-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Soft CAD CPI Sees Treasuries Rally With FOMC Eyed

- Treasuries rally, primarily in spillover from a sizeable miss for Canadian CPI before a strong 20Y Tsy auction.

- The USD index has pulled back from earlier highs but still extends the recovery that began late last week, with strong gains for USDJPY after the BoJ decision.

- Equities have reversed intraday losses, helped by a turnaround in some mega-cap names but with the day's broader strength away from tech.

- WTI is set for the highest close since October in a continuation of moves after drone attacks on Russian refineries.

US TSYS: Front End Sees Push Back To Highs Late In The Session

- Front end Tsys have pushed back to earlier highs but further out the curve keep within session ranges.

- Yields sit 1.5-5bps lower on the day, led by 3s, bull steepening with 2s10s at -39.3bps (+1.3bps).

- The day’s drivers were initially some European spillover before more notably a miss for CAD CPI and then the first stop for a 20Y auction since Nov. Auction details included a solid 2bp trade through along with the highest bid-to-cover since Jun and lowest dealer take since Sep.

- TYM4 trades at 110-05+ (+ 11+), off a post-auction high of 110-08. Resistance is seen at 110-26 (20-day EMA) but yesterday’s 109-24+ pierced the bear trigger at 109-25+ (Feb 23 low) and has opened 109-14+ (Nov 28 low).

- TY cumulative volumes of 1.2m again lag recent averages (70-75%) for the time of day, with tomorrow’s FOMC decision looming.

- Fed Funds implied rates have drifted lower from the June meeting onwards, whilst the Dec implied rate continues to hover around the median dot from the Dec SEP ahead of tomorrow’s new dot plot and forecasts.

- Cumulative cuts from 5.33% effective: 0.5bp Mar, 2.5bp May, 16.5bp Jun, 26.5bp Jul and 73bp Dec.

CANADA: CAD Rates Holding Majority Of Large Rally On CPI

- GoCs have held their lift off highs but still see a strong rally on the day after a surprisingly soft CPI report with every main core measure (trim, median, CIPxFE & CPIX) moderating and the breadth of inflationary pressures narrowing.

- They see a sizeable bull steepening, with 2Y yields 12.5bp lower on the day and the Can-US yield differential 8.5bp lower at -52.5bps.

- BoC-dated OIS sees almost 20bp of cumulative cuts for June from closer to 12.5bp beforehand, whilst cumulative cuts for July have increased ~10bp of the day to 34bps.

- Further out, 3-mth CORRA futures show 79bp of cuts through Mar-Dec’24 contracts, vs 68bps pre-CPI and 88bps before the Mar 6 BoC.

- Analyst takes on CPI so far haven't yielded any formal view changes but some see a greater likelihood of a more notable dovish shift in guidance at the April BoC decision.

EGBs-GILTS CASH CLOSE: Bull Steeper Between Central Bank Flashpoints

Core EGBs and Gilts strengthened Tuesday with curves leaning bull steeper.

- The first major risk event of a busy week had little impact on European instruments, with the Bank of Japan's decision to end negative interest rate and yield curve control policy well-anticipated.

- With little news flow or data (German ZEW beat expectations but not a market-mover), supply was a key theme.

- Gilts ticked higher on a solid Oct-43 auction, helping UK instruments outperform global counterparts. Syndications of 10Y BTPei (E5bln) and Feb-50 EU Green (E7bln) saw sizes at the high end of expectations.

- Periphery EGB spreads widened on the day, with GGBs weakest.

- Wednesday's agenda begins with UK inflation (MNI preview here) ahead of Thursday's BoE decision; we also get ECB commentary from Lagarde, Lane and Schnabel, and after the cash close, the Fed decision and assorted communications.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 3.3bps at 2.919%, 5-Yr is down 2.4bps at 2.453%, 10-Yr is down 0.9bps at 2.45%, and 30-Yr is up 1.1bps at 2.611%.

- UK: The 2-Yr yield is down 4.3bps at 4.26%, 5-Yr is down 4.5bps at 3.954%, 10-Yr is down 3.2bps at 4.057%, and 30-Yr is down 0.5bps at 4.513%.

