-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: China Weighs Zero-Covid Exit But Without Timeline

- CHINA WEIGHS ZERO-COVID EXIT BUT PROCEEDS WITH CAUTION AND WITHOUT TIMELINE - WSJ

- GOP SWEEP STILL SEEN AS MOST LIKELY OUTCOME IN BETTING MARKETS IN NOV 8 MIDTERMS

- EU AIMS TO PROPOSE NEW EUR 18B UKRAINE AID PACKAGE ON WEDNESDAY

- GERMANY WANTS TO RELAUNCH EU-US TRADE TALKS

CHINA (WSJ): China Weighs Zero-Covid Exit But Proceeds With Caution and Without Timeline

Chinese leaders are considering steps toward reopening after nearly three years of tough pandemic restrictions but are proceeding slowly and have set no timeline, according to people familiar with the discussions. Chinese officials have grown concerned about the costs of their zero-tolerance approach to smothering Covid outbreaks, which has resulted in lockdowns of cities and whole provinces, crushing business activity and confining hundreds of millions of people at home for weeks and sometimes months on end. But they are weighing those against the potential costs of reopening on public health and support for the Communist Party.

US MIDTERMS (MNI): GOP Sweep Still Seen As Most Likely Outcome In Betting Markets

Political betting markets continue to show a heavy implied probability that the Republicans take control of both the Senate and House of Representatives in the 8 November midterm elections. Data from Smarkets assigns a 64.9% implied probability that the GOP wins a majority in both chambers, with a Republican House-Democratic Senate scenario the second most likely outcome according to bettors with a 27.8% implied probability.

US MIDTERMS (MNI): Biden and Trump Make Last Pitch To US Voters

President Biden and former President Donald Trump are holding their final rallies of the midterm election cycle today as Republican and Democrat make a last pitch to voters ahead of tomorrow's midterm elections. Biden will be in Bowie, Maryland campaigning on behalf of Democrat gubernatorial candidate Wes Moore. Trump will be in Dayton, Ohio boosting Republican Senate candidate JD Vance and Gov. Mike DeWine (R-OH)

US (BBG): High-Grade Bond Sellers Bring 15-Deal Surge to Beat CPI Data

Fifteen companies are tapping the US investment-grade primary market on Monday, bringing a sales streak to 11-days and making it the busiest session by number of issuers since the crush following the US Labor Day holiday. The sales spree comes ahead of consequential consumer price index data on Thursday and a bond market holiday on Friday. That’s left just three days for borrowers to jam in an expected $25-$30B of issuance.

US (WSJ): CFOs Ask Congress To Repeal Change To R&D Tax Rules

Companies are asking lawmakers to repeal a change in the tax code that requires businesses to spread their research-and-development costs over five years rather than deduct them immediately. In a letter dated Nov. 4, 178 chief financial officers, primarily from large U.S. companies, including Ford Motor Co., Raytheon Technologies Corp., Lockheed Martin Corp. and Boeing Co., said the new rules create a competitive disadvantage for American companies and will lead to job losses and thwart innovation. They are asking Congress to move back to immediate deductibility before the end of the year.

FED (MNI): SF Fed Says Conditions Much Tighter Than Funds Rate Shows

U.S. monetary policy is perhaps 225 basis points tighter than the restriction triggered by interest-rate hikes, as market yields were lifted even further by balance-sheet reduction and forward guidance, San Francisco Fed researchers said in a report Monday.

EU/UKRAINE (BBG): EU Aims to Dispel Criticism on Ukraine Aid With €18 Billion Plan

The European Union will propose on Wednesday a new mechanism to provide €18 billion ($18.1 billion) in financial aid to Ukraine in a more predictable manner after the bloc was slow to provide all the support it promised earlier this year.

EU-US TRADE (MNI): Germany Wants To Relaunch EU-U.S Trade Talks

German Finance Minister Christian Lindner wants EU-U.S. free trade talks relaunched as Europe seeks a solution to the impact of the U.S. inflation-reduction act, which Brussels says might breach international rules with subsidies to green industry. “The inflation-reduction act poses challenges for European industries and the U.S. administration has to be aware of the consequences for our single market,” Lindner told reporters as he went into the Eurogroup meeting in Brussels today.

EUROZONE (MNI): Energy Price Shock To Hit Eurozone Tourism Recovery - ECB

Rising prices related to the energy shock, combined with falling real incomes and increasing uncertainty, may dampen the post-Covid bounce-back in overall demand in eurozone tourism, according to the ECB’s latest economic bulletin. Overall, eurozone supply-side bottlenecks have eased since mid-2022, easing still-elevated upside price pressures.

