-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: CPI Sets Stage for Forward Fed Guidance

- China Stocks Rebound as ETF Volumes Suggest Buying by State Fund, Bbg

- Abu Dhabi Is the World’s Newest Wealth Haven for Billionaires, Bbg

US TSYS Markets Roundup: Fast Recovery After Weak Auctions

- Treasury futures have fully recovered from today's weak 3Y (1.8bp tail) and 10Y (1.4bp tail) auctions - have climbed to current session highs across the board and breaching early overnight highs.

- At the moment, Mar'24 2Y futures +.38 at 102-05.75, 10Y futures +3.5 at 110-12; curves steeper but off highs (3M10Y +.318 at -116.682, 2Y10Y +.578 at -48.942).

- The 10Y contract is through initial technical resistance of 111-09+ High Dec 7, focus on 111-19: 1.236 proj of the Oct 19 - Nov 3 - Nov 13 price swing.

- Unusual to see rates improve so quickly after weak auction performance, one desk chalking it up to nothing more than the "auction process going well and putting supply in the rearview ahead of CPI/PPI and the Fed" one desk posited.

- While Dec remains static, the rebound has seen projected rate cuts gain traction in late trade, see 1421ET bullet.

FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M +0.00480 to 5.35978 (+0.00832 total last wk)

- 3M +0.01313 to 5.37917 (-0.00919 total last wk)

- 6M +0.03725 to 5.32936 (-0.04879 total last wk)

- 12M +0.07804 to 5.09816 (-0.09829 total last wk)

- Secured Overnight Financing Rate (SOFR): 5.32% (+0.00), volume: $1.610T

- Broad General Collateral Rate (BGCR): 5.30% (+0.00), volume: $617B

- Tri-Party General Collateral Rate (TGCR): 5.30% (+0.00), volume: $605B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $101B

- Daily Overnight Bank Funding Rate: 5.32% (+0.00), volume: $252B

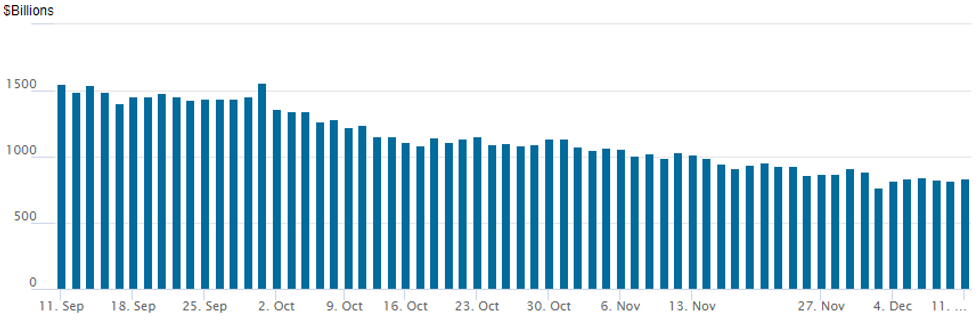

FED REVERSE REPO OPERATION

NY Federal Reserve/MNI

The NY Fed Reverse Repo operation usage climbs to $838.507B w/ 82 counterparties vs. $821.408B Friday. Operation usage fell to the lowest level since early July 2021 of $768.543B on December 1 after falling below $1T for the first time since August 2021 last on November 9 ($993.314B).

SOFR/TREASURY OPTION SUMMARY

Option flow remained mixed in late Monday trade, volumes still subdued as option desks ply the sidelines ahead of the week's data (CPI, PPI) and event risk (FOMC). Underlying futures firmer, near late session highs. Projected rate cuts for early 2024 steady to modestly higher: December flat at 5.333%, January 2024 cumulative -.7bp at 5.323%, March 2024 chance of rate cut at -40.2% vs. -38.7% this morning (-55.2% pre-NFP) with cumulative of -10.8bp at 5.222%, May 2024 -63.8% vs. -59.2% earlier (-70.1% pre-NFP), cumulative -26.7bp at 5.063%. Fed terminal at 5.33% in Feb'24.

