-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Doves Fly Coup Post CPI Revisions

- MNI US: Larry Hogan To Run For Open Maryland Senate Seat

- MNI SECURITY: Axios: Israel Not Shutting Door On Hostage Deal

- MNI LATAM: WSJ, Venezeula Deploys Military To Guyana Border As Tensions Escalate

- ATL FED'S BOSTIC: INFLATION HAS BEEN TOO HIGH FOR TOO LONG, Bbg

- ECB WARNS BANKS OF CAPITAL CHARGES IF CRE RISK NOT WELL MANAGED, Bbg

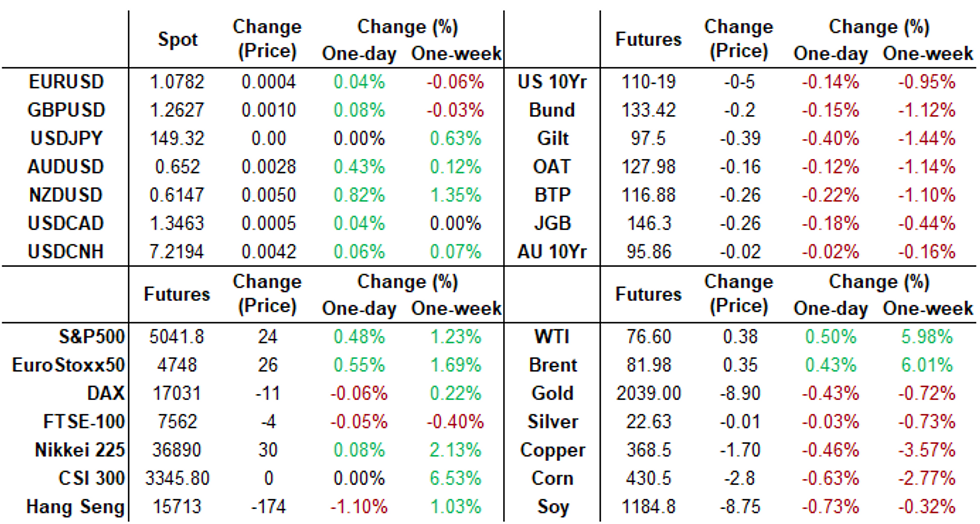

Tsys Back at Dec FOMC Lvls, Minimal Changes to Latest Core CPI Trends

- Treasury futures are looking modestly weaker after the bell, near session lows after futures quickly reversed post-CPI revision support this morning. Curves are flatter with Bonds outperforming, Mar'24 10Y futures -4 at 110-20 vs. 110-16 low - a level not seen since prior to the December 13 FOMC.

- After a brief delay delay, Treasury futures gapped higher (TYH4 tapped 111-01 briefly) after BLS released recalculated seasonally adjusted indexes and adjustment factors for Jan'19-Dec'23. Levels just as quickly reversed as markets digested the 5 years of revisions: very minimal changes to latest trends in core CPI % M/M SA readings.

- Dec’23 0.28% vs 0.31% prior, offset by small upward revisions in Oct and Nov. Largest uplifts back in July and April, largest downward revisions in May and March – all old history now. The Core CPI 3-month annualized rate near enough unrevised: 3.34% vs 3.33% prior. 6-month rate at 3.25% annualized vs 3.21% prior.

- Atlanta Fed's Bostic (’24 voter) local radio interview: still seeing a ways to go on inflation. The remarks are broadly in line with his last main appearance from Jan 19 when he said he wants to make sure we’re well on the way to 2% inflation before cutting.

- Look ahead: Monday data calendar includes NY Fed Inflation Expectations, and more Fed commentary from Fed Gov Bowman, Richmond Fed Barkin MN Fed Kashkar and MN Fed Kashkari.

FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M +0.00272 to 5.32072 (-0.00139/wk)

- 3M +0.00770 to 5.30905 (+0.01859/wk)

- 6M +0.01633 to 5.18866 (+0.09256/wk)

- 12M +0.03395 to 4.88025 (+0.18745/wk)

- Secured Overnight Financing Rate (SOFR): 5.31% (+0.00), volume: $1.669T

- Broad General Collateral Rate (BGCR): 5.30% (+0.00), volume: $679B

- Tri-Party General Collateral Rate (TGCR): 5.30% (+0.00), volume: $669B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $96B

