-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Injects CNY90.3 Bln via OMO Tuesday

MNI ASIA MARKETS ANALYSIS: Risk-Off Ahead CPI

HIGHLIGHTS

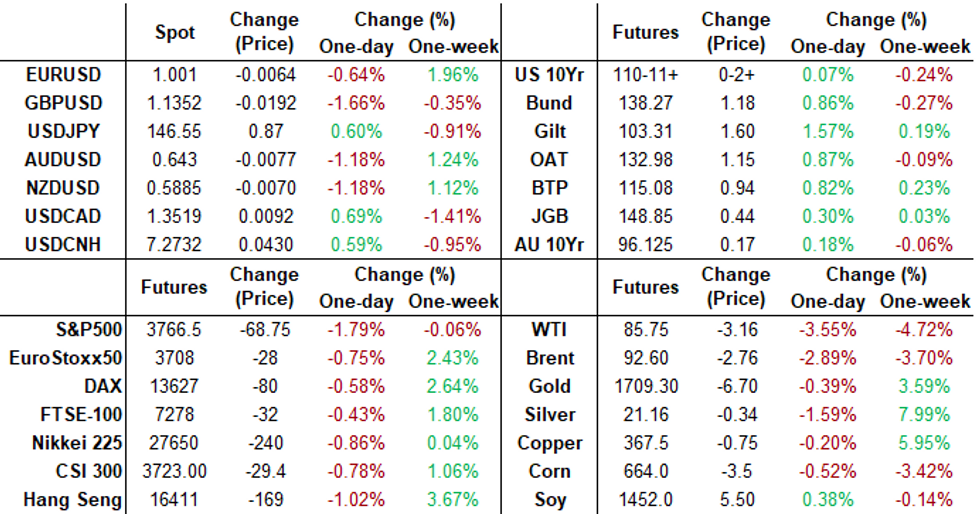

- Meta Begins Slashing 11,000 Jobs Across Company, Bbg

- EU PLANS NEW ANTITRUST CHARGES AGAINST FACEBOOK: POLITICO

- DISNEY FALLS 9% AT THE OPEN AFTER PROFIT DISAPPOINTS, Bbg

- DR HORTON EXPECTS ORDERS TO DROP 25% TO 30% IN 1Q, Bbg

- Redfin Lays Off 13% of Staff, Shuts Down Home-Flipping Business, Bbg

- ROBLOX SHARES FALL 11% AFTER EARNINGS MISS, MOST IN A MONTH, Bbg

- RUSSIA'S SHOIGU ORDERS TROOPS TO PULL BACK FROM CITY OF KHERSON, Bbg

- PUTIN TO SKIP GROUP OF 20 SUMMIT IN INDONESIA NEXT WEEK, Bbg

- BINANCE CHIEF SAYS NEAR COLLAPSE OF FTX ‘SEVERELY’ ERODED CONFIDENCE IN CRYPTO INDUSTRY - FT

Key links: MNI US CPI Preview: Can Cars Drive A Core CPI Slowdown? / MNI INTERVIEW: Fed's Barkin-Prices May Force Higher Rates Peak / MNI INTERVIEW:US CPI Rent Costs To Gain Momentum-Fed Economist

US TSYS: Bonds Weaker at the Bell, 10Y Auction Tailed

After a moderately volatile first half Tsy futures sell-off, curves steepened after $35B 10Y note auction (91282CFD8) tails yet again w/ 4.140% high yield vs. 4.107% WI; 2.23x bid-to-cover vs. 2.34x prior.

- Tsys followed EGBs higher in the first half, Bonds leading as following Russia/Ukraine headline the former planning on withdrawal from city of Kherson. Debatable as a trigger, as stocks bounced off lows as well are trading weaker again: (ESZ2 -35.00 at 3800.25).

- Unrelated Bbg headline around same time: PUTIN TO SKIP GROUP OF 20 SUMMIT IN INDONESIA NEXT WEEK, unlikely to have contributed to FI/EQ bounce.

- Markets remain skittish for a number of reasons including lack of definitive results from US midterm elections, no clear leader for control of Congress as yet.

- Many remain sidelined ahead Thursday's CPI data (prior, est): MoM (0.4%, 0.6%); YoY (8.2%, 7.9%); CPI ex-food and energy MoM (0.6%, 0.5%); YoY (6.6%, 6.5%).

