-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Fed Chair Powell: Give High Rates a Chance

- MNI FED: Fed Chairman Powell Urges Patience, Says Inflation To Move Down

- MNI FED BRIEF: Powell Says Fed Has Tools To Defend Independence

- MNI EU BRIEF: Limited Leeway For States To Escape EDP-Dombrovskis

- MNI US DATA: Core PPI Metrics Surprise Higher, Flat To Notably Negative Revisions

US

US FED (MNI): Fed Chairman Powell Urges Patience, Says Inflation To Move Down: Federal Reserve Chair Jerome Powell on Tuesday called for patience in allowing higher interest rates to do their work to slow the economy and bring inflation back to 2% but said his confidence in the path of disinflation has fallen.

- The first quarter of inflation data "was notable for its lack of further progress on inflation," Powell said. "We did not expect this to be a smooth road, but these were higher than I think anybody expected."

- “What that has told us is we’ll need to be patient and let restrictive policy do its work," he said at a bankers' conference in Amsterdam.

- "I talk to elected representatives in both political parties in the House and the Senate and I think there's very strong support on both sides of the aisle on both sides of Capitol Hill for an independent Fed," he said in Q&A at an event in Amsterdam.

- "The Fed is doing the absolute best we can with the tools that we have in the understanding of the economy that we have. I think that that is very broadly understood and supported on Capitol Hill. I'm less worried about that than the sort of things that have been in the press lately might suggest."

NEWS

US (MNI): Maryland Could Prove Spoiler To Democrat Chances Of Retaining Senate: Maryland voters will today cast their ballots in the Senate Democratic primary to decide whether Rep David Trone (D-MD) or Angela Alsobrooks (D) will take the nomination to face presumptive GOP nominee former Maryland governor Larry Hogan at the general election in November.

US-CHINA (MNI): Commerce Ministry Blasts US For New Tariffs: The Chinese Ministry of Commerce (MOFCOM) has responded to the announcement from the White House regarding the imposition ofnew or expanded tariffs on Chinese-made imports (see 'US-CHINA: White House Unveils Sizeable Tariff Hikes On Certain Chinese Goods', 1024BST). MOFCOM spox: 'China is stringly dissatisfied with US tariff hike...China will take resolute measures to defend its rights and interests.'

US-RUSSIA (MNI): Blinken Signals Intention To Seize Frozen Russia Sovereign Assets: US Secretary of State Antony Blinken, speaking at Kyiv Polytechnic Institute, says that allies of Ukraine should "make Russia pay for Ukraine's recovery and reconstruction," adding: "What Putin destroyed, Russia should and must pay to rebuild. It's what international law demands. It's what the Ukrainian people deserve."

EU BRIEF (MNI): Limited Leeway For States To Escape EDP-Dombrovskis: EU countries with a budget deficit above 3% of GDP will have only very limited leeway to escape facing an Excessive Deficit Procedure, EU Commission Executive Vice President Valdis Dombrovskis warned Tuesday, noting that other relevant factors could be taken into account but only where the excess of any deficit is “close to 3% and temporary”.

US (Bbg): Biden Adds Tariffs on Chinese Chips, Critical Minerals, EVs: President Joe Biden is hiking tariffs on a

wide range of Chinese imports — including semiconductors, batteries, solar cells, and critical minerals — in an election-year bid to bolster domestic manufacturing in critical industries.

JAPAN (Bbg): Japanese Bond Yields Climb to Decade Highs on BOJ Policy Bets: Japanese sovereign bond yields are surging to the highest levels in more than a decade amid signs the central bank is ready to reduce debt purchases to ease pressure on the ailing yen.

US TSYS Focus on CPI After Market Shrugs Off PPI Gain

- Treasury futures are back near session highs after the bell, well off session lows when rates reacted poorly to PPI final demand MoM coming out higher than expected (0.5% vs 0.3% est), YoY steady vs. 2.2% est.; PPI Ex Food and Energy MoM (0.4% vs 0.2% est), YoY steady vs. 2.2% est).

- After Jun'24 10Y futures tapped a session low of 108-15 briefly before rebounding to early session high of 109-02 as markets digested softer airfare and insurance components and down revisions to prior data.

- Midmorning focus turned to Fed Chairman Powell as he called for patience in allowing higher interest rates to do their work to slow the economy and bring inflation back to 2% but said his confidence in the path of disinflation has fallen.

