-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI POLITICAL RISK - Trump's First Post Election Interview

MNI POLITICAL RISK ANALYSIS - Week Ahead 9-15 Dec

MNI ASIA OPEN: Bullard Bond Mkt Not Safe Place to Be?

EXECUTIVE SUMMARY

- MNI BRIEF: Fed's Powell Says 50BP Hike 'On The Table' For May

- MNI BRIEF: Walking Fine Line Between Inflation Growth - BOE Bailey

- POWELL: U.S. LABOR MARKET IS TOO HOT, `UNSUSTAINABLY HOT', Bbg

- FED'S BULLARD REPEATS HE FAVORS 3.5% RATE BASED ON TAYLOR RULE, Bbg

- BULLARD: FED IS BEHIND THE CURVE, WON'T HAVE A HARD LANDING, Bbg

US TSYS: Labor Market Unsustainably Hot

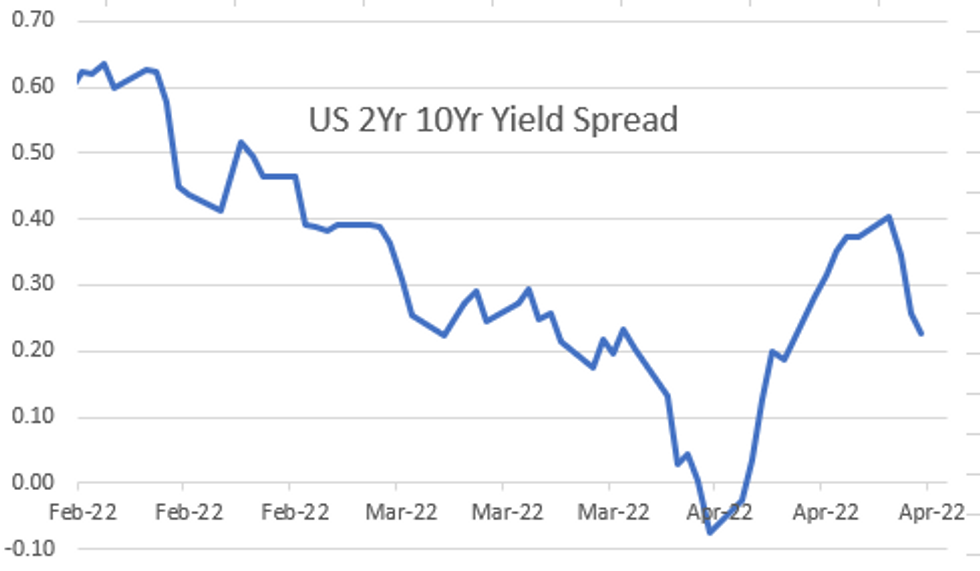

Rates finish weaker Thursday, well off midday lows to near middle of the range. Yield curves bear flattened (2s10s -2.373 at 22.675 vs. 20.661 low) after a brief steepening period in the first half as bonds extended session lows around midday (30YY taps 2.9845% high).

- Of note: 5YY climbed over 3.0% to 3.0123% high - last seen in Nov 2018.

- Little react to weekly claims at 184k, 2k less than est, continuing claims 1.417M some 58k lower than est.

- Late Fed speak: Fed Chairman Powell comments, while hawkish, weren't exceedingly so as he intimated 50bp is on the table for May 4 FOMC. Powell did say labor market is "unsustainably hot". Markets pricing in two additional 50 bps through June and July meetings.

- StL Fed Bullard also weighing in on hikes: the "world would not come to an end" if Fed anncd a 75bp hike. That said, Bullard expressed sentiment the "bond market is not looking like a safe place to be" while the Fed "should avoid disruptions from surprise market moves."

- No scheduled Fed speakers for Friday as yet - but like SF Fed Daly interview on Yahoo Finance today, there is a good chance of more popping up ahead policy blackout that starts late Friday.

US

FED: A half-point interest rate increase is "on the table" at the Federal Reserve's next meeting in May, Chair Jerome Powell said Thursday during an IMF roundtable in Washington, adding it's appropriate for the Fed to move "a little more quickly" to contain historically high inflation.

- "It is appropriate in my view to be moving a little more quickly," he said. "There's something in the idea of front-end loading whatever removal of accommodation one thinks is appropriate. So that's an added point in the direction of 50bps being on the table."

- "Certainly we make these decisions at the meeting and we'll make them meeting by meeting but I would say that 50 basis points will be on the table for the May meeting," he added.

UK

BOE: Bank of England policymakers are walking a very tight line between tackling inflation and recession caused by the hit to real income, Governor Andrew Bailey said Thursday.

- "We are walking this very, very fine line between these two things," Bailey said at a Peterson Institute event. The BOE head said that "the real income shock is going to cause a slowdown in growth" and a key question was whether the tight labour market was going to ease.

