-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: 3Y Inflation Exp At Survey Life Lows

- MNI US CPI Preview: Used Cars Drag Seen Clashing With Firmer Non-Housing Services

- MNI US: New York Special Election To Provide First Hard Voting Data Of 2024

- MNI NY Fed 3Y Inflation Expectations Fall To Lowest In 11 Years Of Data

US

US CPI Preview (MNI): Used Cars Drag Seen Clashing With Firmer Non-Housing Services: Consensus puts core CPI inflation at 0.3% M/M in January with mild risk seen to the downside, for a very similar reading to December after Friday’s annual revisions.

- Those revised seasonal factors plus new weights aren’t seen having a large impact in January but nevertheless add to some uncertainty.

- A broad theme is that service inflation could have strengthened with an offset from a large drag from used cars.

- There is a very wide range to analyst views for CPI supercore (from an admittedly small sample), but even the softest sees the three-month accelerate to 4.5% annualized.

NEWS

US (MNI): New York Special Election To Provide First Hard Voting Data Of 2024

New York's third Congressional district will go to the ballot box tomorrow to fill the vacant House seat of expelled former Republican George Santos. Polling suggests that the race between former Democratic Rep Tom Suozzi and Republican Mazi Melesa Pilip will be tight.

US (MNI): Speaker Johnson Faces Bind Over USD$95b National Security Supplemental Bill

The Senate yesterday cleared another hurdle on the USD$95 billion national security supplemental package, which includes new funding for Ukraine, Israel, and other US allies, teeing up a final vote no later than Wednesday.

LATAM (MNI): White House: No Sign Venezuela Is Preparing For Military Action

White House national security communications adviser, John Kirby, has told reporters that the administration sees no signs that Venezuela is preparing to undertake military operation against Guyana, after an increase of military activity on the border of the disputed, oil rich, Essequibo region.

SECURITY (MNI): Tusk: Increasing Defense Production Is An Absolute Priority

Wires reporting that Polish Prime Minister Donald Tusk, speaking in Berlin, has told reporters that, "increasing defence production is an absolute priority."

US TSYS Week Opener Focus on January CPI

- Treasury futures see-sawed higher in a narrow range Monday, modest volumes (TYH4 appr 920k by the close) with much of Asia/Pac closed for Lunar New Year holidays. Main focus for the week is tomorrow morning's January CPI and Retail Sales on Thursday.

- Inflation expectations in January remained unchanged at the short- and longer-term horizons and declined slightly at the medium-term horizon , according to a New York Fed's survey of consumers, while consumers were more optimistic about their financial situation.

- Median year-ahead inflation expectations were unchanged at 3.00%, while the five-year-ahead measure was unchanged at 2.54%. The three-year-ahead measure decreased 0.2ppt to 2.35%, the lowest since the New York Fed’s Survey of Consumer Expectations started in 2013.

- Decent corporate bond issuance resumed, just over $17B generated decent two way hedging/unwind flows.

OVERNIGHT DATA

US DATA (MNI): NY Fed 3Y Inflation Expectations Fall To Lowest In 11 Years Of Data

- NY Fed inflation expectations held steady at 3.0% for 1Y and 2.5% for 5Y horizons in January.

- The 3Y was more eye-catching however, falling from 2.62% to 2.35% for its lowest on an unrounded basis since the series started in 2013, and with a 65bp decline over two months since the 3% in November.

MARKETS SNAPSHOT

- Key market levels of markets in late NY trade:

- DJIA up 98.55 points (0.25%) at 38769.79

- S&P E-Mini Future down 6.75 points (-0.13%) at 5037.5

- Nasdaq down 55.8 points (-0.3%) at 15935.43

- US 10-Yr yield is down 0.4 bps at 4.1715%

- US Mar 10-Yr futures are up 4/32 at 110-22.5

- EURUSD down 0.0013 (-0.12%) at 1.0771

- USDJPY up 0.11 (0.07%) at 149.4

- WTI Crude Oil (front-month) up $0.02 (0.03%) at $76.87

- Gold is down $5.1 (-0.25%) at $2019.00

- European bourses closing levels:

- EuroStoxx 50 up 30.48 points (0.65%) at 4746.35

- FTSE 100 up 1.11 points (0.01%) at 7573.69

- German DAX up 110.85 points (0.65%) at 17037.35

- French CAC 40 up 42.28 points (0.55%) at 7689.8

US TREASURY FUTURES CLOSE

- 3M10Y -1.351, -122.857 (L: -127.744 / H: -120.002)

- 2Y10Y +1.059, -30.02 (L: -32.092 / H: -29.143)

