-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI POLITICAL RISK - Trump's First Post Election Interview

MNI POLITICAL RISK ANALYSIS - Week Ahead 9-15 Dec

MNI ASIA OPEN: 5s10s Curve Off Inversion

EXECUTIVE SUMMARY

- MNI INTERVIEW: ECB Should Guard Against Euro Weakening-Knot

- U.S. HOUSE VOTES TO REVOKE NORMAL TRADE STATUS WITH RUSSIA, Bbg

- CHINA, U.S. HELD TALKS ON AUDIT SUPERVISION COOPERATION:CAILIAN, Bbg

- UKRAINE FOREIGN MINISTER SAYS UKRAINE IS READY TO CONTINUE DIPLOMATIC EFFORTS TO STOP RUSSIAN AGGRESSION -- UKRAINE FOREIGN MINISTER SAYS TURKEY IS AMONG COUNTRIES UKRAINE WANTS TO AGREE DEAL WITH ON SECURITY GUARANTEES, Rtrs

- MACRON SEEN WINNING FRANCE'S PRESIDENTIAL ELECTION RUN-OFF WITH 61% OF VOTE VS LE PEN - 2022 IPSOS-SOPRA STERIA POLL, Rtrs

EUROPE

ECB: The European Central Bank should ensure that euro depreciation does not aggravate the loss of eurozone purchasing power from rising energy prices, Dutch central bank president Klaas Knot told MNI.

- “The Governing Council is not targeting or responding to a specific level of the exchange rate, but it is clear that when the exchange rate falls it adds to inflationary pressure,” the De Nederlandsche Bank president said in an interview on Wednesday. “Given that most energy prices are invoiced in U.S. dollars, a decline in the euro versus the dollar even aggravates the loss of purchasing power because of the energy price inflation.”

- Oil and gas prices have surged since the Russian invasion of Ukraine, feeding inflation. The euro depreciated by 4.3% against the dollar between the ECB’s December meeting and its meeting earlier this month, when it said it would end net bond purchases in the third quarter if data permits and adjust rates “some time” after. For more see MNI Policy main wire at 0825ET.

US TSYS: Bond Weak Through Second Half, Yield Curves Off Inversion

Tsys holding mixed levels after the close, yield curves steeper with bonds trading weaker through the second half, finishing near lows. Note: 5s30s inverted (recession flag) first time since first time since 2007 yesterday (-1.823 low) finished Thu +2.668 at 2.447; 5s30s bounced 4.267 to 31.280.

- Fed policy in rear view mirror while markets still digesting forward guidance: (1.9% FF end of '22, 2.8% FF end of '23) Eurodollar short end futures firmer after EDZ2-EDH3 down as much as -0.23 Wed).

- Back to Russia/Ukraine headline risk a constant source of market volatility. Markets keyed in on peace talk progress -- or not: stocks gapped lower/Tsys gained recently after headlines that Kremlin called reports of peace talk progress "incorrect".

- Friday data roundup, at 0830ET:

- Existing Home Sales (6.5M, 6.18M)

- Existing Home Sales MoM (6.7%, -5.0%)

- Leading Index (-0.3%, 0.3%)

- Fed speakers out of Blackout:

- MN Fed Kashkari on capital, energy sectors at 1200ET

- Richmond Fed Barkin economic outlook at 1320ET

- Fed Gov Bowman, Fed listens event: Helping Youth Thrive at 1400ET

- Meanwhile, President Joe Biden and his Chinese counterpart Xi Jinping will hold a telephone call on Friday, time TBA.

- The 2-Yr yield is down 0.2bps at 1.9364%, 5-Yr is down 1.7bps at 2.1642%, 10-Yr is up 0.7bps at 2.1921%, and 30-Yr is up 3.4bps at 2.4864%.

