-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Drains CNY177.8 Bln via OMO Wednesday

MNI ASIA OPEN: Hawkish Data Weighs on Tsys Ahead FOMC

- MNI Chicago Business Barometer™ - Dipped to 37.9 in April

- MNI UST Issuance Deep Dive: May 2024 - Refunding Preview

- MNI INTERVIEW: SNB FX Move Eyed If ECB Cut In June - Benigno

- MNI US DATA: A Large Beat For ECI Along With Net Upward Revisions To Wage Components

US Tsys Nearing Technical Support Ahead FOMC, Month End, May Day Holiday

- Treasury futures gap lower after higher than expected Employment Cost Index (1.2% vs. 1.0% est, 0.9% prior), holding lower levels after much lower than expected MNI Chicago PMI comes out at 37.9 vs 45.0 est (41.4 prior).

- Broader macro considerations will have to wait until Thursday’s Q1 preliminary release for productivity. Strong productivity gains have offset labor costs in recent quarters but consensus sees productivity growth tailing off to 0.7% annualized in Q1.

- Futures extended lows into the close, Jun'24 10Y marking 107-13 low, still above initial technical support at 107-04 (Low Apr 25).

- Focus turns to Wednesday's FOMC announcement with Chairman Powell discussing guidance 30 minutes later. That said May Day holiday in Europe tomorrow, closings inconsistent across markets and asset classes (Eurex closed, but not ICE: Gilts re: FI) - that may be exacerbated by month end squaring.

- Projected rate cut pricing continued to recede vs. morning levels: May 2024 -1.0 vs. -2.1% earlier w/ cumulative -0.3bp at 5.326%; June 2024 at -6.6% vs. -10.6% w/ cumulative rate cut -1.9bp at 5.310%, July'24 cumulative at -5.1bp, Sep'24 cumulative -12.6bp.

NEWS

UST Issuance Deep Dive (MNI): May 2024 - Refunding Preview: Treasury’s Quarterly Refunding process for the May-Jul quarter began with borrowing estimates released on Mon Apr 29, followed by the refunding announcement itself on Wed May 1 (0830ET). In this round, there is relatively little intrigue surrounding coupon auction sizes: Treasury has provided clear guidance that there will be no changes to nominal coupon or FRN auction sizes “for at least the next several quarters”, and analysts are unanimously agreed (outside of a potential tweak to TIPS).

INTERVIEW (MNI): SNB FX Move Eyed If ECB Cut In June - Benigno: The Swiss National Bank may further utilise its balance sheet if rate cuts fail to provide sufficient Swiss franc depreciation to offset the disinflationary effects on the domestic economy of a weaker euro, former Federal Reserve staffer, Gianluca Benigno told MNI. With the European Central Bank signalling it intends to ease in June, despite the recent repricing of Federal Reserve cuts, SNB policymakers wary of real rate appreciation may be considering a return to foreign currency intervention, Benigno said in an interview.

ISRAEL (MNI): Mixed Messages Emerge On Hostage Deal & Rafah Assault: Mixed signals continue to emerge with regards the the two major questions surrounding the Israel-Hamas conflict at present: the likelihood of an Israel-Hamas deal on hostages being reached, and the prospect of Israel launching a ground assault into the southern Gazan city of Rafah.

EU (MNI): VdL Raises Prospect Of Working w/Right-Wing Group Post-EP Election: Speaking at a debate among European Commission presidential candidates on the evening of 29 April, incumbent President Ursula von der Leyen didnot rule out relying on support from right-wing European Conservatives and Reformists (ECR) MEPs to secure a second term.

OVERNIGHT DATA

US DATA (MNI): Chicago Business Barometer™ - Dipped to 37.9 in April: The Chicago Business BarometerTM, produced with MNI descended 3.5 points to 37.9 in April. This is the fifth consecutive monthly fall, pushing the index to its lowest levels since November 2022. We also note that this print is 7.5 points below the 2023 average.

- Four out of five subcomponents fell. With the move driven lower significantly by falls in New Orders, Production, Employment, and to a lesser extent Supplier Deliveries, whilst Order Backlogs offset some of this differentiation.

- In particular, Production was down for the fifth consecutive month by 6.9 points to 35.5, which is similar levels to November 2022.

- New Orders dropped by 5.1 points to a similar level as September 2023 and the lowest reading since November 2022. This was due to an increase in respondents reporting fewer new orders (around 40%), again similar to September 2023 levels.