- 2Y30Y +1.352, -10.046 (L: -11.976 / H: -8.63)

- 5Y30Y +0.605, 23.979 (L: 22.511 / H: 24.817)

- Current futures levels:

- Mar 2-Yr futures up 0.5/32 at 102-9.625 (L: 102-08.625 / H: 102-11.25)

- Mar 5-Yr futures up 3/32 at 107-7.75 (L: 107-04.75 / H: 107-11.25)

- Mar 10-Yr futures up 3.5/32 at 110-22 (L: 110-17.5 / H: 110-28)

- Mar 30-Yr futures up 5/32 at 119-25 (L: 119-13 / H: 120-04)

- Mar Ultra futures up 4/32 at 125-31 (L: 125-15 / H: 126-15)

US 10Y FUTURE TECHS: (H4) Bear Threat Remains Present

- RES 4: 114-06+ 2.00 proj of the Oct 19 - Nov 3 - Nov 13 price swing

- RES 3: 114-00 Round number resistance

- RES 2: 113-12 High Dec 27 and the bull trigger

- RES 1: 111-13/113-06+ 20-day EMA / High Feb 1

- PRICE: 110-24+ @ 11:15 GMT Feb 12

- SUP 1: 110-16 Low Dec 13 and Low Feb 9

- SUP 2: 109-31+ Low Dec 11

- SUP 3: 109-17 50.0% of the Oct 19 - Dec 27 bull phase

- SUP 4: 109-05+ Low Nov 28

A bear threat in Treasuries remains present and Friday’s move lower reinforces this condition. The bear trigger at 110-26, the Jan 19 low, has been breached. A clear break would highlight a stronger reversal and open 110-16, the Dec 13 low (tested), ahead of 109-31+, Dec 11 low. Initial key resistance has been defined at 113-06+, Feb 1 high, where a breach would reinstate a bullish theme. First resistance is at 111-13, the 20-day EMA.

SOFR FUTURES CLOSE

- Mar 24 -0.005 at 94.770

- Jun 24 -0.005 at 95.110

- Sep 24 -0.005 at 95.475

- Dec 24 +0.005 at 95.820

- Red Pack (Mar 25-Dec 25) +0.015 to +0.035

- Green Pack (Mar 26-Dec 26) +0.040 to +0.040

- Blue Pack (Mar 27-Dec 27) +0.030 to +0.035

- Gold Pack (Mar 28-Dec 28) +0.020 to +0.025

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M -0.00032 to 5.32040 (-0.00139 total last wk)

- 3M -0.00252 to 5.30653 (+0.01859 total last wk)

- 6M +0.00233 to 5.19099 (+0.09256 total last wk)

- 12M +0.01837 to 4.89862 (+0.18745 total last wk)

- Secured Overnight Financing Rate (SOFR): 5.31% (+0.00), volume: $1.581T

- Broad General Collateral Rate (BGCR): 5.30% (+0.00), volume: $671B

- Tri-Party General Collateral Rate (TGCR): 5.30% (+0.00), volume: $661B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $96B

- Daily Overnight Bank Funding Rate: 5.32% (+0.00), volume: $270B

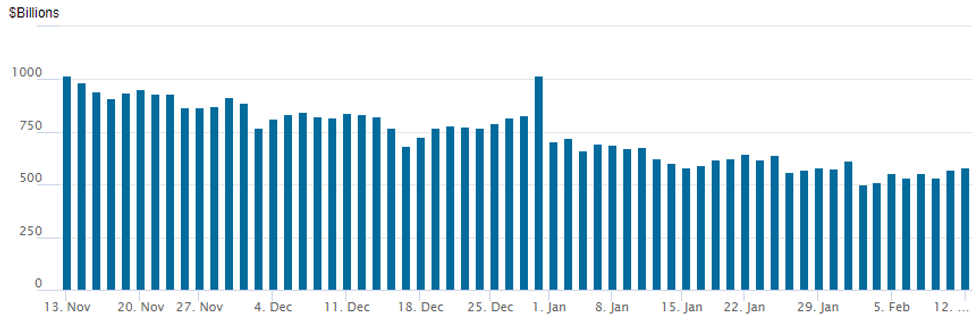

FED REVERSE REPO OPERATION

NY Federal Reserve/MNI

- RRP usage climbs to $581.568B vs. $569.175B Friday - remains well above recent cycle low of $503.548B from Thursday, February 1, the lowest level since mid-2021.

- Meanwhile, the latest number of counterparties is at 78 from 80 Friday (compares to 65 on January 16, the lowest since July 7, 2021).

