

- They continued to strengthen steadily over the course of the session, helped by a strong BTP auction, and the reversal lower in equities in the afternoon helping underpin core bonds.

- The soft Spanish inflation reading induced a retracement in ECB hike pricing, with terminal rates envisaged 5bp lower than prior.

- Notably UK hike pricing was relatively steady, following on from last week's significant sell-off.

- Attention first thing Wednesday will be on German state and French inflation data.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 9.6bps at 2.784%, 5-Yr is down 10.4bps at 2.356%, 10-Yr is down 9.2bps at 2.342%, and 30-Yr is down 6.9bps at 2.499%.

- UK: The 2-Yr yield is down 5.6bps at 4.435%, 5-Yr is down 6.4bps at 4.211%, 10-Yr is down 8.7bps at 4.247%, and 30-Yr is down 5.9bps at 4.584%.

- Italian BTP spread down 3.4bps at 180.9bps / Spanish down 1.7bps at 104.6bps

EGB Options: More Modest Upside Rate Structures Tuesday

Tuesday's Europe rates / bond options flow included:

- ERM3 96.375/96.50/96.625c fly, sold at 4 in 5k

- 0RU3 96.875/97.125/97.375 call fly Bot for 3.25 in 4k

- SFIU3 94.70/94.85cs vs 94.30/93.95ps, bought the cs for -1 in 1.5k

- SFIU3 94.70/94.85cs vs 94.30/93.95ps, bought the cs for -1 in 1.5k

FOREX: AUDJPY Slides 1% Amid Equities Turnaround, MOF Warning

- Despite printing a new cycle high of 140.93 in early European trade, USDJPY has backtracked on Tuesday following an unscheduled tri-party meeting held between the Japanese FSA, the Ministry of Finance and the Bank of Japan.

- Following the meeting, Japan's currency diplomat Kanda warned that the Ministry would take appropriate steps on currency markets if required, and outlined their intention to consider various options.

- This news, combined with the waning optimism for equity markets after the US open has placed downward pressure on the pair which fell as low as 139.57 in mid-session trade. The turnaround is interesting given that price earlier arrived at the top of the bull channel drawn from the Jan 16 low which intersects at 140.81, representing a key resistance.

- The softer tone for risk weighed on the likes of the Australian dollar, prompting AUDJPY to fall the best part of 1%.

- Particular weakness was observed in crude futures, with near 4.5% declines across WTI and Brent pressuring the Norwegian Krone to the lowest level against the Euro since March 2020 (EURNOK high of 12.1064). Worth noting this price action comes ahead of tomorrow's Daily FX Purchases release for June - after the May figure disappointed markets by confirming NOK 1.4bln in daily purchases over the course of the month - this ran counter to expectations NOK selling could shift to NOK buying in the coming months.

- More broadly, the USD index trades close to unchanged as we approach the APAC crossover, with the greenback unable to gather any directional momentum following Monday’s holiday thinned trade.

- RBA Governor Lowe is due to speak overnight before the release of Australian April CPI data. Focus then shifts to Europe and preliminary reads of German regional CPI figures ahead of the June 15 ECB meeting. Canadian GDP and US Jolts data will also cross amid potential month-end dynamics.

FX: Expiries for May31 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0675-85(E1.3bln), $1.0750(E2.2bln), $1.0831-50(E787mln)

- USD/JPY: Y138.00-10($1.7bln), Y140.00($1.8bln)

- AUD/USD: $0.6450(A$571mln), $0.6550(A$743mln)

Equities Roundup: IT Leads

- Stocks continue to reverse early morning gains, Nasdaq outperforming amid carry-over support for Information Technology shares after Nvidia's unprecedented surge last Thursday

- Currently, S&P E-Mini futures are down 11.75 points (-0.28%) at 4202.0; Nasdaq down 1.3 points (0%) at 12974.65; DJIA down 156.84 points (-0.47%) at 32937.69

- For a technical perspective, trend conditions for S&P E-minis remain bullish. Last week’s bounce from 4114.00, May 24 low, means that support around the 50-day EMA remains intact.

- The average intersects at 4129.2 and a clear break of it is required to signal a reversal. For now, the focus is on key resistance at 4244.00, the Feb 2 high. Clearance of this hurdle would resume the uptrend that started on Mar 13.

- Leading laggers: Information Technology, Real Estate and Consumer Discretionary shares, held modest gains, lead by semiconductor stocks: Qualcomm (QCOM) +4.20$, Nvidia and Enphase Energy both up +3.45%, While Intel trades +2.85%.

- leading laggers: Energy, Consumer Staples and Material underperform, a drop in crude prices by nearly $3.50 weighed on energy.

E-MINI S&P TECHS: (M3) Key Resistance Remains Exposed

- RES 4: 4327.50 High Aug 16 2022 (cont)

- RES 3: 4300.00 Round number resistance

- RES 2: 4288.00 High Aug 19 2022

- RES 1: 4244.00 High Feb 2 and a medium-term bull trigger

- PRICE: 4220.00 @ 1115ET May 30

- SUP 1: 4159.93/4114.00 20-day EMA / Low May 24

- SUP 2: 4062.25 Low May 4 and key support

- SUP 3: 4052.50 Low Mar 30

- SUP 4: 4022.75 50.0% retracement of the Mar 13 - May 1 bull leg

S&P E-minis trend conditions remain bullish. Last week’s bounce from 4114.00, May 24 low, means that support around the 50-day EMA remains intact. The average intersects at 4129.2 and a clear break of it is required to signal a reversal. For now, the focus is on key resistance at 4244.00, the Feb 2 high. Clearance of this hurdle would resume the uptrend that started on Mar 13.

