-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Former ECB Smaghi Lends Cut Support to Tsys

- MNI INTERVIEW: ECB To Cut 50BP, Then Wait And See- Bini Smaghi

- MNI INTERVIEW: Clear Case For BOE Alternative Scenarios - Bean

- MNI INTERVIEW: BOC Seen Cutting In June As Economy Fades-BDC

- MNI US DATA: Philly Fed Nonmanufacturing Weak Across The Board

Markets Roundup: Tsys Back Near Early Highs

- Treasury futures have see-sawed back near to higher opening levels following a well received $67B 5Y note sale (4.235% vs. 4.242% WI). Jun'24 10Y futures currently trade +4 at 110-20.5 vs. 110-16 pre-auction, compares to midmorning low of 110-11.5.

- Jun'24 10Y futures briefly marked session high of 110-23.5 this morning but quickly reversed course to extend session lows (TYM4 110-11.5) after the mixed initial data:

- Durable Goods Orders (1.4% vs. 1.0% est, prior down revised to -6.9% from -6.2%), Durables Ex Transportation (0.5% vs. 0.4% est); Cap Goods Orders Nondef Ex Air (0.7% vs. 0.1% est, prior down revised to -0.4% from 0.0%), Cap Goods Ship Nondef Ex Air (-0.4% vs. 0.1% est).

- Philly Fed Non-Mfg Activity missed estimate (-18.3 vs. -8.8 prior) - the lowest print since April 2023 and included fairly weak details: new orders remained negative, sales/revenues fell to a near-zero reading, full-time employment growth was "less widespread", and the price indexes "continued to indicate overall increases in prices".

- Consumer Confidence index dipped from 104.8 to 104.7, defying expectations of a rise to 107.0 (prior was revised down from 106.7). Present Situation rose from 147.6 (rev. from 147.2) to 151.0, with Expectations slipping from 76.3 (rev. from 79.8) to 73.8.

- Meanwhile, The S&P CoreLogic index posted 6.03% Y/Y growth, below the 6.12% expected but up from 5.57% prior; the 20-City index was in line at 6.59% vs 6.60% prior and 6.15% prior.

- Wednesday Data Calendar: Wholesale Sale/Inventories, Tsy $43B 7Y Note Auction while Fed Gov Waller will discuss economic outlook at Economic Club NY at 1800ET (text, Q&A).

NEWS

INTERVIEW (MNI): ECB To Cut 50BP, Then Wait And See- Bini Smaghi: The European Central Bank should cut its deposit rate by 50 basis points in June or by 25bp in both June and July if it wants to buy itself time over the summer without prompting immediate speculation about the timing of subsequent easing, former Executive Board member Lorenzo Bini Smaghi told MNI.

- “Cutting rates by just 25bp will not change dramatically the picture and the discussion will immediately move to the timing of the next cut,” Bini Smaghi said in an interview, adding that cutting by 50bp in June would “justify a wait and see attitude for a few months before the next move.”

INTERVIEW (MNI): Clear Case For BOE Alternative Scenarios - Bean: The Bank of England could enhance its policy communication by publishing alternative scenarios for inflation, former Deputy Governor Charles Bean told MNI ahead of the April publication of a review into the BOE’s forecasting by former Federal Reserve chief Ben Bernanke.

INTERVIEW (MNI): BOC Seen Cutting In June As Economy Fades-BDC: Canada's central bank will start cutting interest rates in June as inflation comes in line and because the economy would head towards recession absent some monetary relief, the chief economist of the federal small business bank told MNI.

- Pierre Cleroux of BDC said in an interview in Ottawa Monday the Bank of Canada will lower rates three or four times this year as officials gauge inflation pressures and an economic slowdown, while attempting not to rekindle the housing market or price expectations.

US (MNI): Biden: Federal Government To Cover Cost Of Reconstructing Baltimore Bridge: President Biden, delivering remarks at the White House, has announced that it is his intention, "that federal government will pay for the entire cost of reconstructing," the Francis Scott Key Bridge in Baltimore, Maryland and he "expects Congress to support" his effort.

