-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Fed Mulls Wage Surge Ahead Final FOMC of 2022

EXECUTIVE SUMMARY

- MNI: Fed's Barkin Fears Persistently Short Labor Supply

- MNI BRIEF: US Nov Jobs Beat Expectations; Wage Growth Surges

- MNI: Canada Nov Unemployment Nears Record Low, Wages Stay Hot

- FRANCE OUTLOOK TO NEGATIVE FROM STABLE BY S&P, RATING AFFIRMED, Bbg

US

FED: The Covid-19 pandemic may have left the U.S. with a persistent labor shortage that will put a lid on growth while keeping inflation higher, Federal Reserve Bank of Richmond President Thomas Barkin said Friday.

- Labor force participation has fallen more than 1 percentage point compared to early 2020 and there are many reasons to think it might not recover, Barkin said. Unemployment has regained its pre-pandemic lows, but even after businesses and schools reopened and vaccines became widely available, participation remained stubbornly below its pre-Covid levels. The labor force participation rate in November dropped another tenth to 62.1%.

- That has significant long-term implications for U.S. policymakers, Barkin argues. The labor shortage has helped feed inflation. The PCE price index, the Fed's preferred measure of consumer inflation, is 6.0%, near 40-year highs. "Fewer workers would constrain our growth and pressure inflation until businesses and governments can deliver productivity enhancements and/or structure incentives to bring more workers into the workforce."

- Average hourly earnings grew 5.1% through the year. Fed Chair Jerome Powell and Federal Reserve officials are looking for wage gains to slow as they raise interest rates.

- The leisure and hospitality (+88,000), health care (+45,000) and government (+42,000) sectors led job gains. Retail trade declined by 30,000 in November. Monthly job growth has averaged 392,000 thus far in 2022, compared with 562,000 per month in 2021. The labor force participation rate at 62.1% and the employment to population ratio at 59.9% were both down a tenth from October.

CANADA

BOC: Canada's unemployment rate fell a notch taking it back towards a record low in November while wage gains continued at about the fastest pace since 1997, arguing against the central bank signaling a pause in hiking interest rates next week.

- The jobless rate declined to 5.1% from October's 5.2%, Statistics Canada said Friday, beating expectations it would instead climb a notch. Employment rose by 10,100, matching forecasts and the third consecutive increase.

- Wage gains were the focus of many economists with the Bank of Canada set to raise interest rates again on Wednesday to bring down inflation. For a second month wages climbed at a 5.6% pace that was the highest in decades outside of the early part of the pandemic when many lower-paid workers were laid off. November is also the sixth straight month of gains exceeding 5%.

US TSYS: Bonds Extend Late Highs, Jobs Data Heeded But Handicapped as Well

Bonds lead the rebound off post jobs data lows, rising steadily higher (read: narrow upward path) through the NY close. Gist: continued sale unwind/buy support operating under the premise this morning's higher than expected Nov jobs gain of +263k (+200k est) not high enough to seriously dampen expectations of a step-down to 50bp hike at Dec 14 FOMC.- Fed enters policy blackout at midnight tonight (Fed speakers Barkin and Evans offered no rebuttal on jobs). Focus will be on next week Fri Nov PPI (final demand YoY 7.2% est vs. 8.0% prior) and CPI on Dec 13, the day ahead the final FOMC annc of 2022.

