-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Inflation Jump To Keep Fed on Hold

- MNI CPI Service Inflation Fastest Since Sep'22

- MNI Extremely Strong CPI Supercore Inflation In January

US TSYS Markets Update: Extending Lows

- Largely quiet since this morning's hot CPI related sell-off, Treasury futures and stocks have quietly extended respective session lows in late trade.

- Currently, Mar'24 10Y futures are -1-03 at 109-20 (early Dec'23 level), nearing initial technical support of 109-17 (50.0% of the Oct 19 - Dec 27 bull phase), 10Y yield marking 4.3104% high (Dec 1 lvl). Treasury curves are bear flattening (2s10s -4.853 -34.727) with short end underperforming as projected rate cut continue to evaporate in light of today's hot inflation measure.

- Projected rate cut pricing continues to ebb: March 2024 chance of 25bp rate cut currently -10.6% (-18.3% late Monday) w/ cumulative of -2.6bp at 5.302%; May 2024 at -28.9% vs. -53.0% late Monday w/ cumulative cut of -9.9bp at 5.230%; June 2024 -57.7% vs. -80.3% late Monday w/ cumulative -24.3bp at 5.086%. Fed terminal at 5.3275% in Feb'24.

- Look ahead: Wednesday dat focus on PPI revisions, Fed speakers Chicago Fed Goolsbee and Fed VC Barr.

NEWS

US (MNI): Senate Passes USD$95B National Security Supplemental

The Senate has passed a USD$95 billion package of foreign aid to Ukraine, Israel, and allies in the Indo-Pacific after a marathon overnight voting session. The package now faces a more challenging pathway through the House of Representatives.

US (MNI): Senate Finance Republicans Could Slow Walk Tax Bill Until After Election

Semafor reports that Washington lobbyists are “getting anxious” about the USD$78 billion Wyden-Smith bipartisan tax bill, which reinstates some child tax credits and business tax breaks.

US (MNI) Biden Calls For House To Pass USD95bn Nat Sec Supplemental

President Joe Biden has released a statement calling for the House of Representatives to approve the UD95bn National Security Supplemental passed by the Senate earlier today. Biden: "We cannot afford to wait any longer. The costs of inaction are rising every day, especially in Ukraine."

US (MNI): 2nd Mayorkas Impeachment Vote Today Ahead Of NY Special Election Result

House Speaker Mike Johnson (R-LA) is expected to re-run his vote to impeach Homeland Security Secretary Alejandro Mayorkas today after House Majority Leader Steve Scalise’s (R-LA) return to Congress following cancer treatment.

US (MNI): House Of Reps Unlikely To Vote On Standalone Israel Bill This Week

Jake Sherman at Punchbowl News reporting on X that: "House Republican leadership isn't putting an Israel aid bill on the floor this week, according to sources. It's dead for now, I've been told."

SECURITY (MNI): Netanyahu Rejects New Hostage Release/Ceasefire Framework

Suleiman Maswadeh at Kan reporting that Israeli Prime Minister Benjamin Netanyahu has rejected a new framework that would see the exchange of Israeli hostages in return for a short-term ceasefire after security talks in Cairo, Egypt.

SECURITY (MNI): Axios: Israel Blocking Delivery Of US Aid To Gaza

Axios reporting that, "Israeli ultranationalist Finance Minister Bezalel Smotrich is blocking a U.S.-funded flour shipment to Gaza," because the recipient of the delivery is the UN Relief and Works Agency (UNRWA), an agency which has been accused by Israel of having ties with Hamas.

OVERNIGHT DATA

US DATA (MNI): Extremely Strong CPI Supercore Inflation In January: CPI Core & Supercore Latest Trends

- Core CPI% M/M: 0.39 in Jan'24 after 0.28 in Dec'23%

- 3mth ar: 4 in Jan'24 after 3.3 in Dec'23%

- 6mth ar: 3.6 in Jan'24 after 3.2 in Dec'23

- Supercore CPI% M/M: 0.85 in Jan'24 after 0.34 in Dec'23%

- 3mth ar: 6.7 in Jan'24 after 4 in Dec'23%

- 6mth ar: 5.6 in Jan'24 after 4.5 in Dec'23

- Core Goods: -0.32 after -0.06

- Used cars: -3.37 in Jan (analysts saw an average -2.4, ranging -1.3 to -4.4) after 0.6% in Dec

- Ex used cars: 0.08 after -0.16% in Dec

- Core Services: 0.66 after 0.38 – strongest pace since Sep’22

- OER: 0.56 after 0.42 (analysts saw an average 0.42, ranging 0.31-0.48)

- Primary rents: 0.36 after 0.39 (analysts saw an average 0.41, ranging 0.32-0.45)

- Supercore: 0.85 after 0.34 (three analysts ranged between 0.33-0.87)

MARKETS SNAPSHOT

- Key market levels of markets in late NY trade:

- DJIA down 732.94 points (-1.89%) at 38051.52

- S&P E-Mini Future down 99.25 points (-1.97%) at 4940

- Nasdaq down 364.2 points (-2.3%) at 15574.39

- US 10-Yr yield is up 13.1 bps at 4.3104%

- US Mar 10-Yr futures are down 33.5/32 at 109-21.5

- EURUSD down 0.007 (-0.65%) at 1.0702

- USDJPY up 1.49 (1%) at 150.84

- WTI Crude Oil (front-month) up $0.87 (1.13%) at $77.75

- Gold is down $27.84 (-1.38%) at $1992.25

- European bourses closing levels:

- EuroStoxx 50 down 57.07 points (-1.2%) at 4689.28

- FTSE 100 down 61.41 points (-0.81%) at 7512.28

- German DAX down 156.52 points (-0.92%) at 16880.83

- French CAC 40 down 64.49 points (-0.84%) at 7625.31

US TREASURY FUTURES CLOSE

- 3M10Y +12.632, -109.448 (L: -126.944 / H: -108.793)

- 2Y10Y -3.598, -33.472 (L: -35.77 / H: -28.715)

- 2Y30Y -8.605, -18.423 (L: -21.072 / H: -8.484)

- 5Y30Y -8.912, 15.22 (L: 13.827 / H: 26.369)

- Current futures levels:

- Mar 2-Yr futures down 11.25/32 at 101-30.5 (L: 101-29.25 / H: 102-13)

- Mar 5-Yr futures down 25.25/32 at 106-14.75 (L: 106-13.5 / H: 107-18.5)

- Mar 10-Yr futures down 1-1.5/32 at 109-21.5 (L: 109-19.5 / H: 111-07)

- Mar 30-Yr futures down 1-25/32 at 118-2 (L: 117-30 / H: 120-28)

- Mar Ultra futures down 2-0/32 at 124-1 (L: 123-28 / H: 127-10)

US 10Y FUTURE TECHS: (H4) Bear Leg Extends on CPI

- RES 4: 114-00 Round number resistance

- RES 3: 113-12 High Dec 27 and the bull trigger

- RES 2: 111-11/113-06+ 20-day EMA / High Feb 1

- RES 1: 110-16 Low Feb 9

- PRICE: 109-21+ @ 1530 ET Feb 13

- SUP 1: 109-17 50.0% of the Oct 19 - Dec 27 bull phase

- SUP 2: 109-05+ Low Nov 28

- SUP 3: 108-19+ 61.8% of the Oct 19 - Dec 27 bull phase

- SUP 4: 108-14 Low Nov 15

A bear threat in Treasuries remains present and the post-CPI sell-off reinforces the current bearish theme. The break lower confirms a resumption of the downleg that started Dec 27. The 110-00 handle has been cleared and sights are on 109-17, a Fibonacci retracement. Clearance of this level would further strengthen the bearish theme. Initial firm resistance is at 111-11, the 20-day EMA.

SOFR FUTURES CLOSE

- Mar 24 -0.045 at 94.720

- Jun 24 -0.140 at 94.965

- Sep 24 -0.205 at 95.270

- Dec 24 -0.230 at 95.590

- Red Pack (Mar 25-Dec 25) -0.245 to -0.23

- Green Pack (Mar 26-Dec 26) -0.22 to -0.195

- Blue Pack (Mar 27-Dec 27) -0.18 to -0.155

- Gold Pack (Mar 28-Dec 28) -0.145 to -0.115

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M -0.00276 to 5.31764 (-0.00308/wk)

- 3M +0.00046 to 5.30699 (-0.00206/wk)

- 6M +0.00516 to 5.19615 (+0.00749/wk)

- 12M +0.00138 to 4.90000 (+0.01975/wk)

- Secured Overnight Financing Rate (SOFR): 5.31% (+0.00), volume: $1.725T

- Broad General Collateral Rate (BGCR): 5.30% (+0.00), volume: $683B

- Tri-Party General Collateral Rate (TGCR): 5.30% (+0.00), volume: $670B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $93B

- Daily Overnight Bank Funding Rate: 5.32% (+0.00), volume: $268B

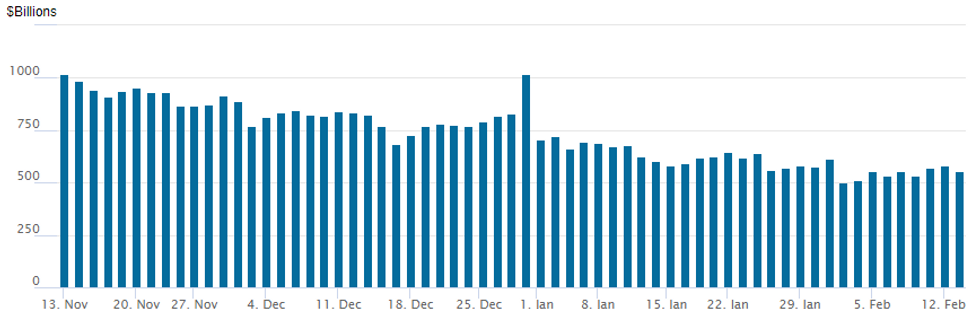

FED REVERSE REPO OPERATION

NY Federal Reserve/MNI

- RRP usage recedes to $553.684B vs. $581.568B Monday - remains well above recent cycle low of $503.548B from Thursday, February 1, the lowest level since mid-2021.