US DATA: Consumer Credit Sees Smaller Than Expected Increase

* MNI: US SEP CONSUMER CREDIT +$25.0B (Bloomberg consensus +$30.0B)

* US SEP REVOLVING CREDIT +$8.3B

* US SEP NONREVOLVING CREDIT +$16.7B

MNI MARKETS ANALYSIS: Biggest US Midterms Risk Is Status Quo

EXECUTIVE SUMMARY:

- Heading into Tuesday's midterm elections, the overwhelming expectation is that the Republicans win at least one if not both chambers of Congress. MNI's Political Risk team's midterm elections preview is available here.

- From an asset class perspective, the impact of that outcome is likely to be muted, and besides, there is little discernible pattern in recent post-midterm asset moves.

- But we could see a strong bearish Treasuries, bullish dollar move in the event the Democrats do the unlikely and win both the Senate and the House.

- That may seem counterintuitive given that it would simply return the status quo. But a strong reaction would be likely as it would change the macro policy setup for 2023 in a more expansionary fiscal / tighter monetary direction than is currently (overwhelmingly) priced in.

FULL ANALYSIS AVAILABLE HERE:

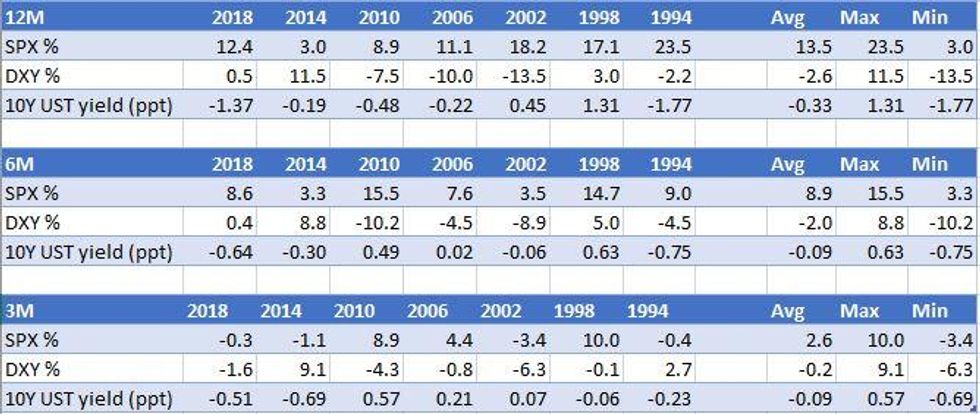

Table 1: Post-Midterm Election Returns (changes calculated from Oct 31 of midterm year)

Source: MNI

Source: MNI

US TSYS: Increasingly Parallel Cheapening Across The Curve

- Cash Tsys are seeing an increasingly parallel cheapening across the curve, with 2YY +6bp and 10YY +5bp after the longer end unwound an overnight rally.

- In a light docket, one of the main drivers came from WSJ sources saying China is weighing a zero-Covid exit, albeit with caution and without a timeline, going against long end yield downward pressure when China NHC officials noted unswervingly adhering to current controls.

- Treasuries also contend with 15 IG deals looking to price (12 left after Wisconsin, Duke Energy and Southern California Gas so far).

- TYZ2 of 109-21+ comes close to session lows of 109-19 but doesn’t yet trouble support at Friday’s low of 109-10+.

- Still to hear ’22 voters Collins & Mester at 1540ET before Barkin (’24) on inflation at 1800ET. A dearth of data/Fedspeak follows tomorrow.

FOREX: Broad Greenback Weakness Persists, GBP Soars 1.4%

- Despite the US Dollar gapping higher at the open, the greenback has resumed its weakening bias that ensued following the US employment release on Friday amid ongoing optimism surrounding the potential relaxation of Covid measures in China and the underlying supportive tone for equity markets.

- The USD index (-0.71%) comfortably traded through last week’s lows and now resides roughly 2.4% below the post-NFP high. Price action has been extending below the 50-day moving average which intersected at 111.21 today. Fairly consistent and broad-based USD weakness extended towards the end of the European session, with EURUSD climbing back above parity and GBPUSD testing the 1.15 handle.

- Little immediate resistance of note for the single currency may pave the way for a move towards 1.0094, the high on Oct 27 and a technical bull trigger.

- For cable (+1.36%), consistent demand has seen a clean break of the 50-day exponential moving average at 1.1429 and further strength now brings into focus 1.1566, the October 27th high.