US DATA (MNI): A Large Beat For ECI Along With Net Upward Revisions To Wage Components: The Employment Cost Index was notably stronger than expected in Q1 at 1.17% non-annualized (cons 1.0%).

- Prior revisions were offsetting, with a strong Q4 (0.93 vs 0.87) vs a weaker Q3 (1.01 vs 1.07).

- It translates to a particularly strong 4.8% annualized, its fastest since 3Q22.

- The wage & salaries component increased 4.5% annualized, its fastest since 1Q23. It follows a strongly upward revised 4.3% in Q4 (from 3.8) but is more mixed after that with 4.4 (from 4.9) in Q3 and 4.1 (from 3.9) in Q2.

- There’s a similar story in the private sector, with the wages & salaries component rising 4.5% annualized (strongest since 1Q23) after an upward revised 4.2% (initial 3.7%) in Q4.

- Broader macro considerations will have to wait until Thursday’s Q1 preliminary release for productivity. Strong productivity gains have offset labor costs in recent quarters but consensus sees productivity growth tailing off to 0.7% annualized in Q1.

- It's the lowest since Jul 2022 and before that early 2021.

- The labor differential added to the dovish takeaway from the headline figure, falling to 25.3 from a downward revised 29.5 (initial 32.2). It’s the lowest since Nov and before that Apr 2021.

- It’s the third consecutive monthly decline from a recent peak of 31.7 in January, and is notable as it takes it further away from the 33 averaged in 2019.

- The decline in the net measure came as jobs plentiful at 40.2% fell to the lowest since Nov and jobs hard to get at 14.9% increased to its highest since Nov.

CANADA DATA (MNI): Canada Flash Q1 GDP Gains 2.5% Though Stalled In March: Canada's gross domestic product grew at a 2.5% annualized first-quarter pace according to a flash reading, close to the central bank's recent upgraded estimate and in line with the idea the economy is running at about potential after being in overheated territory.

MARKETS SNAPSHOT

- Key market levels of markets in late NY trade:

- DJIA down 498.94 points (-1.3%) at 37887.49

- S&P E-Mini Future down 65 points (-1.26%) at 5081.75

- Nasdaq down 244.7 points (-1.5%) at 15738.45

- US 10-Yr yield is up 6.6 bps at 4.6798%

- US Jun 10-Yr futures are down 15/32 at 107-15.5

- EURUSD down 0.0045 (-0.42%) at 1.0675

- USDJPY up 1.38 (0.88%) at 157.72

- WTI Crude Oil (front-month) down $0.94 (-1.14%) at $81.69

- Gold is down $42.86 (-1.84%) at $2292.80

- European bourses closing levels:

- EuroStoxx 50 down 59.87 points (-1.2%) at 4921.22

- FTSE 100 down 2.9 points (-0.04%) at 8144.13

- German DAX down 186.15 points (-1.03%) at 17932.17

- French CAC 40 down 80.22 points (-0.99%) at 7984.93

US TREASURY FUTURES CLOSE

- 3M10Y +6.722, -72.972 (L: -85.004 / H: -71.935)

- 2Y10Y +0.582, -35.942 (L: -37.18 / H: -34.265)

- 2Y30Y -0.702, -25.432 (L: -26.491 / H: -22.751)

- 5Y30Y -1.604, 6.924 (L: 5.952 / H: 9.316)

- Current futures levels:

- Jun 2-Yr futures down 4.25/32 at 101-10.75 (L: 101-10.3744000000002 / H: 101-15.375)

- Jun 5-Yr futures down 10.5/32 at 104-24.5 (L: 104-23.25 / H: 105-03.5)

- Jun 10-Yr futures down 15.5/32 at 107-15 (L: 107-13 / H: 108-00.5)

- Jun 30-Yr futures down 22/32 at 113-29 (L: 113-25 / H: 114-25)

- Jun Ultra futures down 31/32 at 119-20 (L: 119-14 / H: 120-30)

US 10Y FUTURE TECHS: (M4) Trend Needle Points South

- RES 4: 110-06 High Apr 4

- RES 3: 109-26+ High Apr 10

- RES 2: 109-15 50-day EMA

- RES 1: 108-14 20-day EMA

- PRICE: 107-15 @ 1552 ET Apr 30

- SUP 1: 107-04 Low Apr 25

- SUP 2: 106-27 2.764 proj of Dec 27 - Jan 19 - Feb 1 price swing

- SUP 3: 106-11+ Base of a bear channel drawn from the Feb 1 low

- SUP 4: 106-08 3.00 proj of Dec 27 - Jan 19 - Feb 1 price swing

The trend outlook in Treasuries is unchanged and the current direction remains down. The contract traded to a fresh cycle low last week and moving average studies are in a bear-mode set-up too, highlighting a clear downtrend. Note too that the recent consolidation appears to have been a flag formation - a bearish continuation pattern. Sights are on 106-27 next, a Fibonacci projection. Firm resistance is 108-14, the 20-day EMA.

