-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US CPI Preview: Setting The Tone For 2025

MNI ASIA MARKETS OPEN: NY Fed Inflation Expectations Gaining

MNI ASIA MARKETS ANALYSIS: Tsy Ylds Drift Higher Ahead CPI/PPI

MNI ASIA OPEN: Focus on Oct NFP, Fed Exits Blackout

- MNI US Payrolls Preview: Further Strike Disruption To Weigh On Payrolls

- MNI Jobless Claims Data Offer Signs Of Reduced Labor Churn

- MNI Surprisingly Dovish ULC/Productivity Report For Q3

US

US DATA: Bloomberg consensus sees nonfarm payrolls growth of 180k in October after almost doubling estimates with 336k in September along with strong two-month revisions.

- This slowing includes a well-known hit from strikes, with most of the extra 30k striking workers this month linked to the UAW, but there is still uncertainty over spillover from temporary layoffs in affected industries.

- Strike impact shouldn’t affect the unemployment rate, seen unchanged at 3.8% for what would be the third month at a rate the FOMC forecasts for 4Q23.

- AHE are to be watched, with an analyst skew towards a dovish surprise vs consensus of 0.3% M/M.

- A dovish leaning Powell has further reduced additional hike pricing whilst 2024 cuts have built to 90bps. Payrolls and ISM services released 90 minutes later are likely to set the macro tone until CPI on Nov 14.

Tsys Off Highs Ahead October Employment Data

- Risk sentiment continued to improve following yesterday's dovish hold announcement from the Fed and this morning's data: Treasury futures extended gains after lower than expected Unit Labor Costs (-0.8% vs. 0.3% est, 2.2% prior), Nonfarm Productivity (4.7% vs. 4.3% est, 3.5% prior), while Initial Jobless Claims gained (217k vs. 210k est, 210k prior), Continuing Claims (1.818M vs. 1.800M est, 1.790M prior) while

- Treasury futures are paring back from this morning's highs after Factory Orders (2.8% vs. 2.3% est, 1.0% prior rev), Ex Trans (0.8% vs. 0.8% est, 1.5% prior rev), Durable Goods near in-line (4.6% vs 4.7% est), Ex Trans (0.4% vs. 0.5% est). Cap Goods Orders/ship slightly lower than expected at 0.4% and 0.5% respectively.

- How far yields have come: 10Y yield slipped to a session low of 4.6237% after ULC and weekly claims, are drifting near 4.6700% after the close, this compares to last week Monday's 16Y high of 5.0187%.

- Dec'23 10Y futures are currently trading 107-13 (+17.5) vs. 107-28 high (breach of initial technical resistance of 107-22+ (High Oct 16), next level at 108-02 (50-day EMA). Curves broadly flatter - but off lows: 3M10Y -3.250 at -76.775 (-83.440 low), 2Y10Y -10.823 at -31.987 (-34.071 low). Bull flattening over the last 24 hours partially due to the Tsys lower than expected Q4 refunding needs.

- Focus now turns to Friday's headline Oct Employ Report and ISMs while the Fed exits policy Blackout.

OVERNIGHT DATA

US DATA: Productivity growth accelerated to 4.7% annualized (cons 4.3) in Q3 from a slightly upward revised 3.6% (initial 3.5) in Q2.

- After a dire period through 2H22 and early 2023, the level of productivity has drawn back almost level with that seen after its pop higher in the pandemic.

- The second quarter of strong productivity growth helped unit labor costs surprisingly fall -0.8% annualized (cons +0.3%) in Q3, the first decline since 4Q22 and before that 1Q21.

US DATA: Initial claims were a little stronger than expected in the week to Oct 28 as they increased to a seasonally adjusted 217k (cons 210k) after an upward revised 212k (initial 210k).

- The four-week average ticked up another 2k to 210k but remains close to one of its lowest levels of the year and is still firmly below the 2019 average of 218k.