- Pick-up in corporate issuance: GE Healthcare 6-part jumbo rumored appr $8B total, in addition to today's $35B 10Y note sale.

- The 2-Yr yield is down 3.3bps at 4.6173%, 5-Yr is down 1.4bps at 4.2797%, 10-Yr is up 2.1bps at 4.1447%, and 30-Yr is up 3bps at 4.3047%.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00343 to 3.81214% (-0.00415/wk)

- 1M +0.01986 to 3.87857% (+0.02043/wk)

- 3M +0.03800 to 4.63000% (+0.07971/wk) * / **

- 6M +0.02186 to 5.15629% (+0.14500/wk)

- 12M -0.00743 to 5.63286% (-0.03357/wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 4.59200% on 11/8/22

- Daily Effective Fed Funds Rate: 3.83% volume: $101B

- Daily Overnight Bank Funding Rate: 3.82% volume: $288B

- Secured Overnight Financing Rate (SOFR): 3.78%, $978B

- Broad General Collateral Rate (BGCR): 3.75%, $401B

- Tri-Party General Collateral Rate (TGCR): 3.75%, $388B

- (rate, volume levels reflect prior session)

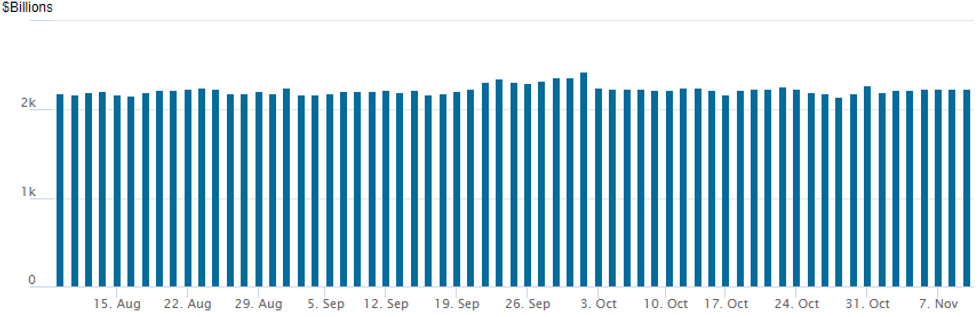

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to $2,237.812B w/ 101 counterparties vs. $2,232.555B in the prior session. Prior record high stands at $2,425.910B on Friday, September 30.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

FI option trade turned mixed Wednesday from more consistent upside call buying in the prior session. Implied vol buoyed as underlying futures sold off following a poorly received 10Y note auction, early vol sellers evaporating ahead Thursday's key CPI data. Salient trade:- SOFR Options:

- +16,200 SFRH3 97.00/98.50 call spds, 0.75 ref 94.94

- Block, 2,000 Green Nov 96.18/96.31 1x2 call spds, 1.5 net ref 96.06

- 4,000 Green Nov 96.31 calls ref 96.07

- 4,000 short Jun 94.00/94.50 put spds ref 95.755

- 4,000 SFRZ3 94.25 puts, ref 95.27 to -.275

- Eurodollar Options:

- -1,000 short Mar 95.00/95.50 strangles, 45.5

- +10,000 Dec 95.00/95.12/95.25 call flys, 1.75

- Treasury Options:

- +7,250 wk3 FV 107.25/107.75 call spds, 3.5

- +10,000 TYZ 108.75 puts, 17 ref 110-02.5

- 4,000 TYZ 111.75/112.75 call spds

- +5,000 TYZ2 111/112/113 call trees, 12

- 3,200 TYF 114 calls, 12 ref 110-14.5

- 3,000 TYF 112.5/113.5 call spds vs. TYF 105.5/106.5 put spds

- 2,500 TYF 107/109 put spds

- +4,300 FVF 104.5/105.25 put spds, 9 ref 106-22

- Block, -10,000 FVZ 105.5/106.75 put spds, 33.5

EGBs-GILTS CASH CLOSE: UK Long End Leads

UK long-end yields fell sharply Wednesday, with the belly outperforming on the German curve.

- Multiple factors spurred the European FI rally amid a generally risk-off session, with equities falling sharply alongside losses in the cryptocurrency space.

- There was also some anticipation over Thursday's US CPI reading, with MNI's preview suggesting most are eyeing downside risks to the print.

- The risk-off tone had a brief respite in the afternoon on news of a Russian setback in Ukraine, but subsequent reports saw pessimism return. Bunds and Gilts rallied throughout.