PIPELINE $3.25B BNP Paribas 2Pt Launched

$4.4B TransDigm 2-part should launch after the close

- Date $MM Issuer (Priced *, Launch #

- 2/12 $4.4B TransDigm $2.2B 5NC2 6.5%, $2.2B 8NC3 6.75%

- 2/12 $3.25B #BNP Paribas $1.75B 6.25NC5.25 +138, $1B 11NC10+158

- 2/12 $2B #American Express $1.7B 4NC3 +85, $300M 4NC3 SOFR+100

- 2/12 $1.75B #PepsiCo Singapore $550M 3Y +40, $300M 3Y SOFR+56, $450M 5Y +45, $450M 10Y +55

- 2/12 $1.5B #Kenya 7Y 10.375%

- 2/12 $1.45B #Bell Canada $700M 10Y +105, $750M 30Y +120

- 2/12 $1.2B #DTE Energy 5Y +103

- 2/12 $1B #Arthur J Gallagher $500M 10Y +132, $500M 30Y +147

- 2/12 $650M #Estee Lauder 10Y +87

EGBs-GILTS CASH CLOSE: Yields End Lower Ahead Of UK Data

Core European yields fell modestly Monday, with curves leaning bull steeper and periphery EGBs outperforming.

- Bunds and Gilts began the week constructively, with yields heading to session lows by midday.

- But befitting a day with little news/macro data flow, yields remained bounded by last week's ranges and reversed higher in the afternoon, with risk looming in the form of US CPI (Tuesday) and UK labour market/CPI data (Tues/Weds).

- Strengthening equities in the afternoon also weighed on core EGBs/Gilts, and helped periphery EGB spreads tighten further, led by BTPs.

- Of note, BoE's Bailey speaks after Monday's cash close.

- UK labour market data (MNI preview here) features early Tuesday, with wages in focus - German ZEW and US CPI arrive later in the session.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 2.3bps at 2.693%, 5-Yr is down 3bps at 2.306%, 10-Yr is down 2bps at 2.362%, and 30-Yr is down 1bps at 2.559%.

- UK: The 2-Yr yield is down 5.1bps at 4.551%, 5-Yr is down 4.8bps at 4.052%, 10-Yr is down 2.9bps at 4.057%, and 30-Yr is down 2.8bps at 4.585%.

- Italian BTP spread down 3.7bps at 154.7bps / Spanish down 2.5bps at 96.2bps

FOREX: Narrow Ranges As US Inflation Data Awaited, NZD Underperforms

- Intraday ranges in currency markets remained narrow amid Chinese New Year holidays and the close proximity to Tuesday’s US CPI release. Despite session fluctuations, the overall continued strength for major US equity benchmarks saw some early greenback strength reverse, tilting the USD index into very moderate negative territory as we approach the APAC crossover on Monday.

- NOK and SEK remain the best performers so far Monday, rising around 0.5% against the greenback. NZD is among the weakest majors as markets trim the solid gains posted last week on the back of renewed hiking expectations from the RBNZ.

- EUR sits marginally weaker Monday, slipping against most others in G10 as EUR/USD slippage extended off the 1.0806 highs into NY hours. EUR/USD made a brief attempt below Friday’s worst levels and initial intraday weak support at 1.0762, however, 1.0742 below has remained intact.

- Despite the slightly lower US yields, USDJPY remains well supported on dips. 148.93 marked the intra-day low as NY sat down, before price action steadily grinded higher back towards the 2024 highs, located just above the 149.50 mark. Given the constructive technical tone, eyes will be on a move to 149.75, the Nov 22 high and then 150.78, the Nov 17 high.

- While China remains out, New Zealand inflation expectations, UK labour and Swiss CPI highlight the early docket on Tuesday. All focus then turns to the release of US CPI where consensus puts core CPI inflation at 0.3% M/M in January with mild risk seen to the downside, for a very similar reading to December after Friday’s annual revisions.

TUESDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 13/02/2024 | 0600/1500 | * |  | JP | Machinery orders |

| 13/02/2024 | 0700/0700 | *** |  | UK | Labour Market Survey |

| 13/02/2024 | 0730/0830 | *** |  | CH | CPI |

| 13/02/2024 | 1000/1100 | *** |  | DE | ZEW Current Expectations Index |

| 13/02/2024 | 1000/1100 | *** |  | DE | ZEW Current Conditions Index |

| 13/02/2024 | 1000/1000 | * |  | UK | Index Linked Gilt Outright Auction Result |

| 13/02/2024 | 1100/0600 | ** |  | US | NFIB Small Business Optimism Index |

| 13/02/2024 | 1330/0830 | *** |  | US | CPI |

| 13/02/2024 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.