OVERNIGHT DATA

- US MAR PHILADELPHIA FED MFG INDEX 27.4

- US JOBLESS CLAIMS -15K TO 214K IN MAR 12 WK

- US PREV JOBLESS CLAIMS REVISED TO 229K IN MAR 05 WK

- US CONTINUING CLAIMS -0.071M to 1.419M IN MAR 05 WK

- US FEB HOUSING STARTS 1.769M; PERMITS 1.859M

- US JAN STARTS REVISED TO 1.657M; PERMITS 1.895M

- US FEB HOUSING COMPLETIONS 1.309M; JAN 1.236M (REV)

- US FEB INDUSTRIAL PROD +0.5%; CAP UTIL 77.6%

- US JAN IP REV TO +1.4%; CAP UTIL REV 77.3%

- US FEB MFG OUTPUT +1.2%

MARKETS SNAPSHOT

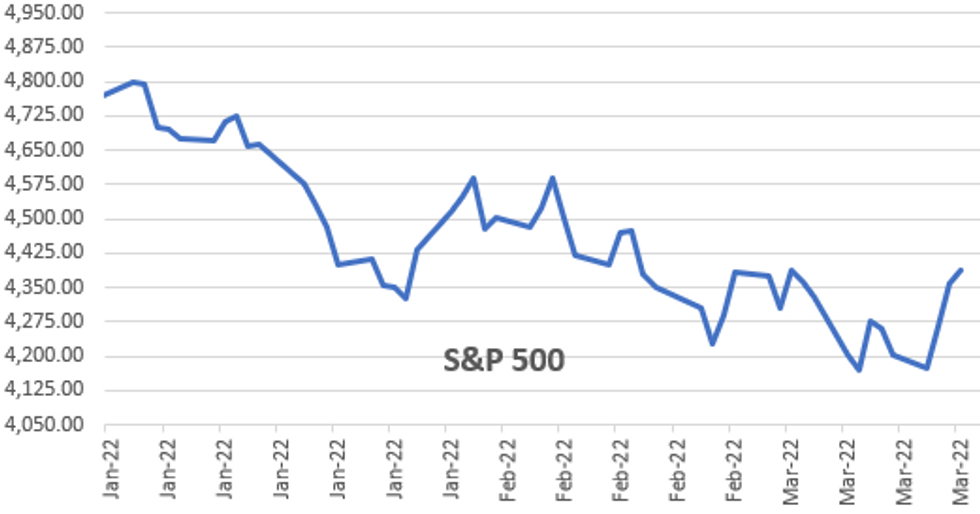

Key late session market levels:- DJIA up 263.22 points (0.77%) at 34327.88

- S&P E-Mini Future up 35.75 points (0.82%) at 4385

- Nasdaq up 116.4 points (0.9%) at 13551.27

- US 10-Yr yield is up 0.5 bps at 2.1903%

- US Jun 10Y are up 3/32 at 124-10.5

- EURUSD up 0.0062 (0.56%) at 1.1098

- USDJPY down 0.14 (-0.12%) at 118.58

- WTI Crude Oil (front-month) up $9.16 (9.64%) at $104.18

- Gold is up $13.41 (0.7%) at $1940.61

- EuroStoxx 50 down 4.37 points (-0.11%) at 3885.32

- FTSE 100 up 93.66 points (1.28%) at 7385.34

- German DAX down 52.68 points (-0.36%) at 14388.06

- French CAC 40 up 23.88 points (0.36%) at 6612.52

US TSY FUTURES CLOSE

- 3M10Y +6.521, 180.091 (L: 165.051 / H: 180.091)

- 2Y10Y +1.998, 26.074 (L: 18.55 / H: 26.074)

- 2Y30Y +4.46, 55.404 (L: 44.309 / H: 55.404)

- 5Y30Y +5.142, 32.155 (L: 24.184 / H: 32.43)

- Current futures levels:

- Jun 2Y up 1.625/32 at 106-17.75 (L: 106-16.375 / H: 106-21.375)

- Jun 5Y up 4.5/32 at 116-0.25 (L: 115-27 / H: 116-09.5)