- Focus now turns to Wednesday's CPI, Retail Sales, TIC Flows and more Fed Speak. Consensus puts core CPI inflation at 0.3% M/M in April after a surprisingly strong Q1 averaging 0.37% M/M.

- An upside surprise will dial up concerns that the Q1 acceleration wasn’t just a bump and could see 2Y Treasury yields eye 5% again, with the start point to Fed cuts pushed further out amidst a still high bar to a rate hike.

- A downside surprise would still see sensitivity but the onus is on multiple low inflation readings before cut expectations are meaningfully brought nearer.

OVERNIGHT DATA

US DATA (MNI): Core PPI Metrics Surprise Higher, Flat To Notably Negative Revisions: The main PPI metrics surprise higher, with no sign of the further moderation in supply chain pressures per the NY Fed’s GSCPI. Downward revisions to PPI ex food & energy take some of the sting off, but PPI ex food, energy & trade services still beats with very mild upward revisions.

- PPI final demand: 0.52% M/M (cons 0.3) after a downward revised -0.10% (initial +0.15).

- Ex food & energy: 0.50% M/M (cons 0.2) but after a net downward revision worth -0.255pps, concentrated in Mar (-0.05% vs an initial +0.23).

- Ex food, energy & trade: 0.42 (cons 0.2) after fractionally upward net revisions worth 0.016pps, following 0.22% (initial 0.21) in March.

MNI US DATA: US REDBOOK: MAY STORE SALES +6.3% V YR AGO MO

MARKETS SNAPSHOT

- Key market levels of markets in late NY trade:

- DJIA up 175.94 points (0.45%) at 39606.34

- S&P E-Mini Future up 27.75 points (0.53%) at 5272.75

- Nasdaq up 133.9 points (0.8%) at 16520.58

- US 10-Yr yield is down 3.7 bps at 4.4492%

- US Jun 10-Yr futures are up 7/32 at 109-1.5

- EURUSD up 0.0031 (0.29%) at 1.0821

- USDJPY up 0.21 (0.13%) at 156.44

- WTI Crude Oil (front-month) down $1.06 (-1.34%) at $78.06

- Gold is up $19.43 (0.83%) at $2355.71

- European bourses closing levels:

- EuroStoxx 50 up 1.33 points (0.03%) at 5080.29

- FTSE 100 up 13.14 points (0.16%) at 8428.13

- German DAX down 25.8 points (-0.14%) at 18716.42

- French CAC 40 up 16.52 points (0.2%) at 8225.8

US TREASURY FUTURES CLOSE

- 3M10Y -2.383, -95.043 (L: -96.088 / H: -87.372)

- 2Y10Y +0.503, -37.39 (L: -37.978 / H: -35.522)

- 2Y30Y +0.951, -22.706 (L: -24.471 / H: -20.981)

- 5Y30Y +1.145, 13.287 (L: 10.212 / H: 14.476)

- Current futures levels:

- Jun 2-Yr futures up 2/32 at 101-23 (L: 101-18.375 / H: 101-23.25)

- Jun 5-Yr futures up 4.5/32 at 105-25.75 (L: 105-14 / H: 105-27)

- Jun 10-Yr futures up 6.5/32 at 109-1 (L: 108-15 / H: 109-03)

- Jun 30-Yr futures up 12/32 at 116-24 (L: 115-21 / H: 116-28)

- Jun Ultra futures up 17/32 at 123-15 (L: 121-30 / H: 123-19)

US 10Y FUTURE TECHS (M4) Channel Resistance Remains Exposed

- RES 4: 110-06 High Apr 4

- RES 3: 109-22+ 38.2% retracement of the Feb 1 - Apr 25 bear leg

- RES 2: 109-09+ High May 3

- RES 1: 109-06+/08+ Channel top from Feb 1 high / 50-day EMA

- PRICE: 108-30 @ 16:11 BST May 14

- SUP 1: 108-20+ 20-day EMA

- SUP 2: 107-04 Low Apr 25

- SUP 3: 106-27 2.764 proj of Dec 27 - Jan 19 - Feb 1 price swing

- SUP 4: 106-09 Base of a bear channel drawn from the Feb 1 low

Treasuries underwent whipsaw price action Tuesday on the back of a mixed PPI release. Despite a brief sell-off, piercing the 20-day EMA, prices returned higher ahead of the close to keep Treasuries in consolidation mode. This keeps the technical parameters unchanged for now, with resistance above at 109-06, the 50-day EMA. Price is also just below the channel top drawn from the Feb 1 high. Clearance of these two resistance points would strengthen a bullish condition.