- Continuing claims were likely in greater focus this week after last week’s surprising surge, and here they again surprised to the upside at a seasonally adjusted 1818k (cons 1800k) in the week to Oct 21 after a slightly downward revised 1783k (initial 1790k).

- The extended increase in continuing claims (further above the 2019 average of 1699k) can be seen as a sign of reduced churn in the labor market as conditions cool, even if the latest inflow of those with unemployment insurance remains historically low.

- However, as with last week, we think some of this surge in seasonally adjusted continuing claims is a factor of a previously overly favorable seasonal adjustment process.

MARKETS SNAPSHOT

- Key market levels of markets in late NY trade:

- DJIA up 515.39 points (1.55%) at 33790.35

- S&P E-Mini Future up 75.5 points (1.77%) at 4331.25

- Nasdaq up 227.9 points (1.7%) at 13289.36

- US 10-Yr yield is down 6.5 bps at 4.6694%

- US Dec 10-Yr futures are up 19.5/32 at 107-15

- EURUSD up 0.0056 (0.53%) at 1.0625

- USDJPY down 0.55 (-0.36%) at 150.41

- WTI Crude Oil (front-month) up $2.07 (2.57%) at $82.53

- Gold is up $3.37 (0.17%) at $1985.81

- European bourses closing levels:

- EuroStoxx 50 up 77.91 points (1.9%) at 4169.62

- FTSE 100 up 104.1 points (1.42%) at 7446.53

- German DAX up 220.33 points (1.48%) at 15143.6

- French CAC 40 up 128.06 points (1.85%) at 7060.69

US TREASURY FUTURES CLOSE

- 3M10Y -3.719, -77.244 (L: -83.44 / H: -72.426)

- 2Y10Y -9.989, -31.153 (L: -34.071 / H: -21.381)

- 2Y30Y -14.034, -16.085 (L: -18.708 / H: -1.285)

- 5Y30Y -9.326, 18.049 (L: 17.805 / H: 28.558)

- Current futures levels:

- Dec 2-Yr futures down 0.625/32 at 101-12.375 (L: 101-10.875 / H: 101-16.25)

- Dec 5-Yr futures up 7/32 at 105-5.5 (L: 105-02 / H: 105-15.5)

- Dec 10-Yr futures up 20/32 at 107-15.5 (L: 107-02.5 / H: 107-28)

- Dec 30-Yr futures up 2-03/32 at 112-17 (L: 110-31 / H: 112-31)

- Dec Ultra futures up 2-26/32 at 116-7 (L: 114-02 / H: 116-27)

US 10Y FUTURE TECHS: (Z3) Corrective Cycle Persists

- RES 4: 109-20 High Sep 19

- RES 3: 108-16 High Oct 12 and key resistance

- RES 2: 108-02 50-day EMA

- RES 1: 107-28 High Nov 2

- PRICE: 107-13+ @ 1445 ET Nov 2

- SUP 1: 105-10+ Low Oct 19 and the bear trigger

- SUP 2: 104-26 2.00 proj of the Jul 18 - Aug 4 - Aug 10 price swing

- SUP 3: 104-02+ 2.0% 10-dma envelope

- SUP 4: 103-20+ Low Jun’07

Treasuries traded higher again early Thursday before rolling off highs through the London close. The contract maintains a firmer tone - for now. Price has breached the 20-day EMA and this has strengthened the S/T bull cycle - a correction. The next important resistance is at 108-02, the 50-day EMA ahead of 108-16, the Oct 12 high. The trend direction remains down and the bear trigger lies at 105-10+, the Oct 19 low. A break would confirm a resumption of the trend and open 104-26, a Fibonacci projection.