- Jun 10Y up 1.5/32 at 124-9 (L: 124-04 / H: 124-28.5)

- Jun 30Y down 18/32 at 151-8 (L: 151-07 / H: 153-09)

- Jun Ultra 30Y down 51/32 at 175-25 (L: 175-25 / H: 180-10)

US 10Y FUTURES TECH: (M2) Bearish Theme

- RES 4: 128-04 High Mar 8

- RES 3: 127-14+ High Mar 9

- RES 2: 126-10+ 20-day EMA

- RES 1: 125-14+ Low Feb 10 and a recent breakout level

- PRICE: 124-15.5 @ 1415ET Mar 17

- SUP 1: 123-25+ Low Mar 16

- SUP 2: 123-19+ 150.0% retracement of the Feb 10 - Mar 7 climb

- SUP 3: 123-06 161.8% retracement of the Feb 10 - Mar 7 climb

- SUP 4: 122-29+ 76.4% of the Oct ‘18 - Mar ‘20 upleg (cont)

Treasuries maintain this week’s bearish theme despite a recovery from yesterday’s low of 123-25+. Monday’s strong sell-off resulted in a break of key support at 125-14+, the Feb 10 low and a bear trigger. This has confirmed a resumption of the primary downtrend and marks an extension of the bearish price sequence of lower lows and lower highs. The focus is on 123-19 next. Initial firm resistance is seen at 126-10+, the 20-day EMA.

US EURODOLLAR FUTURES CLOSE

- Jun 22 +0.080 at 98.560

- Sep 22 +0.035 at 98.130

- Dec 22 -0.005 at 97.705

- Mar-23 steady at 97.46

- Red Pack (Jun 23-Mar 24) steadysteady0 to +0.010

- Green Pack (Jun 24-Mar 25) +0.010 to +0.045

- Blue Pack (Jun 25-Mar 26) +0.055 to +0.060

- Gold Pack (Jun 26-Mar 27) +0.030 to +0.050

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N +0.24571 at 0.32600% (+0.24671/wk)

- 1 Month -0.01900 to 0.44857% (+0.05200/wk)

- 3 Month -0.02028 to 0.92786% (+0.10186/wk) ** Record Low 0.11413% on 9/12/21

- 6 Month +0.01772 to 1.27443% (+0.14386/wk)

- 1 Year +0.06042 to 1.77571% (+0.17971/wk)

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.08% volume: $74B

- Daily Overnight Bank Funding Rate: 0.07% volume: $260B

US TSYS: Repo Reference Rates

- Secured Overnight Financing Rate (SOFR): 0.05%, $1.016T

- Broad General Collateral Rate (BGCR): 0.05%, $375B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $364B

- (rate, volume levels reflect prior session)

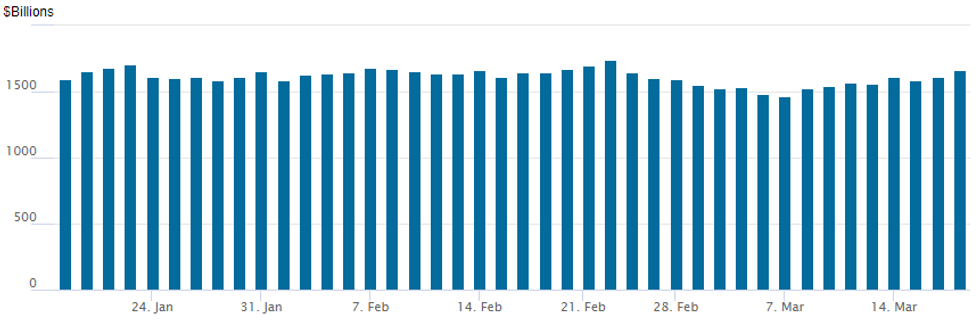

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to highest since Feb 24 at $1,659.977B w/ 86 counterparties vs. $1,613.637B prior session -- remains well off all-time high of $1,904.582B on Friday, December 31.