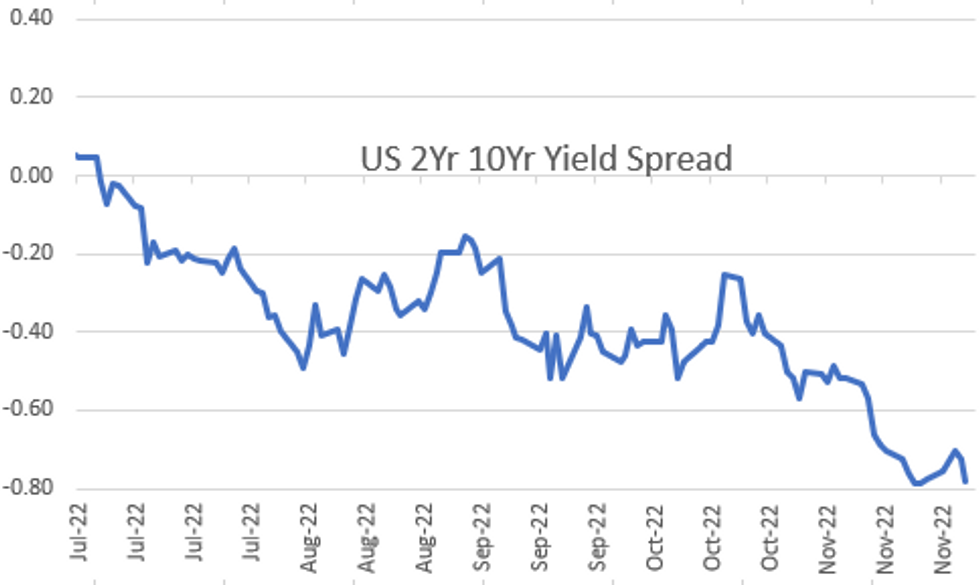

- Very short end bid EDZ2 +2.75 at 95.1625, Fed terminal at 4.92% in May'Jun'23, while 2023 still weaker as prospect for return of 75bp hike remains slightly elevated. In-line, yield curves flatter, but off early wk inverted lows, 2s10s currently -6.564 at -79.275 (-79.513 low).

- Fed funds implied hike for Dec'22 slips to 51.2bp, Feb'23 cumulative has climbed to 87.6bp (84.8bp earlier) to 4.711%, terminal bounces back to 4.915% in May/Jun'23 (4.835% pre-NFP).

OVERNIGHT DATA

- US NOV NONFARM PAYROLLS +263K; PRIVATE +221K, GOVT +42K

- US PRIOR MONTHS PAYROLLS REVISED: OCT +284K (+23k); SEP +269K (-46k)

- US NOV UNEMPLOYMENT RATE 3.7%

- AHE Unrounded - Nov'22:

- M/M (SA): 0.551% in Nov from 0.462% in Oct; Y/Y (SA): 5.091% in Nov from 4.918% in Oct

- AHE Non-Supervisory Unrounded:

- M/M (SA): 0.681% in Nov from 0.468% in Oct; Y/Y (SA): 5.838% in Nov from 5.64% in Oct

US: On the dip in average workweek (0.1 hour to 34.4 hours), looks led by manufacturing: "In manufacturing, the average workweek for all employees decreased by 0.2 hour to 40.2 hours, and overtime declined by 0.1 hour to 3.1 hours. The average workweek for production and nonsupervisory employees on private nonfarm payrolls decreased by 0.1 hour to 33.9 hours." Average hourly earnings came in much higher than expected MoM, at 0.6% vs 0.3. Gains were broad-based but stand out in the “information” industry, which was up 1.55% MoM

MARKETS SNAPSHOT

Key late session market levels:

- DJIA up 24.22 points (0.07%) at 34417.6

- S&P E-Mini Future down 6.5 points (-0.16%) at 4075.5

- Nasdaq down 23.8 points (-0.2%) at 11459.25

- US 10-Yr yield is down 2.8 bps at 3.4771%

- US Mar 10Y are up 7/32 at 114-26.5

- EURUSD up 0.0013 (0.12%) at 1.0532

- USDJPY down 1.01 (-0.75%) at 134.32

- WTI Crude Oil (front-month) down $1.1 (-1.35%) at $80.12

- Gold is down $5.47 (-0.3%) at $1797.61

- EuroStoxx 50 down 6.6 points (-0.17%) at 3977.9

- FTSE 100 down 2.26 points (-0.03%) at 7556.23

- German DAX up 39.09 points (0.27%) at 14529.39

- French CAC 40 down 11.72 points (-0.17%) at 6742.25

US TSY FUTURES CLOSE:

- 3M10Y +0.127, -84.223 (L: -84.301 / H: -69.979)

- 2Y10Y -5.9, -78.611 (L: -78.611 / H: -63.17)

- 2Y30Y -9.57, -73.125 (L: -73.677 / H: -55.947)

- 5Y30Y -4.272, -10.982 (L: -14.7 / H: -2.363)

- Current futures levels:

- Mar 2Y down 0.25/32 at 102-29.75 (L: 102-20.75 / H: 103-03.25)

- Mar 5Y up 4.5/32 at 109-12.75 (L: 108-18.25 / H: 109-14.75)

