-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Inflation Insight: Softer Housing Helps Ensure Dec Cut

MNI INTERVIEW2: Poland To Push For EU Defence Fund

MNI ASIA MARKETS ANALYSIS: PPI Above Est, Fed Daly Resist Cut

- MNI DALY SEES NO NEED TO WAIT UNTIL INFLATION IS 2% TO CUT RATES

- MNI DALY: RECENT DATA HASN'T SHAKEN VIEW INFLATION GOING RIGHT WAY

- MNI US: Manchin Appears To Rule Out Third Party Presidential Bid

- ATL FED BOSTIC: MY OUTLOOK IS TO START NORMALIZING POLICY THIS SUMMER, Bbg

- ATL FED BOSTIC: STILL EXPECTS 2 RATE CUTS THIS YEAR, Bbg

- HEZBOLLAH CHIEF SAYS WILL ESCALATE FIGHT WITH ISRAEL, Bbg

Key Links: MNI US FED: Daly Says Fed Should 'Resist Temptation' To Cut Too Soon / MNI INTERVIEW: Fed Seen Patient As Price Views Sticky - UMich / MNI US FED: Barr Says Fed Has Ramped Up Bank Oversight Post-SVB / MNI US DATA: Strong Headline and Core Metrics, But PCE Components Appear Softer vs CPI / MNI GLOBAL WEEK AHEAD - FOMC Minutes and Flash PMIs In Focus / MNI TV: Key Exclusive Highlights For Week 07

US TSYS Tsys Weaker/Near Support After Strong PPI Print

- Treasury futures holding weaker after the bell - off lows after breaching technical support following this morning's higher than expected PPI.

- Headline final demand PPI printed at its highest SA monthly rate since August '23 in January, with the unrounded 0.33% M/M print easily overshooting the 0.1% M/M consensus (vs -0.15% prior after Wednesday's revisions).

- The core metrics overshot consensus by a larger margin. PPI ex-food and energy at 0.50% M/M (vs 0.1% cons, -0.06% prior) brings the 3mma annualized rate to 2.42% (vs 0.56% prior). Perhaps the one encouraging factor is the 6mma annualized rate, which still moderated a touch to 1.61% (vs 1.75% prior).

- Lower than expected: Housing Starts (1.331M, 1.460M est, prior up-revised to 1.562M from 1.460M) and Building Permits (1.470M vs. 1.512M est).

- Mar'24 10Y futures currently -14.5 at 109-23, after breaching initial technical support of 109-17 (50.0% of Oct 19 - Dec 27 climb) vs. 109-15 intraday low. Curves bear flatten: 2s10s -1.567 at -36.176, 10Y yield +.0669 at 4.2969%.

- Slow start to the week ahead, no data Monday for Presidents Day holiday (rates open for shortened hours on Globex). Tuesday: Philadelphia Fed Non-Manufacturing Activity and Leading Index (-0.1%, -0.3%). Treasury supply: $79B 13W, $70B 26W and $46B 52W bill auctions.

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M -0.00394 to 5.31585 (-0.00487/wk)

- 3M -0.00507 to 5.31402 (+0.00497/wk)

- 6M -0.01239 to 5.23116 (+0.04250/wk)

- 12M -0.02678 to 4.97790 (+0.09765/wk)

- Secured Overnight Financing Rate (SOFR): 5.31% (+0.01), volume: $1.746T

- Broad General Collateral Rate (BGCR): 5.30% (+0.00), volume: $681B

- Tri-Party General Collateral Rate (TGCR): 5.30% (+0.00), volume: $670B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $112B

- Daily Overnight Bank Funding Rate: 5.32% (+0.00), volume: $280B

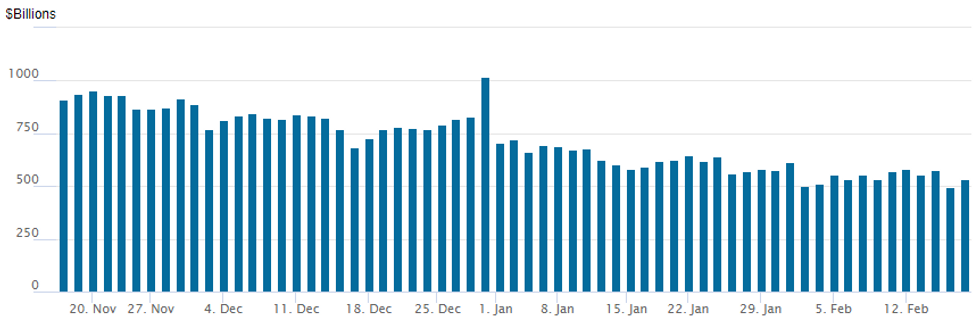

FED Reverse Repo Operation:

NY Federal Reserve/MNI

- RRP usage back over $500B after falling below the figure for the first time since early June 2021 yesterday: current usage climbs to $532.125B vs. $493.065B Thursday.

- Meanwhile, the latest number of counterparties climbs to 94 from 82 yesterday (compares to 65 on January 16, the lowest since July 7, 2021).

SOFR/TREASURY OPTION SUMMARY

Mixed at times, SOFR and Treasury option flow still favored low delta puts and put structures Friday - ongoing theme this week as accts hold to the post-CPI mindset of significantly delayed rate cuts as the Fed waits for sign inflation is at bay.

Smart money as Treasury futures gapped lower after higher than expected PPI this morning while projected rate cut pricing continues to wane: March 2024 chance of 25bp rate cut currently -11.6% vs -14.4% late Thursday w/ cumulative of -2.9bp at 5.300%; May 2024 at -25.8% vs. -31.2% late Thursday w/ cumulative -9.3bp at 5.235%; June 2024 -61.5% vs. -68.5% late Thursday w/ cumulative cut -24.7bp at 5.082%. Fed terminal at 5.33% in Feb'24

- SOFR Options:

- +5,000 SRH4 94.68/94.75/94.81 3x5x2 put fly from 1.5-2 ref 94.71

- +10,000 SRN4/SRU4 94.75/95.00 put spread spread 1.25

- -4,000 SRU4 95.25/95.75/96.00 call tree 1.0 ref 95.26

- Block, +10,000 SFRJ4 94.75/94.87/95.12/95.25 put condors, 6.0 ref 94.93

- Block, +5,000 SFRJ4 94.68/94.81/94.93 put flys, 3.25 ref 94.945

- -20,000 SRU4 94.75/95.00 2x1 put spreads .25 ref 9526.5

- +8,000 SRM4 95.12/95.25/95.50/95.62 call condor vs 94.62 puts 2.5

- Block, -10,000 SFRM5 96.25/97.00/98.75/99.50 call condors, 12.5 net/wings over

- 15,000 SFRJ4 94.75/94.87/95.00 2x1x1 put trees, 0.0-0.5

- 4,600 SFRM4 94.87 calls vs. 0QM4 96.50 calls

- 4,000 SFRM4 94.75/94.87 put spds ref 94.97

- 2,000 SFRM4 94.75/94.87 put spds vs. SFRM4 95.12/95.25 call spds

- 1,000 3QH4 96.00/96.25 3x2 put spds ref 96.32

- 5,000 SFRJ4 94.50/94.75/95.50 call trees ref 94.97

- 1,500 2QH4 96.06/96.31 3x2 put spds ref 96.35 to -.355

- 3,000 0QG4 96.00/96.12 call spds ref 95.91

- 2,400 2QG4 96.25/96.31/96.37 put trees ref 96.355

- 2,000 2QH4 96.38 puts ref 96.355

- Block, 2,500 SFRM4 94.56/94.68/94.81 put flys, 2.25 ref 95.00

- Treasury Options: Reminder, March options expire next week Friday

- +40,000 TYJ 106 puts, 5 ref

- Update, over 10,000 TYH 109.5/111/112.5 put flys ref 109-19.5 to -30

- +10,000 TYH4 109.25 puts 10 ref 109-25 (expire next Friday

- +10,000 TYJ4 107.5/108.5 put spds, 11 ref 110-12.5

- +7,000 wk3 FV 106.25 puts, 2

- 20,000 TYJ4 107.5/108/108.5 put flys ref 110-15 to -14.5

