-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS - Real Yields Touching Highest Levels Since 2008

Highlights:

- Real yields surge, with 5yr yields hitting best levels since 2008 before Treasuries pare losses

- Greenback stages late recovery rally as ADP, ISM top expectations

- US expected to have added 225k jobs across June, unemployment rate seen edging lower

US TSYS: Off ADP-Instigated Cheaps But Still A Significant Sell-Off Ahead Of Payrolls

- Cash Tsys have made decent progress paring losses that were primarily driven by the substantial ADP beat (497k vs cons 225k) and with a helping hand from a hawkish Logan (’23 voter) earlier.

- The paring of losses has been helped by some since questioning a seasonality boost for ADP, whilst other data had strong aspects (ISM services headline beat, higher JOLTS quits rates and lower continuing claims) but were sufficiently nuanced to prevent a further cheapening ahead of tomorrow’s payrolls report.

- Intraday gains have been concentrated at the front-end though and the overriding takeaway, despite moving off cheaps, is a large sell-off in 5-10Y tenors with double digit increases in real yields weighing on risk assets (5Y real +11bp at 2.16% off an earlier high of 2.25% that touched the highest since 2008).

- 2YY +5.9bp at 5.004%, 5YY +12.1bp at 4.370%, 10YY +11.4bp at 4.045% and 40YY +8.1bp at 4.009%.

- TYM3 at 110-19 (-24+) is off lows of 110-05 on particularly elevated volumes of 2M. It cleared key support at 110-27+ (Mar 2 low) and opens 110-00 (continuation of Nov 9, 2022 low).

- The same broad trend is seen in Fed pricing through the day, ultimately holding stronger on the day, especially into the turn of the year. Cumulative change from 5.08% effective +22bp Jul (+1.5bp), +36.5bp to 5.445% terminal in Nov (+4bp) and the first cut from current levels priced for Jun with a cumulative -12bp (+6bp on the day).

MNI US Payrolls Preview: Establishment vs Household Surveys

Executive Summary

- Bloomberg consensus sees payrolls growth of 225k in June after May’s large beat of 339k, with the primary dealer survey pointing to modest upside risk. Watch revisions to see whether that pace is maintained.

- AHE is seen increasing 0.3% M/M for the second month with unusually uniform analyst expectations – a surprise in either direction here should offer a clean read.

- In the separate household survey, the u/e rate is seen ticking a tenth lower on rounding to 3.6% (close either way after May’s unrounded 3.655%) after it jumped 0.3pps in May.

- Along with Wednesday’s CPI, it’s the last major release before the Jul 26 FOMC. The first look at Q2 GDP plus the Q2 ECI and monthly PCE data for June all land 1-2days after the decision.

- The market is pricing a 21-22bp hike for the July 26 decision whilst not yet being won over by the FOMC’s median dot of two hikes from current levels, with a November terminal currently at a cumulative +34bps.

PLEASE FIND THE FULL REPORT HERE:

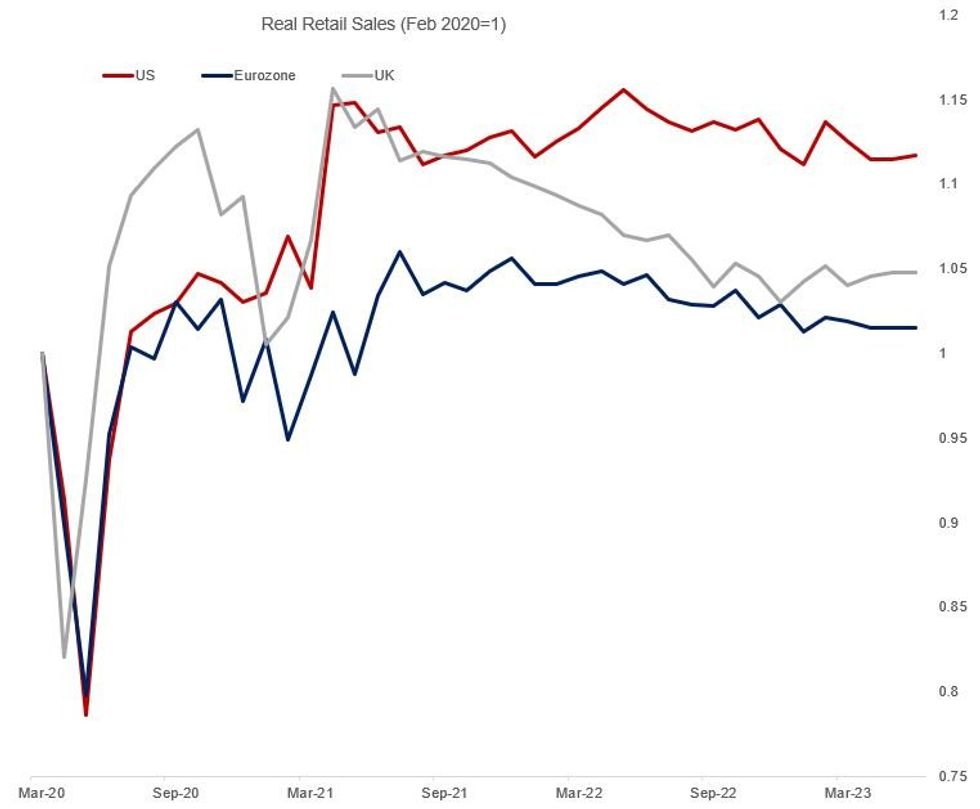

GLOBAL: Europe's Retail Stagnation Contrasts With US Resilience

May's retail sales data suggested continued stagnation for European consumers: today's report showed a third consecutive month of flat Eurozone retail sales volumes.

- This shouldn't be surprising, with squeezed real incomes hurting consumption and confidence low (even if rebounding from 2022 lows).

- The data are not suggestive of a collapse but do represent a meaningful stagnation that should be taken in the context of volumes falling further below pre-pandemic trends.

- Eurozone retail volumes are roughly 3-4% below the level they would have been if the 2013-2020 growth trend had continued, and even until Q2 2022 when the impact of the Russia-Ukraine war started to be felt they were roughly in line.

- UK real retail sales meanwhile have actually picked up from late 2022 lows but are now around 11% below pre-pandemic trend.

- By the same metric, the US recovery from the pandemic stands out, where real retail sales (there is no official volume index, so CPI-deflated) have also been steady since mid-2021 but remain around 5% above their pre-pandemic trend.

- In this context, the US inflation squeeze continues to look more demand-led relative to the Eurozone and UK.

Source: Eurostat, ONS, Census Bureau, BLS, MNI Calculations

Source: Eurostat, ONS, Census Bureau, BLS, MNI Calculations

US Real Yield Surge A Key Driving Factor For Risk-Off

- Real yields have rightly been getting plenty of attention recently, with the 5Y real yield currently +16bp on the day and +23bp week to date at 2.22%. [A latest update puts this now at +11bp on the day at 2.16% but the broad analysis still stands]

- It’s just pulled back from poking above 2.25% for fresh highs since 2008.

- Inflation breakevens remain particularly well behaved at 2.22%, broadly flatlining in recent months and close to recent lows not much below 2.10%, as the Fed’s hawkish dot plot allows this latest market sell-off to borne by real rate channels.

- The acceleration in the trend increase in real yields has been supporting the USD index but to less extent than at the height of the Fed’s hiking cycle when it was moving in 75bp clips in 2022.

- Chart shows 5Y real yields (green), nominal yields (white), breakevens (yellow) and DXY (pink).

Source: Bloomberg

Source: Bloomberg

UKRAINE: NBC News-Fmr US Officials Held Talks w/Russians On Peace Negotiations

NBC News reportingthat "A group of former senior U.S. national security officials have held secret talks with prominent Russians believed to be close to the Kremlin — and, in at least one case, with the country’s top diplomat — with the aim of laying the groundwork for potential negotiations to end the war in Ukraine,"

- The report appears to be strongly sourced, with NBC News stating that "half a dozen people briefed on the discussions" had confirmed the story." The alleged inclusion of Foreign Minister Sergey Lavrov in the discussions would indicate a significant amount of Kremlin knowledge and approval of the move to potentially seek talks. Given that these took place before the Wagner mutiny, that has damaged Putin's image of absolute control, the efforts could end up being accelerated further in the short-to-medium term.

- There has already been talk of prisoner exchanges between Russia and the US regarding WSJ journalist Evan Gershkovich, indicating that the two sides are in contact.

