-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net injects CNY9.8 Bln via OMO Wednesday

MNI: PBOC Sets Yuan Parity Higher At 7.1732 Weds; -0.90% Y/Y

MNI BRIEF: Aussie Monthly Trimmed Mean CPI At 2.8% Y/Y

MNI ASIA OPEN: Curve Climbs Steeper, Tsy Near Midrange for Wk

- MNI US: Republicans' Electoral College Advantage Fading, NYT

- MNI ISRAEL: IDF Chief Hints At Impending Ground Operation As US Pushes Ceasefire

- MNI SECURITY: Russia Could Use Nuclear Weapons If "Critical Threat To Sovereignty"

- MNI US DATA: New Home Prices Cool Further With Elevated Supply

US TSYS: Near Mid-Range Ahead Thu's Heavy Speaker, Data Docket

- Treasuries look to finish weaker - near late session lows Wednesday, but closer to the middle of the week's range on a relatively muted session. Some accounts appear to be plying the sidelines to await tomorrow's flood of data and Fed speakers not to mention next week's September employment data.

- Little reaction to this morning's new home sales - slightly better than expected in August at 716k (saar, cons 700k) after an upward revised 751k (initial 739k) in July.

- Dec'24 10Y Tsy futures are currently -10 at 114-17 vs. 114-16.5 low -- still well off initial technical support at 114-09.5 (Sep 24 low).

- Curves continued to steepen to new 2+Y highs, the 2s10s curve marking 23.585 high.

- Projected rate cuts into early 2025 held steady to mixed, latest vs. morning levels (*) as follows: Nov'24 cumulative -40.4bp (-39.1bp), Dec'24 -78.0bp (-79.1bp), Jan'25 -111.0bp (-112.5bp).

- Looking ahead to Thursday's session: weekly claims, GDP, PCE, Cap Goods, Durables, Pending home sales and a flurry of Fed speakers including Barr, Cook, Kashkari, Williams and Chairman Powell.

NEWS

US (MNI): Republicans' Electoral College Advantage Fading, NYT

The New York Times has published analysissuggesting that former President Donald Trump's Electoral College advantage, relative to the national popular vote "has declined significantly." Nate Cohen at the NYT notes that, "there’s growing evidence to support a surprising possibility: [Trump's] once formidable advantage in the Electoral College is not as ironclad as many presumed. Instead, it might be shrinking."

ISRAEL (MNI): IDF Chief Hints At Impending Ground Operation As US Pushes Ceasefire:

A number of outlets reporting that according to IDF Chief of Staff, Major General Herzi Halevi, Israeli forces preparing to launch a ground operation into Lebanon, marking what would be a significant escalation of the conflict beyond the already sizeable airstrikes that have taken place in recent days.

GERMANY (MNI): Green Party Leadership Resigns Following Brandenburg Blowout:

Ricarda Lang and Omid Nouripour, co-leaders of the environmentalist Greens have announced their resignations alongside that of the party's executive committee. This follows a string of poor results in state elections held across eastern Germany in September. The Greens lost five of its 12 seats in Saxony, and fell out of both the Thuringian and Brandenburger regional parliaments having fallen below the electoral threshold. In a resignation address, Nouripour said that the party was "in the deepest crisis in a decade".

SECURITY (MNI): Russia Could Use Nuclear Weapons If "Critical Threat To Sovereignty"

Wires carrying comments from Russian President Vladimir Putin following a meeting of the Russian Security Council. Putin notes that a "number of clarifications" have been proposed to Russia's nuclear doctrine, due to the emergence of "new sources of military threats and risks for Russia."

RUSSIA (MNI): Kremlin-Putin To Speak @ Sec Council On Nuclear Deterrence:

Wires carrying comments from Kremlin spox Dmitri Peskov. Peskov says that President Vladimir Putin will chair a meeting of the Security Council today (25 Sep) on the subject of nuclear deterrence. The Russian gov't has previously stated that it is revising its nuclear doctrine, which determines how and when Moscow would use such weapons on the battlefield. Putin will deliver an address at the Council, but the remainder will be behind closed doors.