US-CHINA (MNI): China Foreign Min Talks On US Relations Ahead Of Xi Meeting w/Execs: Wires carrying comments from Chinese Foreign Minister Wang Yi following a meeting with an US executives. States that the "crux of China-US relations lies in the US' position of China as the most important strategic competitor and the most important geopolitical challenge." Wang says that "This has led to problems in bilateral relations...This has also led to the failure to translate the commitments made by US leaders into concrete actions."

SLOVAKIA (MNI): Presidential Run-Off Set To Prove Close Contest: Following the first round of the presidential election on 23 March attention now turns towards the run-off on 6 April. Former Foreign Minister Ivan Korcok won a first-round plurality, taking 42.5% of the vote.

OVERNIGHT DATA

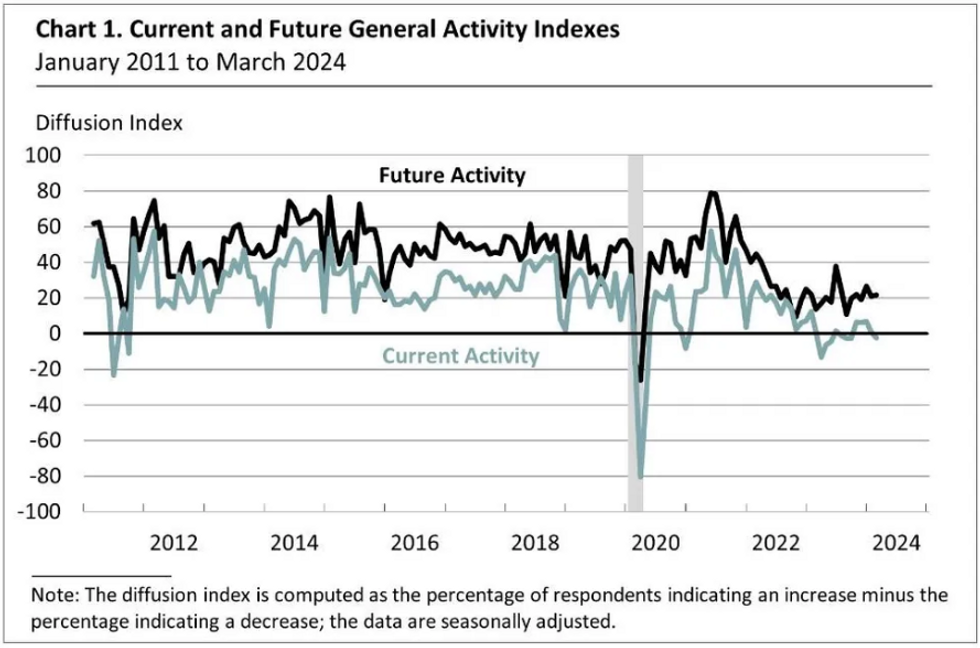

US DATA (MNI): Philly Fed Nonmanufacturing Weak Across The Board: The Philadelphia Fed's Nonmanufacturing Business Outlook Survey showed a negative turn in activity in the region in March, coming in at -18.3 vs -8.8 prior.

- That was the lowest print since April 2023 and included fairly weak details: new orders remained negative, sales/revenues fell to a near-zero reading, full-time employment growth was "less widespread", and the price indexes "continued to indicate overall increases in prices".

- The current activity diffusion index fell to -2.3, the first negative reading since October 2023, from 0.8 in February.

- The most positive aspect of the report was in the future general activity indices which "continued to suggest firms expect growth over the next six months", at 21.7 (fairly steady from 21.2 prior).

- The special questions are often of note in these surveys: in response to "How will your firm’s total sales/revenues for the first quarter of 2024 compare with that of the fourth quarter of 2023?", 22.4% of firms saw a decline of 10% or more; though overall, 46.9% reported an increase, with 36.7% reporting a decrease.

- Overall this was a weak report, though should be taken in the context of the usual volatility of the series.

US DATA (MNI): Consumer Confidence Remains Subdued, With Current Jobs A Bright Spot: March's Conference Board consumer survey showed an unexpected fall in confidence, including a downward revision to February's reading. While expectations also retreated, the "present situation" component picked up. The internals of the report were fairly weak, with inflation apparently remaining front-of-mind for many respondents. In general the survey readings have been fairly steady since early 2022, consistent with the roughly 2% annual average real personal consumption growth posted over that span.