- US and other Western nation stances at next week's NATO summit regarding the level of support for Ukraine both in military terms and in reconstruction funds could prove a potential indicator as to what senior NATO nations see regarding the prospect of peace negotiations.

- The story comes as Belarusian President Alexander Lukashenko also talks up the prospect of negotiations, with Russian state outlet TASS reporting Lukashenko as stating that "Ukraine peace talks might start by autumn." More comments from Lukashenko here.

FOREX: USD Stages Late Recovery on Solid ISM, ADP

- GBP/USD price action showed that markets remain content to sell rallies in the currency, regardless of the run higher in BoE market-implied pricing. An early rally in the pair followed another cycle high in the market-implied peak BOE rate, which now fully prices a 6.50% bank rate for the March meeting next year. GBP/USD rallied to touch 1.2781 just ahead of the cash equity open, but this swiftly reversed course on strong US data.

- The ADP Employment Change release drew initial focus, doubling market expectations to print 497k vs. Exp. 225k. A strong ISM Services report followed, bolstering market expectations ahead of NFP. The subsequent run higher in the US 10y yield (hitting multi-month highs of 4.0812%) helped prop the greenback, dragging GBP/USD as much as 100 pips off the session high.

- JPY outperformed as equities globally turned south. European markets were hit particularly hard, with the EuroStoxx50 shedding 3% on the day. While the decline in Wall Street was less extreme, the pullback in prices continues to underline the sensitivity of equity prices around a resumption of the Fed hiking cycle.

- Focus Friday inevitably turns to the US payrolls report, with markets expecting the US to have added 225k jobs over the month of June, pressing the unemployment lower by 0.1ppts to 3.6%. The Canadian release also crosses, but an increase in unemployment is expected to 5.3, with 20k net change in employment.

- Central bank speakers due on Friday include ECB's Lagarde, BoE's Mann and ECB's Nagel.

FX OPTIONS: Expiries for Jul07 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0750-60(E1.5bln), $1.0800(E836mln), $1.0845-50(E604mln), $1.0900(E896mln), $1.0920-25(E573mln), $1.0970(E881mln), $1.1000(E1.6bln)

- USD/JPY: Y145.00($1.2bln)

- AUD/USD: $0.6700(A$1.6bln)

- USD/CAD: C$1.3300($1.4bln)

- USD/CNY: Cny7.2000($1.5bln)

EU FI Options: Vol Selling And Upside Feature Thursday

Thursday's Europe rates/bond options flow included:

- RXQ3 135/135.5cs, bought for 5.5 in 4.15k (rolling down strike).

- ERU3 96.12^ sold at 19.25 in 7k

- SFIZ3 93.80/94.00cs vs 93.50/93.30ps, bought the cs for -0.25 in 2k

US STOCKS: Equities See Intraday Rally But Macro Backdrop Still Weighs

- A steady rally in equities that started after day’s heavy data schedule had been digested hasn’t been enough to claw back heavy losses on the open that at the time were exacerbated by the largest sell order since Mar 9 with 1932 names.

- The macro backdrop sets the tone today as Tsys may have pared post-ADP losses but it’s been more so at the front end of the curve and real yields still sit +12bp and +10bp on the day for 5Y and 10Y tenors.

- The S&P E-mini trades -0.8%, with Nasdaq inline but Dow (-1.1%) and Russell (-1.8%) underperforming.

- SPX losses are led by energy (-2.6%) and consumer discretionary (-1.5%), but financials at -1.1% mask a heavier day for banks (-2.1%). The separate KBW index suggests no differentiation by size, with BKX (-2.1%)/KRX regionals (-2.0%).

- ESU3's session low of 4419.50 stopped short of support at the 20-day EMA of 4405.73 (20-day EMA).

- North of the border, TSX underperforms at circa -1.5%. Energy clearly weighs (-1.8%) but largest declines are seen in IT (-2.1%) and materials (-2.0%).

COMMODITIES: Crude Oil Reverses US Data-Related Losses After EIA

- Crude prices have seen a session of two halves, sliding after primarily the large ADP beat plus other generally strong data, before rallying after US inventory data and along with a paring of initial Tsy losses.

- Crude stocks were roughly as expected (-1.5mbbls) while crack spreads edged higher with a drop in gasoline and distillates stocks (gasoline stocks -2.5mbbls, distillates -1mbbls).