JAPAN (MNI): Backing From Peers Could Give Koizumi Edge In LDP Leadership Contest:

The leadership contest for the governing conservative Liberal Democratic Party (LDP) takes place on Friday 27 September, with the election still too close to call. On the timing of the election, there is little in the way of an official schedule.

OVERNIGHT DATA

US DATA (MNI): New Home Prices Cool Further With Elevated Supply

New home sales were slightly better than expected in August at 716k (saar, cons 700k) after an upward revised 751k (initial 739k) in July. It left sales -4.7% M/M after a strong 10.3% increase in July, volatile but on balance trending higher with sales about 5% higher than the 2019 average as opposed to existing home sales which are more than 25% lower.

MARKETS SNAPSHOT

- Key market levels of markets in late NY trade:

- DJIA down 297.65 points (-0.71%) at 41900.68

- S&P E-Mini Future down 14 points (-0.24%) at 5777

- Nasdaq up 3.6 points (0%) at 18074.52

- US 10-Yr yield is up 5.7 bps at 3.7849%

- US Dec 10-Yr futures are down 10/32 at 114-17

- EURUSD down 0.0054 (-0.48%) at 1.1126

- USDJPY up 1.53 (1.07%) at 144.76

- WTI Crude Oil (front-month) down $1.84 (-2.57%) at $69.73

- Gold is up $2.74 (0.1%) at $2659.96

- European bourses closing levels:

- EuroStoxx 50 down 23.83 points (-0.48%) at 4916.89

- FTSE 100 down 14.06 points (-0.17%) at 8268.7

- German DAX down 78.13 points (-0.41%) at 18918.5

- French CAC 40 down 38.39 points (-0.5%) at 7565.62

US TREASURY FUTURES CLOSE

- 3M10Y +6.121, -83.827 (L: -91.106 / H: -83.827)

- 2Y10Y +4.149, 22.555 (L: 18.93 / H: 23.585)

- 2Y30Y +3.744, 57.953 (L: 54.292 / H: 59.307)

- 5Y30Y +0.029, 61.451 (L: 59.704 / H: 62.173)

- Current futures levels:

- Dec 2-Yr futures down 2.75/32 at 104-10 (L: 104-09.875 / H: 104-13.5)

- Dec 5-Yr futures down 7/32 at 110-4.5 (L: 110-04.5 / H: 110-13.25)

- Dec 10-Yr futures down 10.5/32 at 114-16.5 (L: 114-16 / H: 114-29.5)

- Dec 30-Yr futures down 27/32 at 124-6 (L: 124-06 / H: 125-06)

- Dec Ultra futures down 1-06/32 at 132-28 (L: 132-28 / H: 134-11)

US 10YR FUTURE TECHS: (Z4) Corrective Cycle

- RES 4: 116-07 1.764 proj of the Aug 8 - 21 - Sep 3

- RES 3: 116-00 Round number resistance

- RES 2: 115-31 1.618 proj of the Aug 8 - 21 - Sep 3

- RES 1: 115-02+/23+ High Sep 19 / 11 and the bull trigger

- PRICE: 114-19 @ 1235 ET Sep 25

- SUP 1: 114-09+ Low Sep 24

- SUP 2: 114-00+ Low Sep 4

- SUP 3: 113-23 50-day EMA

- SUP 4: 113-12 Low Sep 3 and a key support

Treasuries maintain a bullish theme and the latest pullback appears to be a correction - for now. The contract has traded through the 20-day EMA, at 114-23+. A clear break of it would signal scope for a deeper retracement, potentially towards 113-23, the 50-day EMA. For bulls, a resumption of gains would refocus attention on 115-24+, the Sep 11 high and a bull trigger. A break would resume the uptrend.