SOFR FUTURES CLOSE

- Current White pack (Dec 23-Sep 24):

- Dec 23 +0.005 at 94.585

- Mar 24 +0.005 at 94.685

- Jun 24 +0.015 at 94.935

- Sep 24 +0.010 at 95.220

- Red Pack (Dec 24-Sep 25) -0.015 to +0.005

- Green Pack (Dec 25-Sep 26) +0.025 to +0.080

- Blue Pack (Dec 26-Sep 27) +0.095 to +0.115

- Gold Pack (Dec 27-Sep 28) +0.115 to +0.130

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M +0.00700 to 5.32971 (+0.00559/wk)

- 3M +0.00080 to 5.39270 (+0.00949/wk)

- 6M -0.00876 to 5.44491 (+0.00158/wk)

- 12M -0.03028 to 5.36341 (-0.00954/wk)

- Daily Effective Fed Funds Rate: 5.33% volume: $92B

- Daily Overnight Bank Funding Rate: 5.32% volume: $227B

- Secured Overnight Financing Rate (SOFR): 5.32%, $1.621T

- Broad General Collateral Rate (BGCR): 5.30%, $576B

- Tri-Party General Collateral Rate (TGCR): 5.30%, $565B

- (rate, volume levels reflect prior session)

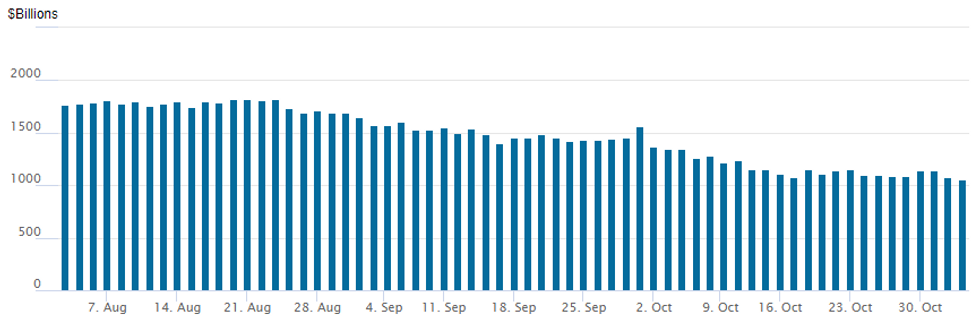

FED REVERSE REPO OPERATION

NY Federal Reserve/MNI

The NY Fed Reverse Repo operation usage falls to new lowest level since mid-September 2021: $1,054.986B w/98 counterparties vs. $1,079.462B in the prior session. The high for 2023 stands at $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

PIPELINE: $2.75B Ford 2Pt Corporate Debt Launched

- Date $MM Issuer (Priced *, Launch #)

- 11/02 $2.75B #Ford Motor Credit $1.5B 5Y +215, $1.25B 10Y +245

- 11/02 $1.35B #Humana $500M +5Y +115, $850M +10Y +147

- 11/02 $750M #SQM 10Y +190

- 11/02 $500M #BOC Aviation 5Y +130

- 11/02 $Benchmark Denmark 2Y investor calls

- 11/02 $Benchmark FMO Dutch Development Bank investor calls next week

EGBs-GILTS CASH CLOSE: UK Curve Bull Flattens As BoE Holds

Gilts easily outperformed Bunds Thursday, with the bullish implications of Wednesday's US Treasury refunding and dovish-leaning Fed meeting still reverberating through European rates.

- The BoE decision and communications were largely as expected (rate hold on a 6-3 vote split), but market pricing of future cuts increased, with UK rates rallying across the curve.

- Bund futures rose to session highs in early afternoon as the BoE decision was digested. 10Y German yields hit their lowest levels since mid-September, but finished off the lows.

- The UK curve bull flattened sharply, with Germany's twist flattening.

- Periphery EGBs rallied, with 10Y BTP spreads to Bunds nearing the tightest levels (sub 190bp) since early Oct.

- ECB's Schnabel speaks after market close Thursday. Friday's calendar includes French industrial data and Spanish/Italian/Eurozone labour market reports, as well as multiple speakers including BOE's Pill.

CLOSING YIELDS / 10-YR PERIPHERY EGB SPREADS TO GERMANY:

- Germany: The 2-Yr yield is up 1.8bps at 3.009%, 5-Yr is down 1.6bps at 2.6%, 10-Yr is down 4.7bps at 2.717%, and 30-Yr is down 7bps at 3.004%.

