-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: SF FED Daly Not Overdoing Hikes

EXECUTIVE SUMMARY

- MNI INTERVIEW: U.S. Consumers' Price Expectations Soften-UMich

- MNI INTERVIEW: Firms' Price Expectations May Be 'Unanchoring'

- MNI INTERVIEW: Businesses Expect Worse Times Ahead - SF Fed

- MNI BRIEF: Fed Pulling Back Stimulus, Not Overdoing Hikes-Daly

- MNI BRIEF: Bullard Does Not Rule Out 100BP Fed Hike in July

- MNI BRIEF: Fed Bullard Says Rates Should Rise to 4% By Dec

- US DATA: U-Mich Sentiment Better Than Expected, But Signs Of Weakness Underneath

US

FED: San Francisco Federal Reserve President Mary Daly said Friday she's not worried that the Fed is overdoing rate increases because the FOMC is still pulling back on stimulus in a strong economy where inflation is too high.

- "I'm not concerned about 'over-cooking' things," she said, repeating a term an interviewer used during a talk with Newsy. "We're just dialing back support." Firms around San Francisco already see a slowdown, a staff economist told MNI.

- "I don't see recession high on my list of outcomes," she said, based on strong gains in retailing, jobs and packed restaurants. "We are in a post-Covid economy and people want to get out there and participate." There are already signs inflation is moderating such as the University of Michigan survey, Daly said. She wants continued progress toward the end of this year taking CPI well down from the current 9.1% pace."

FED: Business sentiment among firms in the western United States has deteriorated over the past eight weeks, pointing to slower growth in the coming months as firms continue to be plagued by high inflation and labor shortages, Federal Reserve Bank of San Francisco economist Luiz Oliveira said in an interview.

- Firms in the San Francisco Fed district, the largest of the 12 Fed districts and home to a fifth of the U.S. nonfarm worker pool, "are saying prospects have deteriorated a little bit," Oliveira said. "What you can expect is a continuation of this easing trend that we have observed in recent weeks."

- The district still expanded modestly overall in recent weeks, but "we are seeing signs of easing in consumption, in homebuilding and the demand for homes, some subindustries within the manufacturing sector and in overall activity," Oliveira said. For more see MNI Policy main wire at 1020ET.

- “I do think that it probably doesn’t make too much difference to do 100 basis points here and less in the other three meetings of this year or do 75 basis points here and do more in the remaining three meetings of the year,” he told an event sponsored by the European Economics and Financial Center. “That’s a judgment that the chair can make in conjunction with other members of the committee.”

FED: The latest inflation figures suggest core inflation has not yet peaked, meaning the Fed may need to raise rates up to as high as 4% this year, St. Louis Fed President James Bullard said Friday.

- “Inflation continued to broaden out,” he said of the fresh 40-year high reading of 9.1% for June CPI. “Based on these numbers, and based on the household rent component, core PCE probably hasn’t peaked at this point, it probably has a few more reports to go, assuming all goes well,” he told a conference sponsored by the European Economics and Financial Center.

- “We have to react with a stronger than anticipated path for the policy rate in the second half of 2022,” saying he'd like to see rates rise to 3.75% to 4% by year end.

- The quarterly survey question asks businesses to assign a percent likelihood to their unit costs rising less than 1%, between 1% and 3%, between 3% and 5%, and more than 5% over the next five to 10 years. In June, 31% of firms surveyed marked "more than 5%," up from 24% in March and just 13% in December 2020.

- The University of Michigan survey's inflation expectation measures declined in the preliminary July report with the median expected year-ahead inflation rate dipping to 5.2% from 5.3% and median long run expectations falling to 2.8%, just below the 2.9-3.1% range seen in the preceding 11 months.

- "It's very flashy that our five year expectations are down to 2.8% but that is a reflection of a widening in the distribution of inflation expectations." For more see MNI Policy main wire at 1346ET.

US TSYS: Fed Speak Tempers Hawkish Pricing Ahead Blackout

Tsys trading moderately higher, inside session range as Fed speak appeared to move markets more than economic data. Reminder: Fed enter policy blackout at midnight tonight.

- Tsys reversed early pre-data gains on slightly better than expected June Retail Sales +1.0% MoM vs. 0.9% est, Sales Ex-autos +1.0% MoM vs. 0.7% est. Down-revisions to control group (-0.3% for May vs. 0.0% prior) spurred rebound with futures back to pre-data levels. Overlooked: lower-than-expected import price numbers, including an 0.4% drop in M/M ex-petroleum import prices, the 2nd consecutive contraction. The stronger dollar is starting to feed through into lower import prices

- Fed Speak delivered brief real vol as mkts extended session ranges. Rates moved higher as Atlanta Fed Bostic walked back post-CPI comments that "everything is in play for future policy decisions" that helped spur the 100bp, saying today that the Fed wants "orderly" policy transition, that moving "too drastically" would undermine economy.