SOFR FUTURES CLOSE

- Dec 24 -0.020 at 96.055

- Mar 25 -0.030 at 96.625

- Jun 25 -0.045 at 96.930

- Sep 25 -0.050 at 97.055

- Red Pack (Dec 25-Sep 26) -0.05 to -0.045

- Green Pack (Dec 26-Sep 27) -0.05 to -0.045

- Blue Pack (Dec 27-Sep 28) -0.045 to -0.045

- Gold Pack (Dec 28-Sep 29) -0.045 to -0.045

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M +0.00081 to 4.85528 (-0.00194/wk)

- 3M -0.01566 to 4.64317 (-0.04808/wk)

- 6M -0.02318 to 4.28644 (-0.06495/wk)

- 12M -0.02846 to 3.76676 (-0.06473/wk)

- Secured Overnight Financing Rate (SOFR): 4.84% (+0.01), volume: $2.171T

- Broad General Collateral Rate (BGCR): 4.83% (+0.01), volume: $811B

- Tri-Party General Collateral Rate (TGCR): 4.83% (+0.01), volume: $768B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 4.83% (+0.00), volume: $94B

- Daily Overnight Bank Funding Rate: 4.83% (+0.00), volume: $269B

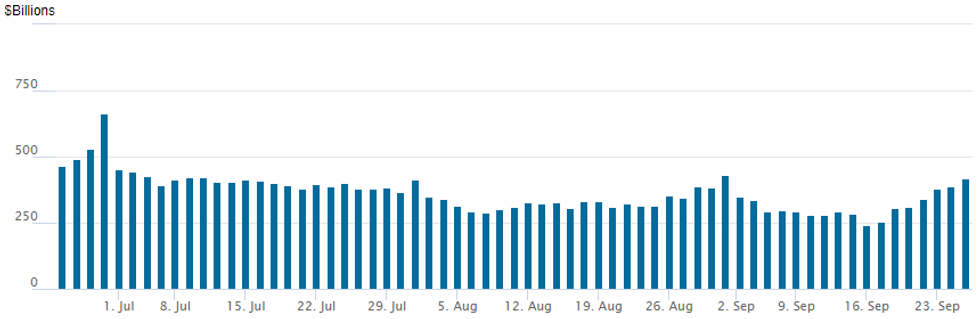

FED Reverse Repo Operation

NY Federal Reserve/MNI

RRP usage climbs back over $400B to $416.913B this afternoon from $388.977B prior. Compares to $239.386B on Monday September 16 2024 -- the lowest level since early May 2021. Number of counterparties at 72 from 65 prior.

US PIPELINE: $6.25B Oracle 4Pt Debt Launched

Consistent with the last couple year's issuance, Oracle's $6.25B 4pt leads today's high grade corporate supply:

- Date $MM Issuer (Priced *, Launch #)

- 9/25 $6.25B #Oracle $1.5B 5Y +70, $1.75B 10Y +95, $1.75B 30Y +125, $1.25B 40Y +138

- 9/25 $2B ADQ $1B 7Y +85, $1B 30Y +120

- 9/25 $1.25B *PSP Capital 5Y SOFR+57

- 9/25 $1B #Danske Bank 6NC5 +110

- 9/25 $1B #Cable & Wireless 8NC3 7.125%

- 9/25 $750M #Ares Strategic Income +5Y +235

- 9/25 $720M #JACTGL WNG 30Y +90

- 9/25 $600M #American National Group 5Y +225

- 9/25 $500M *KT Corp 3Y +80

- 9/25 $Benchmark Saudi Aramco Sukuk 5Y +90, 10Y +105

- 9/25 $Benchmark Turkiye +10Y +7.125a

BONDS: EGBs-GILTS CASH CLOSE: Bellies Underperform

Yields pushed higher across the European space Wednesday, reversing most of the prior session's declines as curve bellies underperformed.

- In a session that was fairly light in both meaningful headlines and data, intraday movements were largely flow and supply related.

- Gilts underperformed, with weakness focused in the belly of the UK curve following soft demand at the 7-year auction.

- There was little reaction in STIR futures to commentary by BoE's Greene that suggested she could back a cut in November.

- A large apparent block sale trade in US rates kept pressure on global FI in the European afternoon.

- OAT spreads widened on further fiscal concerns (Finance Minister Armand noting that the deficit could top 6% of GDP this year) - 10Y out 2.4bp vs Bunds. OATS underperformed periphery EGBs, whose spreads likewise finished wider.

- The German curve also saw belly underperformance, in sympathy with Gilts.

- Thursday's calendar includes Italian and German confidence surveys, Spanish retail sales, the ECB's Economic Bulletin, and the SNB decision (Preview here).

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 2.5bps at 2.122%, 5-Yr is up 3bps at 1.998%, 10-Yr is up 2.7bps at 2.175%, and 30-Yr is up 1.3bps at 2.492%.