- Daily Overnight Bank Funding Rate: 5.32% (+0.00), volume: $271B

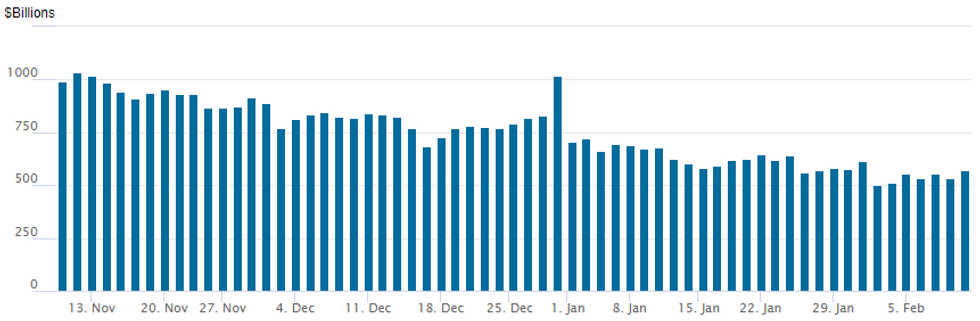

FED Reverse Repo Operation

NY Federal Reserve/MNI

- RRP usage climbs to $569.175B vs. $535.705B Thursday. Holding above recent cycle low of $503.548B from Thursday, February 1, the lowest level since mid-2021.

- Meanwhile, the latest number of counterparties is at 80 from 78 Thursday (compares to 65 on January 16, the lowest since July 7, 2021).

SOFR/TREASURY OPTION SUMMARY

SOFR and Tsy option trade remained mixed Friday, segueing to more paired in the second half from better puts overnight into the NY session. Underlying futures held weaker, near early session lows: TYH4 at 110-18 (-6), a level not seen since prior to the December 13 FOMC, 10Y yield marking 4.1929% high.

Projected rate cut pricing drifted near lows: March 2024 chance of 25bp rate cut currently -19.3% vs. -21.2% late Thursday w/ cumulative of -4.8bp at 5.278%, May 2024 at -54.0% w/ cumulative -18.3bp at 5.143%, while June 2024 slips to -81.3% vs. -89.3% late Thursday (105% pre-NFP for comparison) w/ cumulative -38.6bp at 4.940%. Fed terminal at 5.325% in Feb'24.

- SOFR Options:

- +5,000 SFRM4 94.93/95.12/95.31 put flys, 2.75 ref 95.12

- +5,000 SFRZ4 95.50/96.12/96.37/97.00 call condors, 13.0

- +1,500 SFRZ4 98.00/99.00 call spds, 3.5

- Block, 5,000 0QH4 97.00/97.12 call spds, 0.5

- Block, +5,000 SFRZ4 94.75 puts vs. SFRZ5 94.00/94.75 put spd, 2.5 Z5 over

- Block, 5,000 SFRM4 95.25/95.50/95.75 call flys, 2.0 ref 95.14

- Block, 6,000 SFRU4 95.75/96.25/96.87 broken call flys, 3.0 net vs. 95.53/0.05%

- -15,000 SFRH4 94.93/95.00, 0.5 ref 94.775

- over 7,400 3QH4 96.12 puts ref 96.425

- Block, 1,250 SFRJ4 94.75/94.87 3x2 put spds 2.5

- 8,600 SFRJ4 95.00/95.12 call spds ref 95.12

- Block, 2,750 SFRM4 95.12/95.25 call spds 4.25 ref 95.125, more on screen

- 3,000 SFRK4 97.00 calls, 2.0 last ref 95.125

- 5,000 SFRH4 94.75/94.93/95.00 broken call trees ref 94.775

- 2,000 SFRM4 94.56/94/68/94.81 put flys

- 2,000 SFRM4 95.50/96.00/96.50 call flys ref 95.13

- Block, 2,500 0QH4 95.75/96.00 put spds vs. 3QH4 96.37 puts, 4.5 net, Blues over

- 2,300 SFRJ4 95.00/95.12/95.25 put flys ref 95.125 to -.13

- 1,300 SFRM4 95.50/95.75 call spds vs. 94.50/94.75 put spds ref 95.145

- Treasury Options:

- +5,000 FVH4 108.25 calls, 5 ref 107-04 to -04.25

- 2,000 ush4 116/118 PUT SPDS, 26 REF 119-24

- 2,000 TYH4 109/110 put spds, 12 ref 94.77

- over 7,400 TYH4 110 puts, 18 last

- over 5,800 TYH3 109 puts, 4 last

- over 5,400 TYJ4 111 puts, 55 last

- 1,200 FVH4 109/109.5 1x2 call spds ref 107-08.5

- 1,700 TYH4 110/111/112.5 broken put flys

- 1,500 FVH4 107/107.75 put spds ref 107-08

- 2,000 FVH4 106 puts, ref 107-08

- 2,000 TYJ4 109.5/113 call spds ref 111-10.5

EGBs-GILTS CASH CLOSE: 10Y Yields Close At 2-Month Highs

Bunds and Gilts weakened for a 3rd consecutive session and 5th in 6 on Friday, as rate cuts continued to get priced out.