- UK: The 2-Yr yield is down 5.8bps at 4.739%, 5-Yr is down 11.7bps at 4.341%, 10-Yr is down 11.7bps at 4.382%, and 30-Yr is down 9.3bps at 4.868%.

- Italian BTP spread down 4.9bps at 191.4bps / Spanish down 2.2bps at 105.2bps

FOREX Greenback Reversal Lower Extends Amid Surging Equities

- The significant rally for major equity benchmarks has continued to weigh on the greenback on Thursday, with the USD index briefly extending its post-FOMC decline to over 1%. The move higher for yields during the US session prompted only a moderate USD recovery, with the DXY consolidating the majority of session losses ahead of the US employment data tomorrow.

- G10 gains versus the dollar were broad based with the outperformance unsurprisingly being seen in higher beta currencies such as the New Zealand and Canadian dollars, which have both risen around 0.80%.

- The move lower for USDCAD more notably pushed below support at 1.3790 (Oct 26 low) narrowing the gap significantly with 1.3739, the 20-day EMA. Upward pressure for crude futures amid headlines implying further escalation in the Israel-Hamas conflict have also provided an additional CAD tailwind.

- EURUSD steadily climbed over the first half of the day, regaining the 1.0600 handle and peaking at 1.0668, just shy of the week’s highs at 1.0675. Interestingly ahead of tomorrow’s US data, the overall technical outlook is bearish and short-term gains have been considered corrective so far. The move lower last week has reinforced a bearish theme - the Oct 24 price pattern is a bearish engulfing candle, a strong reversal signal.

- The Japanese Yen also heavily benefitted from the substantial shift lower for US yields late Wednesday and across the first half of Thursday trade. This prompted the pair to briefly slide back below the 150.00 mark to print 149.85, roughly 190 pips below Tuesday’s peak.

- Some emerging market currencies have understandably been the biggest beneficiaries from the more optimistic market backdrop. LatAm FX standouts with the Mexican peso rallying another 1.25%, and the likes of HUF & PLN also rising over 1%.

- All eyes turn to the US employment data on Friday where Bloomberg consensus sees nonfarm payrolls growth of 180k in October after almost doubling estimates with 336k in September along with strong two-month revisions.

FRIDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 03/11/2023 | 0030/1130 | *** |  | AU | Retail trade quarterly |

| 03/11/2023 | 0145/0945 | ** |  | CN | IHS Markit Final China Services PMI |

| 03/11/2023 | 0700/0800 | ** |  | DE | Trade Balance |

| 03/11/2023 | 0700/0300 | * |  | TR | Turkey CPI |

| 03/11/2023 | 0745/0845 | * |  | FR | Industrial Production |

| 03/11/2023 | 0900/0900 |  | UK | BoE's Hauser speech at Watchers' conference | |

| 03/11/2023 | 0930/0930 | ** |  | UK | S&P Global Services PMI (Final) |

| 03/11/2023 | 1000/1100 | ** |  | EU | Unemployment |

| 03/11/2023 | - |  | UK | BoE APF Q3 Report | |

| 03/11/2023 | 1200/0800 |  | US | Fed's Michael Barr | |

| 03/11/2023 | 1215/1215 |  | UK | BoE's Pill MPR National Agency Briefing | |

| 03/11/2023 | 1230/0830 | *** |  | CA | Labour Force Survey |

| 03/11/2023 | 1230/0830 | *** |  | US | Employment Report |

| 03/11/2023 | 1345/0945 | *** |  | US | IHS Markit Services Index (final) |

| 03/11/2023 | 1400/1000 | *** |  | US | ISM Non-Manufacturing Index |

| 03/11/2023 | 1600/1600 |  | UK | BoE's Haskel panellist at Watchers' Conference | |

| 03/11/2023 | 1645/1245 |  | US | Minneapolis Fed's Neel Kashkari | |

| 03/11/2023 | 1930/1530 |  | US | Fed's Michael Barr |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.