- Mar 10Y up 7.5/32 at 114-27 (L: 113-21.5 / H: 114-27)

- Mar 30Y up 21/32 at 130-5 (L: 128-07 / H: 130-06)

- Mar Ultra 30Y up 2-12/32 at 142-31 (L: 139-02 / H: 143-01)

US 10YR FUTURES TECHS: (H3) Finds Support At The Day Low

- RES 4: 115-26 2.00 proj of the Oct 21 - 27 - Nov 3 price swing

- RES 3: 115-03 1.764 proj of the Oct 21 - 27 - Nov 3 price swing

- RES 2: 115-00 High Sep 19

- RES 1: 114-26 High Dec 2

- PRICE: 114-22 @ 1545ET Dec 2

- SUP 1: 113-21+/112-26+ Low Dec 2 / 50-day EMA

- SUP 2: 112-11+ Low Nov 21 and a key short-term support

- SUP 3: 112-05+ Low Nov 14

- SUP 4: 110-22 Low Nov 10

Treasury futures sold off following today’s jobs data but found support at the day low. Short-term pullbacks are considered corrective with support at 112-26+, the 50-day EMA. This represents an important support. If breached, it would expose key trend support at 112-11+, the Nov 21 low where a break would confirm a stronger reversal. Today’s high of 114-26 is the trigger for a resumption of the recent bull leg.

US EURODOLLAR FUTURES CLOSE

- Dec 22 +0.038 at 95.173

- Mar 23 -0.005 at 94.915

- Jun 23 -0.015 at 94.905

- Sep 23 -0.020 at 95.075

- Red Pack (Dec 23-Sep 24) -0.005 to +0.055

- Green Pack (Dec 24-Sep 25) +0.065 to +0.095

- Blue Pack (Dec 25-Sep 26) +0.080 to +0.095

- Gold Pack (Dec 26-Sep 27) +0.065 to +0.075

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00857 to 3.81543% (+0.00343/wk)

- 1M +0.01257 to 4.18486% (+0.13015/wk)

- 3M -0.03243 to 4.73257% (-0.00129/wk)*/**

- 6M -0.02643 to 5.14914% (-0.06957/wk)

- 12M -0.06528 to 5.42943% (-0.16857/wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 4.77857% on 11/30/22

- Daily Effective Fed Funds Rate: 3.83% volume: $99B

- Daily Overnight Bank Funding Rate: 3.82% volume: $269B

- Secured Overnight Financing Rate (SOFR): 3.82%, $1.174T

- Broad General Collateral Rate (BGCR): 3.78%, $442B

- Tri-Party General Collateral Rate (TGCR): 3.78%, $417B

- (rate, volume levels reflect prior session)

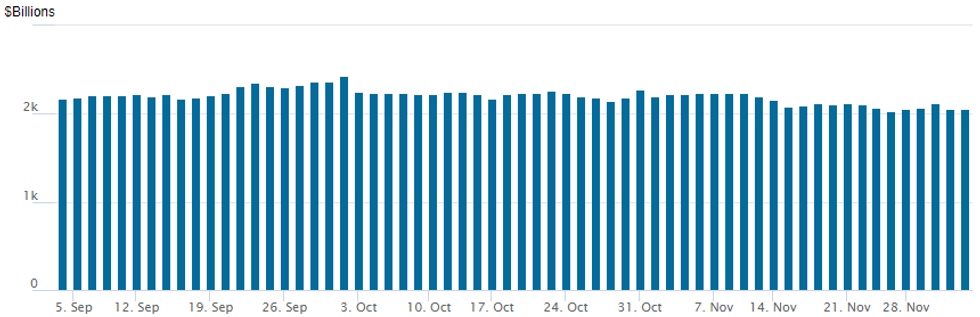

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage slips to $2,049.763B w/ 94 counterparties vs. $2,050.286B in the prior session. Prior record high stands at $2,425.910B on Friday, September 30.

EGBs-GILTS CASH CLOSE: US Jobs Data Reverses Rally

European yields reversed sharply higher Friday afternoon as the highly anticipated November US employment report came in stronger than expected.

- 10Y Bund yields finished 10bp off post-Sept intraday lows; Gilts 15bp.

- Overall Gilts modestly underperformed Bunds; both the UK and German curves bear flattened sharply.