- The Consumer Confidence index dipped from 104.8 to 104.7, defying expectations of a rise to 107.0 (prior was revised down from 106.7). Present Situation rose from 147.6 (rev. from 147.2) to 151.0, with Expectations slipping from 76.3 (rev. from 79.8) to 73.8.

US DATA (MNI): House Prices Shrug Off Higher Mortgage Rates To Hit Fresh All-Time High: House price growth continued apace in January on an annual basis, per the S&P CoreLogic Case-Shiller and FHFA indices, suggesting that momentum in the housing market remains after rising mortgage rates induced temporary weakness in 2022 and early 2023.

- The S&P CoreLogic index posted 6.03% Y/Y growth, below the 6.12% expected but up from 5.57% prior; the 20-City index was in line at 6.59% vs 6.60% prior and 6.15% prior. The FHFA purchases index (SA) rose 6.3% Y/Y, a slight slowdown from 6.6% prior but still marking robust gains.

MARKETS SNAPSHOT

- Key market levels of markets in late NY trade:

- DJIA up 98.34 points (0.25%) at 39408.96

- S&P E-Mini Future up 7.5 points (0.14%) at 5285.5

- Nasdaq up 29.8 points (0.2%) at 16414.41

- US 10-Yr yield is down 1 bps at 4.2356%

- US Jun 10-Yr futures are up 3.5/32 at 110-20

- EURUSD down 0.0003 (-0.03%) at 1.0834

- USDJPY up 0.1 (0.07%) at 151.52

- WTI Crude Oil (front-month) down $0.48 (-0.59%) at $81.46

- Gold is up $5.12 (0.24%) at $2176.89

- European bourses closing levels:

- EuroStoxx 50 up 19.99 points (0.4%) at 5064.18

- FTSE 100 up 13.39 points (0.17%) at 7930.96

- German DAX up 123.04 points (0.67%) at 18384.35

- French CAC 40 up 33.15 points (0.41%) at 8184.75

US TREASURY FUTURES CLOSE

- 3M10Y +5.063, -113.273 (L: -119.71 / H: -109.852)

- 2Y10Y +2.259, -35.954 (L: -39.347 / H: -34.658)

- 2Y30Y +2.181, -19.033 (L: -22.433 / H: -17.598)

- 5Y30Y -0.526, 18.024 (L: 16.105 / H: 18.541)

- Current futures levels:

- Jun 2-Yr futures down 0.375/32 at 102-9.5 (L: 102-08 / H: 102-10.875)

- Jun 5-Yr futures up 1.25/32 at 106-31.25 (L: 106-26.25 / H: 107-02)

- Jun 10-Yr futures up 3.5/32 at 110-20 (L: 110-11.5 / H: 110-23.5)

- Jun 30-Yr futures up 8/32 at 119-18 (L: 119-02 / H: 119-25)

- Jun Ultra futures up 16/32 at 127-17 (L: 126-28 / H: 127-25)

US 10Y FUTURE TECHS: (M4) Resistance Remains Intact

- RES 4: 112-04+ High Mar 8 and bull trigger

- RES 3: 111-24 High Mar 12

- RES 2: 110-31+ 50-day EMA

- RES 1: 110-30+ High Mar 21 & 22

- PRICE: 110-17+ @ 1340 ET Mar 26

- SUP 1: 110-08+/109-24+ Low Mar 21 / 18 and the bear trigger

- SUP 2: 109-14+ Low Nov 28

- SUP 3: 109-12+ 1.764 proj of Dec 27 - Jan 19 - Feb 1 price swing

- SUP 4: 108-25+ 2.00 proj of Dec 27 - Jan 19 - Feb 1 price swing

Treasuries maintain a softer tone and the latest move higher appears to be a correction. Key short-term resistance to watch is 110-31+, the 50-day EMA. A clear break of this average is required to suggest scope for a stronger recovery. Moving average studies remain in a bear-mode position and this continues to highlight a downtrend. On the downside, the bear trigger is unchanged at 109-24+.