SOFR FUTURES CLOSE

- Jun 24 -0.020 at 94.685

- Sep 24 -0.050 at 94.795

- Dec 24 -0.075 at 94.940

- Mar 25 -0.085 at 95.115

- Red Pack (Jun 25-Mar 26) -0.095 to -0.085

- Green Pack (Jun 26-Mar 27) -0.09 to -0.08

- Blue Pack (Jun 27-Mar 28) -0.075 to -0.07

- Gold Pack (Jun 28-Mar 29) -0.07 to -0.065

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M +0.00275 to 5.31592 (+0.00019/wk)

- 3M +0.00133 to 5.32814 (-0.00136/wk)

- 6M +0.00204 to 5.31151 (-0.00271/wk)

- 12M -0.00199 to 5.23454 (-0.00926/wk)

- Secured Overnight Financing Rate (SOFR): 5.32% (+0.00), volume: $1.781T

- Broad General Collateral Rate (BGCR): 5.31% (+0.00), volume: $696B

- Tri-Party General Collateral Rate (TGCR): 5.31% (+0.00), volume: $666B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $94B

- Daily Overnight Bank Funding Rate: 5.32% (+0.00), volume: $270B

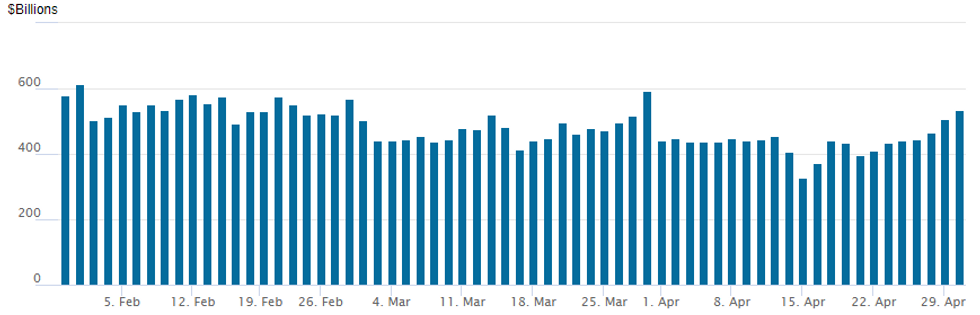

FED Reverse Repo Operation

NY Federal Reserve/MNI

- RRP usage climbs to $534.234B vs. $505.530B Monday. Compares to $327.066B on Monday, April 15 -- the lowest level since mid-May 2021.

- Meanwhile, the latest number of counterparties inches up to 76 vs. 75 prior.

PIPELINE: $2B ICON Investments 3Pt Debt Launched

$5B total US$ debt issuance Tuesday:

- Date $MM Issuer (Priced *, Launch #)

- 4/30 $2.5B #ADQ (Abu Dhabi Development Co) $1.25B 5Y +80, $1.25B 10Y +90

- 4/30 $2B #ICON Investments $750M 3Y +95, $750M 5Y +115, $500M 10Y +135

- 4/30 $500M *L-Bank (Landeskreditbank Baden Wuerttemberg) 2Y SOFR+26

EGBs-GILTS CASH CLOSE: Broad Weakness As Data Pares Implied ECB/BoE Cuts

European yields rose sharply Tuesday as data pointed to fewer 2024 BoE/ECB rate cuts.

- While French and Dutch April inflation out early in the session were largely in line with expectations, the Eurozone-wide report saw slight upside surprises on both core and services HICP while GDP was above-expected, putting pressure on core FI.

- Stronger-than-expected US employment cost data and latterly a jump in MNI Chicago PMI prices paid saw Treasuries drag Bunds and Gilts down further in the afternoon.

- A pullback in oil prices and equities helped EGBs/Gilts find a floor toward the cash close.