- Rates sold off after StL Fed Bullard lived up to his hawk status saying he would not rule out the possibility of 100bp hike at next FOMC, seeing little difference now between 75 and 100bp.

- SF Fed Daly helped temper the hawkish rhetoric as rates pared gains stating she is already "seeing signs inflation is slowing", while concern over recession not high on her list of outcomes.

- Currently, 2-Yr yield is down 0.2bps at 3.1305%, 5-Yr is down 1.2bps at 3.0529%, 10-Yr is down 3.1bps at 2.9281%, and 30-Yr is down 1.4bps at 3.09%.

OVERNIGHT DATA

- US JUN RETAIL SALES +1.0%; EX-MOTOR VEH +1.0%

- US MAY RETAIL SALES REVISED -0.1%; EX-MV +0.6%

- US JUN RET SALES EX GAS & MTR VEH & PARTS DEALERS +0.7% V MAY -0.1%

- US JUN RET SALES EX MTR VEH & PARTS DEALERS +1.0% V US JUN +0.6%

- US JUN RET SALES EX AUTO, BLDG MATL & GAS +0.8% V MAY +0.0%

- US JUN INDUSTRIAL PROD -0.2%; CAP UTIL 80.0%

- US MAY IP REV TO +0.0%; CAP UTIL REV 80.3%

- US JUN MFG OUTPUT -0.5%

- US MAY BUSINESS INVENTORIES +1.4%; SALES +0.7%

- US MAY RETAIL INVENTORIES +1.1%

- MICHIGAN PRELIM. JULY CONSUMER SENTIMENT AT 51.1; EST. 50

- MICHIGAN 5-YR INFLATION EXPECTATIONS DROP TO 2.8% FROM 3.1%

- July's preliminary U-Michigan Survey of Consumers report was better than anticipated (feared?) across the board including lower inflation expectations as well as stronger overall sentiment. The underlying narrative remains fairly weak however with inflation remaining a major dampener on sentiment. Some interesting passages from the report text:

- "Current assessments of personal finances continued To deteriorate, reaching its lowest point since 2011. Buying conditions for durables adjusted upwards, owing both to consumers who cited easing supply constraints and those who believed that one should buy now to avoid future price increases, which would exacerbate inflation going forward."

- "The share of consumers blaming inflation for eroding their living standards continued its rise to 49%, matching the all-time high reached during the Great Recession "strength in the economy has centered on labor markets, but signs of weakness began to surface. Almost 40% of consumers expected unemployment to rise in the year ahead, up from 32% last month and 14% a year ago. When asked about their own incomes, the median expected change was only an increase of 0.6%, reaching its lowest value since May of 2020".

- Atlanta Fed GDPNowfor 2Q growth -1.5% vs -1.2% last

- FOREIGN HOLDINGS OF CANADA SECURITIES +2.3B CAD IN MAY

- CANADIAN HOLDINGS OF FOREIGN SECURITIES +0.6B CAD IN MAY

- CANADA MAY WHOLESALE SALES +1.6%; EX-AUTOS +1.6%

- MAY WHOLESALE INVENTORIES +2.5%: STATISTICS CANADA

MARKETS SNAPSHOT

Key late session market levels:

- DJIA up 581.81 points (1.9%) at 31214.87

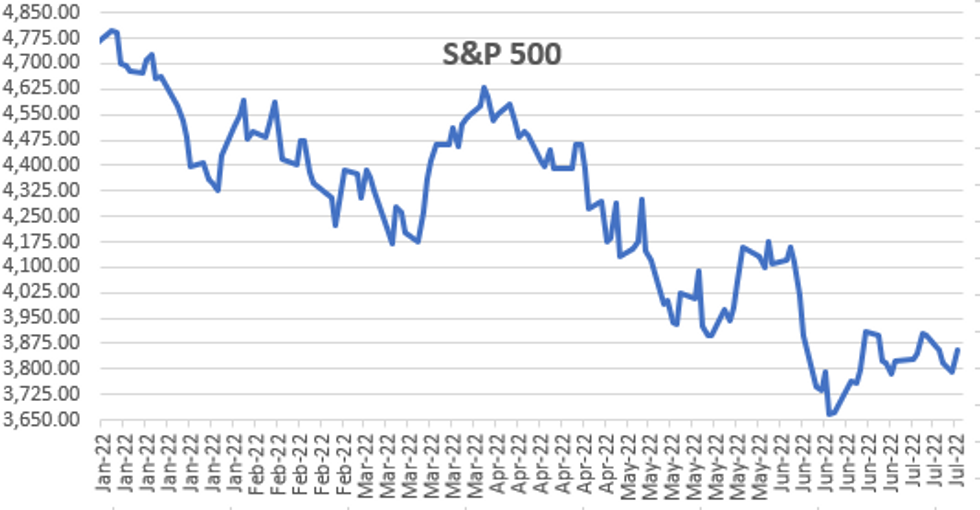

- S&P E-Mini Future up 64.25 points (1.69%) at 3858

- Nasdaq up 173.9 points (1.5%) at 11426.11

- US 10-Yr yield is down 3 bps at 2.93%

- US Sep 10Y are up 4.5/32 at 118-20.5

- EURUSD up 0.0058 (0.58%) at 1.0076

- USDJPY down 0.41 (-0.3%) at 138.55

- WTI Crude Oil (front-month) up $1.86 (1.94%) at $97.65

- Gold is down $4.8 (-0.28%) at $1705.16

- EuroStoxx 50 up 80.59 points (2.37%) at 3477.2

- FTSE 100 up 119.2 points (1.69%) at 7159.01

- German DAX up 345.06 points (2.76%) at 12864.72

- French CAC 40 up 120.59 points (2.04%) at 6036

US TSY FUTURES CLOSE

- 3M10Y +1.195, 59.524 (L: 51.159 / H: 60.949)

- 2Y10Y -3, -20.882 (L: -22.555 / H: -14.428)

- 2Y30Y -1.206, -4.634 (L: -9.47 / H: 2.819)

- 5Y30Y +0.065, 3.618 (L: 0.545 / H: 8.243)

- Current futures levels:

- Sep 2Y up 0.875/32 at 104-22.75 (L: 104-20 / H: 104-28.25)

- Sep 5Y up 0.25/32 at 112-0 (L: 111-27.5 / H: 112-12.25)

- Sep 10Y up 4/32 at 118-20 (L: 118-11.5 / H: 119-00)

- Sep 30Y up 15/32 at 140-1 (L: 139-11 / H: 140-21)

- Sep Ultra 30Y up 12/32 at 155-4 (L: 154-13 / H: 156-01)

US 10YR FUTURES TECHS: (U2) Still Looking For Gains

- RES 4: 121-28+ 1.382 proj of the 14 - 23 - 28 price swing

- RES 3: 121-10 1.236 proj of the 14 - 23 - 28 price swing

- RES 2: 120-19+ High May 26 and a key resistance

- RES 1: 119-06/120-16+ High Jul 13 / High Jul 6 and the bull trigger

- PRICE: 118-22 @ 1520 BST Jul 15

- SUP 1: 117-18/12 Low Jul 8 / 50.0% of the Jun 14 - Jul 6 rally

- SUP 2: 116-11 Low Jun 28 and a key near-term support

- SUP 3: 115-20 Low Jun 17

- SUP 4: 114-05+ Low Jun 14 and the bear trigger

Treasuries are unchanged and remain in consolidation mode. The short-term trend condition is bullish and the recent pullback is considered corrective. Key short-term support is at 116-11, the Jun 28 low where a break would strengthen a bearish threat and signal scope for a deeper retracement. On the upside, attention is on the short-term bull trigger at 120-16+, the Jul 6 high. A break would resume the uptrend.

US EURODOLLAR FUTURES CLOSE

- Sep 22 +0.10 at 96.570

- Dec 22 +0.070 at 96.130

- Mar 23 +0.055 at 96.280

- Jun 23 +0.035 at 96.460

- Red Pack (Sep 23-Jun 24) -0.035 to +0.005

- Green Pack (Sep 24-Jun 25) -0.035 to -0.005

- Blue Pack (Sep 25-Jun 26) +0.010 to +0.045

- Gold Pack (Sep 26-Jun 27) +0.050 to +0.060

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N +0.00700 to 1.56514% (+0.00457/wk)

- 1M -0.03571 to 2.12029% (+0.22058/wk)

- 3M -0.00272 to 2.73757% (+0.31457/wk) * / **

- 6M -0.07000 to 3.31129% (+.26286/wk)

- 12M -0.08186 to 3.89643% (+0.25157/wk)