- over 10,200 TYJ4 109 puts, 28 last

- over 5,200 TYJ4 110.5 calls

- 2,000 TYH4 110.5 calls, 10 ref 109-30.5

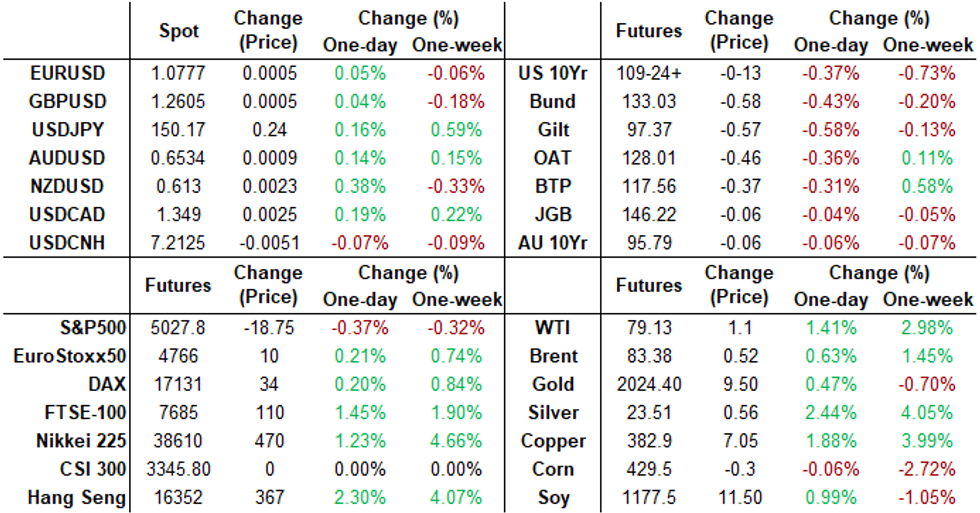

FOREX USD Index Further Pares Post-CPI Advance

- Hotter-than-expected US CPI prompted a near 1% rally for the USD index early in the week. However, as major equity indices steadily recovered their post-data selloff, the greenback has pared the majority of that move, leaving the DXY up just 0.10% as we approach the week's close.

- On Friday, major currency ranges remained contained once more, despite an above-estimate surprise for US PPI prompting a very brief bout of greenback strength. Continued supportive price action for equities has weighed on the USD index, which now tilts into negative territory on the day. In similar price action to Thursday’s session, AUD and NZD are outperforming amid the bolstered risk sentiment across global markets.

- Corrective bounce in AUD/USD extended through the London close, with markets happy to buy the post-PPI dip and tip prices through both pre-data levels as well as the Friday highs. Strength into the weekly close saw the move close in on 0.6546, the 20-day EMA, and signals scope for a larger move towards key resistance at the Jan 30 high of 0.6625.

- EURUSD rose in line with the moves for the greenback, extending above its initial resistance point of 1.0750 (50% retracement for this week's downleg) and has continued to narrow the gap to the 50-dma which resides at 1.0798.

- USDJPY reached as high as 150.65 on the data from the earlier 149.83 lows, but has since settled around mid-range and just above the psychological 150.00 mark.

- President’s Day on Monday turns the focus straight to the RBA minutes and Canadian CPI on Tuesday. The FOMC minutes and European Flash PMIs will be highlights on the docket later in the week.

FX Expiries for Feb19 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0640-50(E1.2bln), $1.0930-40($947mln)

- USD/JPY: Y144.00($1.2bln), Y147.00-15($687mln), Y148.25-45($625mln), Y150.00($786mln)

- GBP/USD: $1.2540-50(Gbp550mln)

- AUD/USD: $0.6460(A$594mln)

- USD/CAD: C$1.3590-95($2.1bln), C$1.3700($1.3bln), C$1.3815-20($2.8bln)

- USD/CNY: Cny7.2000($611mln)

Late Equities Roundup Drifting Off Lows, Materials, Pharma Leading

- Stocks are drifting off late morning lows late Friday amid modest position squaring ahead the extended weekend, Materials and Health Care sectors outperforming. Currently, the DJIA is up 17.58 points (0.05%) at 38790.07, S&P E-Minis up 2.75 points (0.05%) at 5048.75, Nasdaq down 26 points (-0.2%) at 15879.98.