- On the day, ECB 2024 cut pricing was pared 5bp to 66bp; BoE by 6bp to 41bp.

- Bunds underperformed Gilts, with the German curve bear flattening and the UK's bear steepening. Periphery EGB spreads widened modestly.

- Wednesday's calendar sees the US Federal Reserve decision featuring, but European trade will be limited due to the May Day holiday.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 7.2bps at 3.034%, 5-Yr is up 6.8bps at 2.616%, 10-Yr is up 5.2bps at 2.584%, and 30-Yr is up 2.6bps at 2.69%.

- UK: The 2-Yr yield is up 5.2bps at 4.506%, 5-Yr is up 4.8bps at 4.251%, 10-Yr is up 5.5bps at 4.347%, and 30-Yr is up 4.1bps at 4.787%.

- Italian BTP spread up 0.9bps at 133.3bps / Spanish bond down 0.1bps at 77bps

FOREX US Data Underpins Supportive Greenback Tone, AUD, NZD and CHF all Plummet

- Higher-than-expected US data has underpinned a strong USD bid throughout Tuesday’s session, prompting a further adjustment of fed pricing and an associated 0.58% rally for the USD index.

- A firmer-than-expected Q1 employment cost reading provided the latest ‘hawkish’ input for FOMC-dated OIS, leaving ~31bp of cuts priced through ’24 vs. ~35bp pre-release. Even within the Chicago Business Barometer details prices paid rose 6.7 points to 69.3, the highest level since August 2023, and 5.7 points above the prior 12-month average of 63.6.

- Downside pressure on equity markets has provided an additional tailwind for the greenback, with potential month-end dynamics also bolstering the supportive greenback tone.

- AUD and NZD have extended their poor performance overnight and remain the weakest in G10, both declining around 1.2% as we approach the APAC crossover. Weaker-than-expected Australian data overnight set the tone here and AUDUSD has grinded below the 0.6500 handle, narrowing the gap to initial support at 0.6441.

- The Swiss Franc has also notably suffered which sees USDCHF (+0.81%) rise to a fresh cycle high on Tuesday, printing at 0.9185. It’s worth highlighting that we have April Swiss CPI data on Thursday, an important data point given the Swiss Franc’s sensitivity to the March release amid the dovish stance of the SNB, who unexpectedly cut rates in March. USDCHF’s impressive rally across 2024 will continue to target the October 2023 highs, residing at 0.9244.

- For the major pairs, EURUSD remained heavy and briefly traded a new low on the week at 1.0676, however, the pair remains in a 60 pip range on the day. USDJPY edged higher, taking out 157.00 and consolidated around 157.50 as markets slowly eroded the sharp move lower from Monday, following the touted intervention from the BOJ.

- RBNZ Governor Orr is due to hold a press conference about the Financial Stability Report overnight. Multiple European holidays may pave the way for a subdued session before the focus swiftly turns to the US ISM Manufacturing PMI and the May Fed decision/press conference.

WEDNESDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 01/05/2024 | 2300/0900 | ** |  | AU | IHS Markit Manufacturing PMI (f) |

| 01/05/2024 | 0030/0930 | ** |  | JP | IHS Markit Final Japan Manufacturing PMI |

| 01/05/2024 | 0830/0930 | ** |  | UK | S&P Global Manufacturing PMI (Final) |

| 01/05/2024 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 01/05/2024 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 01/05/2024 | - | *** |  | US | Domestic-Made Vehicle Sales |

| 01/05/2024 | 1215/0815 | *** |  | US | ADP Employment Report |

| 01/05/2024 | 1230/0830 | *** |  | US | Treasury Quarterly Refunding |

| 01/05/2024 | 1345/0945 | *** |  | US | IHS Markit Manufacturing Index (final) |

| 01/05/2024 | 1400/1000 | *** |  | US | ISM Manufacturing Index |

| 01/05/2024 | 1400/1000 | * |  | US | Construction Spending |

| 01/05/2024 | 1400/1000 | *** |  | US | JOLTS jobs opening level |

| 01/05/2024 | 1400/1000 | *** |  | US | JOLTS quits Rate |

| 01/05/2024 | 1430/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 01/05/2024 | 1800/1400 | *** |  | US | FOMC Statement |

| 01/05/2024 | 2015/1615 |  | CA | BOC Governor at Senate Banking Committee |

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.