- With little important data/speaker flow in early trade, core FI continued to drift lower, with hawkishness from some late Thursday speakers still reverberating (BoE's Mann, ECB's Holzmann).

- The only release of note was the seasonal revisions of US CPI, which contrary to many expectations for an upward revision, portrayed largely unchanged inflation at end-2023. That saw Treasuries rally, pushing Bunds and Gilts to session highs, but the move fully reversed.

- The German and UK curves bear flattened as ECB and BoE cut prospects faded further in keeping with the recent theme: 114bp of ECB cuts are priced for 2024, 4bp fewer on the day and ~15bp on the week. BoE 2024 implied cuts pulled back by ~6bp to 76bp, around 21bp on the week.

- 10Y Bund yields posted their highest closing yield since November 30; Gilts since Dec 4. Periphery spreads were little changed.

- Ratings reviews for Germany (Moody's), Finland (Fitch), and Italy (Scope) come after Friday's close.

- Attention next week will be on UK data, with labour market figures (Tues) and CPI (Weds) featuring.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 5.6bps at 2.716%, 5-Yr is up 5.2bps at 2.336%, 10-Yr is up 2.8bps at 2.382%, and 30-Yr is unchanged at 2.569%.

- UK: The 2-Yr yield is up 4.9bps at 4.602%, 5-Yr is up 4.8bps at 4.1%, 10-Yr is up 3.5bps at 4.086%, and 30-Yr is up 0.4bps at 4.613%.

- Italian BTP spread up 0.7bps at 158.4bps / Greek down 0.5bps at 114.7bps

EGB Options: Light Euro Rates Trade To Close Out Week

Friday's Europe rates/bond options flow included:

- ERJ4 96.37/96.25ps vs ERM4 96.25/96.12ps, bought the April for 0.75 in 8.88k

- ERM4 96.37/96.50/96.62c fly, bought for 1.5 in 6k

FOREX NZD Remains Best Performer Friday, USDJPY Weekly Close Above 149.00

- After an early extension of post-NFP strength, which saw the USD index climb to its best level since mid-November, the greenback has retraced back to broadly flat on the week as we approach the close. Higher US yields continue to support the dollar, however, the continued rally for major equity indices is providing some resistance to the advance.

- NZD is Friday's best performing currency, pushing NZDUSD (+0.85%) to a one-week high, trading above 0.6150 and topping resistance at the 0.6125 20-day EMA. Moves follow ANZ's view change that it sees 25bps hikes for the RBNZ across the February and April meetings this year. 0.6174 provides the initial resistance for the pair.

- The risk-on tone across markets has also leant support to the Australian dollar on Friday, rising 0.5% on the session. With a bearish theme intact, key short-term resistance to watch is unchanged at 0.6625, the Jan 30 high.

- USDJPY continues to benefit from the higher US yields and the continued dovish rhetoric from the central bank this week. The pair looks set to close above 149.00 for the first time this year, with the pair narrowing the gap to the 150.00 handle, levels not seen since mid-November. Given the constructive technical tone, this opens a move to 149.75, the Nov 22 high and then 150.78, the Nov 17 high.

- US CPI headlines the docket next Tuesday, landing after the significant trimming of Fed rate cut expectations post-NFP and the subsequent FOMC rhetoric calling for patience with cuts. Core CPI is expected at 0.3% M/M in Jan and today’s revisions shouldn’t have materially swayed these estimates. There will be holidays in China and Japan next week.

FX Expiries for Feb12 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0725(E2.7bln), $1.0800(E655mln)

- USD/JPY: Y149.00-15($1.1bln)

Late Equities Roundup: SPX Eminis Continue to Extend Contract Highs

- SPX Eminis continued to extend contract highs late Friday, Nasdaq not far behind in making new highs as well, outperforming Dow components as they climbed off weaker levels. Currently, the DJIA down 10.66 points (-0.03%) at 38713.52, S&P E-Minis up 29 points (0.58%) at 5047 vs. new contract high of 5048.5, Nasdaq up 207.8 points (1.3%) at 16000.79 vs. 16057.44 high on November 19, 2021.