- Meanwhile, the latest number of counterparties is at 84 from 78 Monday (compares to 65 on January 16, the lowest since July 7, 2021).

PIPELINE: $750M EBRD 4Y SOFR Priced

- Date $MM Issuer (Priced *, Launch #)

- 2/13 $750M *EBRD 4Y SOFR+33a

- 2/13 $Benchmark Bristol-Meyers Squibb investor calls

EGBs-GILTS CASH CLOSE: Futures Move Off US CPI-Inspired Intraday Lows

Bunds pared some of their CPI-inspired losses, and have now stabilised somewhat with futures having traded in a ~20 tick range for the past 90 minutes. The first support at 132.89 (50% retracement of the Oct 4 - Dec 27 bull phase) was pierced following the US CPI release but prices quickly rebounded.

- Gilts have seen less of a recovery, likely a function of today's firmer than expect wage data and heightened concerns r.e. tomorrow's domestic CPI print (due 0700GMT/0800CET).

- Cash curves have bear flattened as ECB/BoE rate cut expectations have moderated further. Schatz yields are over 7bps higher today while 2-year Gilt yields are over 13bps higher. Gilt yields operate at or near year-to-date highs across the curve at typing.

- In spite of the rate cut repricing and European equity market weakness, periphery spreads are generally tighter to Bunds. The 10-year BTP/Bund spread is the exception, trading +0.2bps wider at 154.9bps.

- Tomorrow's focus will be on the aforementioned UK CPI data, though we also get the preliminary Eurozone Q4 GDP reading at 1000GMT/1100CET. The advance release from Jan 30 printed at 0.0% Q/Q and 0.1% Y/Y.

FOREX Greenback Surges On Firmer-Than-Expected US CPI, Swiss Franc Slides

- Hotter-than-expected US inflation data prompted a surge higher for the greenback on Tuesday. As Fed rate cut expectations continue to be pushed back, the USD index remains at the best levels of the session as we approach the APAC crossover, having risen 0.72% to a fresh near-three month high.

- Kiwi remains among the worst performers on Tuesday with multiple themes helping NZDUSD (-1.25%) to slide back towards the 0.6050 mark, and the worst levels of the year. Weakness was initiated overnight after RBNZ’s Q1 inflation expectations eased further making any further RBNZ tightening unlikely. The firm dollar and significant weakness for equities exacerbated the NZDUSD decline.

- USDJPY has continued to inch higher across the session, piercing initial resistance in late trade above 150.78, the November 17 high. This extends the intra-day advance to 1.00%, with yield differentials the primary driver following the hot US inflation figures.

- With price now firmly above the psychological 150.00 mark and edging towards last years highs, market participants may once again be cautious of any verbal warnings from the Ministry of Finance, who will no doubt be wary of the impressive 7% advance this year.

- CHF is also among the poorest performer so far, slipping against all others as Swiss CPI also came in soft relative to expectations. The release prompted an extension of recent EUR/CHF gains, putting the cross well through the mid-January highs and above key resistance at the 100-dma of 0.9496. USDCHF rose an impressive 1.35%.

- Wednesday’s data focus will be on UK CPI, after the higher-than-expected earnings data this morning. Fed speakers include Chicago Fed Goolsbee and Fed VC Barr.

WEDNESDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 14/02/2024 | 0700/0700 | *** |  | UK | Consumer inflation report |

| 14/02/2024 | 0700/0700 | *** |  | UK | Producer Prices |

| 14/02/2024 | 0700/0800 | ** |  | NO | Norway GDP |

| 14/02/2024 | 0830/0930 |  | EU | ECB's De Guindos speech at Mediterranean CB's conference | |

| 14/02/2024 | 1000/1100 | ** |  | EU | Industrial Production |

| 14/02/2024 | 1000/1100 | *** |  | EU | GDP (p) |

| 14/02/2024 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 14/02/2024 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 14/02/2024 | 1400/0900 | * |  | CA | CREA Existing Home Sales |

| 14/02/2024 | 1400/1500 |  | EU | ECB's Cipollone statement on digital euro | |

| 14/02/2024 | 1430/0930 |  | US | Chicago Fed's Austan Goolsbee | |

| 14/02/2024 | 1500/1500 |  | UK | BOE's Bailey Lord Economic Affairs Committee | |

| 14/02/2024 | 1530/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 14/02/2024 | 1630/1730 |  | EU | ECB's Cipollone in CEO Summit | |

| 14/02/2024 | 1930/1430 |  | CA | BOC Deputy Mendes panel talk. | |

| 15/02/2024 | 2350/0850 | *** |  | JP | Japan GDP 1st Estimate |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.