- Leading gainers: Materials and Health Care sectors continued to lead gainers in the second half, construction materials shares buoyed the former: Vulcan Materials +5.89%, Albemarle +5.38%, Freeport-McMoRan +2.12%. Pharmaceuticals and biotech shares supported the Health Care sector: Bio-Rad Labs +8.65%, Eli Lilly +4.0%, West Pharmaceuticals +3.5%.

- Laggers: Media and entertainment shares weighed on the Communication Sector for the second day running: Paramount -3.61% (down over 5% on the week after Berkshire Hathaway trimmed positions in Paramount as well as HP and Apple), Warner Brothers -2.42%, Meta -2.15%. Meanwhile, estate management shares weighed on the Real Estate sector: CBRE -1.23% (taking profits after gaining +7% Thursday on strong earning), Costar Group -0.61%.

- Looking ahead: corporate earnings on tap next week include Home Depot and Walmart early Tuesday, followed by Caesars Entertainment, Diamondback Energy, Costar, Teladoc, Palo Alto Networks and Chesapeake Energy after the close.

E-MINI S&P TECHS: (H4) Bullish Trend Structure

- RES 4: 5170.86 2.236 proj of Nov 10 - Dec 1 - 7 price swing

- RES 3: 5110.50 2.00 proj of Nov 10 - Dec 1 - 7 price swing

- RES 2: 5100.00 Round number resistance

- RES 1: 5066.50 High Feb 12 and the bull trigger

- PRICE: 5030.50 @ 1450 ET Feb 16

- SUP 1: 4957.27 20-day EMA

- SUP 2: 4866.000/4845.11 Low Jan 31 / 50-day EMA

- SUP 3: 4702.00 Low Jan 5

- SUP 4: 4594.00 Low Nov 30

The trend condition in S&P E-Minis is unchanged and remains bullish. The pullback from Monday’s 5066.50 high is considered corrective and support to watch lies at 4957.27, the 20-day EMA. A clear break of this average would suggest potential for a deeper retracement, possibly towards the 4866.00 key support, the Jan 31 low. The trigger for a resumption of gains is 5066.50, the Feb 12 high.

COMMODITIES Crude Futures Extend Gains, Underpinned By Geopolitical Tensions

- Crude strengthened on the day with WTI set for 9% gains since the start of the week. Additional Middle East geopolitical tensions are outweighing concerns for the demand outlook. Front Month WTI (March 24) is up 1.40% at 79.12$/bbl approaching the close.

- Today has seen an escalation of tensions between Israel and Iran-backed, Lebanon-based, Hezbollah following an Israeli attack which killed 10 Lebanese civilians this week. In a televised address a short time ago, Hezbollah leader Sayyed Hassan Nasrallah, responding to the attack, said Israel will pay a price "in blood."

- Key short-term resistance has been defined at $79.29, the Jan 29 high and clearance of this level would be a bullish development.

- For precious metals, very similar price action for the USD to Thursday has seen similar advances of 0.36% and 2.15% respectively for spot gold and silver.

- While gold has edged back above its breakout level, a bearish theme does remain intact overall and the yellow metal needs to clear resistance at $2065.5, the Feb 1 high, to reinstate a bullish theme.

MONDAY/TUESDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 19/02/2024 | 2350/0850 | * |  | JP | Machinery orders |

| 19/02/2024 | 0700/0800 | *** |  | SE | Inflation Report |

| 19/02/2024 | 1330/0830 | * |  | CA | Industrial Product and Raw Material Price Index |

| 20/02/2024 | 0900/1000 | ** |  | EU | current account |

| 20/02/2024 | 1000/1100 | ** |  | EU | Construction Production |

| 20/02/2024 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 20/02/2024 | 1330/0830 | *** |  | CA | CPI |

| 20/02/2024 | 1330/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 20/02/2024 | 1630/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 20/02/2024 | 1630/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 20/02/2024 | 1800/1300 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 20/02/2024 | 1800/1300 | ** |  | US | US Treasury Auction Result for 52 Week Bill |

| 21/02/2024 | 2350/0850 | ** |  | JP | Trade |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.