- Periphery EGBs were mixed: GGBs underperformed.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 11.3bps at 2.211%, 5-Yr is down 10.6bps at 2.093%, 10-Yr is down 10.9bps at 2.172%, and 30-Yr is down 9.5bps at 2.09%.

- UK: The 2-Yr yield is down 2.4bps at 3.23%, 5-Yr is down 5.2bps at 3.452%, 10-Yr is down 9.5bps at 3.457%, and 30-Yr is down 17.2bps at 3.566%.

- Italian BTP spread up 0.3bps at 211.5bps / Greek up 5.5bps at 246.3bps

EGB Options: Large Bund Upside Features

Wednesday's Europe rates / bond options flow included:

- ERM3 98.00/99.00c strip sold at 3.5 in 10k

- ERZ2 97.50p, vs 0RZ2 96.375/96.00ps, bought the mid for flat in 5k

- RXF3 142/144cs, bought for 23 and 24 in 37k total.

- OEZ2 119/118.25ps 1x1.5 vs 120.50c bought the ps for flat in 1k

FOREX: Slump In Sentiment Bolsters Greenback Recovery

- Downward pressure for both equity and crypto markets weighed on sentiment Wednesday, prompting a flight to quality in currency markets and the US dollar to recover a portion of its declines on the week.

- The USD Index (+0.85%) looks set to halt a three-day slump as market participants await the latest set of US CPI data that could have significant short-term implications for December Fed-pricing and the immediate direction for the greenback.

- Equities continue to pare the week’s gains, largely shrugging off the earlier comments from Russian minister Shoigu, regarding a potential retreat the city of Kherson, that prompted a brief spike in risk. Global markets seemed to be more focused on the Ukrainian rebuttal with the deepening crypto rout an additional USD tailwind. Additional pressure on treasuries following the US 10yr auction is underpinning the dollar’s grind higher approaching the APAC crossover.

- With risk sentiment dented, the likes of AUD (-1.35%) and NZD(-1.31%) have shown significant weakness for the session, however, GBP is the clear underperformer, having fallen ~1.8%, back below 1.1350 and eyeing the week’s lows around the 1.1300 handle. EURGBP also extended gains above 0.8791 resistance, trading to a 4-week high of 0.8828. Next resistance comes in at 0.8867, high Oct 12.

- A very light data docket on Thursday ahead of the US CPI main event. Fed’s Waller, Mester and George are on the speaker slate as well as BoC’s Macklem.

FX Expiries for Nov10 NY cut 1000ET (Source DTCC)

- EUR/USD: $0.9700(E1.3bln), $0.9800(E1.7bln), $0.9860-75(E1.2bln), $0.9900(E1.3bln), $0.9950-55(E1.1bln), $0.9990-00(E2.5bln), $1.0050-70(E968mln), $1.0090-00(E1.7bln)

- USD/JPY: Y144.30-50($1.1bln), Y145.00($1.0bln), Y146.00-05($665mln), Y147.00($1.3bln), Y150.00($1.9bln)

- GBP/USD: $1.1225-30(Gbp586mln), $1.1450(Gbp787mln), $1.1600(Gbp969mln)

- EUR/GBP: Gbp0.8790-00(E620mln)

- AUD/USD: $0.6500(A$651mln)

- USD/CNY: Cny7.1500($3.0bln), Cny7.2000($2.0bln), Cny7.2700($6.5bln), Cny7.2820($4.5bln)

Late Equity Roundup: Forging Lower

Stocks extended session lows into the FI close, Energy and Consumer Discretionary sectors continuing to underperform. SPX eminis currently trading -66 (-1.72%) at 3769.25; DJIA -524.17 (-1.58%) at 32639.67; Nasdaq -220.8 (-2.1%) at 10396.25.- SPX leading/lagging sectors: Energy (-4.47%) as equipment and servicer shares underperform oil and gas stocks: Occidental Petro (OXY) -8.97%, Coterra Energy (CTRA) -7.35%, Hess Energy (HES) -6.49%. Consumer Discretionary sector (-2.52%) followed with autos underperforming: Tesla -6.09%, Ford -2.88%. Leaders: Utilities (-0.49%), Real Estate (-0.59%) and Health Care Sectors (-0.65%).

- Dow Industrials Leaders/Laggers: scaling back from earlier highs, Merck (MRK) +0.63 at 102.13, McDonalds (MCD) +0.25 at 280.11, Procter & Gamble (PG) +0.17 at 136.98. Laggers: Disney (DIS) -12.60 at 87.30 after profits disappointed, Verizon (V) -7.37 at 194.41, United Health -9.43 at 543.62.