- SOFR Options:

- +8,000 SFRF4 94.81/94.83/95.00/95.12 1x1x2x2 call condors, 1.25

- +10,000 SFRH5 98.00 calls, 12.5

- +20,000 SFRZ4 98.00 calls, 8.0 ref 95.74

- 10,400 SFRH4 94.62/94.75/94.87/95.00 call condors ref 94.80 to -.795

- 7,700 0QG4 95.62 puts, ref 96.04 to -.035

- 3,000 0QZ3 95.50/95.56 put spds

- 2,000 SFRF4 94.62/94.75 put spds

- Treasury Options:

- -23,800 TYG4 111.5 calls, 48 ref 110-13 to -12.5

- 4,100 wk3 TY 108.75/109.25/109.75 put flys, 8 ref 110-12

- Block, 5,000 TUG4 103 calls, 7 vs. 102-04.62/0.50%

- +24,000 TYG4 107.5 puts, 19 ref 110-06.5

- 4,000 wk3 TY 106.5/106.75 put spds ref 106-26.75

- 2,000 TYF4 109.5 puts 27 last

- 1,500 FVF4 107.25 calls, 22-22.5

FOREX USDJPY Consolidates Back Above 146.00 Ahead of US CPI

- The US session saw G10 currencies hold narrow ranges as markets await key US inflation data on Tuesday and major central bank decisions due later this week. Early losses for the Japanese Yen saw USDJPY recover back above 146.00 and the pair has consolidated strong 1% gains on the session.

- USDJPY (+0.90%) price action saw the pair further erase last week's sharp sell-off on Bloomberg headlines citing sources that said the BoJ see little need to reverse negative interest rate policy at next week's policy meeting.

- The latest recovery - for now - appears to be a correction. Key short-term resistance to watch is 147.32, the Dec 7 high, a break of which would undermine the bearish theme. EUR/JPY's recovery toward 158.73 has confirmed the 154.08 200-dma as solid support, a level which should hold focus as the week progresses.

- WTI rebounding back towards overnight highs has provided a small relative boost for CAD, which tops the G10 FX leaderboard today, along with the Swiss Franc.

- Broadly, the dollar index holds close to last week's post-NFP highs, making 104.26 the level of focus ahead. G10 spot ranges across US hours remained very contained as market participants remain on the sidelines ahead of key event risk this week, including tomorrow’s US inflation data.

- Consensus puts US core CPI inflation at 0.3% M/M in November, reaccelerating to 0.3% after a surprise moderation to 0.23% M/M in October. Both the Bloomberg survey and analyst previews seen by MNI imply downside skew.

FX Expiries for Dec12 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0685-00(E1.1bln), $1.0750(E762mln), $1.0830-50(E1.5bln)

- USD/JPY: Y145.35-50($879mln), Y148.00($575mln)

- GBP/USD: $1.2530-50(Gbp535mln)

- USD/CNY: Cny7.2000($926mln)

Late Equity Roundup: Modest Late Session Gains, Focus on Fed

- Stocks gained traction in the second half, trading near late session highs as focus turns to tomorrow's CPI, PPI and the Fed announcement on Wednesday. Currently, DJIA trades is up 105.41 points (0.29%) at 36352.88, the S&P E-Mini Futures up 13.25 points (0.28%) at 4673.5 Nasdaq up 18.6 points (0.1%) at 14421.7.

- Leading gainers: Industrials and Financial sectors continued to outperform in late trade, commercial/professional services shares led the former: Copart gaining 3.44%, Verisk Analysis +2.98%, Veralto +2.28%, ADP +1.88%. Insurance companies continued to support Financials: Allstate +2.69%, Everest Grp +2.06%, Aon +1.85%.