- * Record Low 0.11413% on 9/12/21; ** New 3Y high: 2.74029% on 7/14/22

- Daily Effective Fed Funds Rate: 1.58% volume: $91B

- Daily Overnight Bank Funding Rate: 1.57% volume: $271B

- Secured Overnight Financing Rate (SOFR): 1.53%, $934B

- Broad General Collateral Rate (BGCR): 1.51%, $369B

- Tri-Party General Collateral Rate (TGCR): 1.51%, $362B

- (rate, volume levels reflect prior session)

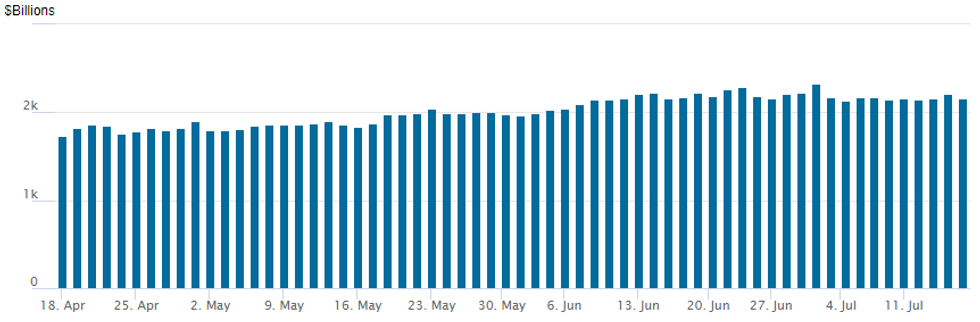

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage recedes to $2,153.750B w/ 95 counterparties vs. $2,207.121B prior session. Record high still stands at $2,329.743B from Thursday June 30.

EGBs-GILTS CASH CLOSE: Short End Sees Relief, But BTP Spreads Widen

The German curve bull steepened while the UK's twist steepened Friday.

- The front end outperformed, helped by mixed/weak US data as well as some Fed speakers who pointed to a 75bp and not 100bp July hike.

- BTP spreads widened amid continued political uncertainty - note publication of an MNI exclusive "Italy PM Draghi Expects To Quit Next Wednesday - Sources".

- Attention turns swiftly to the ECB decision next week - a 25bp hike is fully priced, with a modest chance of a 50bp raise (about 15% now, vs around 40% Thurs morning).

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 2-Yr yield is down 5.7bps at 0.466%, 5-Yr is down 4.5bps at 0.829%, 10-Yr is down 4.9bps at 1.129%, and 30-Yr is down 2.7bps at 1.356%.

- UK: The 2-Yr yield is down 4.3bps at 1.919%, 5-Yr is down 3.4bps at 1.799%, 10-Yr is down 1.5bps at 2.086%, and 30-Yr is up 2.8bps at 2.579%.

- Italian BTP spread up 6.8bps at 214bps / Spanish down 0.4bps at 115.4bps

FOREX: Firmer Risk Sentiment Weighs On Greenback

- An extension of Thursday’s late bounce in major equity indices put the US dollar on the backfoot to end the week. The USD index is seen roughly half a percent lower on Friday, however, the index looks set to rise around 1% for the week and post the highest weekly close since October, 2002.

- Additionally, despite some forecasters now looking for a 100bp fed rate hike, St. Louis Fed President James Bullard and Federal Reserve Governor Christopher Waller have both backed raising rates by 75bp this month. Furthermore, some analysts have noted that today’s fresh data may support this view, likely taking the shine off the USD as well as potential profit taking dynamics before the week’s close.

- The broad dollar weakness has moderated the pressure on EUR/USD, with the rate back above the parity level that gave way earlier this week and making a push back towards the 1.01 mark.

- In similar vein, a solid bounce in the likes of Aussie, which had come under initial pressure on Friday, following weaker than expected Chinese growth data. AUD, NZD and CAD all reside over a half percent stronger on the day.

- Next Monday’s data highlight will be New Zealand CPI, which is expected to have risen to 7.1% Y/y. Markets will also receive inflation data from the UK and Canada next week, before central bank meetings/decisions for both the BOJ and ECB on Thursday.

Monday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 18/07/2022 | - |  | UK | BOE Saunders at Resolution Foundation (Time TBA) | |

| 18/07/2022 | 1215/0815 | ** |  | CA | CMHC Housing Starts |

| 18/07/2022 | 1400/1000 | ** |  | US | NAHB Home Builder Index |

| 18/07/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 18/07/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 18/07/2022 | 2000/1600 | ** |  | US | TICS |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.