-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI Gilt Week Ahead

MNI POLITICAL RISK - Trump Rounds Out Cabinet Nominations

MNI ASIA MARKETS ANALYSIS: UofM Sentiment Sours

- MNI FED Goolsbee: Inflation Too High But At Least Coming Down

- MNI US: Congressional Budget Office Report: Federal Deficit Projected $1.5T

US TSYS: Sentiment Sours, Projected Rate Cuts Moderate

- Treasury futures are holding near lows after the bell, curves flatter, extending inversion with the short end underperforming.

- There were no obvious headline or Block-driven trigger as projected rate cuts continue to climb off Thursday's lows given the rise in UofM's long term inflation expectations and cooling sentiment.

- Even Chicago Fed Goolsbee's comment on PBS over decelerating inflation failed to elicit much of a lasting reaction (though equities are rebounding at the moment: SPX Eminis -7.0 at 4137.0 vs. 4112.25 low).

- Yesterday saw three consecutive 25bp cuts projected to start in September.

- At the moment, however, September cumulative -20.9bp at 4.858%, November cumulative -44.1bp at 4.625%, Dec'23 cumulative -68.5bp at 4.381%, while Jan'24 cumulative is at -91.4bp (vs. 110.2bp Thu) at 4.153%. Fed Terminal currently at 5.08% in Jun'23 and Jul'23.

- White House Press Secretary Karine Jean-Pierre has told reporters that President Biden will meet with the four leaders of Congress "early next week" for a second round of talks on the debt limit, but declined to provide a specific date. Jean-Pierre: "When we have a date, certainly we will share that will all of you," adding that "productive talks" have been ongoing between negotiators representing all parties and will continue over the weekend.

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M -0.00238 to 5.05691 (+.00665/wk)

- 3M -0.01954 to 5.06680 (+.02807/wk)

- 6M -0.03708 to 4.98547 (+.03996/wk)

- 12M -0.07141 to 4.60114 (+.04754/wk)

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00028 to 5.06143%

- 1M -0.00200 to 5.10543%

- 3M -0.00242 to 5.31829% */**

- 6M -0.00557 to 5.34314%

- 12M -0.00986 to 5.25600%

- * Record Low 0.11413% on 9/12/21; ** New 16Y high: 5.34243% on 5/10/23

- Daily Effective Fed Funds Rate: 5.08% volume: $117B

- Daily Overnight Bank Funding Rate: 5.07% volume: $282B

- Secured Overnight Financing Rate (SOFR): 5.05%, $1.372T

- Broad General Collateral Rate (BGCR): 5.02%, $585B

- Tri-Party General Collateral Rate (TGCR): 5.02%, $573B

- (rate, volume levels reflect prior session)

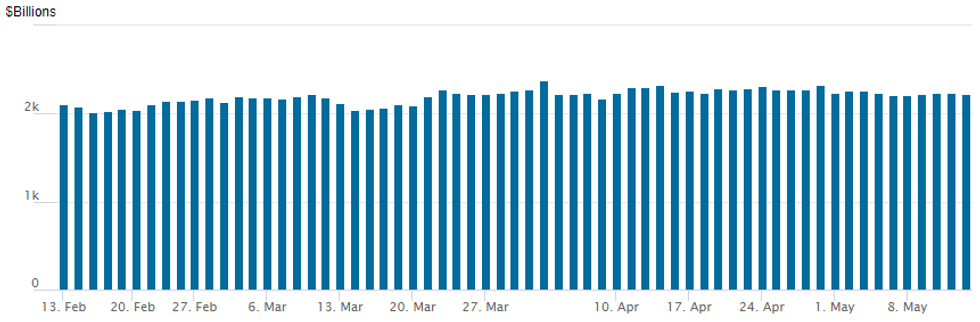

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage recedes to $2,229.199B w/ 109 counterparties, compares to prior $2,242.243B. Compares to high usage for 2023: $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