COMMODITIES: Crude Oil Slumps With Supply In Focus, Gold Buoyed By Risk Off

- Crude oil has slumped more than 4% today, with declines coming from various factors:

- Uncertainty over China demand: updated manufacturing and non-g PMIs for May due out tomorrow.

- Supply focus remains on the OPEC+ meeting at the weekend as some countries, such as Russia and Iraq, have suggested no changes to production targets are currently planned.

- Physical supply remains ample - the June-July WTI cash roll has slipped, signalling low near-term demand and therefore sufficient physical supply at present prices. Contango has also deepened for the front of the WTI futures curve, reinforcing this view.

- WTI is -4.35% at $69.51 with a low of $69.03that cleared support at $69.39 (May 15 low) before ticking higher, to next open $63.9 (May 4 low).

- The day has seen particularly heavy option volumes for the CLN3 at $75/bbl calls (12k) followed by $80/bbl calls (7.5k) and $65/bbl puts (6.5k).

- Brent is -4.50% at $73.60, off a low of $73.20 that pushed through support at $73.49 (May 15 low) to open $71.28 (May 4 low).

- Gold meanwhile is buoyed by Treasury yields falling, currently +0.8% at $1959.18 in a decent recovery after clearing trendline support, although it doesn’t yet trouble resistance at $1971.7 (50-day EMA).

Wednesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 31/05/2023 | 2350/0850 | ** |  | JP | Industrial production |

| 31/05/2023 | 2350/0850 | * |  | JP | Retail sales (p) |

| 31/05/2023 | 0130/1130 | *** |  | AU | CPI Inflation Monthly |

| 31/05/2023 | 0130/1130 | *** |  | AU | Quarterly construction work done |

| 31/05/2023 | 0530/0730 | *** |  | DE | North Rhine Westphalia CPI |

| 31/05/2023 | 0600/1400 | ** |  | CN | MNI China Liquidity Suvey |

| 31/05/2023 | 0630/0830 | ** |  | CH | Retail Sales |

| 31/05/2023 | 0630/0730 |  | UK | DMO to Publish Gilt Op Calendar for Jul-Sep | |

| 31/05/2023 | 0645/0845 | *** |  | FR | HICP (p) |

| 31/05/2023 | 0645/0845 | ** |  | FR | PPI |

| 31/05/2023 | 0645/0845 | *** |  | FR | GDP (f) |

| 31/05/2023 | 0645/0845 | ** |  | FR | Consumer Spending |

| 31/05/2023 | 0755/0955 | ** |  | DE | Unemployment |

| 31/05/2023 | 0800/1000 | *** |  | IT | GDP (f) |

| 31/05/2023 | 0800/1000 | *** |  | DE | Bavaria CPI |

| 31/05/2023 | 0830/0930 | ** |  | UK | BOE M4 |

| 31/05/2023 | 0830/0930 | ** |  | UK | BOE Lending to Individuals |

| 31/05/2023 | 0900/1100 | *** |  | IT | HICP (p) |

| 31/05/2023 | 0900/1100 | *** |  | DE | Saxony CPI |

| 31/05/2023 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 31/05/2023 | 1200/1400 | *** |  | DE | HICP (p) |

| 31/05/2023 | 1230/0830 | *** |  | CA | GDP - Canadian Economic Accounts |

| 31/05/2023 | 1230/0830 | *** |  | CA | Gross Domestic Product by Industry |

| 31/05/2023 | 1230/0830 | *** |  | CA | CA GDP by Industry and GDP Canadian Economic Accounts Combined |

| 31/05/2023 | 1230/1430 |  | EU | ECB Lagarde Q&A at Generation Euro Students' Awards | |

| 31/05/2023 | 1250/0850 |  | US | Boston Fed's Susan Collins | |

| 31/05/2023 | 1250/0850 |  | US | Fed Governor Miki Bowman | |

| 31/05/2023 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 31/05/2023 | 1315/1415 |  | UK | BOE Mann Panellist at Pictet Family Forum | |

| 31/05/2023 | 1342/0942 | ** |  | US | MNI Chicago PMI |

| 31/05/2023 | 1400/1000 | ** |  | US | JOLTS jobs opening level |

| 31/05/2023 | 1400/1000 | ** |  | US | JOLTS quits Rate |

| 31/05/2023 | 1430/1030 | ** |  | US | Dallas Fed Services Survey |

| 31/05/2023 | 1730/1330 |  | US | Philadelphia Fed's Pat Harker | |

| 31/05/2023 | 1730/1330 |  | US | Fed Governor Philip Jefferson | |

| 31/05/2023 | 1800/1400 |  | US | Fed Beige Book | |

| 01/06/2023 | 2300/0900 | ** |  | AU | IHS Markit Manufacturing PMI (f) |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.