PIPELINE: Banks Crowd Funding Market, $4B Wells Fargo Leads

At least $19.75B to price Thursday, still waiting for NatWest and two sovereigns to launch: Nigeria and Turkey.

- Date $MM Issuer (Priced *, Launch #)

- 03/17 $4B #Wells Fargo 6NC5 +137.5

- 03/17 $3.5B *Bank of America $3B 4NC3 +123, 4NC3 SOFR +133

- 03/17 $3B #Toyota Motor $1.2B 2Y +60, $400M 2Y SOFR+62, $1.4B 5Y +90

- 03/17 $2.75B #Banco Santander $1.25B 3Y +135, $1.75B 6NC5 +200

- 03/17 $1.5B #NextEra Energy $1.1B 2NC.5 +100, $400M 2NC.5 SOFR+102

- 03/17 $1.5B #Royal Bank of Canada 5Y SOFR+65

- 03/17 $900M *Blackstone Private Cr Fund 3Y +260

- 03/17 $600M #Southwest Gas 10Y +190

- 03/17 $Benchmark NatWest 3Y +135a, 3Y SOFR

- 03/17 $Benchmark Nigeria 7Y around 8.75%

- 03/17 $2B Turkey 5.5Y around 8.625%

FOREX: USD Continues To Trade With Heavy Tone Amid Buoyant Equities

- The greenback continued on a downward trajectory on Thursday after faltering late Wednesday following the FOMC March decision/press conference.

- The substantial 3.5% bounce in S&P 500 futures has weighed on the dollar indices, while underpinning the likes of the Euro, Aussie and Kiwi.

- AUDUSD leads G10 performance on Thursday, rising a solid 1.2%. The pair has defined a key short-term support at 0.7165, the Mar 15 low with the strong reversal from this point signalling a possible resumption of the uptrend that started Jan 28. The extension to the upside has breached 0.7368, Mar 10 high and now targets 0.7441, the Mar 7 high and technical bull trigger.

- The underperformer amid the greenback weakness has been GBP following a more dovish reaction in markets to the Bank of England decision. The BoE said it was raising its policy rate by 25 basis points to 0.75% on Thursday but softened the move with gentler policy guidance and a warning that inflation down the track could undershoot by even more than it had previously expected.

- While cable gave up early gains to remain broadly unchanged on the session, EURGBP managed to gain traction to the upside. The cross has recently broken above a key resistance of 0.8406, the Feb 25 high. This has strengthened the short-term bullish condition and signals scope for an extension towards the next resistance at the early February highs of 0.8478.

- Worth noting EURUSD gradually climbed above 1.11 throughout NY trade and in doing so, temporarily breached its key short-term resistance of 1.1121 - the Jan 28 low, a recent breakout level plus the Mar 10 high. This suggests scope for a stronger correction, initially targeting the 50-day EMA around the 1.12 mark.

- Overnight sees the Bank of Japan decision. The BoJ will leave its policy settings unchanged at its March meeting, with the uncertainty surrounding the Russia-Ukraine conflict and the resultant spiral in global energy prices set to produce increased focus on downside risks, if not a downgrade to the Bank’s overall economic view.

- Canada retail sales and US existing home sales round off the week’s economic data releases.

Friday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 18/03/2022 | 0700/0800 | ** |  | SE | Unemployment |

| 18/03/2022 | 1000/1100 | * |  | EU | Trade Balance |

| 18/03/2022 | 1230/0830 | ** |  | CA | Retail Trade |

| 18/03/2022 | 1400/1000 | *** |  | US | NAR existing home sales |

| 18/03/2022 | 1720/1320 |  | US | Richmond Fed's Tom Barkin | |

| 18/03/2022 | 1800/1400 |  | US | Chicago Fed's Charles Evans | |

| 18/03/2022 | 1800/1400 |  | US | Fed Governor Michelle Bowman |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.