- UK: The 2-Yr yield is up 4.4bps at 3.962%, 5-Yr is up 6.3bps at 3.835%, 10-Yr is up 4.9bps at 3.99%, and 30-Yr is up 5.1bps at 4.566%.

- Italian BTP spread up 1.7bps at 134.9bps / Spanish up 1.5bps at 80.2bps

FOREX: USD Index Trades on Firmer Footing, NZD Underperforms

- Following the first daily close below 100.50 since July 2023, the USD index firmly reversed on Wednesday, benefitting from the persistent step higher for US yields and the steepening of the curve.

- The Japanese yen stands out as a relative underperformer, as USDJPY extends session highs around 144.75, and up 1.05% on the session. AUD and NZD are also among the worst performing G10 currencies, both giving up the majority of Tuesday’s substantial moves higher.

- EURUSD also stands out on a chart. Having pierced the 1.1200 handle and very briefly eclipsing the late August highs, the pair now resides down 0.52% around 1.1122 as we approach the APAC crossover. Bolstering this theme of the single currency turnaround, EURJPY matched key resistance at the 50-day EMA (161.67 high), before sharply reversing course back below 161.00.

- The higher yields helped cement the CHF weakness on Wednesday as markets await the SNB’s decision tomorrow. Most analysts believe the SNB will cut rates by 25bps tomorrow, however, there are a small minority expecting a bolder cut, citing the focus will be on any indication of SNB discomfort with franc strength.

- Latest price action signals scope for a stronger GBPCHF recovery and exponential moving averages have now converged into bull mode. This could target a move towards resistance around 1.15, a psychological/inflection point over the past two years.

- BOJ minutes will precede the SNB decision. Focus then shifts to the final reading of Q2 US GDP and durable goods data for August. Fed Chair Powell is also due to deliver pre-recorded opening remarks at the US Treasury Market Conference.

THURSDAY DATA CALENDAR

| Date | GMT/Local | Impact | Country | Event |

| 26/09/2024 | 0600/0800 | * |  | GFK Consumer Climate |

| 26/09/2024 | 0700/0900 | ** |  | Economic Tendency Indicator |

| 26/09/2024 | 0730/0930 | *** |  | SNB Interest Rate Decision |

| 26/09/2024 | 0800/1000 | ** |  | M3 |

| 26/09/2024 | 0800/1000 | ** |  | ISTAT Business Confidence |

| 26/09/2024 | 0800/1000 | ** |  | ISTAT Consumer Confidence |

| 26/09/2024 | 0900/1100 |  | ECB's Elderson remarks at governance & risk meeting | |

| 26/09/2024 | 1230/0830 | *** |  | Jobless Claims |

| 26/09/2024 | 1230/0830 | ** |  | WASDE Weekly Import/Export |

| 26/09/2024 | 1230/0830 | *** |  | GDP |

| 26/09/2024 | 1230/0830 | * |  | Payroll employment |

| 26/09/2024 | 1230/0830 | ** |  | Durable Goods New Orders |

| 26/09/2024 | 1310/0910 |  | Fed's Susan Collins, Adriana Kugler | |

| 26/09/2024 | 1325/0925 |  | New York Fed's John Williams | |

| 26/09/2024 | 1330/1530 |  | ECB Lagarde address at ESRB Conference | |

| 26/09/2024 | 1400/1000 | ** |  | NAR Pending Home Sales |

| 26/09/2024 | 1415/1615 |  | ECB's De Guindos in macroprudential policy panel | |

| 26/09/2024 | 1430/1030 | ** |  | Natural Gas Stocks |

| 26/09/2024 | 1500/1100 | ** |  | Kansas City Fed Manufacturing Index |

| 26/09/2024 | 1600/1800 |  | ECB's Schnabel at Wirtschaftsrat der CDU e.V | |

| 26/09/2024 | 1700/1300 |  | Fed's Neel Kashkari, Michael Barr | |

| 26/09/2024 | 1700/1300 | ** |  | US Treasury Auction Result for 7 Year Note |

| 26/09/2024 | 1900/1500 | *** |  | Mexico Interest Rate |

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.