- Italian BTP spread up 3.2bps at 125.4bps / Spanish bond spread up 1.5bps at 80bps

US FI OPTIONS: Tuesday Summary

Tuesday's US rates/bond options flow included:

- SFRJ4 94.87/95.00/95.25c ladder, bought for 2 in 3k

- SFRJ4 94.87/95.00cs 1x2, bought for 1 in 5k.

- SFRJ4 94.87/94.93/95.00c ladder, bought for flat in 3k

- SFRU4 95.06/95.18/95.50/95.62c condor traded 3.25 in 3.5k, for 3.5 in 2.5k and in 7.5k on screen

- SFRM4 94.81/94.68/94.56p fly, traded 4.25 in 2.75k (on Block)

- SFRU4 95.00/94.62ps 1x3, bought for 3.25 in 10k total (on block)

- SFRU4 95.12^ sold at 44.5 and 43.5 in 2k (on screen)

- 0QJ4 96.25/96.37cs bought for 1.5 in 20k total

- 0QM4 96.12/97.12cs with SFRU4 97.00c vs SFRM5 97.12c, bought the strip for halfin 5k

EU FI OPTIONS: Ratio Spread Trades In Favour Tuesday

Tuesday's Europe rates/bond options flow included:

- DUK4 105.90/106.50cs, bought for 7.5 in 5k

- RXJ4 131/130.50ps 1x2, bought for 1.5 in 3.2k

- ERJ4 96.37/96.50cs 1x2, bought for 0.25 in 4k

- ERM4 96.50/96.37ps 1x2 sold the 1 at flat in 10k

- SFIU4 96.12/96.37/96.50c fly bought for 1.5 in 2.5k

FOREX: Japanese Yen Continues To Weaken Following BOJ Overnight

- Although off session highs, the USD index has extended the recovery that began late last week, rising 0.26% at typing, and looking set to extend its streak of consecutive winning days to 4. Greenback strength has been driven on Tuesday by a strong USDJPY rally in the aftermath of the BOJ decision.

- Late upside across USDJPY puts pair at new highs and briefly tops the resistance mentioned a handful of times today at Y150.89 - clearing the path for a test on last November's highs at 151.91 a little further out - and levels that will likely re-ignite intervention speculation from the Japanese authorities.

- Move in currency markets coincides with resumed gains for equities, as the e-mini S&P sees buying interest up to yesterday's highs at 5240.25. We note the downside pressure on the front-end of the USD/JPY vol curve - highly correlated with JPY downside: USD/JPY 3m implied vols are now through the YTD lows to print levels last seen in March 2022.

- Elsewhere, the RBA decision overnight came in unchanged, as expected, and has worked against Antipodean currencies as the RBA dropped their tightening bias in the policy statement. AUDUSD (-0.44%) has backtracked below the 200-dma and traded within 4 pips of the 0.6500 handle, weakness through which would put prices at the lowest level since March 6th.

- Tight ranges for major pairs such as EURUSD, GBPUSD and USDCHF meant that the broad-based yen weakness kept focus on cross/JPY, a theme that may continue as we approach tomorrow’s Fed decision and press conference, given the Yen’s sensitivity to US yields.

- UK inflation kicks off Wednesday’s docket before all focus turns to the Fed’s summary of economic projections and Chair Powell. Markets will also be on the lookout for potential comments from ECB’s Lagarde, due to speak at the ECB and its Watchers Conference, in Frankfurt.

EQUITIES: S&P E-mini Holding Shy Of Monday’s High, Tech Lags

- The S&P 500 e-mini sits close to session highs of 5239.00 that stopped just shy of yesterday’s 5240.25. The bull trigger is seen at 5257.25 (Mar 8 high).

- In a reversal of yesterday’s AI-focused gains, the Nasdaq 100 lags today.

- E-minis: S&P 500 +0.4%, Nasdaq 100 +0.2%, Dow Jones +0.6% and Russell 2000 +0.6%.

- Within the S&P 500, energy (+1.0%) leads with WTI seeing similar-sized further increases, followed by utilities (0.8%) and IT (+0.7%). Communication services lag (-0.3%), weighed down by Alphabet (-0.5%) and Meta (-0.7%) in a limited retracement of strong gains yesterday, followed by real estate (-0.1%) and materials (almost flat).

