-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS - USD and Real Yields Higher On Fedspeak

- Hawkish Fedspeak, two scheduled from Bullard & Williams and two unscheduled from Mester & Brainard, helps drive terminal rate pricing back up to 5% and real yields higher.

- It forces an intraday cheapening in Treasuries, a return of USD strength and a rolling over in equities, with risk sentiment further weighed by BlockFi's earlier Chapter 11 filing.

- In energy space, oil is buoyed by OPEC+ seen seriously considering production cuts at its next meeting.

- On Tuesday, markets will see German and Spanish CPI data as well as Canadian GDP and US consumer confidence. Eurozone CPI data and US employment remain the key data points in focus later this week.

US TSYS: Fedspeak Helps Drive Intraday Cheapening

- Cash Tsys have held onto much of their intraday cheapening, more than reversing an overnight bid on China covid worries from first hawkish ECB language, then hawkish Fedspeak pushing back on 2023 rate cuts (Bullard and Williams, plus earlier from Mester on the need to see several good CPI prints) and at the margin a surprise improvement for the Dallas Fed mfg survey.

- The latest addition to Fedspeak has been unscheduled updated remarks from Brainard which includes a point that the drawn-out sequences of negative supply shocks can call for tighter policy, although there has been surprisingly little net reaction in front yields.

- With the curve trading 1-3.5bps cheaper, 2s10s at -76.6bps have nudged off new multi-decade lows

- TYZ2 trades just 2+ ticks lower at 112-30+ off a session low of 112-28 and overnight high of 113-17, the latter now forming resistance. Further moves lower could see support at the 50-day EMA of 112-14 after which lies key short-term support at 112-04 (Nov 21 low).

- House prices and consumer confidence are in focus tomorrow with no scheduled Fedspeak but potential further pop-ups after two today in Mester and Brainard.

US EURODLR FUTURES: Williams and Bullard Push Back On 2023 Rate Cut Pricing

- The Williams/Bullard combo helped Eurodollars continue to unwind the earlier rally, back little changed on the day. EDZ3 for example is 95.195 (-0.015) off US session highs of 95.245.

- The comments don’t materially change the curve though, with almost 45bps of inversion through EDM3/Z3 and then EDZ3/Z4 only pulling back slightly off record lows of -1.235.

- Bullard re-iterated the need for rates at the bottom end of a 5-7% rate range and that the FOMC Fed may have to keep rates higher through 2023 and into 2024.

- Williams meanwhile can see a path to reducing nominal Fed rates in 2024, but prior to that expects the need to keep restrictive policy through 2023.

FOREX: Risk Backdrop Filters Through To Greenback Recovery

- A volatile start to the week across currency markets as reports emanating from China surrounding rising covid cases and bouts of social unrest dampen global risk sentiment. Despite the greenback initially opening on the front foot, two substantial reversals have occurred during Monday’s European and US trading sessions.

- Weighing on the greenback as Europe sat down was the significant move lower in USDJPY, which reached fresh three-month lows at 137.50. Filtering through to the broader USD complex, currencies such as the Euro that had gapped lower at the open saw swift reversals as those gaps were bridged. Short-term positioning then accentuated the dollar weakening over the course of the European morning.

- Looking at Euro in particular, marginal hawkish ECB rhetoric provided and additional tailwind which saw EURUSD rise to fresh recent highs of 1.0497 and given the poorer risk profile, Euro crosses such as EURAUD saw significant upside, at one point rising as much as 1.5%.

- However, the overall USD index weakness was short-lived as the continued grind lower for equities filtered through once again to safe haven demand for the greenback. The index currently sits around 1.3% off the lows, up 0.7% on the day approaching the APAC crossover. This late dollar demand was also aided by continued hawkish rhetoric from Fed officials focusing around the central bank having “more work to do”.

- On Tuesday, markets will see German and Spanish CPI data as well as Canadian GDP and US consumer confidence. Eurozone CPI data and US employment remain the key data points in focus later this week.

STOCKS: Fedspeak, BlockFi and Apple Production Issues Weigh

- US stocks are increasingly weighed on by a collection of drivers today, including Fedspeak on restrictive policy helping push real yields higher, BlockFi’s Chapter 11 filing and idiosyncratic factors such as Apple’s iPhone production issues and Twitter spat.

- S&P sits -1.5% to eat into last week’s gains, with broadly similar-sized declines across other major indices.

- ESA trades at 3971.5 off a session low of 3967.25 although the recent bullish trend structure means that support is still a way off at 3924.36 (20-day EMA). To the upside, the bull trigger sits at 4050.75 (Nov 15 high).

- Canadian equities see an extension of recent outperformance, with the TSX 60 limiting declines to -0.8%.

COMMODITIES: Oil Gains As OPEC+ Seen Considering Cuts

- Crude oil reversed earlier losses on headlines that OPEC+ is seriously considering new cuts at its meeting next week according to Eurasia, with Brent underperforming WTI after EU diplomats say talks on the Russian price cap have stopped for the day with no deal and that it has discussed a cap as low as $62/bbl.