SOFR/TREASURY OPTIONS SUMMARY

Despite underlying rate futures trading weaker as projected rate cuts into year-end moderated, option trades continued to rotate around better upside call and call structure buying Friday. Salient trade include:- SOFR Options:

- Block, 5,000 SFRN3 95.25/95.75/96.25 call flys, 4.0 ref 95.235

- Block, 8,000 SFRU3 95.25/95.75/96.25 call flys, 2.75 ref 95.23

- Block, 5,000 SFRU3 94.81/94.93/95.06 put trees, 0.5 net 2-legs over

- +15,000 SFRU 95.12/95.37/95.62 call flys, 1.5

- -20,000 SFRM3 94.68/94.75 put spds 0.75 vs. 94.955/0.05%

- +4,000 SFRM3 95.25/96.00 2x3 call spds, 3.75 net ref 94.945

- +1,000 SFRQ3 96.25/97.25 1x2 call psds, 2.75

- +5,000 SFRH4 94.68/95.18 put spds, 9.5

- 1,500 SFRN3 95.18 puts, ref 95.295

- 1,100 SFRN3 95.12/95.37/95.62 call flys ref 95.29

- Treasury Options:

- -7,000 FVM 110/110.5 put spds, 17.5 ref 110-07.25

- +14,000 wk3 FV 111/111.5 call spds, 3.5 ref 110-06.75

- +20,000 wk3 TY 115/116.75 call over risk reversal from 1-2 vs. 115-27.5

- 2,800 TYM3 115.5 puts, 28 ref 115-30

- 2,000 TYM3 116 calls ref 116-03.5

- 10,000 FVM3 109.75 puts, 11.5 ref 110-18 to -17

FOREX: USD Undergoes Late Rally Into European Close

- Currency markets are being led by fixed income here, with the greenback putting in a pre-London close rally to help USD/JPY back above Y135.00 and within range of the next upside level at 135.47.

- Moves coincide with re-jigging of Fed implied policy path after the University of Michigan sentiment data, which showed a stubborn turnout for inflation expectations (4.5% vs. Exp. 4.4% for 1y, 3.2% vs. Exp. 2.9% for 5-10y).

- NZD remains the poorest performer of the session so far, tilting NZD/USD through both the 100- and 50-dma to narrow in on the $0.62 handle.

- Despite the more active morning across currency futures, there is evidence that volumes have faded through the NY crossover, with the fade in EUR/USD seeing lighter participation relative to this morning's European trade.

FX Expiries for May15 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0500(E1.0bln), $1.0890-05(E760mln) $1.1000-10(E1.1bln), $1.1200(E1.3bln)

- GBP/USD: $1.2390-00(Gbp632mln)

- AUD/USD: $0.6438-50(A$1.2bln)

- USD/CAD: C$1.3500-05($950mln)

- USD/CNY: Cny6.6500($2.8bln), Cny6.9500($1.6bln)

Late Equities Roundup: Off Late Lows, Banks, Auto Makers Lagging

Stocks are holding modestly weaker levels in late trade, off lows following comments from Chicago Fed Goolsbee on PBS:" Inflation Too High But At Least Coming Down".- S&P E-Mini Future currently down 21.5 points (-0.52%) at 4122.25; Nasdaq down 90.3 points (-0.7%) at 12238.06; DJIA down 116.22 points (-0.35%) at 33192.4.

- Leading laggers: Consumer Discretionary, Information Technology and Financial sectors outperformed, automakers weighing on the former with GM -2.7%, Tesla -2.4% in late trade. Banks weighing on Financials, Comerica -4.25%, Keybank -3.7%, Well Fargo -2.8%.

- From a technical point of view, S&P E-minis are consolidating and continue to trade above the 50-day EMA, which intersects at 4106.37. An extension higher would refocus attention on key resistance and the bull trigger at 4206.25, the May 1 high.