- Leading gainers: Information Technology and Consumer Discretionary sectors led gainers in the second half, semiconductor stocks supporting the former: Applied Materials +6.32%, First Solar +6.17%, Enphase +5.8% while Nvidia gained +3.21% after announcing investment in new chip unit for cloud firms. Broadline retailers and automakers buoyed the Consumer Discretionary sector: Etsy +5.21%, Amazon +2.8%, CarMax +1.68%, Tesla +1.82%.

- Laggers: Energy and Consumer Staples continued to underperform in late trade, oil and gas shares weighed on the former: Conoco-Phillips -2.27%, Hess Corp -2.03%, Exon Mobil -1.85%. Food and beverage shares weighed on the Consumer Staples sector: Kellanova and Campbell Soup were both -3.15%, Hershey and Tyson Foods both -3.05%.

- Looking ahead: corporate earnings expected next Monday (after the close): Catalent, Arista Networks, Avis Budget Group, Cadence Design, Waste Management, Goodyear Tire.

E-MINI S&P TECHS: (H4) Bull Cycle Extends

- RES 4: 5170.86 2.236 proj of Nov 10 - Dec 1 - 7 price swing

- RES 3: 5110.50 2.00 proj of Nov 10 - Dec 1 - 7 price swing

- RES 2: 5100.00 Round number resistance

- RES 1: 5050.14 1.764 proj of Nov 10 - Dec 1 - 7 price swing

- PRICE: 5045.75 @ 1450 ET Feb 9

- SUP 1: 4913.92 20-day EMA

- SUP 2: 4866.000/4796.82 Low Jan 31 / 50-day EMA values

- SUP 3: 4702.00 Low Jan 5

- SUP 4: 4594.00 Low Nov 30

The trend condition in S&P E-Minis is unchanged and remains bullish - this week’s gains reinforce current conditions. The contract has traded to a fresh cycle high again today, confirming a resumption of the uptrend. Recent corrections have been shallow - this also highlights a strong uptrend. The focus is on 5050.14, a Fibonacci projection. On the downside, initial key short-term support has been defined at 4866.00, the Jan 31 low.

COMMODITIES Crude Oil Sees Strong Gains On The Week With Fading Ceasefire Hopes

- Crude prices made gains during US hours, with WTI up strongly on the week and retuning to levels last seen in late-January. WTI continues to find support from diminishing hope of any near-term ceasefire deal in Gaza.

- The WSJ is reporting that Venezuela has moved military hardware to its border with Guyana as a row over a disputed, oil-rich province escalates.

- US oil rigs were unchanged on the week at 499, according to Baker Hughes, but oil output from the Permian basin in West Texas and New Mexico is set to reach a fresh record this year: US pipeline operator Plains said.

- OPEC+ members bound to production targets overshot by 350k b/d, taking total output to 34.67m b/d, according to Argus estimates.

- WTI is +0.5% at $76.62 having earlier cleared resistance at $76.95 (Feb 1 high) to open a key resistance at $79.29 (Jan 29 high).

- Brent is +0.5% at $82.02 as it takes a small step closer to key resistance at $84.17 (Jan 29 high).

- Gold is -0.5% at $2024.44, having slipped ahead of US CPI revisions and then holding losses despite a weaker USD index on the day. It remains above support at $2015.0 (Feb 5 low).

- US natural gas prices are under pressure, with the Henry Hub front month extending its most recent downtrend starting Jan. 26 for lowest levels since Sep. 2020. Furthering the decline was the smaller than normal storage draw yesterday, ongoing mild weather, and steady production.

- Weekly moves: WTI +6.0%, Brent +6.0%, Gold -0.75%, US HH nat gas -11.2%, EU TTF nat gas -7.5%.

MONDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 10/02/2024 | 0900/1000 |  | EU | The ECB Podcast on future euro banknotes | |

| 12/02/2024 | 0945/1045 |  | EU | ECB's Lane at conference on statistics post pandemic | |

| 12/02/2024 | 1315/1415 |  | EU | ECB's Lane participates in 'post-pandemic' roundtable | |

| 12/02/2024 | 1420/0920 |  | US | Fed Governor Michelle Bowman | |

| 12/02/2024 | 1550/1650 |  | EU | ECB's Cipollone participates in panel on Euro@25 | |

| 12/02/2024 | 1800/1300 |  | US | Minneapolis Fed's Neel Kashkari | |

| 12/02/2024 | 1800/1800 |  | UK | BOE's Bailey lecture at Loughborough University | |

| 12/02/2024 | 1900/1400 | ** |  | US | Treasury Budget |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.