- Nasdaq has still seen a sizeable turnaround on the day though, reversing losses of as much as 0.9%.

- NVidia has played a sizeable role in the latter, having pared losses of ~4% for currently +1.7% as its conference continues. It plans to take a larger share of an annual market opportunity of $250bn in data centers.

COMMODITIES: WTI Set For Highest Close Since October

- WTI is set for its highest close since late October on Tuesday as escalating Ukrainian drone attacks on Russian refineries sparked supply concerns.

- WTI is up 1.0% on the day at $83.5/bbl.

- WTI futures have started this week on a bullish note, after last week’s gains resulted in a break of $79.87, the Mar 1 high. The move higher confirms a resumption of the uptrend that has been in place since mid-December. Sights are on $83.87 next, the Oct 20 ‘23 high, a break of which would open $84.87, the Sep 15 ‘23 high and a key resistance.

- Henry Hub front month also traded higher on the day as cooler weather forecasts offset curtailed LNG feedgas flows.

- US natural gas APR 24 is up another 2.2% at $1.74/mmbtu.

- Spot gold edged down by 0.1% on Tuesday to $2,158/oz, as the yellow metal continues to consolidate ahead of tomorrow’s FOMC meeting.

- The trend condition in gold is bullish and the latest pullback is considered corrective and appears to be a bull flag - a continuation pattern. Having cleared $2135.4, the Dec 4 high, to deliver a fresh all-time cycle high, this has opened $2206.6, a Fibonacci projection. Firm support is $2117.4, the 20-day EMA.

FIXES AND PRIOR SESSION REFERENCE RATES

SOFR FIX - Source BBG/CME

1M 5.32864

3M 5.33300

6M 5.27957

12M 5.09686

REPO REFERENCE RATES (rate, change from prev. day, volume):

* Secured Overnight Financing Rate (SOFR): 5.31%, no change, $1788B

* Broad General Collateral Rate(BGCR): 5.30%, no change, $699B

* Tri-Party General Collateral Rate (TGCR):5.30%, no change, $683B

Effective Fed Funds Rate New York Fed EFFR for prior session (rate, chg from prev day):

* Daily Effective Fed Funds Rate: 5.33%, no change, volume: $91B

* Daily Overnight Bank Funding Rate: 5.32%, no change, volume: $260B

Source: NY Fed

FED: A Second Limited Increase In O/N RRP

- The Fed’s O/N RRP saw uptake of $447.0bn in today’s operation.

- It’s a daily increase of only $6bn for a limited $33bn compared to Friday’s new recent lows, relatively small compared to some estimates of potential GSE inflows at this time of the month.

- The number of counterparties held steady at 70, still at the low end of recent readings.

CANADA DATA: Underlying Inflation Sees Sizeable Step Lower

- The February CPI report looks out and out dovish across the main core CPI measures.

- The average of the BoC’s preferred core measures (median and trim) printed 3.15% Y/Y (cons 3.35) after an unrevised 3.35%.

- The three-month run rate dropped to 2.2% annualized from 3.1% (3.2 prior to revisions), its lowest since Jan’21 and close to the 2% target midpoint.

- Whilst only three months, the six-month also pushed lower from 3.2% to 2.6% for its first reading back in the 1-3% target band since May’21.

- Alternate core measures are showing notably softer rates still: CPIxFE and CPIX saw 1.4% and 0.0% annualized over three months, or 2.8% and 2.1% Y/Y respectively.

- Averaging all four measures for a simple measure of underlying inflation, ‘underlying’ inflation slowed from 2.5% to 1.5% over the past three months, the six-month rate fell from 2.8% to 2.1% and the Y/Y fell from 3.1% to 2.8% Y/Y.

- More broadly, StatsCan notes: “Notable contributors to the deceleration included the indexes for cellular services, food purchased from stores, and Internet access services.”

CANADA DATA: Breadth Of Inflation Improves In February But Still Room To Go

- Adding to the above, Desjardins write "The share of components rising faster than 3% a year, a metric closely watched by Governor Macklem, has fallen to roughly 40% from 45% in January."