- A break of this level would confirm a resumption of the bull trend that started Mar 13. Key support has been defined at 4062.25, the May 4 low. A move through this support would be a bearish development.

E-MINI S&P TECHS: (M3) Resistance Remains Exposed

- RES 4: 4288.00 High Aug 19 2022

- RES 3: 4244.00 High Feb 2 and a medium-term bull trigger

- RES 2: 4223.00 High Feb 14

- RES 1: 4173.25/4206.25 High May 10 / 1

- PRICE: 4123.00 @ 1510 ET May 12

- SUP 1: 4062.25 Low May 4 and key near-term support

- SUP 2: 4052.50 Low Mar 30

- SUP 3: 4022.75 50.0% retracement of the Mar 13 - May 1 bull leg

- SUP 4: 4006.00 Low Mar 29

S&P E-minis are consolidating and continue to trade above the 50-day EMA, which intersects at 4106.37. An extension higher would refocus attention on key resistance and the bull trigger at 4206.25, the May 1 high. A break of this level would confirm a resumption of the bull trend that started Mar 13. Key support has been defined at 4062.25, the May 4 low. A move through this support would be a bearish development.

COMMODITIES: WTI Tests $70/bbl After Weak Consumer Sentiment, Gas Jumps On Rig Count Slump

- Crude oil has again come under pressure today after surprisingly weak US consumer sentiment built on broader demand concerns that had emerged through the week including a slower recovery in China.

- On the supply side, strong Russian output weighs against tigher supplies from OPEC, Iraq and Canada with the latter hindered by Alberta wildfires, although Chevron has since started to resume some operations.

- WTI is -1.1% at $70.06 as it moves nearer support at $68.43 (May 5 low).

- Brent is -1.05% at $74.18 as it moves nearer support at $71.28 (May 4 low).

- Gold is +0.0% at $2015.33 with relative resilience considering a firm increase in Treasury yields and a second day of dollar strength.

- Special mention also goes to US natural gas prices currently +3.7% after bouncing in late trade with a sharp drop in the rig count (-16 to 141, with the 10% drop the sharpest since Feb’16). Notably different trends in Europe though, with TTF prices sliding on the week with strong LNG supplies amid low demand from Asia, high seasonal storage levels and muted demand with limited pickup in industrial demand despite the low prices.

- Weekly moves: WTI -1.8%, Brent -1.5%, Gold -0.1%, US nat gas +6.2%, EU TTF nat gas -10.4%

Monday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 12/05/2023 | 2345/1945 |  | US | St. Louis Fed's James Bullard | |

| 12/05/2023 | 2345/1945 |  | US | Fed Governor Philip Jefferson | |

| 13/05/2023 | 1430/1030 |  | US | Fed Governor Lisa Cook | |

| 15/05/2023 | 0600/0800 | *** |  | SE | Inflation report |

| 15/05/2023 | 0900/1100 | ** |  | EU | Industrial Production |

| 15/05/2023 | - |  | EU | ECB Lagarde & Panetta in Eurogroup Meeting | |

| 15/05/2023 | 1215/0815 | ** |  | CA | CMHC Housing Starts |

| 15/05/2023 | 1230/0830 | ** |  | CA | Wholesale Trade |

| 15/05/2023 | 1230/0830 | ** |  | US | Empire State Manufacturing Survey |

| 15/05/2023 | 1300/0900 | * |  | CA | CREA Existing Home Sales |

| 15/05/2023 | 1315/0915 |  | US | Minneapolis Fed's Neel Kashkari | |

| 15/05/2023 | 1400/1000 |  | CA | BOC Financial System Survey report | |

| 15/05/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 15/05/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 15/05/2023 | 1600/1700 |  | UK | BOE Pill Monetary Policy Report Q&A | |

| 15/05/2023 | 2000/1600 | ** |  | US | TICS |

| 15/05/2023 | 2100/1700 |  | US | Fed Governor Lisa Cook Fed Governor Lisa Cook |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.