SOFR FUTURES CLOSE

- Jun 24 +0.003 at 94.698

- Sep 24 +0.010 at 94.885

- Dec 24 +0.020 at 95.115

- Mar 25 +0.030 at 95.360

- Red Pack (Jun 25-Mar 26) +0.045 to +0.055

- Green Pack (Jun 26-Mar 27) +0.045 to +0.050

- Blue Pack (Jun 27-Mar 28) +0.035 to +0.040

- Gold Pack (Jun 28-Mar 29) +0.030 to +0.030

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M +0.00287 to 5.31964 (-0.00023/wk)

- 3M +0.00432 to 5.32238 (+0.00472/wk)

- 6M +0.00501 to 5.29355 (+0.00924/wk)

- 12M +0.00624 to 5.15822 (+0.01929/wk)

- Secured Overnight Financing Rate (SOFR): 5.31% (+0.00), volume: $1.805T

- Broad General Collateral Rate (BGCR): 5.30% (+0.00), volume: $719B

- Tri-Party General Collateral Rate (TGCR): 5.30% (+0.00), volume: $702B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $76B

- Daily Overnight Bank Funding Rate: 5.32% (+0.00), volume: $269B

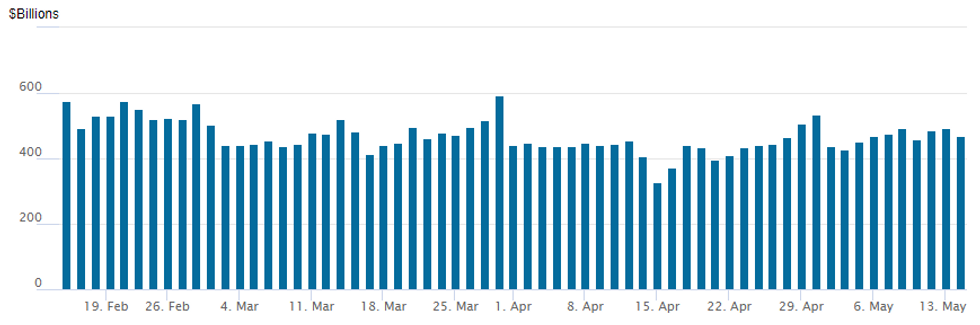

FED Reverse Repo Operation

NY Federal Reserve/MNI

- RRP usage declines to $468.344B from $492.068B prior; number of counterparties 76. Compares to $327.066B on Monday, April 15 -- the lowest level since mid-May 2021.

PIPELINE $2.75B NatWest 4Pt Launched

NatWest 4pt caps off Tuesday's $18B total US$ corporate issuance:

- Date $MM Issuer (Priced *, Launch #)

- 5/14 $4B *CADES (Caisse d'Amortissement de la Dette Social) 5Y SOFR+40

- 5/14 $3.5B *ADB (Asia Development Bank) 2Y SOFR+18

- 5/14 $2.75B #NatWest $850M 3Y +80, $500M 3Y SOFR+90, $1B 5Y +95, $400M 5Y SOFR+114

- 5/14 $2.25B #Ford Motor $1.5B 3Y +127, $750M 2034 tap +195

- 5/14 $1.5B *OKB (Oesterreichische Kontrollbank) 3Y SOFR+25

- 5/14 $1.5B #CRH $750M 5Y +75, $750M 10Y +100

- 5/14 $1B *JICA (Japan Int Coop Agcy) 5Y SOFR+53

- 5/14 $1B #McDonald's 5Y +63, 10Y +80

- 5/14 $500M *QNB Finansbank 5Y WNG 7.375%

EGBs-GILTS CASH CLOSE: Gilts Gain As Wage Data Keeps June BoE Cut In Play

Core European FI finished mixed Tuesday, after some intraday gyrations spurred by US producer price data.

- The early highlight was the UK labour market report which brought a slightly soft private sector regular wages print of 5.9% Y/Y (3 mos to March) that marginally increases the likelihood of a June BoE cut -. MNI's review of the data is here (PDF).

- That, plus BoE's Pill noting potential for a conversation on rate cuts this summer, helped Gilts outperform on the day.

- The UK curve bull steepened, versus light bear steepening in the German curve.