- EGBs held in relatively well, with spreads finishing mostly wider (though Greek spreads tightened again).

- Only limited reaction to late news that the EU had agreed a $60/bbl price cap for Russian oil exports (EUR and GBP jumped, though.)

- In European data, Oct saw a stronger-than-expected contraction M/M, but this masked an uptick in core.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 7.6bps at 2.105%, 5-Yr is up 6.7bps at 1.865%, 10-Yr is up 3.9bps at 1.853%, and 30-Yr is down 3.2bps at 1.687%.

- UK: The 2-Yr yield is up 7.3bps at 3.352%, 5-Yr is up 7.2bps at 3.281%, 10-Yr is up 5.3bps at 3.153%, and 30-Yr is up 9bps at 3.495%.

- Italian BTP spread up 2.5bps at 191.1bps / Greek down 2bps at 204.6bps

FOREX: USD Index Set To Post Weak Close Despite Post-NFP Surge

- Stronger headline US employment data gave the greenback a solid initial reprieve with the USD index surging over 1% in the immediate aftermath of the report. However, a slow erosion of these gains throughout Friday’s session saw the index slip back into negative territory, which could see the greenback slip for a third consecutive session and post its lowest close since late June.

- USDJPY volatility continued in heightened fashion, both before and after the release of the US data. A continuation of JPY strength saw USDJPY trade down to 133.63 in early trade on Friday, narrowing the gap with the next touted support at 132.56, the Aug 15 low.

- Short-term positioning dynamics saw a very strong reaction to the data, with the pair rallying from around 134.20 to highs of 135.98. The pair was unable to reverse the entirety of the gains, however, will be closing around 3.5% lower on the week overall.

- One currency pair that was able to pare the entire post-payroll move was GBPUSD. Cable grinded sharply back to briefly test the 1.23 handle again with the technical trend remaining firmly bullish after clearing the 200-day moving average. The immediate focus for next week is on 1.2339, a Fibonacci projection.

- Elsewhere, AUDNZD (-0.65%) continues its impressive break, after extending below 1.0750 on Thursday and trading within close proximity of the March 2022 lows at 1.0615.

- US ISM Services PMI data on Monday precedes the RBA decision on Tuesday, the first of several final DM and EM central bank meetings of 2022.

Monday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 03/12/2022 | 0230/0330 |  | EU | ECB Lagarde at Bank of Thailand Roundtable | |

| 05/12/2022 | 2200/0900 | * |  | AU | IHS Markit Final Australia Services PMI |

| 05/12/2022 | 0030/0930 | ** |  | JP | IHS Markit Final Japan Services PMI |

| 05/12/2022 | 0145/0945 | ** |  | CN | IHS Markit Final China Services PMI |

| 05/12/2022 | 0145/0245 |  | EU | ECB Lagarde at Central Bank Governors IMF Seminar | |

| 05/12/2022 | 0700/0200 | * |  | TR | Turkey CPI |

| 05/12/2022 | 0815/0915 | ** |  | ES | IHS Markit Services PMI (f) |

| 05/12/2022 | 0845/0945 | ** |  | IT | IHS Markit Services PMI (f) |

| 05/12/2022 | 0850/0950 | ** |  | FR | IHS Markit Services PMI (f) |

| 05/12/2022 | 0855/0955 | ** |  | DE | IHS Markit Services PMI (f) |

| 05/12/2022 | 0900/1000 | ** |  | EU | IHS Markit Services PMI (f) |

| 05/12/2022 | 0930/1030 | * |  | EU | Sentix Economic Index |

| 05/12/2022 | 0930/0930 | ** |  | UK | IHS Markit/CIPS Services PMI (Final) |

| 05/12/2022 | 1000/1100 | ** |  | EU | retail sales |

| 05/12/2022 | - |  | EU | ECB Panetta at Eurogroup Meeting | |

| 05/12/2022 | 1330/0830 | * |  | CA | Building Permits |

| 05/12/2022 | 1445/0945 | *** |  | US | IHS Markit Services Index (final) |

| 05/12/2022 | 1500/1000 | *** |  | US | ISM Non-Manufacturing Index |

| 05/12/2022 | 1500/1000 | ** |  | US | factory new orders |

| 05/12/2022 | 1630/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 05/12/2022 | 1630/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.