- WTI is +1.0% at $77.06, having come close to testing support at $73.38 (1 proj of Aug 30 – Sep 28 – Nov 7 price swing) before retracing higher. Resistance is seen at $79.9 (Nov 25 high).

- Brent is -0.7% at $83.03, off an intraday low of $80.61 that now forms initial support after which sits the round $80.

- Gold is -0.8% at $1740.41 after a reversal in dollar strength and higher Treasury yields through the session. It moves closer to support at the 20-day EMA currently of $1729.2.

US DATA: Continued ISM Mfg Downside From Regional Fed Surveys

- The Dallas Fed mfg index surprisingly improved in November, from -19.4 to -14.4 (cons -22.0), as it rounded out a collection of mixed Regional Fed surveys for the month.

- The five regional surveys continue to point to a more meaningfully sub-50 ISM mfg reading (released Dec 1, consensus sees 49.8 down from 50.2), as has been the case in recent months although also joined by last week’s surprise fall in the manufacturing PMI.

- Coming ahead of the ISM, the MNI Chicago PMI on Nov 30 gives a final steer having better predicted recent ISM outturns.

- Back to the Dallas Fed survey, price components were more favourable. Raw materials prices at 22.6 (-9pts) fell below its series average for the first time in more than two years although finished goods prices at 13.9 (-8pts) were still slightly above the series average.

CANADA DATA: Surprising Lack Of Reaction To Q3 BoP Deterioration

- The Canadian current account balance fell back to a much larger deficit than expected in Q3, switching from a surplus of C$2.65B to a deficit of -C$11.1B (cons -C$4B), along with sizeable downward revisions prior to Q2.

- It sees a current account deficit at circa -1.6% GDP in Q3 (estimating Q3 GDP) after average surpluses of 0.3% GDP in 1H22 in a sharp re-adjustment back towards pre-pandemic deficits that were running between 2-2.5% GDP.

- Deterioration on the quarter was led by goods (lower energy export prices) but the service and investment income deficits also widened further.

- In % GDP terms, the current account balance is the most negative since 3Q20, with a similar picture in basic balance terms at -3.2% GDP on a 4Q rolling basis with continued acceleration of net FDI outflows.

- Even allowing for the fact its for data back in Q3, there is relatively little reaction in USDCAD, which has drifted a few pips lower, and with Can-US yield differentials little changed.

FED: Reverse Repo Uptake Nudges Off June Lows

- RRP usage ticked up $24B today to $2.055T after seeing the lowest since Jun 3 on Friday, and marking the first increase since last Monday.

- The number of participants was unchanged at 90, the lowest since mid-May.

- It’s in line with Wrightson ICAP’s estimate that usage could have rebounded by about $25B as overnight funding markets stabilise following the US holiday with Friday’s shortened session seeing some volatility in the repo market, although that was “without much conviction”.

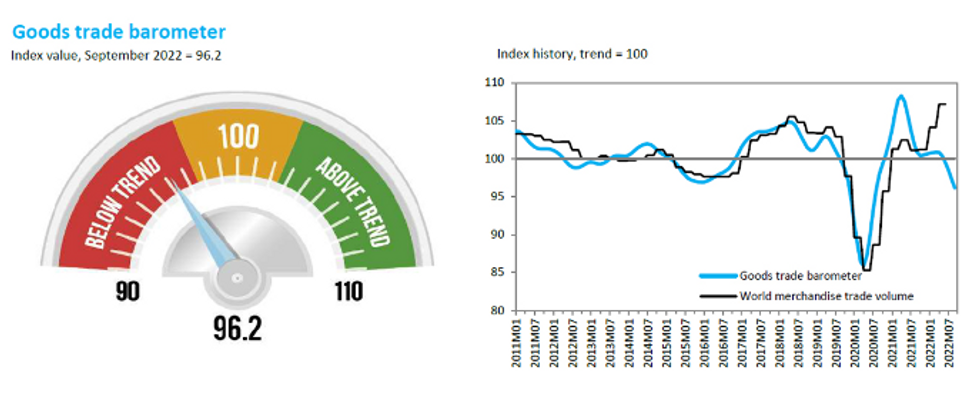

GLOBAL: WTO Trade Barometer: Below Trend On Weaker Import Demand

- The WTO’s global trade barometer fell from 100 in Aug to 96.2 in today’s update, the lowest since recovering from the depths of the pandemic and below its long-term trend line.

- The trade slowdown is consistent with its latest forecasts from Oct 5, with today's reading suggesting global trade growth is likely to slow into 2023 as well.

- Within the details: “The barometer index was weighed down by negative readings in sub-indices representing export orders (91.7), air freight (93.3) and electronic components (91.0). Together, these suggest cooling business sentiment and weaker global import demand. The container shipping (99.3) and raw materials (97.6) indices finished only slightly below trend but have lost momentum. The main exception is the automotive products index (103.8), which rose above trend due to stronger vehicle sales in the United States and increased exports from Japan as supply conditions improved and as the yen continued to depreciate.”

Source: WTO

Source: WTO

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.