OVERNIGHT DATA

- US JOBLESS CLAIMS -2K TO 184K IN APR 16 WK

- US PREV JOBLESS CLAIMS REVISED TO 186K IN APR 09 WK

- US CONTINUING CLAIMS -0.058M to 1.417M IN APR 09 WK

- US APR PHILADELPHIA FED MFG INDEX 17.6

MARKETS SNAPSHOT

Key late session market levels:

- DJIA down 370.44 points (-1.05%) at 34879.17

- S&P E-Mini Future down 67.5 points (-1.52%) at 4398.5

- Nasdaq down 289.3 points (-2.2%) at 13192.86

- US 10-Yr yield is up 7.4 bps at 2.9056%

- US Jun 10Y are down 22/32 at 118-26

- EURUSD down 0.0018 (-0.17%) at 1.0839

- USDJPY up 0.4 (0.31%) at 128.26

- Gold is down $6.28 (-0.32%) at $1951.73

- EuroStoxx 50 up 31.22 points (0.8%) at 3928.03

- FTSE 100 down 1.27 points (-0.02%) at 7627.95

- German DAX up 140.38 points (0.98%) at 14502.41

- French CAC 40 up 90.19 points (1.36%) at 6715.1

US TSY FUTURES CLOSE

- 3M10Y +7.302, 207.702 (L: 198.873 / H: 211.661)

- 2Y10Y -2.093, 22.955 (L: 20.661 / H: 26.797)

- 2Y30Y -4.064, 25.154 (L: 22.674 / H: 31.263)

- 5Y30Y -4.543, -3.497 (L: -5.58 / H: 1.867)

- Current futures levels:

- Jun 2Y down 5.875/32 at 105-10.625 (L: 105-07 / H: 105-17.125)

- Jun 5Y down 15.75/32 at 112-11.75 (L: 112-03.75 / H: 112-28)

- Jun 10Y down 22/32 at 118-26 (L: 118-14 / H: 119-18)

- Jun 30Y down 28/32 at 140-5 (L: 139-09 / H: 141-08)

- Jun Ultra 30Y down 56/32 at 161-10 (L: 159-22 / H: 163-07)

US 10Y FUTURES TECH: (M2) Trend Needle Still Points South

- RES 4: 123-04 High Mar 31 and a key resistance

- RES 3: 122-12+ High Apr 4

- RES 2: 121-06+/09 20-day EMA / High Apr 14 and a key resistance

- RES 1: 120-00+ High Apr 18

- PRICE: 119-07 @ 11:04 BST Apr 21

- SUP 1: 118-19+ Low Apr 20

- SUP 2: 118-02+ 0.618 proj of the Mar 7 - 28 - 31 price swing

- SUP 3: 117-22+ Low Nov 8 2018 (cont)

- SUP 4: 116-28 0.764 proj of the Mar 7 - 28 - 31 price swing

Treasuries remain soft and futures are trading closer to recent lows. Yesterday's sell-off resulted in a fresh cycle low of 118-19+. This confirms a resumption of the primary downtrend and an extension of the price sequence of lower lows and lower highs. Moving average studies also point south. The focus is on 118-02+ next, a Fibonacci projection. Initial firm resistance is unchanged at 121-09, the Apr 14 high.

US EURODOLLAR FUTURES CLOSE

- Jun 22 -0.065 at 98.190

- Sep 22 -0.130 at 97.395

- Dec 22 -0.140 at 96.880

- Mar 23 -0.135 at 96.570

- Red Pack (Jun 23-Mar 24) -0.135 to -0.115

- Green Pack (Jun 24-Mar 25) -0.115 to -0.105

- Blue Pack (Jun 25-Mar 26) -0.10 to -0.08

- Gold Pack (Jun 26-Mar 27) -0.08 to -0.07

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N -0.00457 to 0.32643% (-0.00343/wk)

- 1M +0.03629 to 0.66786% (+0.07343/wk)

- 3M +0.04771 to 1.18400% (+0.12129/wk) ** Record Low 0.11413% on 9/12/21

- 6M +0.04700 to 1.72157% (+0.16486/wk)

- 12M +0.07157 to 2.44043% (+0.21886/wk)

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.33% volume: $71B

- Daily Overnight Bank Funding Rate: 0.32% volume: $258B

US TSYS: Repo Reference Rates

- Secured Overnight Financing Rate (SOFR): 0.27%, $912B

- Broad General Collateral Rate (BGCR): 0.30%, $345B

- Tri-Party General Collateral Rate (TGCR): 0.30%, $330B

- (rate, volume levels reflect prior session)

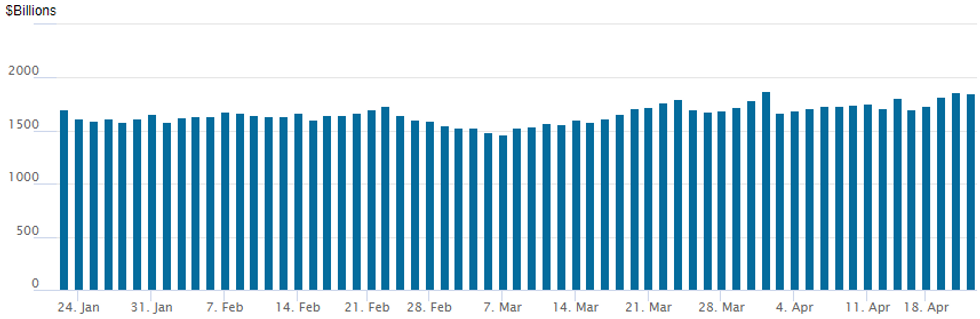

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage receded to 1,854.700B w/ 80 counterparties from prior session 1,866.560B. Compares to all-time high of $1,904.582B on Friday, December 31.