SOFR FUTURES CLOSE

- Jun 24 steady at 94.890

- Sep 24 -0.015 at 95.170

- Dec 24 -0.015 at 95.465

- Mar 25 -0.010 at 95.735

- Red Pack (Jun 25-Mar 26) steady to +0.020

- Green Pack (Jun 26-Mar 27) +0.020 to +0.025

- Blue Pack (Jun 27-Mar 28) +0.020 to +0.020

- Gold Pack (Jun 28-Mar 29) +0.020 to +0.025

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M -0.00201 to 5.33016 (+0.00145/wk)

- 3M +0.00187 to 5.30942 (-0.00306/wk)

- 6M +0.00353 to 5.22513 (-0.00387/wk)

- 12M +0.01698 to 5.00990 (+0.00612/wk)

- Secured Overnight Financing Rate (SOFR): 5.31% (+0.00), volume: $1.820T

- Broad General Collateral Rate (BGCR): 5.31% (+0.00), volume: $671B

- Tri-Party General Collateral Rate (TGCR): 5.31% (+0.00), volume: $660B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $85B

- Daily Overnight Bank Funding Rate: 5.32% (+0.00), volume: $245B

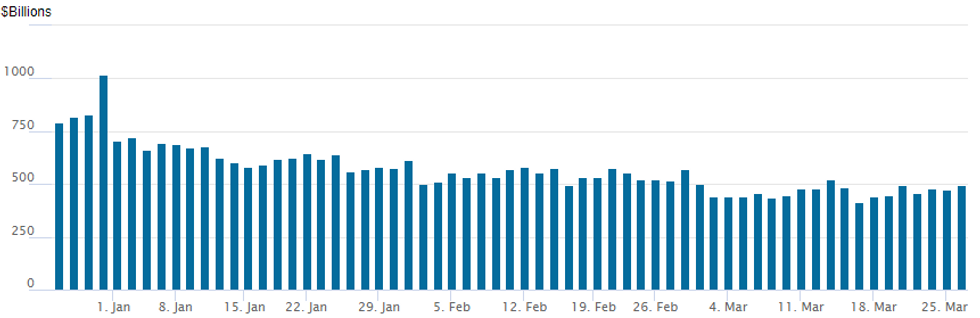

FED Reverse Repo Operation

NY Federal Reserve/MNI

- RRP usage rebounds to $496.062B from $473.787B on Monday. Compares to Friday, March 15 when usage fell to $413.877B - the lowest level since May 2021.

- Meanwhile, the latest number of counterparties slips to 73 vs. 74 yesterday (compares to 65 on January 16, the lowest since July 7, 2021)

PIPELINE At Least $15.6B Corporate Debt to Price Tuesday

- Date $MM Issuer (Priced *, Launch #)

- 3/26 $4B #Glencore Funding $800M 3Y +95, $350M 3Y SOFR+106, $1.1B 5Y +115, $1.25B 10Y +140, $500M 30Y +150

- 3/26 $3.75B *Quebec 5Y SOFR+50

- 3/26 $2.75B #Smurfit Kappa $750M +5Y +100, $1B 10Y +120, $1B 30Y +137.5

- 3/26 $1.15B Algonquin Power WNG 2Y +150a

- 3/26 $1.2B #Marathon Oil $600M 5Y +112, $600M 10Y +147

- 3/26 $1B *AIA 10Y +125

- 3/26 $500M #Yapi Kredi PerpNC5.25 9.75%

- 3/26 $1.25B #CSL $600M 10Y +87, $600M 30Y +102

- 3/26 $Benchmark TD Bank 3Y +60, 3Y SOFR+73, 5Y +78

- 3/26 $Benchmark SMBC Aviation Capital 5Y +108, 10Y +135

- 3/26 $Benchmark CQB (The Commercial Bank, Qatar) 5Y +150a

EGBs-GILTS CASH CLOSE: Gains Resume Ahead Of Euro Inflation Round

Gilts and Bunds resumed their advance Tuesday, with bull flattening in the UK and German curves.

- Central bank hawks came across relatively dovish: BoE's Mann didn't explicitly say that rate cuts weren't appropriate at this stage (just that market expectations had gone too far), while ECB's Muller noted that the time for rate cuts is drawing nearer.