- The Yuan matched the US Dollar's underperformance as the central bank dialed back its support for the currency via fixings and the strong performance for major equity indices was unable to filter through despite other EM currencies continuing to perform well such as the ZAR (+1.05) and MXN (+0.42%).

- US Mid-Terms are likely to dominate the newsflow over the course of Tuesday, however, markets will remain focused on the US inflation release due Thursday.

US STOCKS: Equities Firmer Post CFOs Looking To Repeal Change in R&D Tax

- Equities firmed more sharply following a coordinated push from US CFOs to repeal the change in R&D tax rules mentioned above, after what had been a particularly narrow range for much of the US session.

- ESA now sits +1% on the day at 3817 (high 3819.5), coming closer to the 50-day EMA of 3828.6 as a bull cycle remains in play, as does Nasdaq at +1%.

EU FI: EGBs-GILTS CASH CLOSE: Bear Flattening

European curves bear flattened to start the week, with Gilts underperforming Bunds.

- Amid a fairly quiet session with limited volumes and newsflow, the flattening move accelerated in the afternoon ((UK2s10s moved 6bp lower) with the BoE's APF tender showing a low cover ratio.

- Heavy corporate issuance on both sides of the Atlantic maintained pressure on global bonds.

- Rate hike expectations picked up across the board: BoE terminal pricing up 1.8bp, with ECB up 4.3bp.

- Periphery spreads tightened modestly.

- Attention remains on US elections Tuesday and CPI Thursday.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 8.1bps at 2.209%, 5-Yr is up 6.3bps at 2.236%, 10-Yr is up 4.8bps at 2.343%, and 30-Yr is up 3.4bps at 2.267%.

- UK: The 2-Yr yield is up 16bps at 3.23%, 5-Yr is up 11.5bps at 3.54%, 10-Yr is up 10.1bps at 3.638%, and 30-Yr is up 8.3bps at 3.853%.

- Italian BTP spread down 2bps at 214.6bps

- Spanish bond spread down 1.3bps at 104.4bps

EUROPE OPTIONS: Mostly Sonia Calls To Start The Week

Monday's Europe rates/bonds options flow included:

- OEZ2 118/117 put spread bought for 25 in 2k

- RXZ2 135/132 put spread sold at 67.5/68 in 1.5k

- SFIZ2 9590/9610 call spread bought for 16.5 in 3k (vs 21.5)

- SFIZ2 9530/60 call spread sold at 29 in 2k (vs 20.5)

- 0NZ2 9550/9600/9650 1x1.5x0.5 call fly sold at 14.5 in 1k

COMMODITIES: Oil Fluctuates As Markets Assess China Zero-Covid Policies

- Crude oil prices have broadly trended higher today but for the most part haven’t made up for the sharp decline at open on limited prospects of China moving away from its zero-Covid policy (NHC officials saying the country will "unswervingly" adhere to current controls). WSJ sources then saying that this could be under consideration spurred some intraday increases but they were limited by the noted caution that would be taken and the fact there is no timeline.

- WTI is -0.9% at $91.74, pulling back from a high of $93.74 having cleared resistance at $92.87 (Nov 4 high). Most active strikes in the CLZ2 are by far $100/bbl and $95/bbl calls.

- Brent is -0.8% at $97.79, having also cleared resistance at $98.81 (Nov 4 high) before retreating.

- Gold is -0.3% at $1676.80 as higher US yields help offset any tailwind from a weaker USD. It sits close to resistance at $1682.1 (Nov 4 high).

| Date | GMT/Local | Impact | Flag | Country | Event |

| 08/11/2022 | 0001/0001 | * |  | UK | BRC-KPMG Shop Sales Monitor |

| 08/11/2022 | 0745/0845 | * |  | FR | Foreign Trade |

| 08/11/2022 | 0745/0845 | * |  | FR | Current Account |

| 08/11/2022 | 0900/1000 |  | IT | Retail Sales | |

| 08/11/2022 | 0900/0900 |  | UK | BOE Pill Panels UBS European Conference | |

| 08/11/2022 | 1000/1100 | ** |  | EU | retail sales |

| 08/11/2022 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 08/11/2022 | 1100/0600 | ** |  | US | NFIB Small Business Optimism Index |

| 08/11/2022 | - |  | US | Legislative Elections / Midterms | |

| 08/11/2022 | - |  | EU | ECB de Guindos at ECOFIN meeting | |

| 08/11/2022 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 08/11/2022 | 1500/1000 | ** |  | US | IBD/TIPP Optimism Index |

| 08/11/2022 | 1800/1300 | *** |  | US | US Note 03 Year Treasury Auction Result |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.