- OPEC is holding its 8th International Seminar in Vienna on 5-6 July. OPEC forecasts for 2024 oil demand growth to be lower than this year of 2.35mbpd. OPEC chief Al Ghais said OPEC’s market share is expected to rise to 40%, from 30%, by 2040. OPEC had conversations with four nations to potentially join the group.

- WTI is +0.2% at $71.96 off a low of $70.22. A pre-data high of $72.34 came closer to resistance at $72.72 (Jun 21 high) whilst support at $66.96 remains comfortably untested.

- Brent is unch at $76.64 off a low of $75.03, also having come closer to resistance at $77.25 (Jun 21 high) and not close to testing support at $71.43 (May 31 low).

- Gold is -0.2% at $1910.82 as the net USD strength on the day weighs slightly. Trend conditions remain bearish, with support seen at $1893.1 (Jun 29 low), with gold touching a low of $1902.86 before Treasury yields receded somewhat.

CANADA: 2024 Rate Inversion Cut Notably Ahead Of Tomorrow’s Jobs Report

- BAX futures have been chipping away at ADP-inspired losses but still hold a sizeable cheapening on the day, especially later into 2024.

- Front Sep’23 (-0.01), Dec’23 (-0.03), Jun’24 (-0.09) and Dec’24 (-0.13).

- The combination pushes the BAU3/Z3 spread back to +5.5bps for levels prior to Friday’s monthly GDP and BoC surveys. There’s a more notable push higher in BAU3/Z4 to-67bps (from -79bp yesterday) for its smallest in absolute terms since October.

- BoC-dated CORRA OIS sits at +16.5bp for next week’s decision, building to a cumulative +40bp by year-end.

- It comes ahead of tomorrow’s jobs report, with analysts looking for a bounce after May’s -17k employment was hit by a slump in the <25yr old cohort. Analysts entries are closely tied between 5.2% and 5.3% for the u/e rate (series low of 4.9% in Jul’22) although wage growth could moderate in Y/Y terms.

FED: Reverse Repo Usage Continues Trend Decline

- RRP usage falls again to $1854B (-$13B) as it extends yesterday’s -$43B and Monday’s -$125B after the sharp pullback from month/quarter-end factors.

- It’s the lowest since mid-May’22 as the surge in T-bill issuance continues to help cut balances.

- Number of counterparties dips back to 101 (-1).

Repo Reference Rates

REPO REFERENCE RATES (rate, change from prev. day, volume):

* Secured Overnight Financing Rate (SOFR): 5.06%, no change, $1589B

* Broad General Collateral Rate (BGCR): 5.05%, no change, $582B

* Tri-Party General Collateral Rate (TGCR): 5.05%, no change, $577B

SOFR volumes closing in on late May cycle highs of $1627B.

Effective Fed Funds Rate

New York Fed EFFR for prior session (rate, chg from prev day):- Daily Effective Fed Funds Rate: 5.08%, no change, volume: $123B

- Daily Overnight Bank Funding Rate: 5.07%, no change, volume: $269B

| Date | GMT/Local | Impact | Flag | Country | Event |

| 07/07/2023 | 0545/0745 | ** |  | CH | Unemployment |

| 07/07/2023 | 0600/0800 | ** |  | DE | Industrial Production |

| 07/07/2023 | 0600/0800 | ** |  | NO | Norway GDP |

| 07/07/2023 | 0600/0800 | ** |  | SE | Private Sector Production |

| 07/07/2023 | 0645/0845 | * |  | FR | Foreign Trade |

| 07/07/2023 | 0800/1000 | * |  | IT | Retail Sales |

| 07/07/2023 | 0900/1100 |  | EU | ECB de Guindos Keynote Address at King's College | |

| 07/07/2023 | 1230/0830 | *** |  | CA | Labour Force Survey |

| 07/07/2023 | 1230/0830 | *** |  | US | Employment Report |

| 07/07/2023 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 07/07/2023 | 1400/1000 | * |  | CA | Ivey PMI |

| 07/07/2023 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 07/07/2023 | 1430/1530 |  | UK | BOE Mann Panellist at CEBRA | |

| 07/07/2023 | 1645/1845 |  | EU | ECB Lagarde Panels Rencontres Economiques |

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.