- Recall Macklem said in the BoC press conference that the 45% was roughly double what is normal, but the measure, which had been 50% in Dec, was also down from 80% at one point after the pandemic.

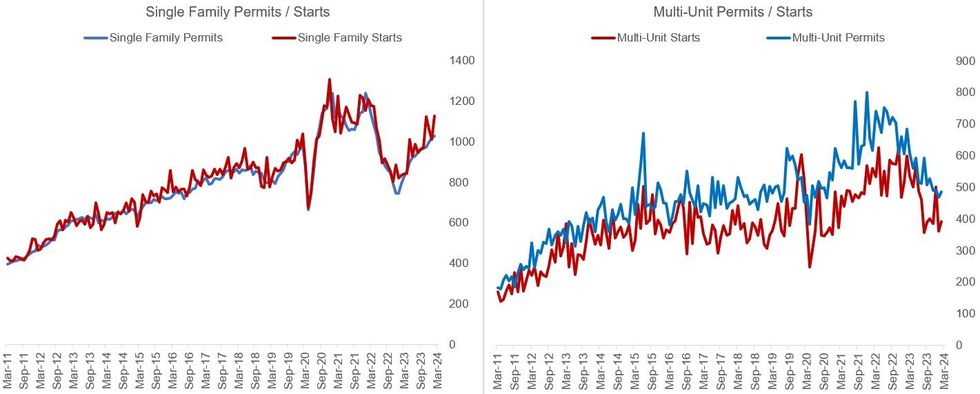

US DATA: Single Family Units Continue To Drive Overall Housing Activity

February housing starts and building permits came in stronger than expected, with January's figures also revised upward - but the divergence between single family and multi-unit housing activity remains stark.

- Total Starts totalled 1,521k on an annualized basis (1,440k expected, 1,374k prior - revised up 43k). Permits came in at 1,518k (1,496k expected, 1,489k prior - revised up 19k). That meant Starts grew 5.9% Y/Y, with Permits +2.4% Y/Y, suggesting overall housing construction activity is picking up more broadly.

- Looking at the underlying data though, single family permits made up 1,031k of permits highest since May 2022 and the 13th consecutive monthly increase, with multi-units just 487k - a slight uptick from January but in a broader downtrend that started in mid-2022.

- Likewise, single-family starts came in at 1,129k - the highest since April 2022 - while multi-unit starts remained below the 400k mark for another month (392k), and well below late 2022/early 2023 levels.

- The divergence in the series continues to be explained by rising interest rates offsetting investor interest in multi-unit housing, while single-family activity is gaining as homeowners are unwilling to move and refinance lest they give up their low-rate fixed mortgages, pushing new home demand higher.

- While there is a disinflationary impact from multi-family supply coming online - 5+unit completions hit the highest since 1974 in February - resilience in real housing market activity in the face of tighter monetary policy will remain a confounding factor in the FOMC's thinking on the potential for rate cuts later this year.

Source: Census Bureau, MNI

Source: Census Bureau, MNI

MNI UK Inflation Preview - February 2024

- Inflation is expected to continue to normalise across the major categories in February (albeit with some offsetting positive base effects from energy prices relative to those seen in January).

- Analysts are generally split between both headline and services inflation printing in line with the BOE’s February MPR forecast or seeing a repeat of the 0.1ppt downside surprise to the Bank’s forecast seen last month.

- We look in more detail at analyst expectations and outline the biggest expected drivers of the change in February as well as some potential sources of risk to consensus forecasts.

- We don’t think that the majority of the MPC will need to see inflation undershoot the February MPR forecasts in order to begin cutting rates. The MNI Markets team continues to put more weight on the wage data, and do not think a quorum can be achieved to vote for the first cut until it has become more evident that Q1 and April wage data are showing more meaningful signs of slowing.

- We think that a higher-than-expected inflation print (particularly for services CPI) would likely have a greater impact on delaying any possible BOE cuts than a lower-than-expected print could accelerate cuts. We therefore see asymmetry in potential market reactions – with a higher-than-expected print likely to have a larger market impact than a lower-than-expected print in our view.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.