- Laggers: Communication Services and Consumer Discretionary sectors underperformed. Media and entertainment weighed on the communication services: Paramount -3.47% Meta -2.17% and Google -1.8%. Auto makers weighed on the Discretionary sector: Tesla -1.85% while GM slipped 0.18%.

E-MINI S&P TECHS: (H4) Heading North

- RES 4: 4738.50 High Jul 27 and key resistance

- RES 3: 4700.00 Round number resistance

- RES 2: 4690.75 High Aug 2

- RES 1: 4676.25 Intraday high

- PRICE: 4672.50 @ 1500ET Dec 11

- SUP 1: 4583.14 20-day EMA

- SUP 2: 4517.21 50-day EMA

- SUP 3: 4420.25.25 Low Nov 14

- SUP 4: 4354.25 Low Nov 10

In S&P e-minis, a bullish theme remains intact and the contract traded higher Friday. Since the October 27 reversal, corrections have been shallow - this is a bullish signal. Note too that moving average studies are in a bull-mode position, highlighting positive market sentiment. A continuation higher would signal scope for a climb towards 4690.75, the Aug 2 high. Initial support lies at 4583.14, the 20-day EMA.

COMMODITIES WTI Rebounds But Can’t Prevent Weekly Decline, Gold Tumbles Post-Payrolls

- WTI has rebounded today after hitting lowest levels since late June yesterday. However, crude remains around 3.8% down on the start of the week as strong non-OPEC supply and fears around OPEC+ voluntary cut commitments breed bearish sentiment.

- The day’s gains were supported from a macro backdrop by an on balance stronger than expected payrolls report and stronger consumer sentiment.

- US oil and gas rig count rose by 1 to 626 rigs, according to Baker Hughes Dec. 8, the highest since the week ending Sep. 22. Oil rig count: -1 to 503

- The US Energy Department is seeking to buy 3mn bbl of crude for the US SPR with March delivery according to an official solicitation.

- OPEC+ output fell by 110k bpd in November m/m to 42.6mn bpd according to a Platts survey.

- WTI is +2.7% at $71.21, pushing back closer to resistance at $72.37 (Nov 16 low).

- Brent is +2.4% at $75.79 vs resistance at $79.73 (20-day EMA).

- Gold is -1.4% at $2000.64 off a low of $1994.73 having seen sustained downward pressure since the payrolls report. It’s pushed through support at $2007.5 (20-day EMA) to open $1975.0 (50-day EMA). It’s a week that started with a spike to an all-time high of $2135.39 first thing in Monday Asia trading.

- Weekly moves: WTI -3.9%, Brent -3.9%, Gold -3.5%, US HH nat gas -8.8%, EU TTF nat gas -11.3%

TUESDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 12/12/2023 | 0700/0800 | ** |  | NO | Norway GDP |

| 12/12/2023 | 0700/0700 | *** |  | UK | Labour Market Survey |

| 12/12/2023 | 1000/1100 | *** |  | DE | ZEW Current Conditions Index |

| 12/12/2023 | 1000/1100 | *** |  | DE | ZEW Current Expectations Index |

| 12/12/2023 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 12/12/2023 | 1100/0600 | ** |  | US | NFIB Small Business Optimism Index |

| 12/12/2023 | - | *** |  | CN | Money Supply |

| 12/12/2023 | - | *** |  | CN | New Loans |

| 12/12/2023 | - | *** |  | CN | Social Financing |

| 12/12/2023 | 1330/0830 | *** |  | US | CPI |

| 12/12/2023 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 12/12/2023 | 1500/1000 | * |  | US | Services Revenues |

| 12/12/2023 | 1630/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 12/12/2023 | 1800/1300 | *** |  | US | US Treasury Auction Result for 30 Year Bond |

| 12/12/2023 | 1900/1400 | ** |  | US | Treasury Budget |

| 13/12/2023 | 2145/1045 | ** |  | NZ | Current account balance |

| 13/12/2023 | 2350/0850 | *** |  | JP | Tankan |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.