- Data was fairly inconsequential from a markets perspective, but some attention was paid to a wider-than-expected 2023 French fiscal deficit which posed upside risks to 2024's shortfall and makes further spending cuts likely - OAT spreads to core EGBs had widened in recent days amid pre-release reports of a large deficit.

- Overall, core instruments traded well within Monday's ranges. Periphery EGB spreads tightened modestly to Bunds in a broadly risk-on session.

- Spain kicks off the March flash inflation round on Wednesday morning - our preview of the Eurozone-wide data went out today (PDF here).

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 1.3bps at 2.872%, 5-Yr is down 1.8bps at 2.371%, 10-Yr is down 2.2bps at 2.35%, and 30-Yr is down 1.9bps at 2.507%.

- UK: The 2-Yr yield is down 0.3bps at 4.181%, 5-Yr is down 1.5bps at 3.857%, 10-Yr is down 1.7bps at 3.971%, and 30-Yr is down 2.8bps at 4.456%.

- Italian BTP spread down 1.9bps at 130.3bps / Spanish down 0.7bps at 83.1bps

FOREX CHF Remains Notable Underperformer Amid Tight DXY Range

- The Swiss Franc is the poorest performing currency on Tuesday, helping EURCHF (+0.45%) rise above the key upside level and bull trigger at 0.9788. The pair printed a high of 0.9814 during US hours, the highest level since June 2023.

- A sustained break of this level, along with 0.9020 in USDCHF (+0.51%) could unlock the next stage of weakness for the CHF after last week's surprise SNB rate cut, at which the bank became the first in G10 to ease monetary policy after the post-pandemic tightening cycle.

- We highlighted yesterday that while the AUDUSD technical theme remains bearish, exponential moving average indicators appear positive for AUDCHF, and the dovish SNB combined with the overall buoyant backdrop for global equities could point to further strength ahead for the cross.

- Importantly, we do have Australian data overnight, with February CPI expected to tick up to 3.5% Y/y on Wednesday. The data precedes Thursday’s February retail sales data, and for both releases, attention will be paid following last week’s stellar jobs report.

- Elsewhere in G10, major pairs are showing very moderate adjustments, with the USD index marginally in the green approaching the APAC crossover. While USDJPY remains just 0.10% higher on the day, the pair has bounced 40 pips off the overnight lows to 151.60. The slow grind higher comes in the face of further verbal rhetoric from MOF officials denouncing speculative moves in the yen. USDJPY remains very close to the significant multi-decade resistance point at 151.91/95.

- Focus for Wednesday will turn to Spanish CPI, which kicks off the Eurozone inflation schedule, previewed by MNI here. Later in the session, Fed’s Waller is due to speak about monetary policy at the Economic Club of New York, where a Q&A is expected.

WEDNESDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 27/03/2024 | 0030/1130 | *** |  | AU | CPI Inflation Monthly |

| 27/03/2024 | 0700/1500 | ** |  | CN | MNI China Liquidity Index (CLI) |

| 27/03/2024 | 0745/0845 | ** |  | FR | Consumer Sentiment |

| 27/03/2024 | 0800/0900 | *** |  | ES | HICP (p) |

| 27/03/2024 | 0830/0930 | *** |  | SE | Riksbank Interest Rate Decison |

| 27/03/2024 | 0900/1000 |  | EU | ECB Cipollone At House of the Euro Event | |

| 27/03/2024 | 1000/1100 | ** |  | EU | EZ Economic Sentiment Indicator |

| 27/03/2024 | 1000/1100 | * |  | EU | Consumer Confidence, Industrial Sentiment |

| 27/03/2024 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 27/03/2024 | 1230/1330 |  | EU | ECB Elderson At Climate-Related Financial Risks Panel | |

| 27/03/2024 | 1430/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 27/03/2024 | 1530/1130 | ** |  | US | US Treasury Auction Result for 2 Year Floating Rate Note |

| 27/03/2024 | 1700/1300 | ** |  | US | US Treasury Auction Result for 7 Year Note |

| 27/03/2024 | 2200/1800 |  | US | Fed Governor Christopher Waller |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.