- The US PPI report sparked a sharp initial sell-off in global core FI as a much stronger than expected headline/core reading hit the wires, but softer details and downward revisions led to a full reversal.

- Periphery EGB spreads initially went wider on the PPI release, but recovered to close tighter to Bunds.

- Wednesday's docket is highlighted by US inflation data, though we also get appearances by ECB's Rehn, Villeroy, Makhlouf and Muller, and preliminary Eurozone Q1 GDP.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 3.2bps at 2.987%, 5-Yr is up 3.8bps at 2.578%, 10-Yr is up 3.8bps at 2.548%, and 30-Yr is up 3.7bps at 2.68%.

- UK: The 2-Yr yield is down 1.1bps at 4.322%, 5-Yr is down 0.6bps at 4.049%, 10-Yr is down 0.1bps at 4.173%, and 30-Yr is down 0.6bps at 4.652%.

- Italian BTP spread down 0.9bps at 134.2bps / Spanish bond spread down 0.9bps at 78.5bps

FOREX PPI Whipsaw Sees USD, JPY Sold

- A mixed US PPI release underpinned a short spell of volatility in USD pairs, as the higher-than-expected ex-food and energy prints (0.5% vs. Exp. 0.2% M/M, 2.4% vs. Exp. 2.3% Y/Y) triggered USD strength to send EUR/USD, GBP/USD and AUD/USD to new daily lows. This price action swiftly reversed, however, as details in the PPI report showed negative revisions to the March data and few ramifications for PCE.

- The subsequent USD weakness aided GBP/USD back to the 50-dma resistance at 1.2594, a break above which opens 1.2634 and levels last seen in mid-May.

- The extended post-PPI reaction worked against JPY, which traded softer against all others in G10. This pressured a trade-weighted JPY index, and a further 0.25% depreciation puts JPY at new May lows, with another ~1.8% sell-off needed to hit pre-intervention cycle lows.

- This highlights the strength of the EUR/JPY bounce over the past two weeks - with EUR/JPY ~1.4% shy of highs vs. USD/JPY's ~2.3%. A close at current or higher levels would mark seven consecutive sessions of gains in EUR/JPY, the longest winning streak since April of last year - which extended to 10 consecutive trading days.

- Focus Wednesday shifts to the US CPI print, and in particular any signals for an out-of-consensus view on PCE. Fed market pricing still only fully discounts a first rate cut by the November FOMC decision, on which Powell commented today that policy is likely to be kept tighter for longer. Outside of the US inflation print, appearances from ECB's Rehn, Muller, Villeroy & Makhlouf and Fed's Kashkari & Bowman are due.

WEDNESDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 14/05/2024 | 0015/2015 |  | US | Kansas City Fed's Jeff Schmid | |

| 15/05/2024 | 0130/1130 | *** |  | AU | Quarterly wage price index |

| 15/05/2024 | 0600/0800 | *** |  | SE | Inflation Report |

| 15/05/2024 | 0645/0845 | *** |  | FR | HICP (f) |

| 15/05/2024 | 0900/1100 | ** |  | EU | Industrial Production |

| 15/05/2024 | 0900/1100 | *** |  | EU | GDP (p) |

| 15/05/2024 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 15/05/2024 | 1215/0815 | ** |  | CA | CMHC Housing Starts |

| 15/05/2024 | 1230/0830 | *** |  | US | CPI |

| 15/05/2024 | 1230/0830 | ** |  | CA | Monthly Survey of Manufacturing |

| 15/05/2024 | 1230/0830 | *** |  | US | Retail Sales |

| 15/05/2024 | 1230/0830 | ** |  | US | Empire State Manufacturing Survey |

| 15/05/2024 | 1300/0900 | * |  | CA | CREA Existing Home Sales |

| 15/05/2024 | 1400/1000 | * |  | US | Business Inventories |

| 15/05/2024 | 1400/1000 | ** |  | US | NAHB Home Builder Index |

| 15/05/2024 | 1400/1000 |  | US | Fed Vice Chair Michael Barr | |

| 15/05/2024 | 1405/1505 |  | UK | Bernanke Review of Bank of England Forecasting | |

| 15/05/2024 | 1430/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 15/05/2024 | 1600/1200 |  | US | Minneapolis Fed's Neel Kashkari | |

| 15/05/2024 | 1920/1520 |  | US | Fed Governor Michelle Bowman | |

| 15/05/2024 | 2000/1600 | ** |  | US | TICS |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.