E-MINI S&P (Z2): Trading Above Last Week’s Low

- RES 4: 4100.00 Round number resistance

- RES 3: 4023.44 61.8% retracement of the Aug 16 - Oct 13 downleg

- RES 2: 3981.25 High Sep 14

- RES 1: 3928.00 High Nov 1 and a bull trigger

- PRICE: 3770.50 @ 14:45ET Nov 9

- SUP 1: 3704.25/3641.50 Low Nov 3 / Low Oct 21

- SUP 2: 3590.50/3502.00 Low Oct 17 / 13 and the bear trigger

- SUP 3: 3491.13 50.0% retracement of the 2020 - 2022 bull cycle

- SUP 4: 3453.78 1.618 proj of the Aug 16 - Sep 7 - 13 price swing

S&P E-Minis remain above last week’s low of 3704.25 (Nov 3). A breach of this level would expose the key short-term support at 3641.50, the Oct 21 low, where a break would signal scope for a continuation lower. For bulls, a stronger reversal higher and more importantly a breach of 3928.00, the Nov 1 high, is required to confirm a resumption of the recent bull theme. This would open 3981.25, the Sep 14 high.

COMMODITIES: WTI Eyes Key Support On Demand Fears and Surprise Supply Build

- Crude oil has seen heavy declines for the second day running, down another 3-3.5%.

- Initial downward pressure from China’s Guangzhou locking down a third district on Covid fears and a build in API crude stocks was added to by EIA domestic crude supplies surprisingly seeing the largest weekly climb in a month.

- WTI is -3.6% at $85.74, eyeing key support at $85.30 (Oct 31 low) having already cleared the Nov 3 low of $87.60.

- Brent is -2.9% at $92.6, through support at the 20-day EMA of $93.79 but still a little off key support at $91.46.

- Gold is -0.3% at $1706.8 giving back only so of yesterday’s surge as crypto slides. The yellow metal is trading above both the 20- and 50-day EMAs and attention turns to resistance at $1729.5, the Oct 4 high and a bull trigger.

Thursday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 10/11/2022 | 0001/0001 | * |  | UK | RICS House Prices |

| 09/11/2022 | 0100/2000 |  | US | Minneapolis Fed's Neel Kashkari | |

| 10/11/2022 | 0101/0101 | ** |  | UK | IHS Markit/REC Jobs Report |

| 10/11/2022 | 0130/0130 |  | UK | BOE Ramsden Panels PIIE & LKY Conference | |

| 10/11/2022 | 0700/0200 |  | US | Fed Governor Christopher Waller | |

| 10/11/2022 | 0700/0800 | * |  | NO | CPI Norway |

| 10/11/2022 | 0900/1000 | * |  | IT | Industrial Production |

| 10/11/2022 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 10/11/2022 | - |  | UK | House of Commons Recess Starts | |

| 10/11/2022 | 1300/1400 |  | EU | ECB Schnabel Discussion at at Bank of Slovenia | |

| 10/11/2022 | 1330/0830 | ** |  | US | Jobless Claims |

| 10/11/2022 | 1330/0830 | *** |  | US | CPI |

| 10/11/2022 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 10/11/2022 | 1400/0900 |  | US | Philadelphia Fed's Patrick Harker | |

| 10/11/2022 | 1435/0935 |  | US | Dallas Fed's Lorie Logan | |

| 10/11/2022 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 10/11/2022 | 1600/1100 |  | US | San Francisco Fed's Mary Daly | |

| 10/11/2022 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 10/11/2022 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 10/11/2022 | 1650/1150 |  | CA | BOC Gov Macklem speech, "The evolution of Canadian labour markets" | |

| 10/11/2022 | 1730/1230 |  | US | Fed Governor Loretta Mester | |

| 10/11/2022 | 1800/1300 | *** |  | US | US Treasury Auction Result for 30 Year Bond |

| 10/11/2022 | 1830/1330 |  | US | Kansas City Fed's Esther George | |

| 10/11/2022 | 1900/1400 | ** |  | US | Treasury Budget |

| 10/11/2022 | 1900/1400 | *** |  | MX | Mexico Interest Rate |

| 10/11/2022 | 2335/1835 |  | US | New York Fed's John Williams |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.