PIPELINE: $8.75B Bank of America 4Pt Jumbo Launched

Bank of America continues theme for week of outsized, multi-tranche debt issuance, outpacing earlier $5B KFW.

- Date $MM Issuer (Priced *, Launch #)

- 04/21 $8.75B #Bank of America 4pt $2B 3NC2 +115, $500M 3NC2 SOFR+110, $2.25B 6NC5 +140, $4B 11NC10 +165

- 04/21 $5B *KFW 5Y SOFR+31

- 04/21 $2.3B #Lockheed Martin $800M 10Y +100, $850M 31Y +125, $650M 40Y +140

- 04/21 $1B *Development Bank of Japan 5Y SOFR+57

- 04/21 $1B #PNC Financial perpNC5 6%

FOREX: US Yields/Equities Weigh On Antipodean FX, CNY Continues Slide

- Initially On Thursday, the USD Index extended on the prior day’s declines, exacerbated by a firm rally in the Euro. EURUSD rose from 1.0825 to a high print of 1.0936 in early European trade. This prompted the DXY to retreat a further 0.5% and briefly trade back below 100

- However, during the US session, continued upward pressure on US yields and equities extending to fresh session lows lent support to the greenback which recovered to print fresh highs for the day.

- EURUSD fell roughly 90 pips off the earlier highs, narrowing the gap with the intra-day low at 1.0824.

- In similar vein, USDJPY made fresh session highs above 128.64. Short-term pullbacks - as seen on Wednesday - may prove technically corrective. Recent activity reinforces underlying bullish conditions and signals potential for a continuation of the bull cycle, with the focus on 129.40/44, yesterday’s high as well as a Fibonacci projection.

- The weakness in major equity benchmarks weighed on the likes of AUD and NZD, both falling around 1% and were the main underperformers. Despite the notable intra-day shift, both pairs simply erased the entirety of yesterdays gains and spot prices reside close to the week’s opening levels.

- The last few days were marked by some significant moves in the CNY, with USDCNY breaking above the key 200DMA and probing resistance at the 6.45 level. The 200DMA has historically acted as a strong resistance; therefore, the bull trend could extend further in the near term following the recent breakout.

- Approaching the APAC crossover, markets will turn their focus to a swathe of flash manufacturing and services PMIs, first for Australia and Japan before key European readings. Canadian retail sales will also be published before further comments at the IMF spring meetings from BOE Governor Andrew Bailey.

Friday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 22/04/2022 | 2301/0001 | ** |  | UK | Gfk Monthly Consumer Confidence |

| 22/04/2022 | 2330/0830 | *** |  | JP | CPI |

| 22/04/2022 | 0030/0930 | ** |  | JP | IHS Markit Flash Japan PMI |

| 22/04/2022 | 0600/0700 | *** |  | UK | Retail Sales |

| 22/04/2022 | 0715/0915 | ** |  | FR | IHS Markit Services PMI (p) |

| 22/04/2022 | 0715/0915 | ** |  | FR | IHS Markit Manufacturing PMI (p) |

| 22/04/2022 | 0730/0930 | ** |  | DE | IHS Markit Services PMI (p) |

| 22/04/2022 | 0730/0930 | ** |  | DE | IHS Markit Manufacturing PMI (p) |

| 22/04/2022 | 0800/1000 | ** |  | EU | EZ Current Acc |

| 22/04/2022 | 0800/1000 | ** |  | EU | IHS Markit Services PMI (p) |

| 22/04/2022 | 0800/1000 | ** |  | EU | IHS Markit Manufacturing PMI (p) |

| 22/04/2022 | 0800/1000 | ** |  | EU | IHS Markit Composite PMI (p) |

| 22/04/2022 | 0830/0930 | *** |  | UK | IHS Markit Manufacturing PMI (flash) |

| 22/04/2022 | 0830/0930 | *** |  | UK | IHS Markit Services PMI (flash) |

| 22/04/2022 | 0830/0930 | *** |  | UK | IHS Markit Composite PMI (flash) |

| 22/04/2022 | - |  | EU | ECB Lagarde & Panetta in IMF/World Bank Meetings | |

| 22/04/2022 | 1300/1500 |  | EU | ECB Lagarde Speech at Peterson Institute | |

| 22/04/2022 | 1345/0945 | *** |  | US | IHS Markit Manufacturing Index (flash) |

| 22/04/2022 | 1345/0945 | *** |  | US | IHS Markit Services Index (flash) |

| 22/04/2022 | 1430/1530 |  | UK | BOE Bailey Panels IMF Event |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.